In the United Kingdom, Value Added Tax (VAT) is a consumption tax applied to the sale of goods and services. When providing services to overseas customers, the VAT treatment depends on several factors, including the nature of the service and the status of the customer.

If your business provides services to overseas customers, you need to be aware of how VAT is applied to these transactions, especially when trading with customers in different countries.

Let’s dive into the details of VAT on services to overseas customers, unpack the rules, and explore what businesses need to know to ensure they are VAT-compliant when dealing internationally.

Table of Contents

What Is VAT on Services for Overseas Customers?

VAT on services to overseas customers refers to the Value Added Tax applied when businesses provide services to customers outside their home country. The rules surrounding VAT on cross-border services can vary based on the location of the company and the nature of the service being provided.

For businesses, understanding these rules is key to ensuring that they don’t overcharge customers and also stay compliant with the tax authorities. When VAT does apply to services provided to overseas customers, it’s often a simplified process compared to the standard rules applied to goods.

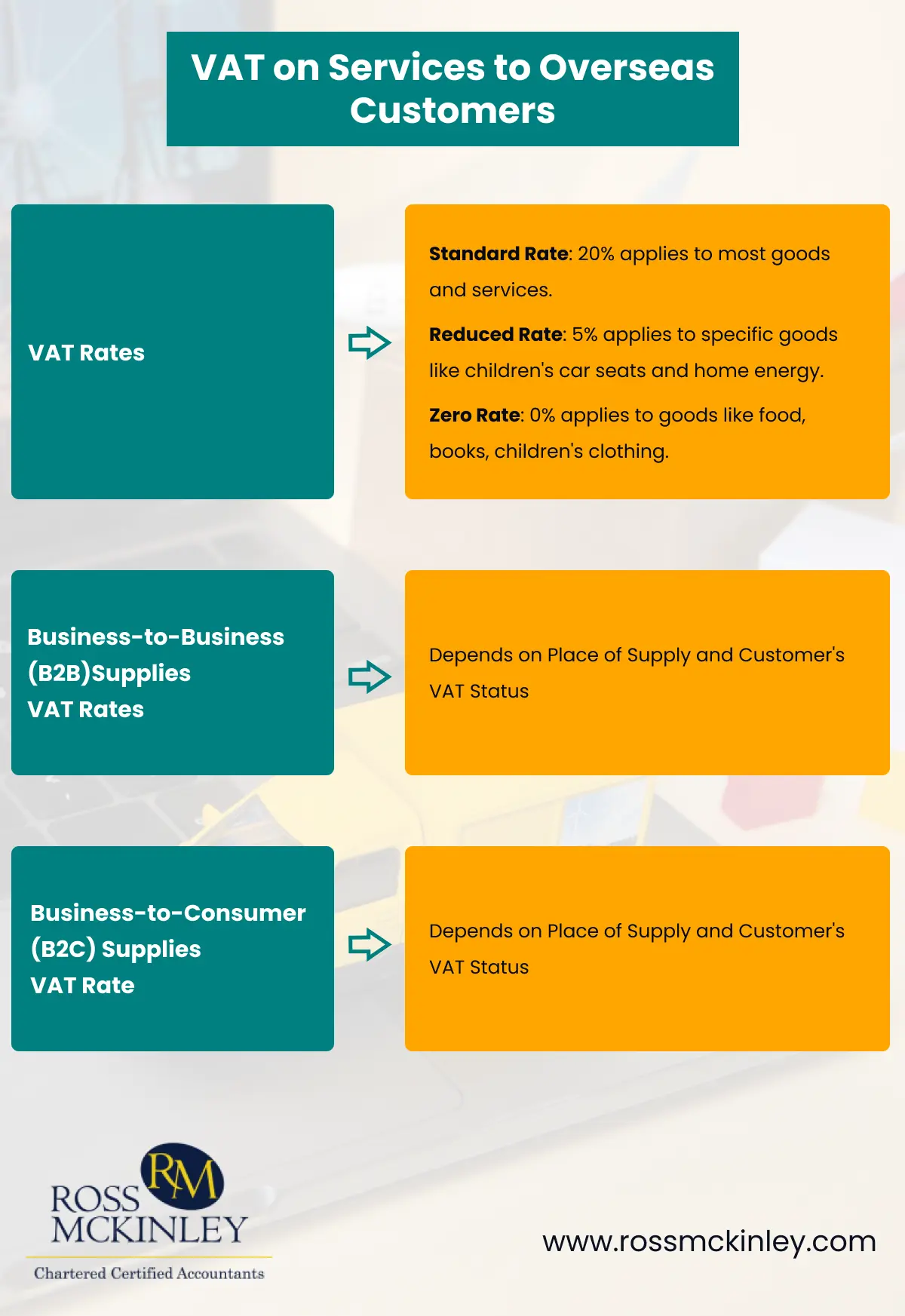

| VAT Rates | Standard Rate: 20% applies to most goods and services. Reduced Rate: 5% applies to specific goods like children’s car seats and home energy.Zero Rate: 0% applies to goods like food, books, children’s clothing. |

| Business-to-Business (B2B) Supplies VAT Rates | Depends on Place of Supply and Customer’s VAT Status |

| Business-to-Consumer (B2C) Supplies VAT Rate | Depends on Place of Supply |

VAT Rates and Tax Brackets

The UK VAT system comprises three primary rates. Each rate is applied based on the nature of the product or service, aiming to balance revenue generation with affordability for essential items. Below is a detailed explanation of these VAT rates:

Grow Your Practice with Confidence

Standard Rate

The standard VAT rate of 20% applies to the majority of goods and services sold in the UK. This includes items like electronics, clothing, alcoholic beverages, and most forms of entertainment.

