While many people have heard of VAT, not everyone realizes it contributes about a third of the government’s revenue. VAT affects everyone, not just businesses, as it’s included in nearly everything we buy online or on the high street.

You might haven’t noticed but we have to pay VAT on imports as well. Although VAT is significant, it remains one of the least understood taxes. So, if this concept is a mystery for you too you’ll find the read-ahead useful.

Table of Contents

What is VAT on Imports?

VAT, or Value Added Tax, is an indirect tax imposed on goods and services at each production stage, based on the added value at each step. It is widely adopted worldwide, especially in the EU, making the end consumer bear the final tax cost.

VAT on imports is a tax that countries impose on goods and services brought in from outside their borders. Like domestic VAT, it generates revenue and ensures that imported products are taxed similarly to locally made goods.

The tax is generally calculated based on the total value of the imported item, including costs like shipping, insurance, and sometimes customs duties. Import VAT becomes payable when the goods enter the country and is often collected at customs.

Grow Your Practice with Confidence

VAT Rates for Imported Products: Standard vs. Reduced

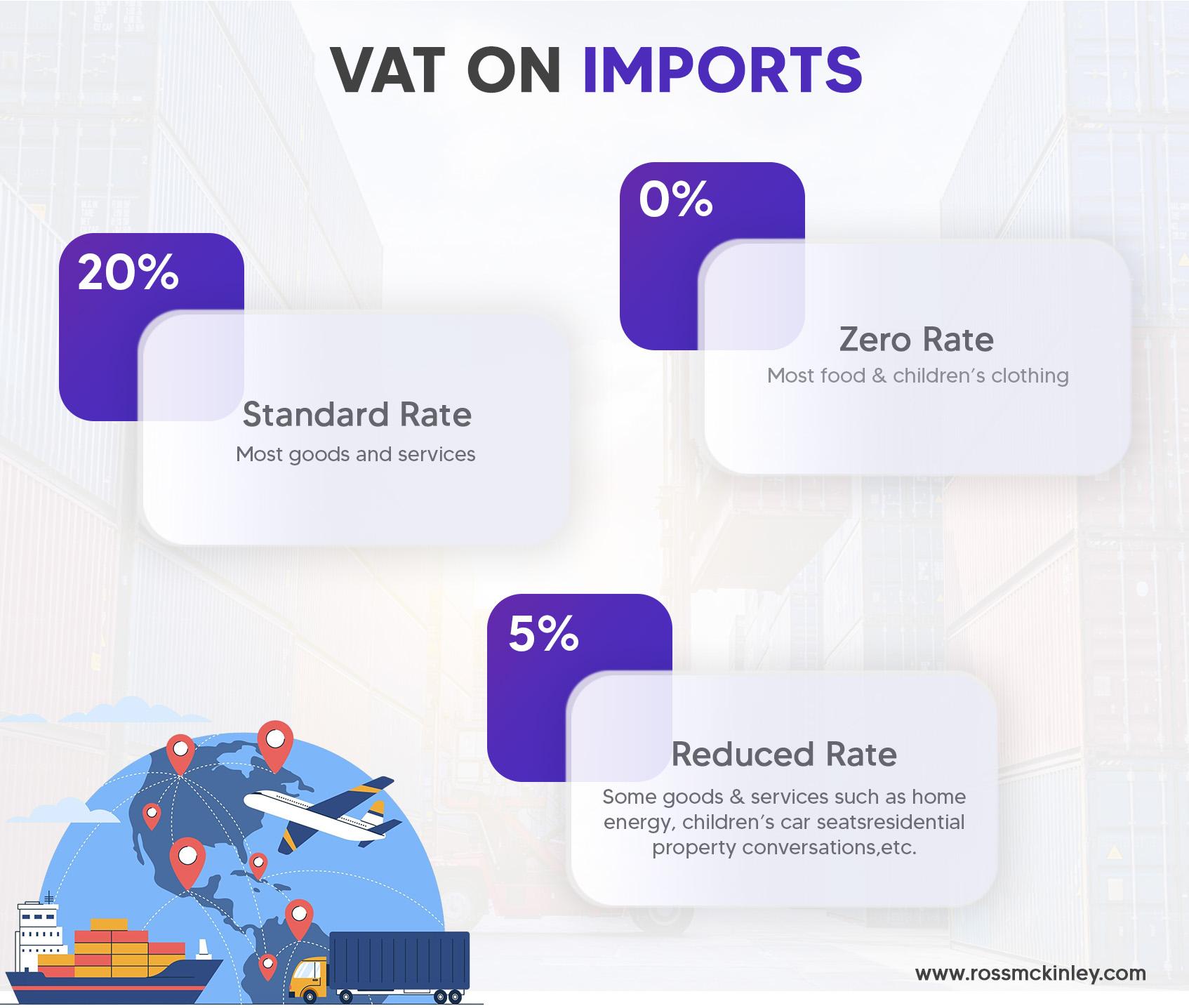

In the United Kingdom, value-added tax (VAT) is applied to most imported goods, with rates varying based on the type of product. Recognizing these rates is important for both consumers and businesses. The primary VAT rates for imports in the UK are the standard rate, the reduced rate, and the zero rate. Here’s an overview of each:

Standard Rate (20%)

A 20% VAT rate in the UK is standard. This rate is applied to a wide range of imported items, including:

- Electronics: Gadgets, computers, and other electronic devices.

