When businesses mix up tax on value added with VAT, they often face serious problems. Misunderstanding these taxes can lead to complex issues with tax authorities, incorrect pricing, and revenue loss. Mistakes here cost money, harm a company’s reputation, and increase the compliance burden.

Understanding the differences between tax on value added and VAT is important for businesses to avoid these issues. Clear knowledge allows better financial planning and smoother compliance. In this article, we’ll walk you through tax on value added vs VAT, covering their differences, differences and examples to simplify things.

Table of Contents

What Is Meant by Tax on Value Added and VAT?

A tax on value added is applied at every step of the production process where value is added to a product or service. The tax amount depends on the increased value at each stage. The main goal is to tax the value added to the product or service before it reaches the final consumer.

For example, consider a shirt. When the manufacturer sells it to a wholesaler for £50, the tax applies only to the added value. However, when the wholesaler sells it to a retailer for £80, the tax applies to the value difference.

This process continues until it reaches the final buyer, who pays a price that includes all these small tax amounts.

Value-added tax (VAT) is a consumption tax applied to goods and services. Unlike a general value-added tax, which can vary by region or product type, VAT follows strict government regulations, including rates and exemptions.

Consider the example of a company that produces and sells chocolate to retailers. If the VAT rate is 10%, and the retailer sells the chocolate for £10, the final consumer pays an extra £1 as VAT.

The business collects this VAT from consumers and remits it to the government, ensuring tax is collected at each stage without the businesses bearing the final tax burden.

Grow Your Practice with Confidence

Tax on Value Added vs VAT: Differences

Are you struggling to understand the differences between tax on value added vs VAT? You don’t need to worry anymore because we’ll elaborate on them later. For now, look at some basic differences between tax on value-added and VAT.

