Do you confuse working capital with cash flow? Many people who lack financial expertise do it, and the reality is that both serve different purposes.

Cash flow tracks the movement of money in and out of a business over time. Working capital, on the other hand, focuses on the company’s ability to meet its immediate financial obligations. Both are essential for assessing financial health.

A strong working capital position means a business can pay its bills, manage unexpected costs, and invest in growth opportunities. Our latest blog will explain the major components of working capital, the formula for calculating it, and the limitations of working capital in accounting.

Table of Contents

What Is Working Capital?

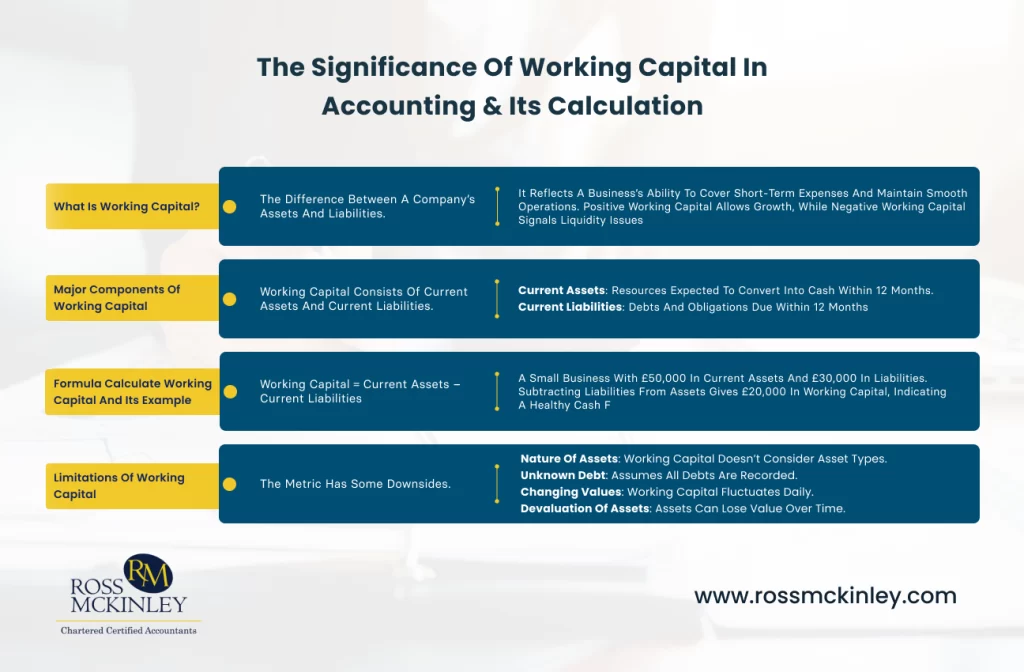

Working capital, or net working capital (NWC), is the difference between a company’s assets and liabilities. It reflects a business’s ability to cover short-term expenses and maintain smooth operations. Positive working capital means the company can fund daily activities and invest in growth, while negative working capital signals potential liquidity issues.

However, excessive working capital isn’t always ideal, as it may indicate unused cash, excess inventory, or missed opportunities for low-cost borrowing. Striking the right balance ensures financial stability and supports long-term business success.

Grow Your Practice with Confidence

Major Components of Working Capital

Working capital in accounting consists of two elements: current assets and current liabilities. Let’s have a look at the major components of working capital in business:

| Major Components of Working Capital | Description |

| Current Assets | Resources a company expects to convert into cash within 12 months.Inventory: Unsold goods, including raw materials, partially finished products, and items ready for sale.Prepaid Expenses: Payments made in advance for services or goods, like insurance or rent, still holding short-term value.Cash and Cash Equivalents: Money available in bank accounts, foreign currency, or low-risk investments like money market funds.Notes Receivable: Amounts due from signed agreements, such as loans or other formal arrangements.Accounts Receivable: Money customers owe for goods or services sold on credit, minus any doubtful payments.Other Current Assets: Additional short-term assets, such as deferred tax assets or temporary investments. |

| Current Liabilities | Wages Payable: Salaries and wages owed to employees, typically covering up to one month of work. Accounts Payable: Unpaid bills to suppliers for goods, services, or utilities, often due within 30 days. Accrued Tax Payable: Taxes owed to the government that must be paid within the next 12 months. Current Portion of Long-Term Debt: Payments due within the next year on long-term loans or debts. Unearned Revenue: Payments received in advance for services or products not yet delivered. Dividend Payable: Approved shareholder payments that have yet to be distributed. |

Current Assets

Current assets are resources a company expects to convert into cash within the next 12 months. These include:

- Inventory: Unsold goods, including raw materials, partially finished products, and items ready for sale.

