Do you run your business in the UK, and energy costs are badly affecting your business? All businesses across the UK are feeling the pinch. Recent energy price surges mean many companies pay double or even more for their energy bills.

On top of this, VAT on electricity for businesses adds an extra 20% to the cost, making energy bills even harder to manage. Did you know that in some cases, businesses can pay a reduced VAT on business electricity of just 5%? You only need to take steps to qualify for VAT on commercial electricity.

In this guide, we’ll explain VAT on commercial electricity, its rates, how to claim it on your business energy bills, and practical ways to lower your energy costs.

Table of Contents

What is VAT on Commercial Electricity?

VAT, or Value Added Tax, is a consumption tax UK residents pay on most goods and services, especially energy. For businesses, this means you pay VAT on commercial electricity, gas, and other energy sources.

The standard commercial electricity VAT rate is 20%. This tax is often less of a worry for VAT-registered businesses because they can reclaim it. However, smaller companies or those not registered for VAT must pay the full cost, which can hit their cash flow hard.

VAT-registered businesses charge VAT on their sales and pay it on purchases, including energy bills. They then reclaim the VAT they’ve paid from HMRC, essentially offsetting the cost.

However, for many smaller companies, reclaiming VAT isn’t an option. Thus, it’s essential for them to explore other ways to reduce the impact of VAT on energy bills.

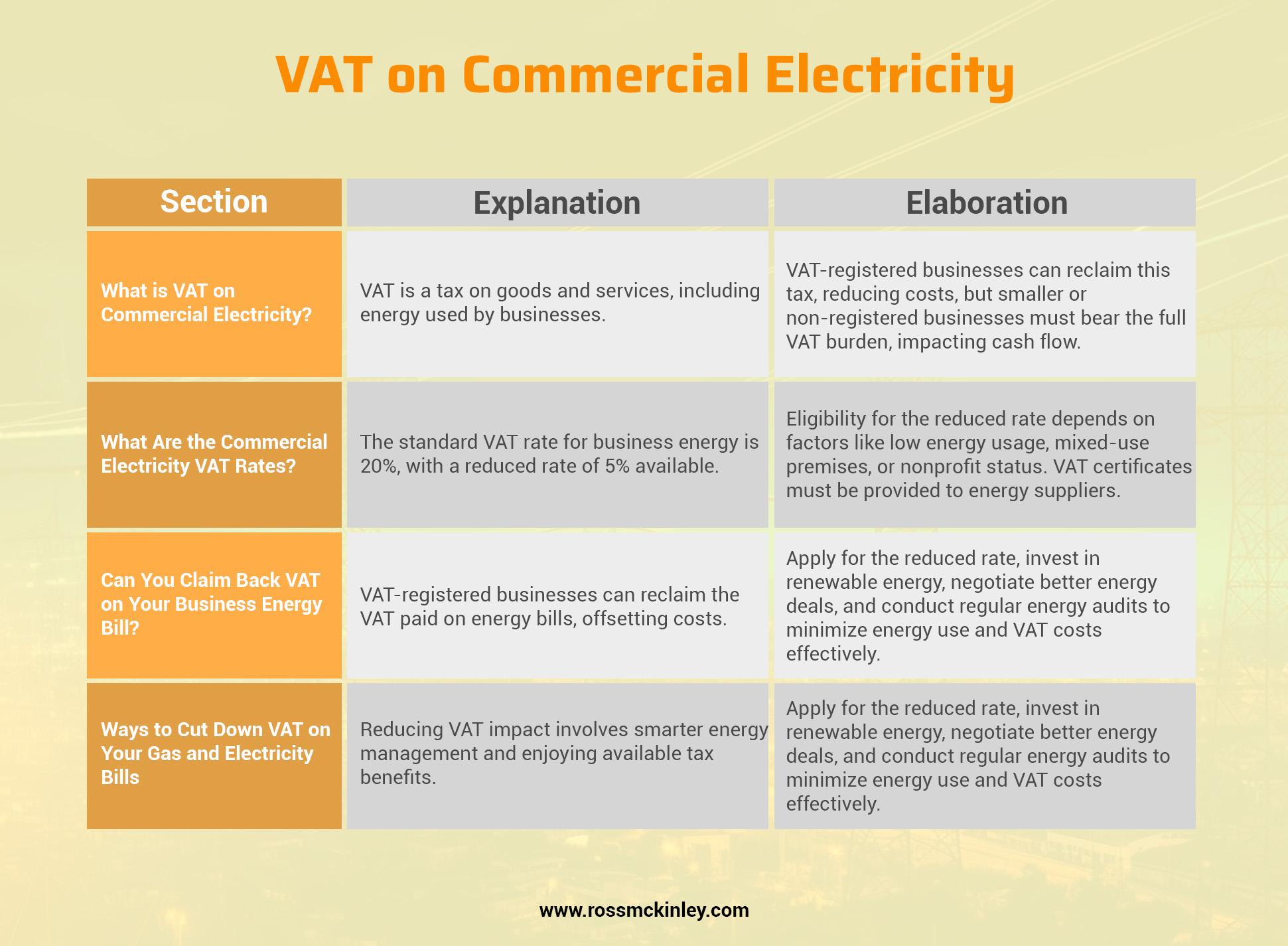

| Section | Explanation | Elaboration |

| What is VAT on Commercial Electricity? | VAT is a tax on goods and services, including energy used by businesses. | VAT-registered businesses can reclaim this tax, reducing costs, but smaller or non-registered businesses must bear the full VAT burden, impacting cash flow. |

