Electric cars are the future, which is why the government is implementing a “Green Agenda” to promote their use. However, the government’s VAT rate on electric cars isn’t very motivating for buyers.

So, if you are planning an upgrade to electric cars, you might want to have complete knowledge of the VAT on electric cars. We have dived deep to showcase our complete knowledge of VAT on electric cars.

You can also find out if companies can claim VAT on electric cars and whether you can claim VAT on charging electric vehicles.

Table of Contents

VAT on Purchase of Electric Cars

One might assume that UK laws must provide VAT relief on electric cars owing to their green agenda. However, that’s not true. The VAT on purchasing electric cars has the same rules and charges as on petrol or diesel vehicles and implies 20% VAT charges.

If the car is bought for commercial use but is instead being used privately, no input VAT can be claimed back. If the owner or the employee uses the car to commute from home to the office, this comes under personal use.

Also, if the car is purchased for business purposes, it shouldn’t be available to anyone else. You should have clear evidence that the car is not available for private use to reclaim VAT on electric cars.

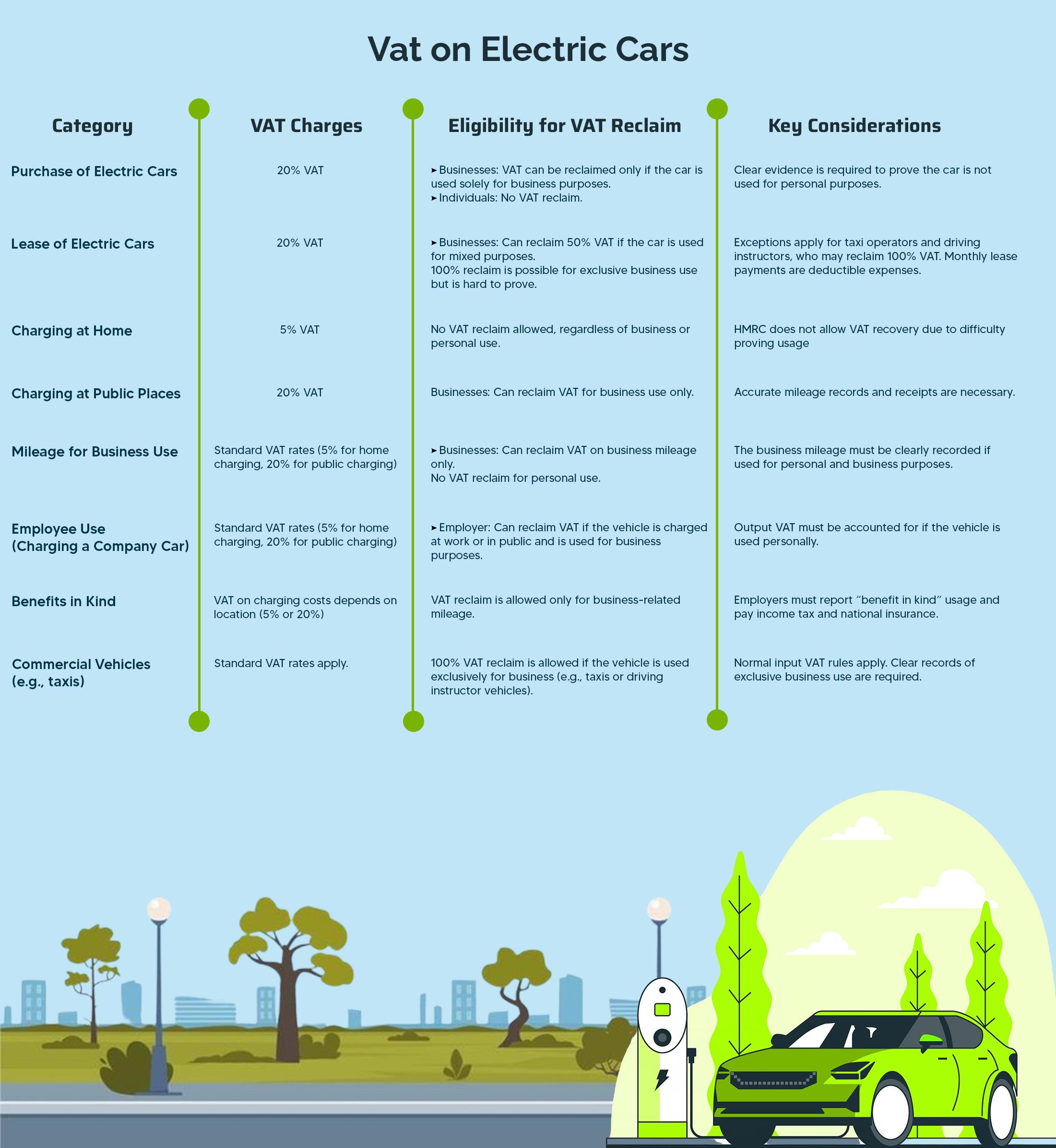

| Category | VAT Charges | Eligibility for VAT Reclaim | Key Considerations |

| Purchase of Electric Cars | 20% VAT | – Businesses: VAT can be reclaimed only if the car is used solely for business purposes.- Individuals: No VAT reclaim. | Clear evidence is required to prove the car is not used for personal purposes. |