- Clothing and Footwear: Most apparel and footwear items.

- Household Goods: Furniture, kitchen appliances, and general homeware.

- Luxury Items: High-end products and non-essential goods.

Businesses importing goods under the standard rate must incorporate this VAT into their pricing structures and ensure it is accurately reported in their VAT returns.

Reduced Rate (5%)

A Reduced VAT rate of 5% is applied to certain goods classified as partially essential. This lower rate helps make certain products more affordable for consumers. Items qualifying for the reduced VAT rate include:

- Children’s Car Seats: Safety seats for young children.

- Sanitary Products: Certain hygiene and health-related items.

- Energy-Efficient Materials: Products like insulation that contribute to energy savings.

Zero Rate (0%)

The zero rate is applied to essential goods, meaning no VAT is charged on these imports. However, businesses must still report these sales to comply with VAT regulations. Products that fall under the zero rate include:

- Food Items: Most groceries and foodstuffs.

- Children’s Clothing and Footwear: Apparel specifically designed for children.

- Books and Newspapers: Printed educational and informational materials.

- Medical Supplies: Certain healthcare-related products.

By zero-rating these essential items, the government ensures that necessary goods remain affordable for the public.

Grow Your Practice with Confidence

Calculating VAT on Goods Imported into the UK

When bringing goods into the UK, calculating the VAT is essential. No matter what product you are importing you need to calculate VAT. To clear up your confusions and doubts, here’s a straightforward guide to the procedure.

Step 1: Identify the VAT Rate

VAT rates differ according to the product you bring in. For electronic goods, household items and luxury goods it’s a standard 20%. A 5% VAT rate is applied to children’s car seats, sanitary products and energy efficient materials. There is zero VAT on essential goods. If you have a product and may be confused about its VAT rate, consult the VAT rate for imported products above.

Step 2: Calculate VAT

If the Customs Value is £500 and the VAT rate is 20%. First, convert the VAT rate into decimal by dividing it with 100. Add it in the formula given below and you’ve got your VAT amount.

Convert percentage in to decimal:

20% /100 = 0.20

Use the formula:

VAT Amount = (Customs Value) (VAT Rate)

VAT = £500 × 0.20 = £100

Who Is Responsible for Paying Import VAT?

Import VAT is the responsibility of the importer, whether an individual or a VAT-registered business, which can reclaim the VAT on their returns. Non-registered individuals must pay the VAT upfront, while customs agents may assist with the payment.

- Importers: Responsible for paying VAT.

- Registered Businesses: Can reclaim VAT on returns.

- Non-Registered Individuals: Pay VAT and cannot reclaim.

- Customs Agents/Brokers: Facilitate payments; the importer is responsible.

- Postponed VAT Accounting: Defers VAT payment but does not eliminate liability.

Using Postponed VAT Accounting in the UK

In the UK, Postponed VAT Accounting (PVA) allows VAT-registered businesses to delay paying VAT on imported goods. Instead of paying VAT at the border, importers can record it on their VAT returns, which helps improve cash flow.

To use PVA, businesses need to meet certain requirements, keep accurate records, and report the postponed VAT. This VAT should be included in the VAT return for the period when the goods are brought into the country.

It’s also important to apply PVA on customs declarations. By following these steps, businesses can handle VAT more efficiently while meeting HMRC rules.

Claiming a Refund on Overpaid Import VA

If a business has overpaid import VAT, it may be eligible to claim a refund. Overpayments can happen due to miscalculations, incorrect valuations, or classification errors in customs declarations. If you’ve paid more VAT on imports than necessary, you can reclaim the excess through a straightforward process.

- Identify Overpayment: Confirm the amount of VAT overpaid on imports.

- Gather Documentation: Collect invoices, customs declarations, and payment proofs to support your claim.

- VAT Return: VAT-registered businesses can reclaim the overpaid VAT on their next VAT return.

- Submit Claim: If not registered or for significant overpayments, submit a formal claim to HMRC with the required forms and documentation.

- Time Limits: Claims must be made within four years from the import date.

- Follow-Up: Track the status of your claim and provide additional information if requested by HMRC.

Conclusions

In conclusion, VAT on imports is essential to the UK tax system, ensuring fair taxation of imported and local goods alike. It empowers consumers to make informed choices and allows businesses to manage cash flow with options like Postponed VAT Accounting.

The ability to reclaim overpaid VAT further supports financial stability for businesses. With guidance from HMRC and customs experts, navigating VAT on imports is accessible and beneficial to the economy.