The primary objective of running a non-profit is to make a difference. But the mechanism that keeps everything functioning properly behind every success story is financial management. It may feel like full-time work to keep up compliance, manage spending, and keep track of donations.

Bookkeeping can help with that. Transparency and trust are more important than just stats. When done correctly, it helps you stay on course with your objective and demonstrates to donors that their money is having an impact.

For non-profits, this guide simplifies bookkeeping into manageable tasks. You’ll discover how to handle money stress-free, from keeping records organized to preparing for taxes.

Table of Contents

First Understand What Non-Profit Bookkeeping Is.

Any effective non-profit organization relies heavily on bookkeeping. Recording every donation, expense, and transaction is at the heart of it. It fulfils a unique function for non-profits by ensuring legal compliance, donor transparency, and a transparent financial health picture.

Nonprofits have to keep a close eye on how money is distributed to programs and overhead, unlike for-profit companies. Reliable documentation demonstrates to stakeholders and donors that their money is being used sensibly. Additionally, it greatly simplifies the process of creating reports, submitting taxes, and applying for grants.

Grow Your Practice with Confidence

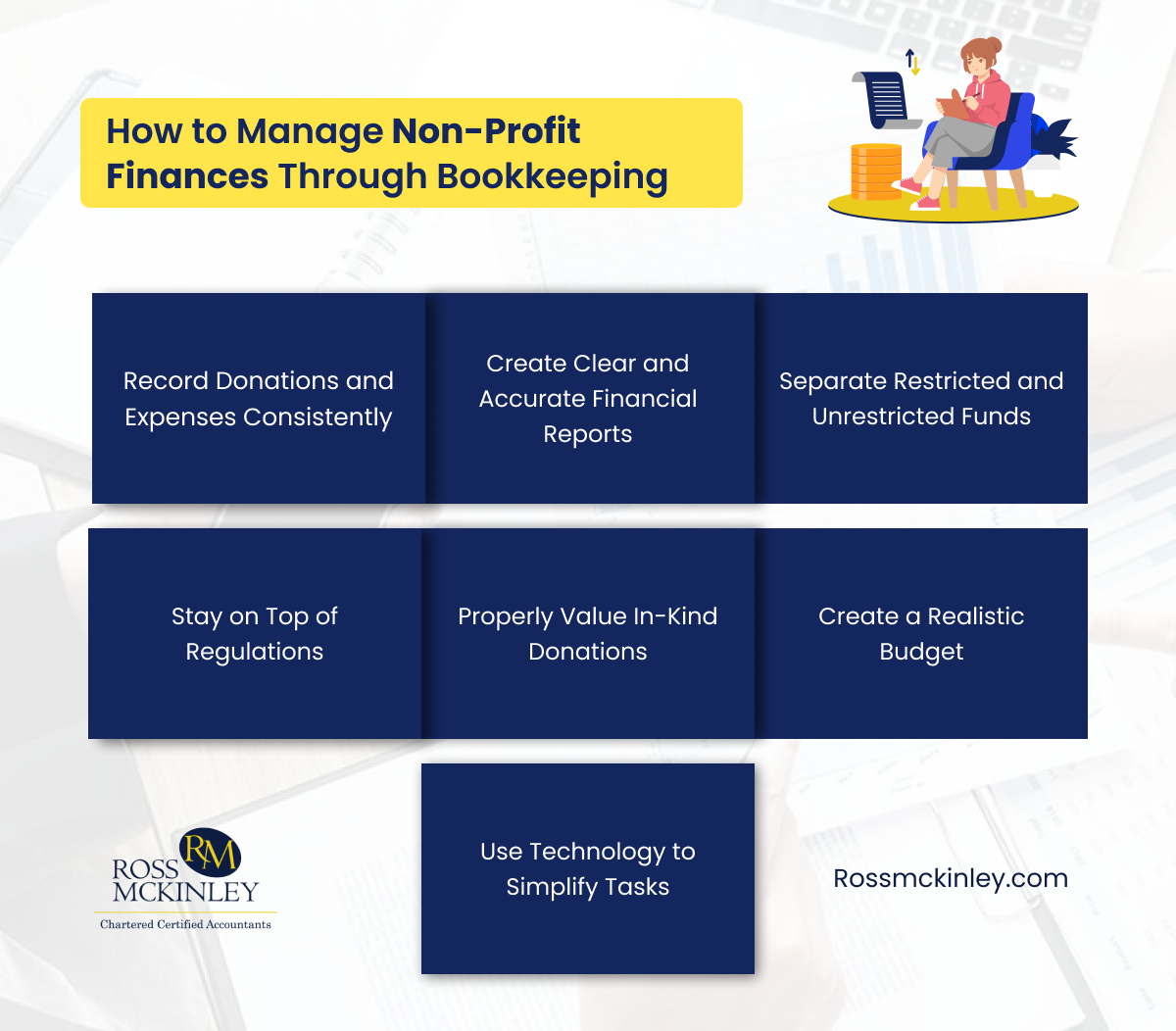

How to Manage Non-Profit Finances Through Bookkeeping

Non-profit bookkeeping might not be the most glamorous part of your business, but it’s key to making an impact. But don’t stress—here’s how to deal with the usual challenges and keep things running smoothly.

1. Record Donations and Expenses Consistently

One of the biggest challenges nonprofits face is keeping track of where the money comes from and where it goes. You might have a mix of online donations, cash contributions, and event expenses piling up. It’s easy for records to slip through the cracks, especially if multiple people are handling the accounts.

To make things easier, create a habit of recording every donation and expense as soon as it happens. Use simple accounting software that’s easy to navigate, even for beginners, or keep a spreadsheet if you’re on a tight budget. By maintaining a clear and consistent system, you’ll not only stay organized but also reduce the chances of errors in your financial records.

2. Create Clear and Accurate Financial Reports

Financial reports are the backbone of transparency for non-profits. They show donors and board members how funds are being used and help with making better decisions. However creating these reports can get tricky, especially if the data isn’t organized. You might end up with reports that are confusing or missing critical information, which can lead to misunderstandings or even mistrust.

Grow Your Practice with Confidence

The best approach is to stick to a standard reporting format. Tools like QuickBooks or other non-profit-focused software can help you prepare professional-looking reports. If you don’t already have one, consider creating a monthly checklist to ensure you’ve included everything needed, like revenue, expenses, and fund balances.

3. Separate Restricted and Unrestricted Funds

