If you’re running a business, VAT registration is often one of those things you have to deal with. But what happens when it no longer makes sense to stay registered? That’s where VAT deregistration comes in.

Whether you’re scaling down operations, restructuring your business, or simply don’t meet the VAT threshold anymore, deregistering can save you from unnecessary compliance headaches. But let’s be real—navigating the process isn’t always straightforward.

This guide will walk you through everything you need to know about VAT deregistration: when to do it, how it works, and why it might be the right move for your business.

Table of Contents

What Is VAT Deregistration?

VAT deregistration is the process of officially canceling your Value-Added Tax (VAT) registration with the relevant tax authority. Simply put, it’s the point where you no longer need to collect VAT on sales or file VAT returns. But there’s more to it than just canceling registration.

VAT deregistration comes with implications, deadlines, and specific scenarios where it’s mandatory or voluntary. Knowing these details can save your business from unnecessary penalties and compliance headaches.

Reasons for VAT Deregistration

The decision to deregister from VAT isn’t always straightforward. It’s often driven by significant shifts in your business operations and financial performance. Let’s explore these changes in more detail:

- Business Activity Changes

If a business undergoes structural changes—such as a merger, restructuring, or transitioning to zero-rated supplies—it may be required to cancel its VAT registration. These changes can trigger the need for deregistration, especially when taxable activities decrease or end. - Ceasing Taxable Supplies

If a business ceases making VAT-applicable goods or services, the VAT deregistration process becomes necessary. For example, a business may decide to halt production or completely pivot away from taxable goods, triggering the need to cancel its registration. - Falling Below the VAT Threshold

One of the most common reasons for VAT deregistration is when a business’s annual turnover drops below the required VAT registration threshold. Every country has its own threshold, and businesses must keep a close eye on their turnover to avoid complications.

Grow Your Practice with Confidence

VAT Deregistration Scenarios and Implications

VAT deregistration can be triggered by different business scenarios, each with its own set of requirements and consequences. Whether voluntary or mandatory, it’s important to understand the process to avoid potential issues. Here are some common VAT deregistration situations that businesses should be aware of:

- Voluntary Deregistration

Businesses often choose voluntary deregistration if their taxable turnover is consistently below the VAT threshold. Voluntary VAT deregistration can help reduce administrative costs but requires careful consideration of future business activities.

Key Implications:

- File a final VAT return within 30 days.

- Pay output VAT on remaining stock/assets.

- Claim input VAT on purchases made before deregistration.

- Compulsory Deregistration

Tax authorities may enforce deregistration if a business fails to comply with VAT regulations or neglects to file VAT returns. This scenario requires businesses to act quickly to avoid penalties and interest.

Key Implications:

- Settle all outstanding VAT.

- File a final VAT return to avoid penalties.

- An official notice will be issued by the tax authority.

- Business Restructuring

VAT deregistration is also triggered by major changes in business structure, such as mergers or shifts from taxable to zero-rated supplies. The business must inform tax authorities and settle any VAT dues before completing the process.

Key Implications:

- Notify the tax authority of structural changes.

- Submit a final VAT return and clear all outstanding VAT dues.

- Re-register if new business activities require VAT compliance.

- Sale of Business

When a business is sold as a going concern, VAT deregistration must take place unless the buyer intends to keep the VAT registration number. In this case, it’s critical to inform the buyer about VAT responsibilities, especially if their turnover exceeds the VAT threshold.

Key Implications:

- File a final VAT return.

- Notify the buyer about VAT responsibilities if turnover exceeds thresholds.

- Group Deregistration

VAT groups can choose to deregister collectively, or individual members of the group may need to cancel their registrations if they are no longer part of the group structure.

Key Implications:

- File a group VAT return for any outstanding dues.

- Evaluate the need for individual company VAT registrations within the group structure.

