Value-added tax is a tax added to the price of goods and services. While primarily applied to commercial activities, it can also impact charitable organizations, especially when they engage in commercial activities.

Charity is a beautiful thing, people unite to support those in need. But even the noblest intentions can get tangled in the web of taxes. Yes, you guessed it, we’re talking about VAT on charities.

Charities claiming VAT reliefs need to provide proof of their charitable status, such as their HMRC recognition reference. This article delves into how VAT applies to charities, the reliefs available, and the obligations charities must fulfill to remain compliant.

Table of Contents

VAT Reliefs for Charities

The specific VAT rules for charities can be complex and vary from country to country. Charities need to understand the relevant regulations to ensure compliance and avoid unnecessary tax liabilities. For VAT purposes, a charity must meet the following criteria:

- Be based in the UK.

- Operate exclusively for charitable purposes.

- Be registered with the Charity Commission or equivalent regulatory body.

- Be run by “fit and proper persons.”

- Be recognized by HMRC.

The question of whether charities should be subject to VAT is a complex one. Charities are subject to VAT on goods and services they purchase from VAT-registered businesses. However, they may qualify for reduced or zero rates in specific circumstances.

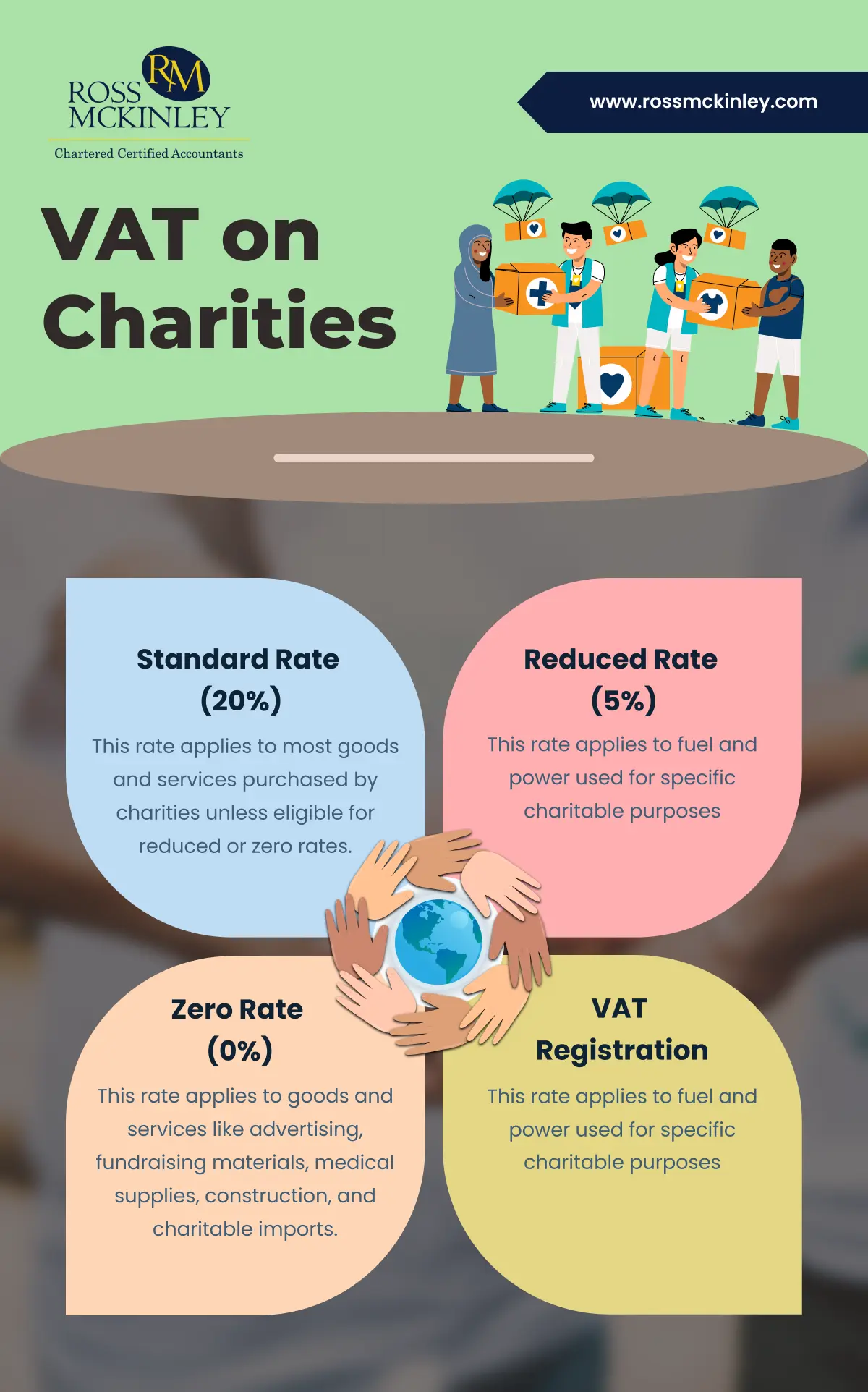

These include standard-rated (20%), reduced-rated (5%), or zero-rated goods and services.

Grow Your Practice with Confidence

For instance:

- Standard Rate: Most goods and services.

- Reduced Rate: Domestic fuel and power.

- Zero Rate: Books, food, and passenger transport.

| Topic | Details |

| Standard Rate (20%) | This rate applies to most goods and services purchased by charities unless eligible for reduced or zero rates. |

| Reduced Rate (5%) | This rate applies to fuel and power used for specific charitable purposes. |

| Zero Rate (0%) | This rate applies to a range of goods and services including advertising and fundraising materials, aids, medical supplies, construction services, imports for charitable activities. |

| VAT Registration | Charities must register for VAT if taxable sales exceed the registration threshold (£85,000). If below the threshold, registration is optional. |

Standard Rate (20%)

The standard VAT rate of 20% applies to most goods and services purchased by charities unless they qualify for a reduced or zero rate. Common examples include Office supplies, General building maintenance, Standard business utilities (if they don’t qualify for reduced or zero rates), and event management services unrelated to charitable activities.

While charities can recover VAT on these purchases if they are VAT-registered, non-registered charities cannot reclaim this VAT, adding to their operational costs.

Reduced Rate (5%)

Charities may qualify for the reduced VAT rate of 5% on Fuel and power used for

- Residential accommodation.

- Charitable non-business activities.

