Shouldn’t food be a tax-free essential like the air we breathe in? Well, that’s not true because we have to pay taxes on the food we consume. VAT on food is crucial as it affects consumers, businesses, and governments globally.

Knowing VAT on food can help us identify how much the restaurants may be charging for the fine dining experience so we won’t be getting the mini heart attack we get after seeing the bill.

VAT on food is also crucial for businesses so that they can identify the tax they need to pay on their sales and purchases. Whether you are a foodaholic or a businessman, the read-ahead will interest you and make you identify the VAT on food and its various types.

Table of Contents

What is VAT on Food?

VAT stands for Value-added tax, induced by the government upon value added to goods and services during stages of production and distribution. The VAT on food begins with the transition of goods from raw materials to presentable final products.

VAT works on food in a way that farmers pay it for the growing process, manufacturers for processing and packaging, retailers for sales, and consumers bear the final burden on the finished product.

VAT is charged on each value-added stage including input and output. The input VAT is the tax paid on purchases and output VAT is the tax charged on sales.

TYPES OF VAT ON FOOD

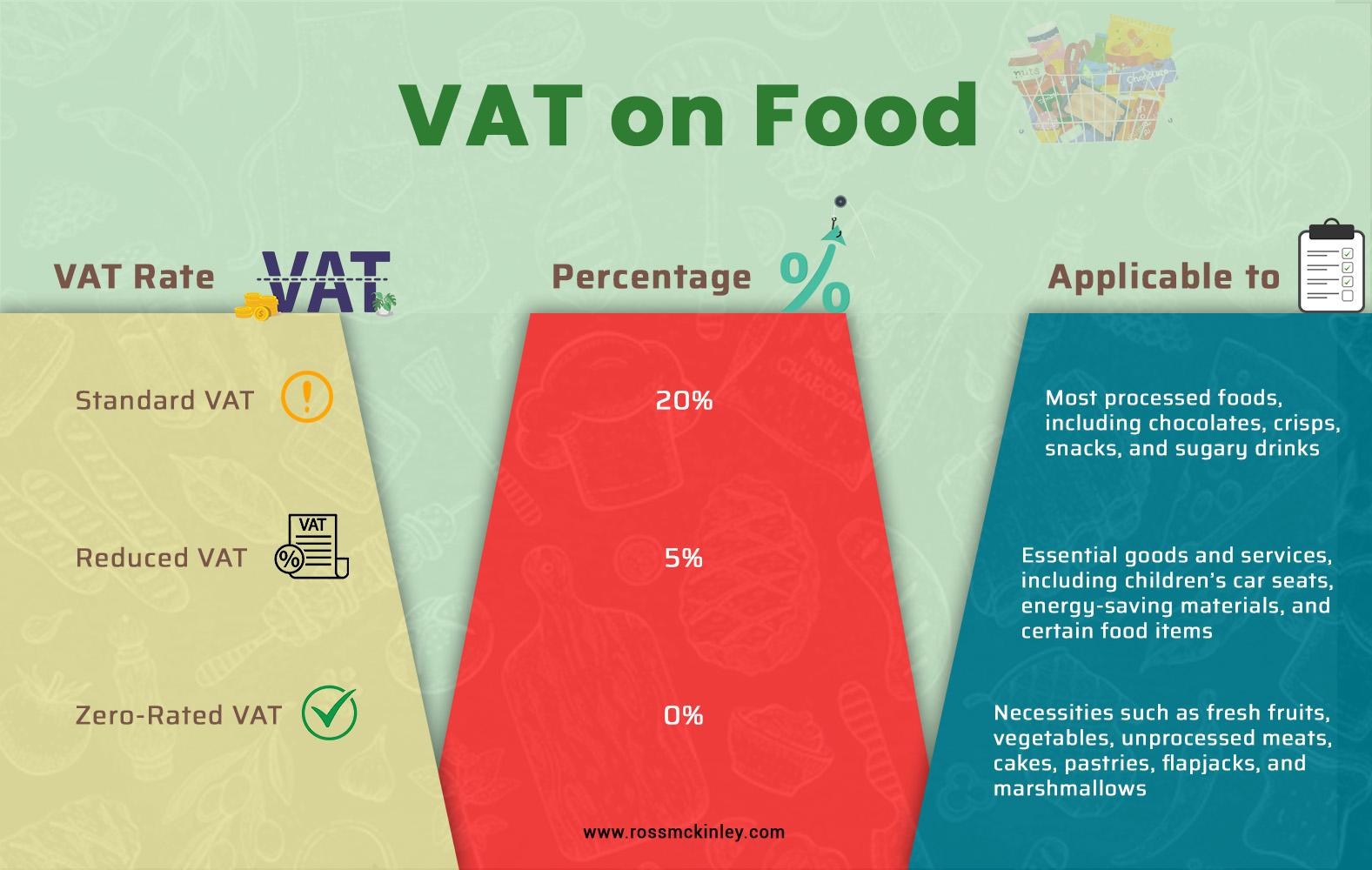

Understanding VAT on food is like cracking a secret code as it’s pretty complicated. There are different VAT rates on different foods and they differ in different countries. In the UK there are three types of VAT that are implied on various food types.

Standard VAT (20%): It is applied to most processed foods including chocolates, crisps, snacks, and sugary drinks.

Reduced VAT (5%): A lower rate is applied to essential goods and services including children’s car seats, energy-saving materials, and certain food items.

Zero- Rated VAT (0%): No VAT is charged on necessities example fresh fruits, vegetables, and unprocessed meats. You can devour cakes, pastries, flapjacks, marshmallows, and all these kinds of food items at zero VAT.

Exempt VAT: No VAT charges are applied on these items, examples include healthcare services, educational services, and financial services.

Grow Your Practice with Confidence

VAT on Confectionery

A standard rate of 20% VAT is implied on your favorite confectionary items including those which are normally sweetened and normally eaten with fingers. These cover all the products that offer you a sweet escape into the world of indulgence.

So, next time you crave a sweet or a chocolate make sure you have enough greens to support your craving. Here’s a list of all the confectionery that have standard 20% VAT charges:

- Chocolates

