Managing VAT on holiday lets can be a challenging task for property owners. You have to deal with multiple regulations, income thresholds, and tax schemes while maximizing profits and staying compliant.

Properly handling VAT affects not only your cash flow but also your ability to reclaim certain expenses and avoid costly fines. Knowing when VAT applies, how to register, and how to manage VAT charges could make a big difference in your business’s profitability.

This blog will guide you through VAT on holiday lets, from basic concepts to practical steps for registration and much more. So, let’s make VAT management for your holiday property simpler and more effective.

Table of Contents

What Is VAT on Holiday Lets?

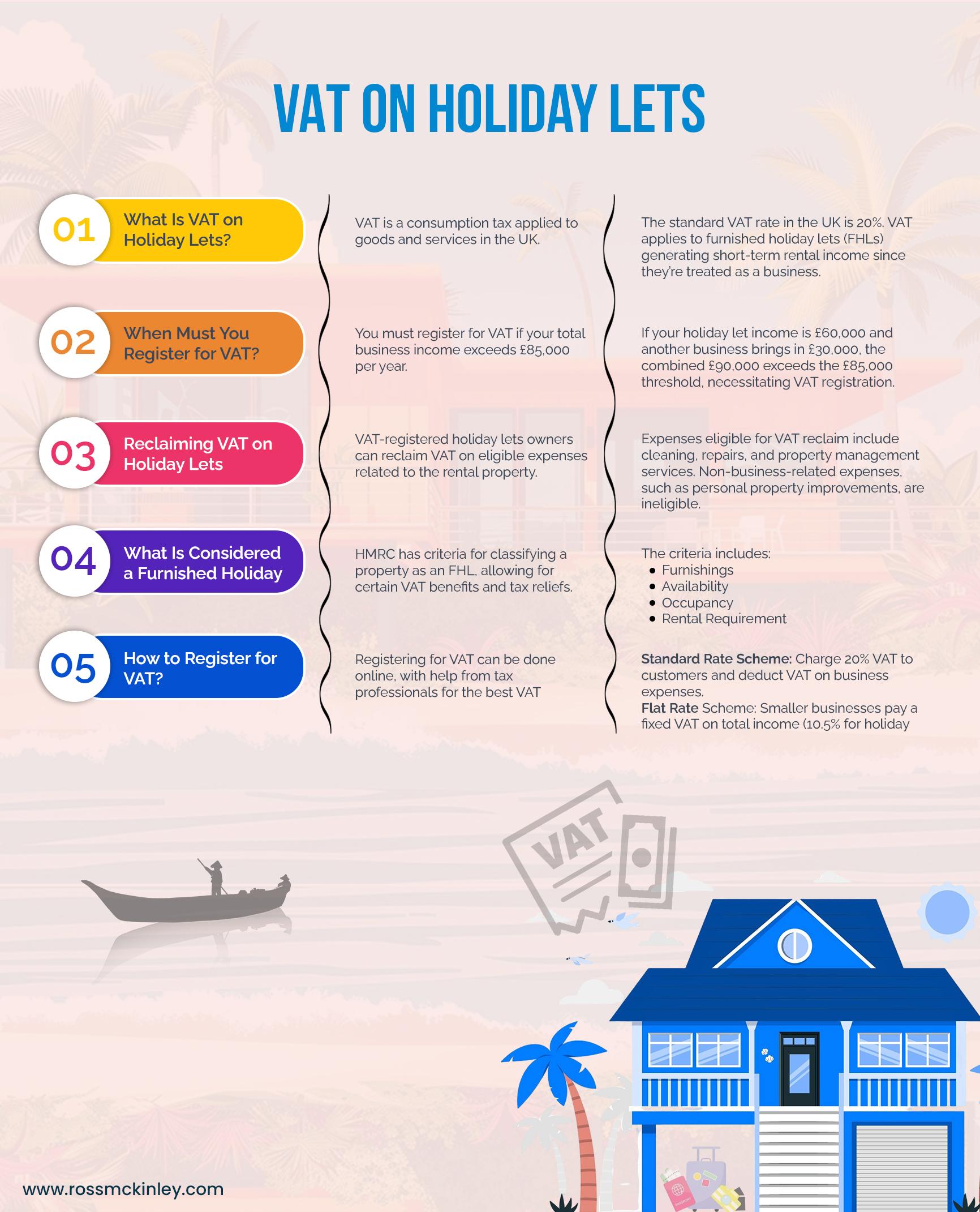

Value Added Tax, or VAT, is a consumption tax applied to goods and services in the UK, with a standard rate of 20%. When you rent out a holiday let, you’re considered to be providing a taxable service under UK tax law, which makes VAT applicable.