| Lease of Electric Cars | 20% VAT | – Businesses: Can reclaim 50% VAT if the car is used for mixed purposes.100% reclaim is possible for exclusive business use but is hard to prove. | Exceptions apply for taxi operators and driving instructors, who may reclaim 100% VAT. Monthly lease payments are deductible expenses. |

| Charging at Home | 5% VAT | No VAT reclaim allowed, regardless of business or personal use. | HMRC does not allow VAT recovery due to difficulty proving usage. |

| Charging at Public Places | 20% VAT | Businesses: Can reclaim VAT for business use only. | Accurate mileage records and receipts are necessary. |

| Mileage for Business Use | Standard VAT rates (5% for home charging, 20% for public charging) | – Businesses: Can reclaim VAT on business mileage only.No VAT reclaim for personal use. | The business mileage must be clearly recorded if used for personal and business purposes. |

| Employee Use (Charging a Company Car) | Standard VAT rates (5% for home charging, 20% for public charging) | – Employer: Can reclaim VAT if the vehicle is charged at work or in public and is used for business purposes. | Output VAT must be accounted for if the vehicle is used personally. |

| Benefits in Kind | VAT on charging costs depends on location (5% or 20%) | VAT reclaim is allowed only for business-related mileage. | Employers must report “benefit in kind” usage and pay income tax and national insurance. |

| Commercial Vehicles (e.g., taxis) | Standard VAT rates apply. | 100% VAT reclaim is allowed if the vehicle is used exclusively for business (e.g., taxis or driving instructor vehicles). | Normal input VAT rules apply. Clear records of exclusive business use are required. |

Grow Your Practice with Confidence

VAT on Lease of Electric Cars

On the lease of electric cars, the standard rate of 20% implies that individuals buying the vehicle for personal use cannot reclaim VAT. On the contrary, if a company leases an electric car specifically for commercial usage, it can reclaim 50% of the VAT.

Companies can claim back 100% of the VAT charged, but it is extremely difficult to prove to HRMC that the car has not been used personally. Hence, it’s best to avoid the hassle and enjoy 50% savings instead.

There are still some exceptions to this rule for taxi operators and driving instructor businesses. Moreover, businesses can benefit from leasing electric cars because the monthly rental payments can be considered deductible expenses and can be set against the profit for a lesser tax bill.

VAT on Electric Vehicle Mileage

Well, VAT can be reclaimed on electric cars as well as those that run on petrol or diesel. According to HMRC, VAT can be reclaimed on electric cars used particularly for business purposes if the company is VAT-registered and does not use the car for personal use.

Grow Your Practice with Confidence

A company or an employee can claim the VAT incurred on charging an electric vehicle. If a vehicle is charged at home, 5% VAT is implied, and if it’s charged at a public place, then the standard rate applies.

One should have detailed records and mileage receipts to support their claim. Also, if you buy an electric car for personal use, you cannot reclaim any VAT charges you bear on its charging.

Claiming VAT Charges on Electric Cars Mileage for Commercial Use

Luckily, if you own or lease an electric car for commercial use, you can claim the cost of its charging. However, make sure to have accurate records that the electric vehicle is not used for personal purposes. Only then can the company reclaim VAT on its charging.

If the electric car is used for both commercial and personal purposes, you can claim VAT charges incurred only on business mileage. This scenario will be considered a “benefit in kind,” and you’ll be entitled to pay income tax and national insurance for it.

Employee VAT Charges on Electric Cars Mileage for Commercial Use

If an employee is charging the company’s electric vehicle at work or in a public place, the employer can recover input VAT associated with the vehicle’s charging. The employer or the company will also have to account for output VAT entitled to the personal use of the company’s vehicle.

If the employer charges the vehicle at home, he cannot reclaim any VAT associated with the charging. This is because it will be difficult to prove whether the vehicle was being used for personal or company use.

Moreover, HMRC doesn’t clearly mention the VAT treatment of vehicles available for commercial use, such as pool cars or taxi services. It can be assumed that the normal input tax rules may also apply to electricity charges incurred for such usage.

Therefore, if any such electric vehicle is charged within the company premises and used specifically for business purposes, input tax can be claimed back. Lastly, here’s a summary of the VAT charges and reclaim eligibility for businesses and individuals.

Conclusion

With fuel prices on the rise and adverse climate changes, electric cars are better for future sustainability. However, it’s disappointing that tax implications on electric cars in the UK are similar to those of petrol or diesel-run cars.

Luckily, companies can still enjoy VAT savings by reclaiming VAT on electric cars used solely for business reasons. Charging costs, maintenance repairs, insurance, and other business-related costs, such as breakdown coverage, can all be reclaimed.

However, companies will need to keep a clear record of all of their expenses related to the commercial usage of electric cars to be eligible for VAT returns. If you’re using electric cars for personal use, upgrading to a more advanced and eco-friendly model brings both joy and lasting satisfaction on its own.