Mileage claims may initially appear to be a small detail in the world of enterprises, however, if you’re frequently on the voyage for work, they can add up substantially. Whether you’re a business owner or an employee, knowing VAT (value-added Tax) can significantly help you.

VAT on mileage claims can assist you in making sure you’re correctly accounting for your charges and maximizing your returns. For many, VAT would possibly feel a bit hefty at the start, but with a breakdown of the essentials, you’ll see that claiming VAT on mileage is a practical matter.

A practical manner to recover some of the expenses that come with business travel. So, in case you’ve jumbled thoughts over VAT on mileage claims, take a seat, as we’re diving deep into how it works, why it matters, and the way you could make the most of it!

Table of Contents

How do Mileage Claims Work?

While employees drive their vehicles for work purposes, businesses reimburse them primarily based on an agreed fee, commonly called mileage allowance.

This price covers not simply the value of gas, but additionally the different expenses like put on and tear, coverage, and general renovation of the automobile.

However, only the fuel portion of the mileage is eligible for VAT reclaim, not the complete mileage allowance.

What’s VAT on Mileage Claims?

First things First, VAT on mileage claims refers to the capability to reclaim VAT on the fuel part of mileage charges for business-associated journeys.

Whilst employees or directors use their personal vehicles for work, they’re generally entitled to assert back a positive amount according to per mile for fuel costs.

However, here’s the kicker: a portion of that mileage claim includes VAT, which can be recovered, assuming your company is VAT registered and your mileage information is up-to-date.

Grow Your Practice with Confidence

Why claim VAT on Mileage?

Now you are probably questioning why trouble with VAT on mileage claims. Is it worth it? The answer is yes, mainly for organizations with excessive mileage desires. Here’s why:

1. Cost Savings:

Claiming VAT on mileage can result in vast savings over time, especially in case your employees tour regularly for business purposes.

2. Tax efficiency:

With the help of reclaiming VAT on mileage, businesses can reduce their overall tax burden, allowing them to use funds elsewhere.

Despite the fact that the reclaimable VAT on every mile appears small, the numbers add up over the years, making it really worth the effort for plenty of organizations. Sounds good, right?

What’s Required to claim VAT on Mileage?

Now, let’s get into the nitty-gritty of what’s certainly needed to make those claims. To reclaim VAT on mileage, there are a few necessities to hold in thoughts:

