Bookkeeping Tips for Freelancers and Solopreneurs

May 18, 2025

Benefits of Outsourcing Bookkeeping

May 20, 2025Manual vs Automated Bookkeeping

Let’s be honest, bookkeeping isn’t exactly the most glamorous part of running a business. But whether you’re a solopreneur or managing a growing team, keeping your finances in check is non-negotiable. And here’s where the age-old debate kicks in: should you stick with the classic, pen-and-paper approach or embrace automated tools that do the heavy lifting for you?

Think of it like driving. Manual bookkeeping is like cruising in a vintage car, you’re in control, but it’s a lot of effort. Automated bookkeeping? That’s your sleek self-driving Tesla, making your ride smoother and saving you time.

However, the question arises: Should one rely on manual bookkeeping or keep up with the technology and switch to automated bookkeeping? Let’s dive into the details to help you decide.

Table of Contents

What is Manual and Automated Bookkeeping?

Manual bookkeeping involves recording financial transactions by hand. It relies on physical books, ledgers, or simple spreadsheets. Traditionally, bookkeepers meticulously entered each transaction, categorized expenses, and balanced accounts, ensuring accuracy at every step.

This approach is suitable for small businesses with simple financial needs as it offers complete control over records. However, it requires a significant time investment and is more prone to human error due to manual calculations.

In contrast, Automated bookkeeping uses software to record, categorize, and reconcile financial transactions. It integrates with bank accounts, e-commerce platforms, and payment systems to automatically pull and organize data, reducing the manual workload.

Automated bookkeeping tools often include compliance checks and tax preparation features, streamlining financial management and improving accuracy.