Businesses registered for VAT must charge this rate to their customers unless the item qualifies for a reduced or zero rate.

Reduced Rate

The reduced VAT rate of 5% applies to specific goods and services that are considered essential or beneficial for the public. Examples include Children’s car seats which Ensure safety at an affordable price.

Moreover, Domestic energy supplies and mobility aids for the elderly are also subject to 5% VAT.

Zero Rate

The zero VAT rate is applied to essential goods and services, ensuring they remain exempt from VAT charges. Examples include unprocessed food items like fruits, vegetables, and bread, which help maintain affordable access to basic nutrition.

Moreover, children’s clothing and footwear, which reduce financial pressure on families; and books and printed materials, which promote education and literacy.

VAT on Services Supplied to Overseas Customers

In most cases, VAT may not apply to services provided to customers outside the country, but there are specific scenarios where VAT will be applicable. Let’s explore the common cases when VAT is applied to services provided to overseas customers:

Grow Your Practice with Confidence

- Business-to-Business (B2B) Supplies

Understanding VAT rules in B2B supplies is essential for ensuring compliance and efficiency, especially in cross-border dealings. Let’s highlight key aspects such as the place of supply and verifying a customer’s VAT status.

- Place of Supply

For most B2B services, the place of supply is the customer’s location. Therefore, if you supply services to a business customer outside the UK, the supply is considered to take place outside the UK. As a result, UK VAT does not apply to these services.

- Customer’s VAT Status

To apply for the B2B exemption, you must obtain and verify your customer’s VAT registration number. This ensures that the customer is a taxable person in their own country.

- Business-to-Consumer (B2C) Supplies

For most B2C services, the place of supply is the supplier’s location. Therefore, if you supply services to a non-business customer outside the UK, the supply is considered to take place in the UK. Consequently, UK VAT applies to these services.

Certain services are exceptions to the general B2C rule and are taxed based on where they are performed or used. For example, cultural, artistic, sporting, scientific, educational, and entertainment services are taxed where they take place.

Therefore, if such services are provided to non-business customers outside the UK, they may be exempt from UK VAT.

Calculating VAT on Services to Overseas Customers

When providing services to overseas customers, it’s essential to determine whether the supply is subject to UK VAT. If the supply is exempt from UK VAT (as in most B2B supplies), you do not charge VAT on the invoice.

However, you must keep records of the transaction and, if applicable, obtain evidence of the customer’s VAT registration number and the nature of the service provided.

Impact of VAT on Services to Overseas Customers

VAT can significantly impact businesses providing services to overseas customers, influencing pricing, administrative duties, and profitability.

Pricing and Competitiveness

If VAT doesn’t apply to services for overseas customers, businesses can offer more competitive prices. This is particularly beneficial for businesses looking to expand internationally.

For digital services, VAT based on the customer’s location can complicate pricing, as different customers will face varying VAT rates.

Administrative Burden

Managing VAT for cross-border services increases administrative work. Businesses may need to register for VAT in different countries or comply with systems like the EU’s VAT Mini One Stop Shop (MOSS).

VAT Recovery and Refunds

Businesses may incur VAT on expenses when providing services overseas. Some jurisdictions allow recovery of VAT paid on expenses if the services are outside the scope of VAT, reducing the overall tax burden.

Cross-Border Tax Planning

Understanding VAT’s impact is crucial for cross-border tax planning. Proper structuring of international transactions helps businesses comply with VAT laws while minimizing negative effects on profitability.

Penalties for Non-Compliance

Failing to comply with VAT regulations when providing services to overseas customers can lead to significant penalties.

These can include financial fines, interest charges, or even legal action in some cases. To avoid these risks, businesses should:

- Stay Informed

Keep up-to-date with changing VAT rules and regulations, especially when expanding to new countries.

- Consult Experts

Work with tax professionals or VAT consultants to ensure your business is compliant with VAT laws.

- Maintain Proper Records

Accurate documentation of cross-border transactions is essential for VAT compliance and to avoid penalties.

Conclusion

VAT on services to overseas customers is a complex but crucial aspect of international business. While many services provided to overseas clients are exempt from VAT or subject to special rules, businesses must carefully navigate the regulations to ensure compliance.

By understanding the nuances of VAT on cross-border services, businesses can optimize their pricing, streamline their administrative processes, and avoid costly penalties.

With the right knowledge and strategy, you can manage VAT effectively and continue to grow your international customer base without unnecessary tax complications.