- Small-scale use approximately up to 1,000 kWh of electricity monthly.

If less than 60% of fuel and power is used for qualifying purposes, the reduced rate applies proportionally, with the remainder charged at the standard rate.

Grow Your Practice with Confidence

Zero Rate (0%)

Charities can benefit from zero VAT on various goods and services, including advertising and fundraising materials used for donation campaigns or promotional activities. Additionally, aids for disabled individuals, such as specialized equipment, are eligible for zero VAT.

Medical supplies, including resuscitation training models, also fall under this category, as do construction services for buildings designated solely for charitable purposes.

Charities can also import essential goods, including basic necessities and items intended for charity events, without incurring VAT.

When to Register for VAT?

Charities must register for VAT if their taxable sales exceed the VAT registration threshold. Taxable sales include any income liable to VAT at the standard, reduced, or zero rate.

If taxable income falls below the threshold, charities can opt to register voluntarily. But, Charities that make no taxable sales cannot register for VAT.

When does VAT apply to charities?

VAT on charities applies when they supply taxable goods or services, similar to any other business. However, charities often benefit from specific exemptions and reduced rates depending on the nature of their activities.

For instance, VAT may apply to fundraising events, sales of certain goods, or services provided by the charity. Exemptions often cover activities like education, healthcare, and welfare services, which are considered non-business supplies.

Charities must register for VAT if their taxable turnover exceeds the threshold, currently £85,000 in the UK. Understanding VAT rules helps charities optimize their resources while ensuring compliance with tax regulations.

Penalties for Non-Compliance

Non-compliance with VAT regulations can have significant consequences for charitable organizations. To mitigate these risks, charities should maintain accurate records, seek professional tax advice, and stay updated on the latest VAT regulations.

By adhering to these guidelines, charities can ensure their compliance and avoid potential penalties. Penalties for VAT non-compliance can include:

- Financial Penalties:

Monetary fines are imposed by tax authorities.

- Interest Charges:

Interest may be charged on unpaid VAT amounts.

- Legal Action:

In severe cases, legal action may be taken, leading to potential criminal charges.

- Loss of Charitable Status:

Non-compliance may jeopardize a charity’s charitable status, impacting its ability to receive tax benefits and donations.

Conclusion

While VAT can be a complex issue for charities, by understanding the rules and seeking expert advice, you can ensure that your organization is compliant and that your charitable funds are used effectively.

So, let’s continue to support our favorite charities and help them make a positive impact on the world, even in the face of taxation.