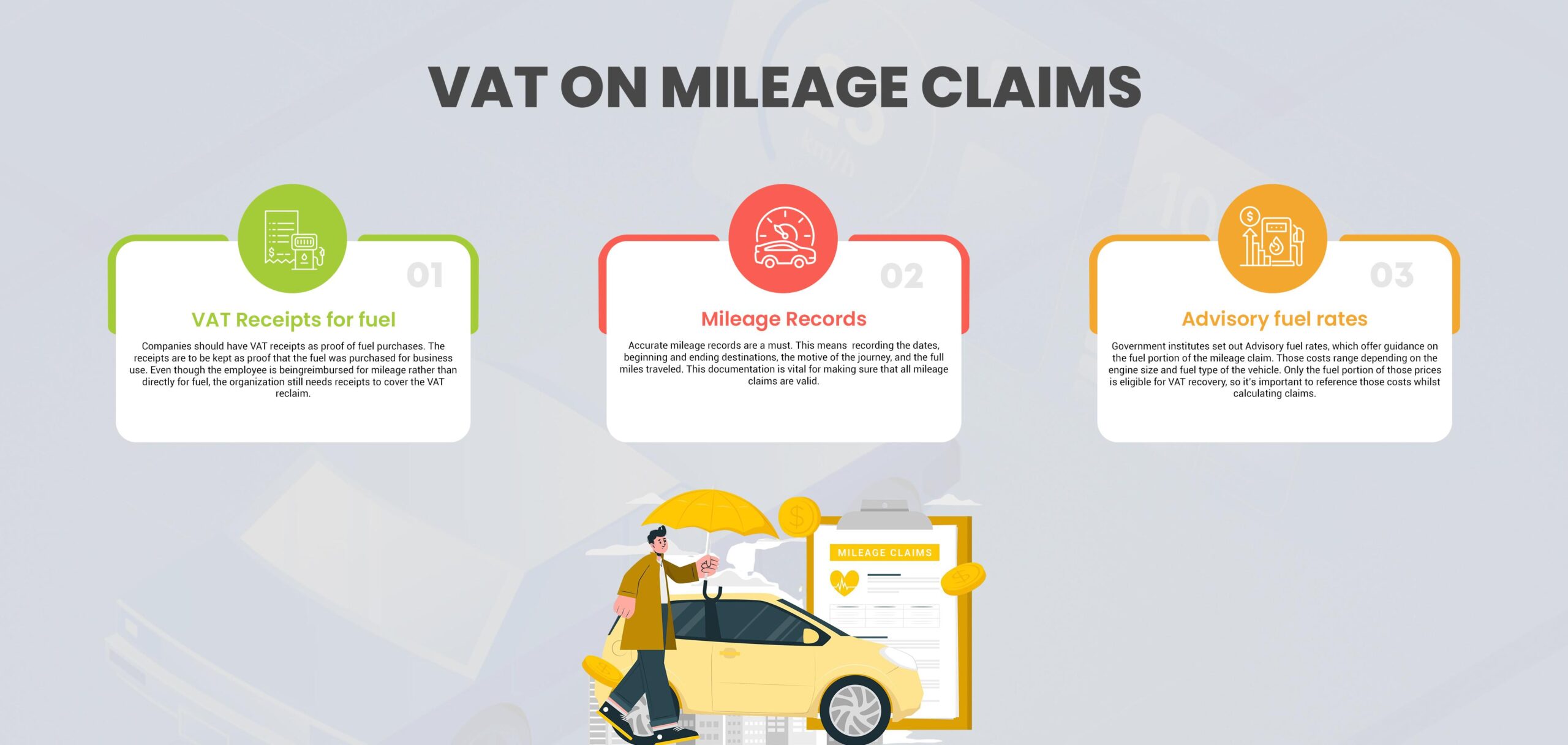

1. VAT Receipts for fuel:

Companies should have VAT receipts as proof of fuel purchases. The receipts are to be kept as proof that the fuel was purchased for business use. Even though the employee is being reimbursed for mileage rather than directly for fuel, the organization still needs receipts to cover the VAT reclaim.

2. Mileage Records:

Accurate mileage records are a must. This means recording the dates, beginning and ending destinations, the motive of the journey, and the full miles traveled. This documentation is vital for making sure that all mileage claims are valid.

3. Advisory fuel rates:

Government institutes set out Advisory fuel rates, which offer guidance on the fuel portion of the mileage claim. Those costs range depending on the engine size and fuel type of the vehicle. Only the fuel portion of those prices is eligible for VAT recovery, so it’s important to reference those costs whilst calculating claims.

Grow Your Practice with Confidence

Tips for Smooth VAT Mileage Claims

By imposing some straightforward practices, you can ensure that your claims are correct, compliant, and as easy as possible to manage. Whether you’re dealing with claims for yourself or handling them for employees, these recommendations will help hold your mileage reimbursements and VAT claims on the right track.

- Encourage Consistent Record-Keeping: Ensure employees maintain accurate mileage logs and submit VAT receipts for fuel purchases. This minimizes discrepancies and keeps your records audit-ready.

- Use Mileage Tracking Apps: For businesses with employees frequently on the road, a mileage tracking app can help automate the process. These apps track mileage, record start and stop locations, and can be a lifesaver for both employees and accounting teams.

- Stay Updated on HMRC Rates: HMRC updates Advisory Fuel Rates quarterly, so it’s essential to check these rates regularly to ensure your calculations are accurate. Using outdated rates can lead to incorrect claims, and HMRC is often quick to spot inconsistencies.

Common Mistakes to Avoid

When it comes to VAT on mileage claims, some common mistakes can result in expensive mistakes or HMRC scrutiny. From forgetting VAT receipts to the usage of old fuel rates, even small oversights can affect your claims. Here’s a look at some frequent pitfalls and a way to avoid them:

- Forgetting VAT Receipts: Even if employees are paid based on mileage and not reimbursed directly for fuel, VAT receipts for fuel must be kept on file to validate the claim.

- Claiming on Non-Business Mileage: VAT can only be claimed on business-related mileage, not personal trips. Mixing personal and business mileage can lead to some major issues with HMRC.

- Not Adjusting for Vehicle Type: Different vehicles have different advisory rates for fuel. Failing to apply the correct rate based on vehicle size and fuel type can lead to inaccurate claims.

- Ignoring Quarterly Rate Updates: Since HMRC updates rates quarterly, businesses must adjust accordingly. Using outdated rates can lead to discrepancies and potential HMRC challenges.

Conclusion

At first glance, VAT on mileage claims might seem like a lot of extra paperwork for a few pennies per mile. However, for businesses with employees constantly on the road, those small amounts can stack up quickly.

Over months or years, reclaiming VAT on mileage can contribute to significant savings, helping to offset the high costs of business travel. The process may feel a bit bureaucratic, but you can ace it with the right record-keeping practices in place and a solid understanding of the rules.

In this manner, VAT on mileage claims can become an easy and beneficial part of your business’s financial strategy. So, next time you’re filling up for a business trip, remember to keep that receipt—there’s value in those miles beyond just getting from A to B!