Regarding property investments, rental income is a hot topic for many landlords and property owners. While it may sound simple, you rent a property and collect income. Things can get tricky when you introduce taxes like VAT (Value Added Tax) into the discussion.

Whenever you’re renting some type of residential property, understanding VAT on rental income is critical for ensuring compliance and maximizing profitability. So let’s break down what VAT on rental income is, when it applies, and how to manage it effectively.

Table of Contents

What is VAT on Rental Income?

First things first: VAT is an abbreviation for Value Added Tax that is generally levied during production and sales with the final price being paid by the buyer. However, VAT on rental income is the tax levied on rent earned from letting out properties, primarily commercial properties.

It applies under specific circumstances depending on local laws and regulations. Residential rental income is typically exempt in many jurisdictions, VAT often comes into play with commercial leases, certain short-term rentals, and furnished holiday lets.

The purpose of VAT is to tax the value added to goods and services at each stage of production or supply. When it comes to rental income, landlords or property owners are considered suppliers of a service. They are providing the use of a property in exchange for rent. If VAT applies, landlords must account for it, charge it to their tenants, and remit it to the tax authorities.

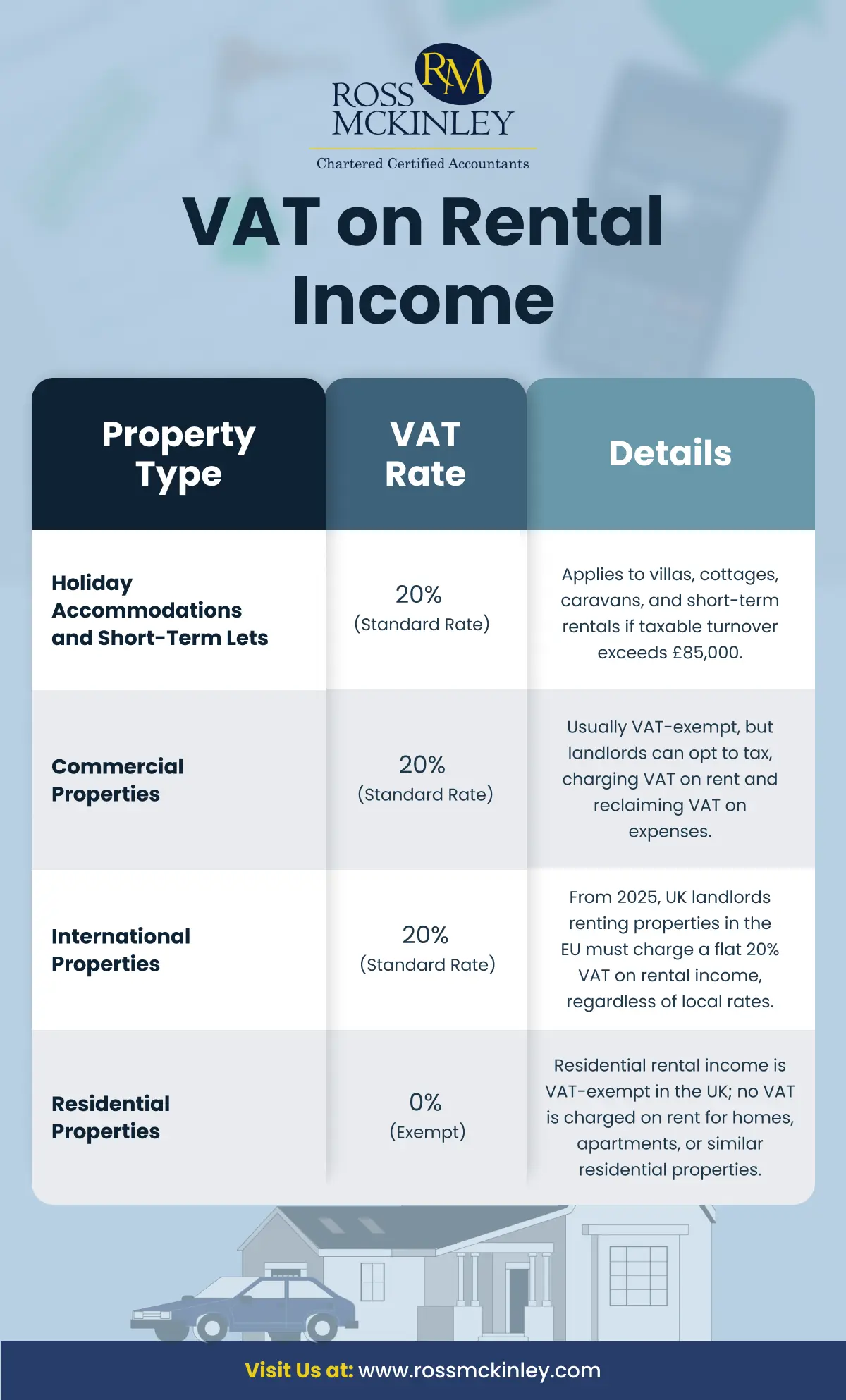

| Property Type | VAT Rate | Details |

| Holiday Accommodations and Short-Term Lets | 20% (Standard Rate) | Applies to villas, cottages, caravans, and short-term rentals if taxable turnover exceeds £85,000. |

| Commercial Properties | 20% (Standard Rate) | Usually VAT-exempt, but landlords can opt to tax, charging VAT on rent and reclaiming VAT on expenses. |

| International Properties | 20% (Standard Rate) | From 2025, UK landlords renting properties in the EU must charge a flat 20% VAT on rental income, regardless of local rates. |

| Residential Properties | 0% (Exempt) | Residential rental income is VAT-exempt in the UK; no VAT is charged on rent for homes, apartments, or similar residential properties. |

What Are the VAT Charges?