Notably, VAT does not apply to long-term residential lettings, as these are exempt. However, VAT generally applies to furnished holiday lets (FHLs), which generate short-term rental income if certain criteria are met. This is because FHLs are treated more like businesses than simple rental properties.

| Section | Explanation | Elaboration |

| What Is VAT on Holiday Lets? | VAT is a consumption tax applied to goods and services in the UK. | The standard VAT rate in the UK is 20%. VAT applies to furnished holiday lets (FHLs) generating short-term rental income since they’re treated as a business. |

| What Is Considered a Furnished Holiday Let? | HMRC has criteria for classifying a property as an FHL, allowing for certain VAT benefits and tax reliefs. | The criteria includes:FurnishingsAvailabilityOccupancyRental Requirement |

| When Must You Register for VAT? | You must register for VAT if your total business income exceeds £85,000 per year. | If your holiday let income is £60,000 and another business brings in £30,000, the combined £90,000 exceeds the £85,000 threshold, necessitating VAT registration. |

| How to Register for VAT? | Registering for VAT can be done online, with help from tax professionals for the best VAT scheme choice. | Standard Rate Scheme: Charge 20% VAT to customers and deduct VAT on business expenses.Flat Rate Scheme: Smaller businesses pay a fixed VAT on total income (10.5% for holiday lets) but cannot reclaim VAT on most purchases. |

| Reclaiming VAT on Holiday Lets | VAT-registered holiday lets owners can reclaim VAT on eligible expenses related to the rental property. | Expenses eligible for VAT reclaim include cleaning, repairs, and property management services. Non-business-related expenses, such as personal property improvements, are ineligible. |

What Is Considered a Furnished Holiday Let?

HMRC specifies certain criteria to classify a property as a furnished holiday let. Meeting these standards not only qualifies your property as an FHL but also makes you eligible for certain VAT benefits. It can also help you access Capital Gains Tax relief and certain income tax advantages, so here’s the criteria:

- Furnishings: The property must be fully furnished and equipped, meeting a basic level of comfort for holiday stays.

- Availability: The property should be available to rent out for at least 210 days per year, ensuring it’s genuinely accessible for holiday use.

- Occupancy: Each guest’s stay should not exceed 31 days, with a total occupancy of no more than 155 days by long-term residents.

- Rental Requirement: The property must be rented out commercially for at least 105 days in the year, showing that it’s actively used as a holiday let.

Grow Your Practice with Confidence

When Must You Register for VAT as the Owner of Holiday Lets?

VAT registration becomes mandatory if your total business income, including your sources, exceeds the current threshold of £85,000 annually.

For example, if your holiday lets generate an annual income of £60,000. On the other hand, you own a second business that brings in £30,000, so your total income would hit £90,000. Thus, you must register for VAT, as your combined income surpasses the £85,000 limit.

Interestingly, many owners also consider voluntary VAT registration, which can be beneficial if you have substantial VAT-eligible expenses.

Voluntarily registering lets you reclaim VAT on expenses related to your holiday let, so it is a good option if you regularly invest in maintenance or property upgrades.

How Do You Register for VAT on Holiday Lets?

Registering for VAT is a simple process that you can complete online through the HMRC website. However, to ensure you make the best financial decision, it’s wise to consult with a tax professional who can help you choose the optimal VAT scheme for your business.

Your decision between the schemes must depend on factors such as expected rental income and the VAT you can reclaim on expenses.

A few available choices for VAT schemes:

- Standard Rate Scheme: This is the most common VAT scheme, where you charge 20% VAT to customers and deduct VAT on business expenses.

- Flat Rate Scheme: This is best for small businesses as it allows you to pay a fixed VAT rate on your total income. For accommodation, this flat rate is 10.5%. However, with this option, you won’t be able to reclaim VAT on most purchases.

Flat Rate Scheme for VAT on Holiday Lets

The Flat rate scheme is a simplified VAT on holiday lets scheme for smaller businesses with a turnover below £150,000 (excluding VAT). Under this scheme, you pay a fixed percentage, which is 10.5% for holiday lets on your gross income. Thus, you don’t need to calculate VAT separately for each transaction.

Aspects to consider when opting for the VAT on holiday lets Flat rate scheme:

- Simplicity: It simplifies your VAT returns by eliminating the need to track VAT on every expense, making it less time-consuming.

- Limited Reclaim Opportunities: With this scheme, you won’t be able to reclaim VAT on most expenses, which could be a disadvantage if you regularly spend on property maintenance or renovations.

Choosing between the standard VAT scheme and the Flat Rate Scheme will depend on your specific business needs and the proportion of VAT-eligible expenses you incur.

For example, if your gross rental income is around £100,000, you would owe about £10,500 under the Flat Rate Scheme. In contrast, under the standard scheme, you would need to evaluate your potential VAT claim to see if it offers greater savings.

Grow Your Practice with Confidence

Reclaiming VAT on Holiday Lets

One of the benefits of being VAT registered as a holiday let owner is the ability to reclaim VAT on expenses directly related to your rental property. It includes costs for cleaning, repairs, furnishings, or property management services, as well as everything that supports your holiday let business.

However, VAT cannot be reclaimed on personal or non-business expenses, such as improvements for private use. For example, while you can reclaim VAT on new bedding and kitchen supplies for the rental, you wouldn’t be able to reclaim VAT for personal items.

For those registered under the flat rate scheme, the reclaimable VAT is generally limited to capital expenses that exceed £2,000. To keep things organized, maintaining detailed records of all VAT expenses and ensuring you retain VAT receipts is essential.

Conclusion

Knowing when to register, choosing the right VAT on holiday lets scheme, and reclaiming eligible VAT on expenses are essential steps for every holiday lets owner.

As you consider VAT registration, take the time to weigh the benefits of the flat rate scheme against the standard VAT option. Making the right choice here could impact your cash flow and profitability significantly.

When in doubt, consult a tax professional. With the right guidance, you’ll be able to maximize your holiday let’s potential while ensuring compliance and minimizing VAT liabilities.