- Cereal bars

- Sweets

- Fruit bars

- Chocolate biscuits

- Diabetic chocolates

- Liqueur chocolates

- Pastilles

- Lollipops

- Chewing gum

- Turkish delight

- Candy floss

- Sherbet

- Frozen yogurt

- Sorbet

- Icecream

VAT on Takeaway Food

A standard VAT is charged on the food served by restaurants within its premises or available for takeaway. However, there is a glitch! If the food offered is intentionally kept hot to be sold fresh then there will be VAT charges on it.

VAT is not charged on products that are not kept warm which is why most baked products have zero VAT charges on their consumption. Cold food takeaway is zero-rated hence you can enjoy them without paying extra.

On the contrary, hot food and drink takeaways which may also include confectionery items such as potato crisps or chocolates have a standard VAT rate charge on them.

VAT on Catering

The standard VAT rate is applied to food or drinks provided by the catering company. Also, the catering services provided may be of several types so the VAT rate varies accordingly. Catering services can be where food and drinks are supplied by cafes and restaurants.

Caterers may provide food for parties and conferences or deliver cooked ready-to-eat meals to the clients. Either way, a standard rate will be charged for the food delivered by the caterers. In contrast, if customers prepare food, thaw frozen food, or reheat cooked food it will be zero-rated.

Grow Your Practice with Confidence

VAT on Animal Feed, Plants And Seeds

Certain animal feed products, seeds, and plants are zero-rated. However, a standard rate is applied to packaged animal feed designated for cats, dogs, birds, or other domestic pets. Also, the pigeon feed is generally zero-rated unless advertised as bird food which will imply a standard rate for it.

Food for labrador is standard rated unless it’s used as a gun dog where its food will be zero-rated. Hence, it can be declared that different conditions may lead to differences in VAT rates.

Conclusion

VAT on food is a multifaceted issue affecting businesses and consumers worldwide. A varying rate of VAT with the difference in usage can change the VAT rate for businesses and consumers. Hence, individuals and businesses should be very particular about the VAT rate.

This issue continues to evolve and so stakeholders must engage themselves in inducing a proper management system that notifies them about the latest market trends and regulations.

Having proper knowledge about how VAT on food works is the only way to know how to tackle it to your advantage and stay on budget. This is why we have included all the crucial details about VAT on food above to help businesses and individuals easily identify the VAT rate on food.