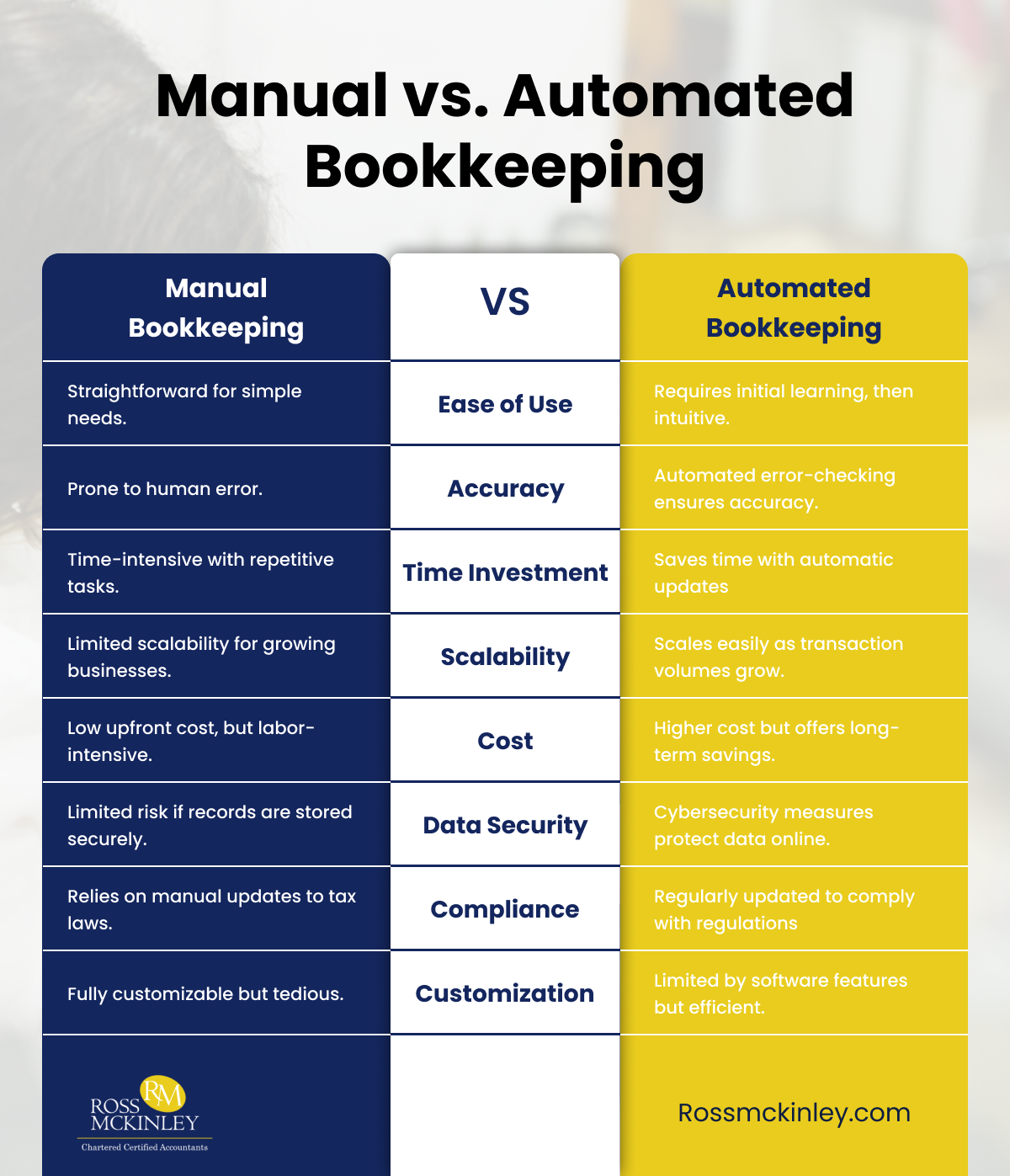

Manual vs. Automated Bookkeeping

While both are ways of bookkeeping what sets both of them apart is their approach and execution. Manual bookkeeping relies on traditional methods, involving physical records or spreadsheets, while automated bookkeeping uses software to streamline processes, enhance accuracy, and save time.

1. Ease of Use

While the process is straightforward and requires minimal setup in manual bookkeeping, users need to understand bookkeeping basics. Tasks like creating ledgers or updating spreadsheets are simple but can become burdensome as transactions increase. Human oversight is critical to avoid errors, adding to the workload.

For automated bookkeeping, modern bookkeeping software often features intuitive dashboards, drag-and-drop interfaces, and automation. Initial learning may be required, but tutorials and support are often available. Automation handling repetitive tasks allows users to review results rather than do all the groundwork.

2. Accuracy

Since everything is entered by hand in manual bookkeeping, errors such as miscalculations, misclassifications, or skipped entries are common.

For example, entering numbers incorrectly or forgetting to record a transaction could throw off financial records. Regular manual audits are needed to maintain accuracy.

On the Other hand, Bookkeeping software significantly reduces errors by auto-populating entries and reconciling data. Tools like real-time error detection and alerts ensure mistakes are caught early.

3. Time Investment

In manual bookkeeping, Tracking, organising, and reconciling finances manually is labor-intensive. Each transaction needs individual attention, and creating reports or updating ledgers takes considerable time, especially for larger businesses or during busy seasons like tax time.

In contrast, automation saves hours by instantly categorising transactions, generating reports, and reconciling accounts. Software updates data in real time, meaning less manual intervention. Tasks that take hours manually may take minutes with automated systems.

4. Scalability

As businesses grow and transactions multiply, manual bookkeeping becomes cumbersome. Additional complexities like payroll, VAT compliance, and audits demand more resources, making scalability challenging.

Automated systems scale effortlessly. Most software allows for adding new accounts, managing multiple entities, or handling complex transactions.

For instance, as your business grows, the software can integrate with new payment systems or track multi-currency operations seamlessly.

5. Cost

For manual bookkeeping, the upfront cost is minimal, most likely limited to stationery or spreadsheet software. However, as the workload increases, you may need to hire additional staff, increasing labor costs.

But in the case of automated bookkeeping, software subscriptions often come with an upfront cost, which might seem higher. However, these costs are offset by time savings, reduced errors, and the ability to handle more transactions without hiring extra staff.

6. Data Security

Data stored in physical ledgers or basic spreadsheets is vulnerable to theft, damage, or misplacement. There’s also no easy way to recover lost data in case of a fire, flood, or other disasters.

The most modern software uses advanced encryption, secure backups, and restricted user access to protect sensitive financial data. Cloud-based tools add another layer of security by keeping information safe from physical damage.

7. Compliance

In manual bookkeeping, staying compliant with tax regulations, VAT requirements, or payroll laws requires constant manual monitoring of legal updates. Missing these changes could lead to penalties or audits.

But, on the contrary, most accounting tools are updated regularly to reflect new compliance standards. Features like automated VAT calculations, tax reminders, and payroll processing ensure adherence to legal requirements with minimal effort.

8. Customization

A plus point of manual bookkeeping is that it’s fully customizable since you control every detail. However, creating custom reports or formats takes time and effort, and changes require manual updates across records.

For Automated systems, Customization depends on the software’s flexibility. Most systems allow tailored reports, adjustable templates, or integration with specific business tools. The level of customization varies between platforms but generally supports diverse business needs.

Why Choose Us?

At Ross McKinley, we don’t just manage numbers—we empower your business to thrive. With our expert bookkeeping services, you gain accurate records, stress-free tax preparation, and actionable insights tailored to your unique needs. Our team blends precision with modern tools, ensuring you stay compliant and efficient while focusing on growth.

Conclusion

Both manual and automated bookkeeping have their place, but automation is becoming increasingly popular for its efficiency, accuracy, and scalability. Businesses in the UK, particularly those navigating complex tax regulations and growing transaction volumes, may find automated systems indispensable.

Regardless of your choice, maintaining accurate financial records is key. Whether you prefer traditional methods or cutting-edge software, the right approach depends on your business’s unique needs.