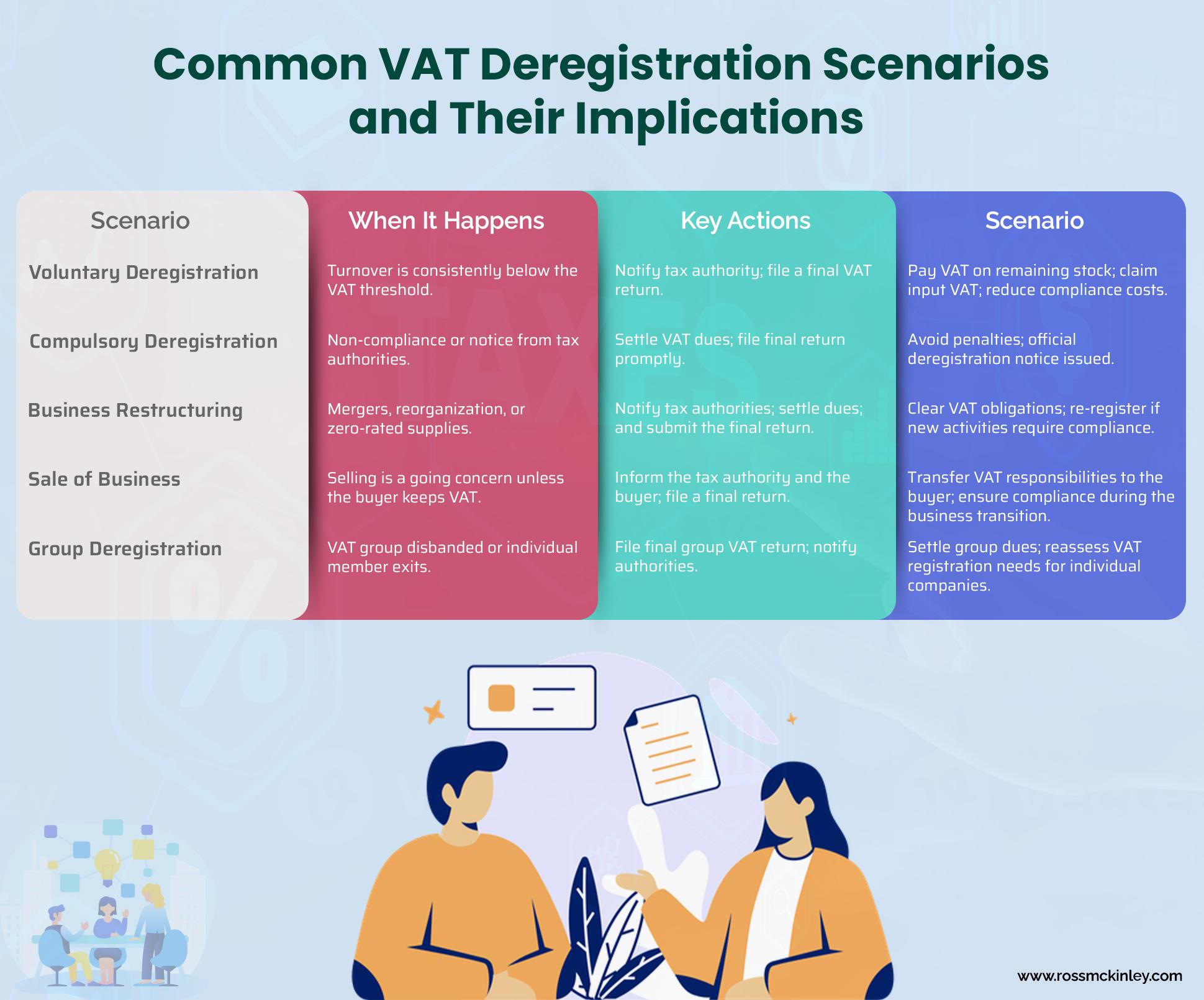

Here’s a brief breakdown of common VAT deregistration scenarios and their implications.

| Scenario | When It Happens | Key Actions | Implications |

| Voluntary Deregistration | Turnover is consistently below the VAT threshold. | Notify tax authority; file a final VAT return. | Pay VAT on remaining stock; claim input VAT; reduce compliance costs. |

| Compulsory Deregistration | Non-compliance or notice from tax authorities. | Settle VAT dues; file final return promptly. | Avoid penalties; official deregistration notice issued. |

| Business Restructuring | Mergers, reorganization, or zero-rated supplies. | Notify tax authorities; settle dues; and submit the final return. | Clear VAT obligations; re-register if new activities require compliance. |

| Sale of Business | Selling is a going concern unless the buyer keeps VAT. | Inform the tax authority and the buyer; file a final return. | Transfer VAT responsibilities to the buyer; ensure compliance during the business transition. |

| Group Deregistration | VAT group disbanded or individual member exits. | File final group VAT return; notify authorities. | Settle group dues; reassess VAT registration needs for individual companies. |

Tax Implications of VAT Deregistration

VAT deregistration brings with it several financial considerations that businesses must address to stay compliant. Once you’ve canceled your VAT registration, there are a few key areas you’ll need to manage—outstanding invoices, bad debts, and VAT on imports and exports. Let’s break them down separately:

Grow Your Practice with Confidence

- VAT on Outstanding Invoices

After deregistration, businesses must account for VAT on any outstanding invoices. If invoices were issued but payments are yet to be received, VAT on these amounts must still be paid. - VAT on Bad Debts

If a business has bad debts, it may be eligible for a VAT adjustment. Businesses must report any VAT adjustments before deregistration to ensure compliance with the tax authority. - VAT on Imports/Exports

Before completing VAT deregistration, businesses must ensure all VAT has been properly accounted for in relation to imports or exports. This is particularly important when goods are still in transit or pending delivery.

Best Practices for VAT Deregistration

Deregistering from VAT doesn’t have to be a stressful process. If you approach it methodically, you can navigate it seamlessly. To ensure everything runs smoothly, here are the essential steps to follow:

- Consult Professionals

Seeking guidance from professionals who specialize in VAT deregistration can help ensure your business complies with all rules and regulations, preventing issues down the line. - Notify Stakeholders

Communicate with your customers and suppliers about the VAT deregistration status to avoid confusion and ensure that everyone is on the same page regarding pricing and invoicing. - Update Records

Maintain accurate records to avoid discrepancies. Ensure that all documents, invoices, and receipts reflect the updated VAT status after deregistration. - File Returns on Time

It’s essential to file a final VAT return on time, adhering to deadlines. Failing to do so can result in penalties, so be sure to submit everything promptly. - Plan for Future Activities

Consider the impact of VAT deregistration on future business activities. Plan accordingly to minimize disruptions and ensure that your operations can continue smoothly after deregistration.

Simplify VAT Deregistration with Expert Help from Ross McKinley:

Navigating the VAT deregistration process can be tricky, especially if you’re not familiar with the regulations in your country. But here’s the good news: you don’t have to figure it out on your own.

Ross McKinley is here to help you every step of the way, ensuring you stay compliant and avoid costly mistakes. Whether you’re shutting down operations, restructuring your business, or simply no longer meeting the VAT registration threshold, Ross McKinley offers the expertise you need to handle deregistration seamlessly.

Ready to Get Started?

Contact Ross McKinley for personalized, step-by-step guidance through VAT deregistration:

- Email: accounts@rossmckinley.com

- Phone: +44 (203) 950 8076

Don’t risk complications—let Ross McKinley ensure your VAT deregistration is handled correctly, so you can focus on growing your business.