We remember that people recorded the earliest payroll in 7000 BC. In the 5th Century, Greeks kept payroll records by chiseling all the information into stone. Sounds tough, right?

Even a genius like Albert Einstein believes income tax is the hardest thing to understand. Nowadays, who has time to dig their head into figuring out payroll complexities? With never-ending tax rules and manual calculations, it can feel like you’re stuck in an ancient process yourself.

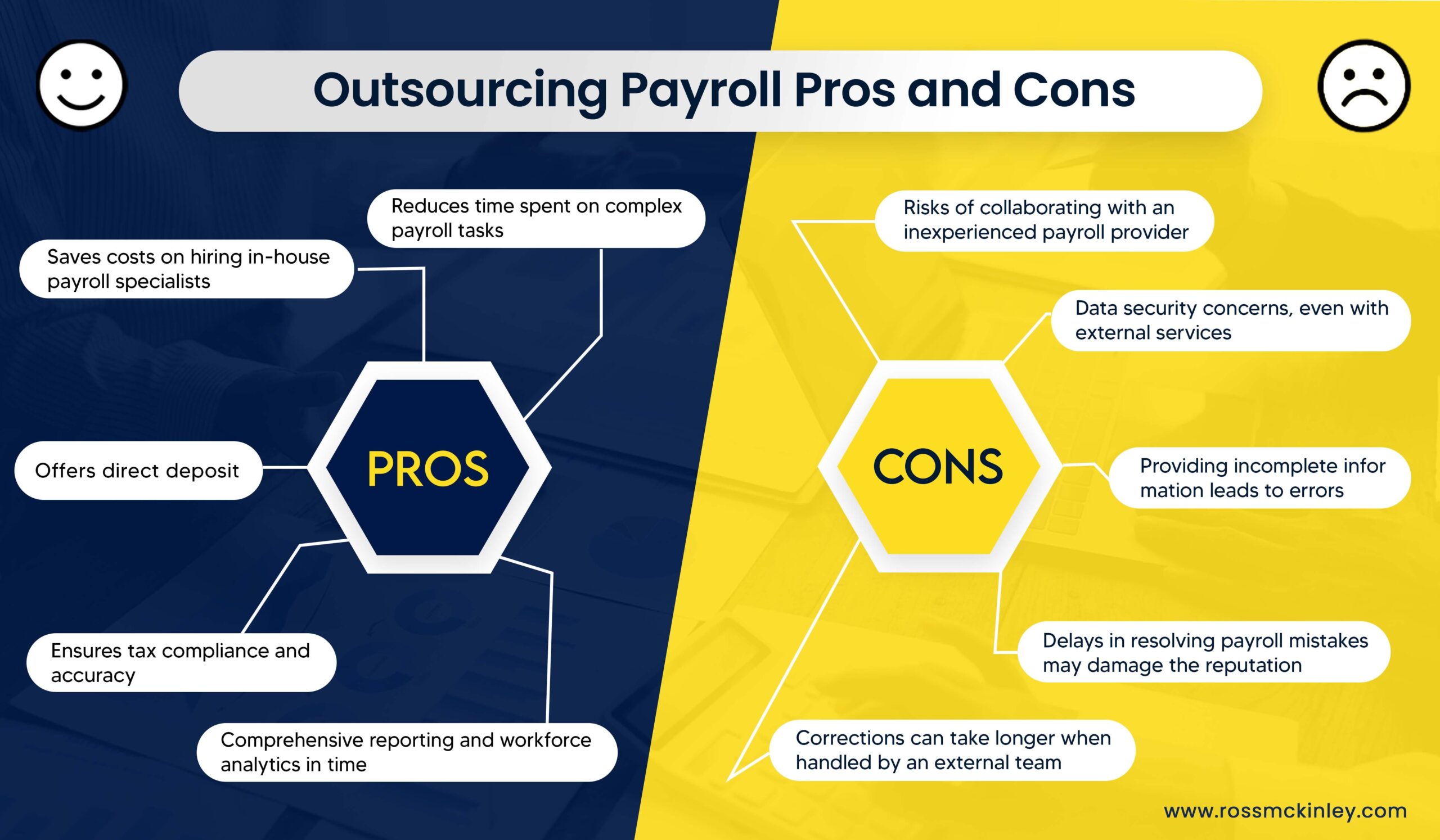

Outsourcing payroll means you can ditch the hassle and focus on growing your business. Experts handle the numbers while you stay stress-free. To help you get started, we have outlined the pros and cons of payroll outsourcing so you can make an informed decision.

Why You Must Consider Outsourcing Payroll?

Managing payroll in-house often leads to time-consuming tasks and potential errors. It can distract businesses from more important work.

However, when outsourcing payroll services, experts take care of tax calculations, compliance updates, and payroll processing.

Additionally, outsourcing improves accuracy and reduces risk. Payroll mistakes can result in fines or unhappy employees.

