Who doesn’t want vacations? Well, we all want memorable getaways. Thanks to platforms like Airbnb, finding unique and affordable accommodations has never been easier. But what about the not-so-fun part? Taxes, obviously.

When it comes to short-term rentals like those on Airbnb, understanding VAT (Value Added Tax) is essential for hosts looking to stay compliant and avoid unexpected costs.

While renting out your property can be a lucrative venture, VAT introduces an additional layer of complexity, particularly if you’re offering furnished accommodations for temporary stays. Knowing when VAT applies, how to calculate it, and the potential implications that can help you manage your rental business.

So, Sit back as we dive deep into the complexities of VAT on Airbnb, when does it apply, and its working.

Table of Contents

What is VAT on Airbnb

VAT on Airbnb rentals refers to the Value Added Tax applied to income generated from short-term accommodation services. This tax is often required when hosts provide furnished properties for temporary stays, classifying the activity as a taxable supply in many jurisdictions.

For Airbnb hosts, VAT is typically calculated on the total rental income, including any service fees charged to guests. Depending on local regulations, hosts may also need to charge VAT separately to their guests and remit it to the tax authorities.

Failing to account for VAT can lead to penalties, making it crucial for hosts to understand their obligations and maintain accurate financial records.

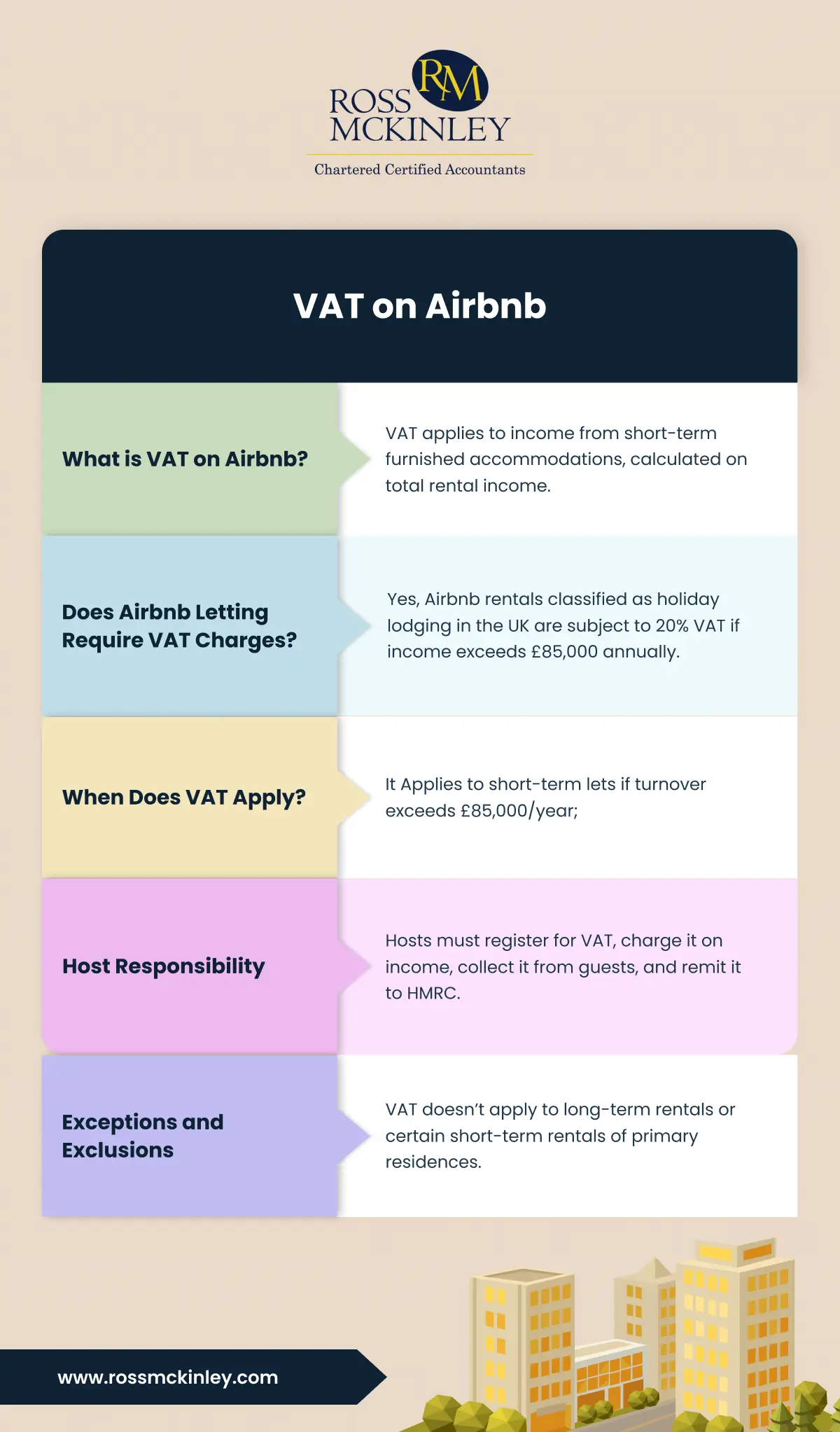

| What is VAT on Airbnb? | VAT applies to income from short-term furnished accommodations, calculated on total rental income. |