Not all donations are the same—some are meant for specific programs, while others can be used wherever needed. Mixing these up can cause major issues, like spending restricted funds on the wrong projects. This not only creates financial stress but can also upset donors who expect their contributions to be used a certain way.

To avoid this, make sure you have a clear system in place to track restricted and unrestricted funds separately. Accounting software often has features that let you label donations based on their purpose. If you’re doing it manually, create separate categories in your records to track each type of fund.

4. Stay on Top of Regulations

Non-profits have strict rules to follow, like filing annual tax forms and maintaining records for audits. Missing a deadline or providing incorrect information can lead to fines or, worse, losing your tax-exempt status.

To stay compliant, keep a calendar of all important deadlines, including filing dates for forms like the IRS Form 990. Partnering with an accountant or a firm experienced in non-profit regulations can also take the pressure off your team. They’ll ensure everything is filed correctly, giving you peace of mind.

5. Properly Value In-Kind Donations

Non-profits often receive donations that aren’t cash, like supplies, equipment, or services. While these are incredibly helpful, they can be hard to account for because you need to assign a dollar value to them for your records.

Start by documenting every in-kind donation as soon as it’s received. Research the fair market value of the items and include this in your records. This not only ensures your financial statements are accurate but also shows donors the full value of their contributions.

6. Create a Realistic Budget

Non-profits usually operate on tight budgets, which makes it even more important to plan carefully. Without a clear budget, it’s easy to overspend or run out of funds before the year ends.

Take some time at the start of each year to create a budget that aligns with your goals. Break it down into categories, like program expenses, staff salaries, and fundraising costs. Track your spending throughout the year and adjust your budget as needed. Regular check-ins with your team can help everyone stay on the same page.

7. Use Technology to Simplify Tasks

Managing non-profit finances manually can be overwhelming, especially if you’re dealing with a lot of transactions. Relying on outdated methods increases the chances of errors and takes up valuable time that could be spent on other important tasks.

Invest in accounting tools designed for non-profits. Many software options, like QuickBooks or Wave, are budget-friendly and make it easy to track income, and expenses, and generate reports. Even small upgrades in technology can save you hours of work and improve accuracy.

Conclusion

Effective bookkeeping practices are key to running a transparent and efficient non-profit. By implementing internal controls, tracking donations properly, and staying on top of tax compliance, you’ll build trust and accountability. Now, it’s time to apply these tips and take your financial management to the next level.

For many non-profits, working with trusted experts, like Ross Mckinley, who specialize in non-profit bookkeeping services in London, can provide the support needed to ensure your finances are always in order. The clearer your finances, the stronger your organization’s foundation.