The best payroll outsourcing companies have access to the latest software, and their experienced teams handle your payroll efficiently. Before we discuss the pros and cons in detail here’s a quick layout of what’s in store for you ahead.

Grow Your Practice with Confidence

| Pros | Cons |

|---|---|

| Saves costs on hiring in-house payroll specialists | Risks of collaborating with aninexperienced payroll provider |

| Reduces time spent on complex payroll tasks | Data security concerns, even with external services |

| Ensures tax compliance and accuracy | Delays in resolving payroll mistakes may damage the reputation |

| Comprehensive reporting and workforce analytics in time | Corrections can take longer when handled by an external team |

| Offers direct deposit | Providing incomplete information leads to errors |

Outsourcing Payroll Pros

Managing payroll demands relevant expertise and someone who isn’t familiar with its rules or processes may need to invest a considerable amount of time learning.

However, a better option is to outsource payroll so that it’s managed by someone who specializes in the field. Let’s have a look at some of the benefits you can reap from outsourcing payroll:

Cost Saving

When you choose payroll management outsourcing, you can reduce expenses related to hiring in-house payroll experts and maintaining expensive tools.

Outsourced payroll services offer predictable costs and may even provide additional features, such as time tracking and employee self-service, without added fees.

Timesaving

Managing payroll in-house takes time and precision. However, with outsourced payroll solutions, businesses can save time, and their in-house teams can focus on designing and implementing marketing and growth strategies.

Tax Accuracy

Payroll providers ensure tax calculations are up-to-date and error-free. This removes the risk of mistakes due to complicated and continuously changing tax regulations.

Get Complete Support

When a small business outsources its payroll, its operations are smooth, and it receives complete support from the service providers. Suppose your internal staff is unavailable. You’ll get reliable and uninterrupted service because your outsourced team has your back.

Offer Direct Deposit

Small businesses that manage their in-house payroll processing themselves may fail to offer direct deposit. Well-established payroll companies have the resources and can provide deposit ease for your employees.

Outsourcing Payroll Cons

Outsourcing payroll also comes with many challenges because you’re not the boss of your payroll system. Outsourcing payroll means you are sharing important credentials of your business which may be used against the interest of the business. Well, either way, let’s find out the cons of outsourcing payroll:

Substandard Service Provider

Choosing the wrong partner for payroll management outsourcing can harm your business. To avoid potential issues, it’s essential to research providers, compare them, and check their qualifications.

Data Security

While most providers have strong security protocols, there’s always a risk of data breaches. Outsourcing doesn’t guarantee complete data protection, so security measures must be considered when deciding the cost of outsourcing payroll.

Service Agreements

Delays in addressing payroll errors by the provider can damage your company’s reputation. You can avoid payroll processing challenges by understanding the service level agreements.

Grow Your Practice with Confidence

Error and Time

Although outsourcing reduces errors, mistakes can still occur. Asking your provider to correct them often takes more time than asking your in-house team because they may respond late.

Missing Information

Several times, when you share the payroll and employee information with the payroll processing company, you may miss some details. This delays payroll processing, and your employees may not receive their checks on time.

Best Practices for Outsourcing Payroll

Humans started using the word “payroll” in the 1750s. The phrase combines the verb “pay” and the noun “roll.” It refers to the payments made to employees in the form of salary. Here are some of the best practices that you must consider before outsourcing your payroll to a company:

Expertise and Compliance

Choose a payroll provider with a strong track record and expertise in your industry. Ensure they stay updated on tax regulations and labor laws. It will enable them to maintain compliance and reduce risks associated with payroll errors.

Scalability and Flexibility

When you choose a payroll service provider, you may have fewer employees. But as your business grows, you onboard more employees to manage things effectively. So, choose a payroll service provider that can adjust and provide excellent services according to changing needs.

Integration Capabilities

Look for a payroll solution that easily integrates with your existing systems, such as HR and accounting software. This integration enhances data accuracy and streamlines processes, saving time and minimizing errors.

Customer Support

Opt for a payroll provider that offers reliable customer support. Payroll outsourcing services that resolve your issues quickly and provide assistance whenever you need it are what we call excellent customer support.

Conclusion

Outsourcing payroll services can simplify business operations, save money, and time, and improve tax accuracy. Moreover, you can enjoy direct deposit and get complete support whenever possible.

When you pick the right payroll service provider, you can focus on what truly matters while ensuring compliance and keeping your employees happy.

To get the most out of payroll outsourcing, you must do your homework before choosing a provider. Look for one with solid expertise, scalability, and integration capabilities.

Keep the lines of communication open with your payroll partner so you can quickly tackle any issues that come up.

Regularly review your payroll processes and stay updated on tax laws to keep everything running smoothly and enjoy the benefits of outsourcing payroll.

You can also ask your employees to provide their feedback about payroll management. Remember, a good payroll provider doesn’t just process payments; they become your strategic partner and help your business grow.