- Prepaid expenses: Payments made in advance for services or goods, like insurance or rent, still hold short-term value.

- Cash and cash equivalents: Money available in bank accounts, foreign currency, or low-risk investments like money market funds.

- Notes receivable: Amounts due from signed agreements, such as loans or other formal arrangements.

- Accounts receivable: Money customers owe for goods or services sold on credit, minus any doubtful payments.

- Others: Any additional short-term assets, such as deferred tax assets or temporary investments.

Current Liabilities

Current liabilities are debts or obligations a company must pay within 12 months. These include:

- Wages payable: Salaries and wages owed to employees, typically covering up to one month of work.

- Accounts payable: Unpaid bills to suppliers for goods, services, or utilities, often due within 30 days.

- Accrued tax payable: You must pay taxes owed to the government within the next 12 months.

- Current portion of long-term debt: Payments due within the next year on long-term loans or debts.

- Unearned revenue: Payments received in advance for services or products not yet delivered.

- Dividend payable: You approved shareholders’ payments but have yet to distribute them.

Formula to Calculate Working Capital

To find your company’s working capital, you’ll need to estimate its current assets and liabilities for the next 12 months. This means predicting cash, inventory, customer payments, upcoming bills, wages, and short-term debts.

Compare these numbers to determine whether your business has enough resources to cover its short-term needs.

Here’s the formula to calculate working capital:

Working Capital = Current Assets – Current Liabilities

Grow Your Practice with Confidence

Example of Working Capital

A small business has £50,000 in current assets, which includes cash, inventory, and money owed by customers. At the same time, it has £30,000 in current liabilities, such as unpaid bills and employee wages. To calculate working capital, subtract the liabilities from the assets, and you’ll get £20,000.

This result indicates positive working capital, meaning the business can easily cover its short-term expenses. However, the business might struggle with cash flow issues if liabilities exceed assets.

Limitations of Working Capital

Working capital plays a significant role in calculating your company’s short-term health. However, the metric can become misleading due to some downsides to the calculation. Here are the major limitations of working capital in accounting:

Nature of Assets

Working capital does not consider the types of assets. For example, a company relying only on accounts receivable may face cash flow issues if customers delay payments.

Unknown Debt

Working capital calculations assume you have recorded all debts. However, missed invoices or agreements during fast-paced operations or mergers can lead to inaccurate figures.

Changing Values

Working capital constantly changes as current assets and liabilities shift during daily operations. When financial data is collected, the working capital position may differ from the original calculation.

Devaluation of Assets

Assets can lose value quickly due to customer bankruptcy, outdated inventory, or theft. Even cash is at risk, directly impacting working capital.

How Can Ross Mckinley Help With Working Capital?

Ross McKinley’s management accounts service is the most effective way to improve working capital in management accounting. These accounts offer real-time insights into cash flow, expenses, and profitability, helping businesses make smarter financial decisions. They identify trends early, allowing companies to control costs, optimise inventory, and boost liquidity.

With accurate data, businesses can maintain sufficient working capital to meet daily needs and plan for growth. Our job is to ensure your business stays financially healthy and prepared for future opportunities.

Conclusion

Working capital is the difference between a company’s assets and liabilities, showing its ability to cover short-term expenses. It plays a major role in maintaining smooth operations and financial stability.

Understanding working capital in accounting helps businesses manage cash flow, plan for growth, and handle unexpected challenges.

To improve working capital, reduce unnecessary expenses, speed up customer payments, and optimise inventory levels.

Regularly reviewing financial statements ensures you stay on top of the importance of working capital. When you closely monitor these factors, your business can maintain a healthy financial position and achieve long-term success.