What Is Working Capital in Accounting and How It Works?

February 14, 2025

Incorporated Business Advantages and Disadvantages: A Complete Guide

May 1, 2025Single Entry vs Double Entry Bookkeeping: Are They Different?

Bookkeeping is the backbone of every business, regardless of size or industry. It helps you monitor your financial health and make smarter decisions. However, not all bookkeeping systems are created equal.

Understanding single-entry vs. double-entry bookkeeping is essential if you want your books to reflect accurate data. The wrong choice can lead to errors and headaches down the line.

Our latest blog will clear the fog around these two methods of bookkeeping. You’ll learn how they work, their differences, and which suits your business best. Let’s get started and make bookkeeping less of a chore and more of a strategic tool.

Table of Contents

What Is Single-Entry Bookkeeping?

Single-entry bookkeeping is the simplest of the two systems and is often used by small businesses or sole traders. It works like a personal cheque book where you record one transaction per entry. Every transaction either adds to or subtracts from your cash balance. It is the fundamental way to track money coming in and going out.

Here is one of the single-entry system examples:

Let’s say you sell a product for £50. You would record it as:

Sales: +£50

Expenses work similarly. For example, if you pay £20 for supplies, you’d record:

Supplies: -£20

This system is straightforward but has limitations. It doesn’t track assets, liabilities, or equity, making it less suitable for businesses with complex financial needs. So, if you’re running a corner shop or freelancing, this might work. But if things start getting serious, you’ll need more.

Single-entry bookkeeping’s simplicity makes learning easy but also means sacrificing depth. This could be your go-to if you’re running a small side hustle and just need to track income and expenses. However, when your business grows or you need detailed records, it’s time to look elsewhere.

What Is Double-Entry Bookkeeping?

Double-entry bookkeeping is the gold standard for businesses of all sizes, especially those with more complicated transactions. Every transaction affects at least two accounts, ensuring your books always balance. It uses the fundamental accounting equation: Assets = Liabilities + Equity.

Here is one of the double-entry system examples:

Suppose your business earns £50 from a sale. You’d make two entries:

- Debit: Cash £50 (increase in assets)

- Credit: Sales Revenue £50 (increase in income)

If you pay £20 for supplies:

- Debit: Supplies £20 (increase in expenses)

- Credit: Cash £20 (decrease in assets)

This system offers a complete picture of your finances and minimises errors. Plus, accountants swear by it when preparing those daunting financial statements. While it takes more effort to maintain, the benefits outweigh the hassle. Detailed records, easier audits, and reliable data for decision-making make this system invaluable.

Double-entry bookkeeping isn’t just for big corporations. Even small businesses can benefit, mainly if they aim to grow. The system ensures your financial data stays accurate and provides insights that single-entry simply can’t offer.