| What Are the Commercial Electricity VAT Rates? | The standard VAT rate for business energy is 20%, with a reduced rate of 5% available. | Eligibility for the reduced rate depends on factors like low energy usage, mixed-use premises, or nonprofit status. VAT certificates must be provided to energy suppliers. |

| Can You Claim Back VAT on Your Business Energy Bill? | VAT-registered businesses can reclaim the VAT paid on energy bills, offsetting costs. | For example, a home-based VAT-registered business using 60% of energy for work can reclaim £20 from a £33.33 VAT amount on a £200 bill. Over a year, this adds up significantly. |

| Ways to Cut Down VAT on Your Gas and Electricity Bills | Reducing VAT impact involves smarter energy management and enjoying available tax benefits. | Apply for the reduced rate, invest in renewable energy, negotiate better energy deals, and conduct regular energy audits to minimize energy use and VAT costs effectively. |

What Are the Commercial Electricity VAT Rates?

The standard VAT on gas and electricity for business is 20%. Most businesses fall under this rate, but certain conditions allow some businesses to qualify for a reduced % VAT on business electricity of 5%.

You can benefit from the 5% VAT rate by providing a VAT certificate to your energy supplier. Once approved, the discount will apply to future bills. This can significantly affect your overall energy expenses, especially for small or nonprofit organizations.

Here’s when your business can qualify for the lower rate:

Grow Your Practice with Confidence

Low Energy Usage

Electricity usage is less than 33 kWh per day or 1,000 kWh per month, and gas usage is less than 145 kWh per day or 4,397 kWh per month.

Mixed-Use Premises

If you use your property for both business and domestic purposes, you may qualify for the reduced rate on the portion of energy used for domestic activities.

Eligible Business Categories

Nonprofits, charities, and certain businesses may qualify based on their activities and structure.

Can You Claim Back VAT on Your Business Energy Bill?

If your business is VAT-registered, you can reclaim VAT on your energy bills. This is one advantage of being VAT-registered, as it neutralizes the tax impact on your expenses.

For example, Sarah runs a small graphic design business from her home and is VAT-registered. Her total monthly energy bill is £200, including VAT. Sarah calculates that 60% of her energy usage is for business purposes; thus, she can reclaim VAT on that portion.

The VAT amount on her bill is £33.33 (20% of £166.67, the pre-VAT amount). Since 60% of her energy use is for business, she can reclaim £20 (60% of £33.33). Over a year, this adds up to £240 in reclaimed VAT, significantly reducing her overall energy expenses.

If Sarah later discovers she qualifies for the reduced 5% VAT rate, she can also request a refund for the overpaid VAT on past bills.

Home-based businesses can also claim back a portion of VAT on energy used for work purposes. For example, you can reclaim VAT if 50% of your household energy is for business.

You can request a partial refund if you’ve been paying 20% VAT but qualify for the reduced rate. Keep your invoices and VAT certificates handy for a smooth process.

Ways to Cut Down VAT on Your Gas and Electricity Bills

Reducing the impact of VAT on your energy bills involves more than just applying for the reduced rate. You can manage energy usage and make smarter choices to lower costs and ease the strain on your cash flow.

Here are some ways to cut down VAT on your gas and electricity bills:

Qualify for the Reduced Rate

If your business meets the 5% VAT rate criteria, apply immediately. Whether it’s because of low energy usage, mixed-use premises, or nonprofit status, securing this discount is the easiest way to reduce the cost of VAT on an average business electricity bill.

Manage Energy Usage

Understanding your energy consumption is important. The less energy you use, the less VAT you’ll pay. To avoid wasting energy, you can install energy-efficient appliances and lighting and do regular energy audits. Moreover, you can encourage employees to adopt energy-saving habits, like turning off unused devices.

Negotiate a Better Energy Deal

When your contract ends, compare energy suppliers to find a better deal. A lower unit rate and standing charge can significantly reduce your bills. Check online comparison tools or consult energy brokers for guidance.

Work from Home

If you manage your business from home, you can benefit from the domestic VAT rate of 5% on energy. If at least 50% of your household energy usage is for business purposes, you’ll qualify for this lower rate.

Grow Your Practice with Confidence

Invest in Renewable Energy

Switching to renewable energy sources like solar panels can reduce your reliance on grid energy. Although the initial cost is higher, you save money on energy and VAT over time.

Conclusion

High energy bills combined with VAT on commercial electricity can feel like an extra burden for businesses already struggling to stand out. However, understanding commercial electricity VAT rates and knowing when to qualify can ease the financial burden.

Start by assessing your energy usage. If eligible, apply for the reduced VAT rate and explore ways to minimize energy consumption. Simple changes can lead to substantial savings, such as using energy-efficient equipment and negotiating better deals.

Remember, staying informed and proactive is the key to managing your energy expenses effectively. Take control today and keep your business running efficiently without overpaying on VAT.