VAT on rental income is subject to various tax brackets and rates depending on the type of property, the purpose of the rental, and the jurisdiction. Below is a detailed breakdown of VAT charges based on different scenarios:

Grow Your Practice with Confidence

20% (Standard Rate)

- Holiday Accommodations and Short-Term Lets

Holiday accommodations, including villas, cottages, caravans, and short-term rentals, are subject to VAT at the standard rate. If a landlord’s taxable turnover exceeds the VAT registration threshold (£85,000 in the UK for the 2023/2024 tax year), they must charge VAT on such rentals.

- Commercial Properties

While most commercial property rentals are exempt, landlords can opt to tax, allowing them to charge VAT at the standard rate on rent. Opting to tax enables landlords to reclaim VAT on associated expenses but may have financial implications for tenants.

- International Properties

Starting in 2025, a flat average VAT rate of 20% will apply to UK landlords earning rental income from properties in the EU, regardless of local rates.

0% ( Exempt )

- Residential Properties

Residential rental income is typically exempt from VAT in the UK and many other jurisdictions. Landlords do not charge VAT on rent for homes, apartments, or other residential properties.

Grow Your Practice with Confidence

Exemptions and Exclusions

VAT rules for rental income are far from one-size-fits-all, especially when exemptions and exclusions come into play. Here’s a quick rundown of Residential rentals, Commercial Rentals, and Charities:

Residential Rentals

VAT generally doesn’t apply to residential rental income, so don’t worry about adding VAT to tenants’ rent payments.

Commercial Rentals

Without opting to tax, most commercial rents are VAT-exempt. However, opting in can allow you to reclaim VAT on property-related expenses.

Charities

Charities renting properties for their exempt purposes may be VAT-exempt, so VAT might not come into play here.

Penalties

It’s important to pay VAT payments and file VAT returns within the due date or else you face consequences in the form of penalties. The same is the case for late VAT returns and late VAT payments. Depending on the region you’re in, these penalties may vary.

In the UK, penalties on late VAT returns and late VAT payments are charged differently. So it’s important to understand the difference between the two:

- Filing VAT returns means filling and submitting a form to the tax authorities that provides them information about how much VAT you have charged, how much is paid to other businesses, and the difference between these two amounts. This helps to understand how much VAT you owe.

- Whereas, VAT payments are the payments that the property owner or landlord owes according to their VAT returns.

Here is some explanation of how penalties are charged on late VAT payments and late VAT returns:

Penalties on late VAT returns – The Points-Based System:

As of 1st January 2023, there has been a change in the penalties for late VAT payments and returns. Now a points-based system has been introduced and penalties on late VAT returns are charged based on the number of penalty points. In line with this points-based system, if you fail to submit a VAT return within the due date, you will receive a penalty point.

For every accounting period, there is a penalty points threshold i.e. the maximum number of penalty points you can get. If you reach this threshold, you will have to pay a penalty of £200.

The penalty points threshold for every accounting period is different. So, your penalty points threshold will depend on whether your region follows an annual, quarterly, or monthly accounting period.

| Accounting Period | Penalty Points Threshold |

| Annual | 2 points |

| Quarterly | 4 points |

| Monthly | 5 points |

Now in case, you were again lazy and did not submit your VAT return even after reaching the penalty points threshold, the good news is that you won’t get another point. The bad news is that you will have to pay another penalty of £200 on top of the one you paid when you reached the penalty points threshold.

So do try your best to submit your VAT returns within the deadline!

Penalties on late VAT payments:

If you fail to pay your VAT payments before the deadline, you will be charged some interest on it as a form of late payment penalty. If you are not able to pay the VAT payment due to some financial constraints, there is something called the Time to Pay Arrangement, in which HRMC creates a payment plan for you according to your financial situation.

Now penalties on late VAT payments depend on how late you are making the payment.

- If you make the late VAT payment within the first 15 days of the deadline or arrange a time to pay, then there is no interest i.e. no late payment penalty.

- When VAT payments are paid 16 to 30 days later than the due date, then a 2% interest is incurred on the unpaid VAT amount due.

- On VAT payments made 31 or more days late, then a 2% interest is incurred on the amount that was outstanding on day 30 and an additional 4% per year is charged daily until the VAT amount is paid.

Conclusion

VAT on rental income can seem like a maze, but understanding its basics can help landlords stay compliant and make informed financial decisions. From determining when VAT applies to managing its impact on rental operations, it’s crucial to stay informed and organized.

Whether you’re renting out commercial properties or dabbling in short-term holiday lets, VAT is an important consideration that shouldn’t be overlooked. Proper management ensures you stay on the right side of the law while optimizing your tax position, paving the way for smoother property investments and greater financial success.