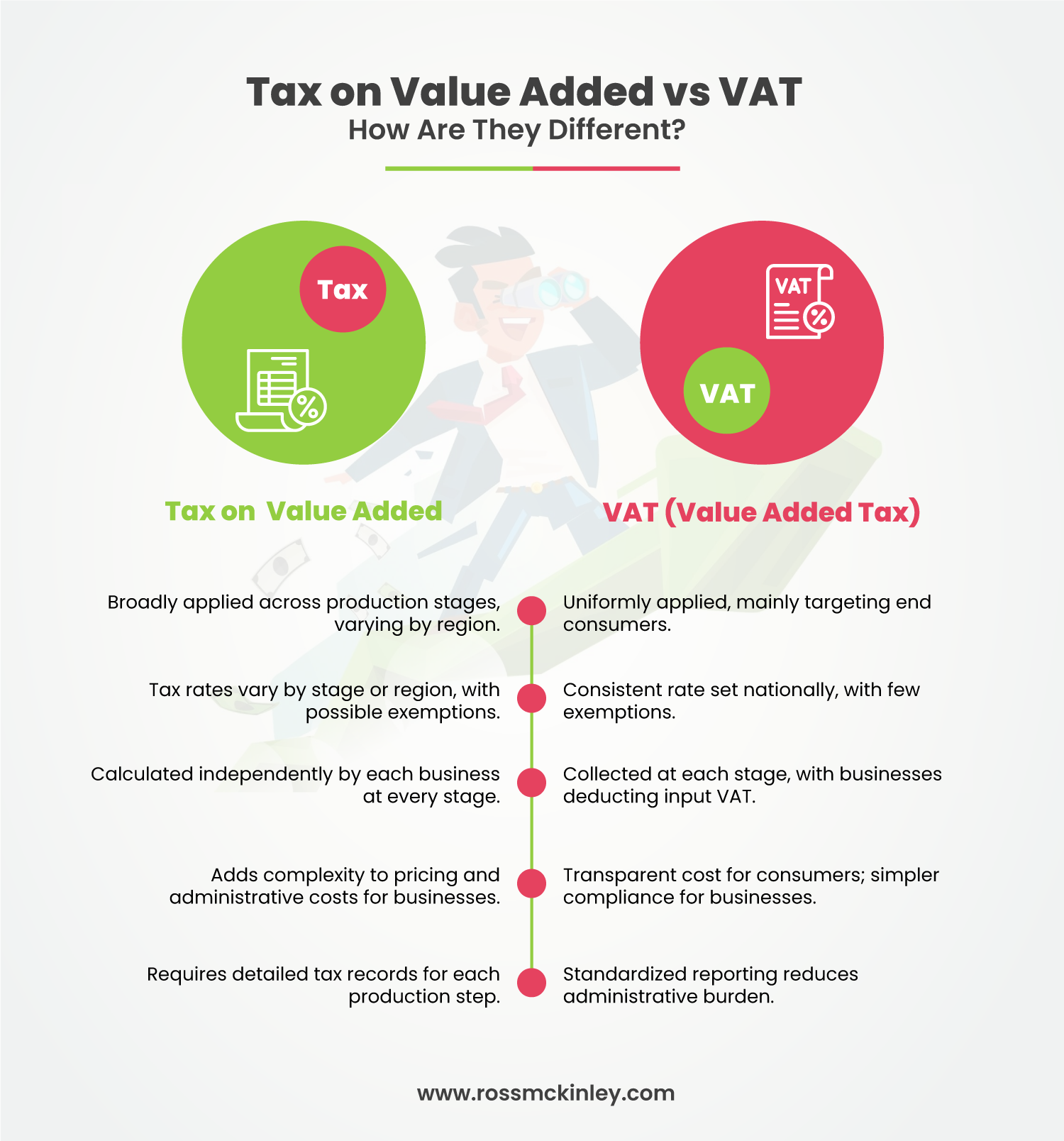

| Tax on Value Added | VAT (Value Added Tax) |

| Broadly applied across production stages, varying by region. | Uniformly applied, mainly targeting end consumers. |

| Tax rates vary by stage or region, with possible exemptions. | Consistent rate set nationally, with few exemptions. |

| Calculated independently by each business at every stage. | Collected at each stage, with businesses deducting input VAT. |

| Adds complexity to pricing and administrative costs for businesses. | Transparent cost for consumers; simpler compliance for businesses. |

| Requires detailed tax records for each production step. | Standardized reporting reduces administrative burden. |

Tax on Value Added vs VAT: Are They Different?

While the tax on value-added and VAT might seem similar, they have distinct structures and applications. VAT is a tax on value added but is governed by specific rules, while a general tax on value added can vary depending on each stage or region.

Here are some of the differences between tax on value added vs VAT:

Scope of Application

The scope of tax on value added is broad and can include various tax forms applied at multiple production and distribution stages. In many parts of the world, each participant in the production chain contributes to the final tax amount based on the value they add.

Conversely, VAT is a uniform tax applied in a regulated manner at each stage of production, but only the final consumer bears the full tax cost. This means that VAT’s scope is primarily consumer-oriented, focusing on most economies’ end-users.

Difference in Tax Structure of Tax on Value Added and VAT

A major difference between the tax on value-added and VAT lies in the tax structure. Tax on value added can vary widely, often depending on local or regional rules. Different levels in the production process can face different tax rates or adjustments based on the value they add.

VAT, however, follows a consistent rate determined by national regulations. This rate applies to all relevant stages of the production chain without variations. VAT is also regulated to have fewer exemptions, ensuring a more standardized tax amount for every consumer.

Grow Your Practice with Confidence

Collection Process Difference

In the collection process, tax on value added often requires businesses to calculate their contributions to the tax at each production step. Businesses report and pay based on the added value they contribute, which involves independent tax computation.

With VAT, the tax is collected uniformly and remitted to the government by each business. Businesses can deduct the VAT amount paid on purchases from the VAT they collect on sales, creating a balanced tax input-output system.

This streamlined process can make managing VAT easier for businesses with established compliance structures.

Impact on Consumers and Businesses

VAT usually results in a predictable added cost for consumers, typically included in the final sale price. Since the VAT system passes the cost onto the final consumer, prices are transparent, with the VAT amount visibly included in many cases.

Businesses benefit from VAT’s simplicity but must deal with compliance costs and accurate reporting to avoid penalties. For general tax on value added, businesses sometimes face more administrative work in calculating the added value tax at each step.

As a result, it increases overhead costs and makes pricing strategies more complex.

Administrative Complexity in Tax on Value Added vs VAT

Tax on value added often involves greater administrative work for businesses since each stage requires its tax calculations. Each business along the chain must manage its part of the tax, which can vary and require detailed records.

In contrast, VAT typically follows a simpler, standardized structure that reduces administrative complexity. Businesses calculate VAT based on their sales, deduct any already paid on purchases, and submit the net VAT amount to the government.

This streamlined approach makes VAT less complex for compliance and record-keeping purposes.

Conclusion

While the tax on value-added and VAT share similarities, their application, structure, and administrative demands differ significantly. Tax on value added applies at each stage where value is added, requiring businesses to independently calculate and manage contributions.

VAT is generally more straightforward for consumers, who face clear costs, and for businesses, which benefit from a simplified reporting system. Understanding the differences can lead to better compliance and pricing strategies for businesses.

Knowing which tax applies and how to manage it can save time and money. Businesses can also gain a competitive advantage by aligning their pricing strategies with the correct tax structure.

qWhen in doubt, consulting a tax advisor or learning local regulations can ensure your business meets its tax obligations smoothly.