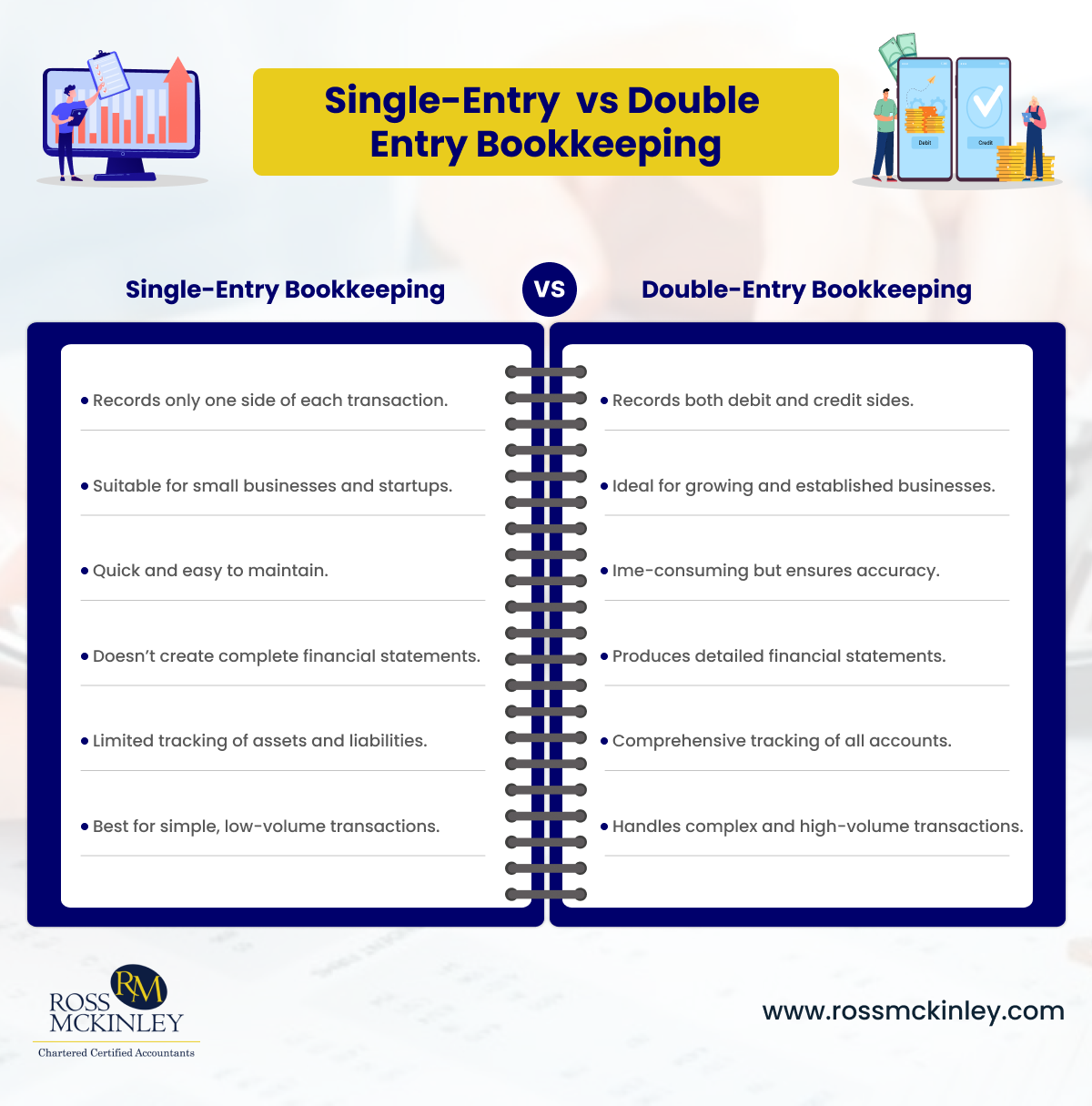

Single Entry vs Double Entry Bookkeeping: Differences

Understanding the differences between single-entry and double-entry bookkeeping can help you choose the right system for your business. While both serve the same purpose, they cater to different needs.

Here are the differences between single-entry vs double-entry bookkeeping:

| Single-Entry Bookkeeping | Double-Entry Bookkeeping |

| Records only one side of each transaction | Records both debit and credit sides |

| Suitable for small businesses and startups | Ideal for growing and established businesses |

| Quick and easy to maintain | Time-consuming but ensures accuracy |

| Doesn’t create complete financial statements | Produces detailed financial statements |

| Limited tracking of assets and liabilities | Comprehensive tracking of all accounts |

| Best for simple, low-volume transactions | Handles complex and high-volume transactions |

Comparison of Recording Transactions

In single-entry bookkeeping, you only record one side of a transaction, making it quicker but less detailed. Double-entry bookkeeping records both sides, ensuring every penny is accounted for.

For example, paying for office supplies is simply logged as an expense in the single-entry system, while in double-entry, it affects both the cash and supplies accounts.

Impact on Financial Statements

Single-entry bookkeeping doesn’t provide a complete set of financial statements. It’s limited to essential records like income and expenses. In contrast, double-entry bookkeeping creates detailed reports like balance sheets, profit and loss statements, and cash flow reports.

Difference in Accuracy

Double-entry bookkeeping is inherently more accurate because it ensures your books are balanced. Errors are easier to spot since debits must equal credits.

Single-entry bookkeeping lacks this safeguard, increasing the risk of mistakes that could go unnoticed. This could mean trouble when tax season rolls around.

One of Them Is Less Time-consuming

Single-entry bookkeeping is quicker and works well for businesses with minimal transactions. Double-entry bookkeeping, while more time-consuming, offers greater accuracy and is ideal for scaling businesses. If you’re juggling dozens of invoices, double-entry is your best friend.

Simple vs Complexity

Single-entry is simple to understand and use, even for someone without accounting knowledge. Double-entry, however, requires a basic understanding of accounting principles, but its complexity comes with significant benefits for larger businesses.

If you’re running a lemonade stand, stick with single-entry. But for anything more important, it’s double-entry all the way.

Flexibility and Scalability

Single-entry bookkeeping works well for businesses that are unlikely to expand or diversify. However, double-entry offers flexibility and scalability, easily accommodating growth, additional accounts, and more complex transactions.

For long-term planning, double-entry is the better choice.

How Can Ross Mckinley Help You With Bookkeeping?

If bookkeeping feels like a chore, Ross Mckinley can make it stress-free. Our experts have covered everything from choosing the right system to maintaining accurate records. With customised solutions and years of experience, we’ll handle the numbers so you can focus on growing your business.

Our team also ensures compliance with financial regulations and offers guidance tailored to your business goals. So get in touch with us to simplify your financial management today!

Conclusion

Single-entry vs double-entry in accounting differs significantly in complexity, accuracy, and suitability. Single entry is simple, while double entry is necessary for detailed financial tracking.

When choosing between the two, consider your business’s size, complexity, and future goals. A single-entry system might save time, but double-entry bookkeeping provides the accuracy and financial insights you need to grow.

We suggest hiring experts to guide you, as Bookkeeping doesn’t have to be a headache! Remember, the right bookkeeping system sets the foundation for your business’s success.