| Does Airbnb Letting Require VAT Charges? | Yes, Airbnb rentals classified as holiday lodging in the UK are subject to 20% VAT if income exceeds £85,000 annually. |

| When Does VAT Apply? | It Applies to short-term lets if turnover exceeds £85,000/year; |

| Host Responsibility | Hosts must register for VAT, charge it on income, collect it from guests, and remit it to HMRC. |

| Exceptions and Exclusions | VAT doesn’t apply to long-term rentals or certain short-term rentals of primary residences. |

How to Calculate VAT Charges on Airbnb?

One of the most significant differences between regular and Airbnb rentals is this. In the UK, residential rental income is not subject to VAT. However, rather than being categorized as a traditional buy-to-let residential rental, Airbnb is categorized similarly to hotels.

Since it qualifies as vacation lodging, Airbnb has a standard rating. This implies that you must add 20% VAT to the rent you charge your lodger. Don’t worry, though, if your total income is less than the £85,000 VAT registration requirement for the 2022–2023 tax year.

Grow Your Practice with Confidence

When Does VAT Apply to Airbnb Hosts?

In the UK, VAT applies to Airbnb hosts when their rental activities qualify as a taxable supply, typically for short-term accommodations like furnished holiday lets.

VAT is generally applicable if the host’s total taxable turnover exceeds the VAT registration threshold, which is currently £85,000 per year. For hosts providing longer-term residential rentals, VAT usually doesn’t apply, as these are often exempt supplies.

Usage

VAT applies to short-term rental services where guests stay for less than 28 days. This includes Airbnb rentals and other furnished holiday lets. Since these are considered taxable supplies, VAT is charged on the total rental income, including cleaning fees and other services provided as part of the stay.

Timeframe

Once a host’s taxable turnover crosses the threshold, they must register for VAT with HMRC. VAT returns are typically filed quarterly, and payments must be made promptly to avoid penalties. Keeping track of income and monitoring thresholds regularly is vital to ensure compliance.

Focus

The focus of VAT regulations is to ensure that businesses offering taxable rental services contribute their share of tax revenue. For Airbnb hosts, understanding when VAT applies is crucial for compliance and financial planning, avoiding penalties, and managing costs effectively.

How Does VAT on Airbnb Work?

The rules for VAT on Airbnb rentals depend on the type of rental activity and the host’s income. Hosts need to understand their responsibilities, as VAT compliance varies based on the services provided and their annual turnover.

Host Responsibility

Hosts are required to register for VAT if their total taxable turnover exceeds the VAT registration threshold (currently £85,000 per year). Once registered, hosts must charge VAT on their Airbnb rental income, collect it from guests, and remit it to HMRC.

This applies primarily to short-term, furnished holiday lets classified as taxable supplies.

Grow Your Practice with Confidence

Platform Responsibility

Platforms like Airbnb are not currently responsible for collecting or remitting VAT on behalf of hosts in the UK. However, they may charge service fees that include VAT, which could affect the overall cost for both hosts and guests.

It’s essential for hosts to monitor their turnover and seek professional advice to ensure VAT compliance and avoid penalties.

Exceptions and Exclusions

While VAT typically applies to short-term rentals, there are exceptions. Long-term rentals exceeding a set duration are often exempt. Primary residences rented out for short periods may qualify for reduced rates or exemptions.

Additionally, business travelers may sometimes reclaim VAT on their accommodation expenses.

Penalties for Non-Compliance

Non-compliance with VAT regulations can lead to serious consequences, including hefty fines for late or incorrect VAT returns, interest charges on unpaid VAT amounts, and even legal action in severe cases. These penalties highlight the importance of understanding and adhering to VAT rules to avoid costly repercussions.

Conclusion

While VAT on Airbnb might not be the most exciting topic, it’s an important one to understand. By being aware of the rules and regulations, we can minimize the impact of taxes on our travel plans and ensure a more enjoyable vacation.

For hosts, understanding VAT obligations can help avoid unexpected penalties, and for guests, it’s a small step to making informed booking decisions. So, the next time you’re booking an Airbnb, remember to factor in VAT and enjoy your trip, guilt-free (well, almost).