When starting a business, you have several structures to choose from, including incorporating. It gives legal separation between owners and the company, protecting personal assets. However, this structure also has responsibilities that impact taxes, control, and costs.

An incorporated business offers credibility, funding opportunities, and limited liability for owners. However, it requires strict compliance, higher fees, and detailed record-keeping. Weighing these factors is essential before making a decision.

To help you, we will discuss incorporated business advantages and disadvantages in our latest blog, so read it.

Table of Contents

What Is Incorporated Business?

A corporation is a business that exists separately from its owners, also called shareholders. Individuals or other companies can own shares, and ownership transfers easily through stock sales. Since it is a separate legal entity, it can face lawsuits without affecting the owner’s personal assets.

Many entrepreneurs choose a corporation for a formal business structure with long-term growth potential. To form an incorporated business, you must follow state laws, create corporate bylaws, and file incorporation documents. Here’s a quick layout of the distinct features of incorporated businesses.

Grow Your Practice with Confidence

Features of Incorporated Business

- Separate Legal Entity: Business is independent of its owners.

- Limited Liability: Owners are not personally liable for business debts.

- Perpetual Existence: Continues regardless of ownership changes.

- Raises Capital Easily: Can issue shares to investors.

- Tax Benefits: Potential for lower corporate tax rates and deductions.

- Professional Image: Enhances credibility and trust.

- Transferable Ownership: Shares can be bought/sold easily.

- Regulatory Compliance: Must follow legal and reporting requirements.

- Access to Funding: Easier to secure loans or investments.

- Employee Benefits: Can offer stock options and retirement plans.

- Dividends: Profits can be distributed to shareholders.

- Brand Protection: Business name is legally protected.

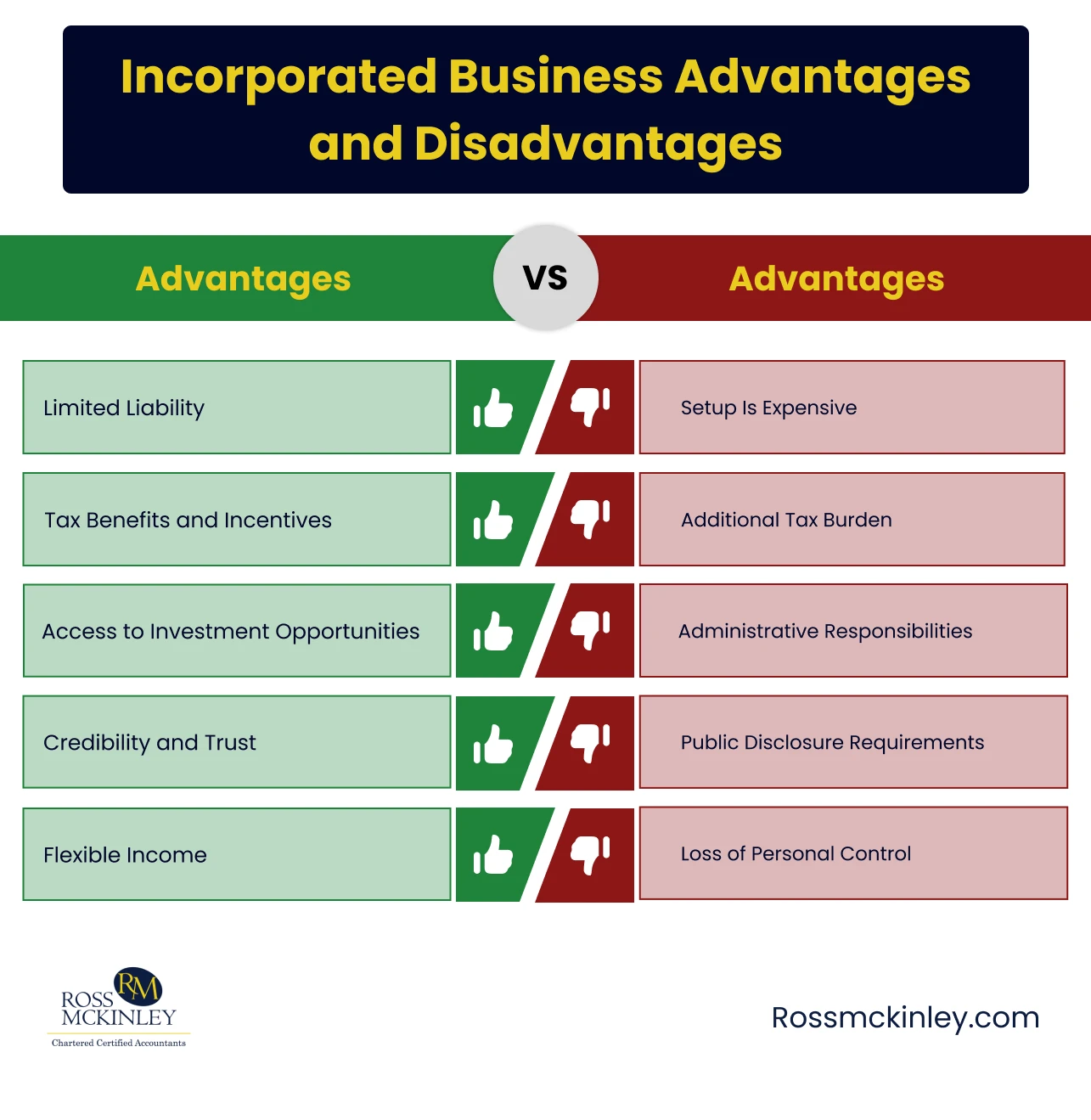

Advantages of Incorporated Business

Here are the advantages of incorporating a business:

Limited Liability

One major benefit of forming an incorporated business is protection from personal liability. Unlike sole proprietors, corporation owners do not risk their personal assets for business debts.

The legal separation protects owners from legal claims, unpaid debts, and other liabilities. It offers peace of mind by ensuring that personal finances stay secure, even if the business faces financial difficulties.

Tax Benefits and Incentives

Business incorporation opens doors to tax benefits, including lower corporate tax rates and deductions. Governments also offer tax incentives to encourage entrepreneurship and innovation, reducing overall tax burdens.

Additionally, corporations can distribute income more efficiently to optimize tax savings. Owners can structure salaries and dividends wisely, minimise tax liabilities, and improve financial management.

Access to Investment Opportunities

Registered corporations can issue shares, making it easier to attract investors and raise funds. This flexibility helps businesses secure capital for expansion, research, or operational growth.

Besides attracting investors, corporations have better access to bank loans and credit lines. Lenders trust incorporated businesses more due to their stability, increasing their chances of approval for financial support.

Credibility and Trust

Incorporating a business boosts credibility and trust among customers, suppliers, and investors. A company with “Ltd” or “Limited” appears more professional and reliable. It helps with global clients who prefer dealing with legally recognised businesses.

A corporation’s structured management and legal status show long-term stability. Your reputation can help you enhance partnerships, attract business opportunities, and increase brand value in competitive markets.

Grow Your Practice with Confidence

Flexible Income

An incorporated business provides flexibility in managing and distributing income efficiently. Owners can decide when and how to take earnings, reducing tax burdens. Instead of receiving a fixed salary, they can adjust payouts based on financial needs.

Business owners can also receive income as dividends, often lowering their tax liabilities. Flexibility helps with strategic financial planning, ensuring more control over earnings and expenses.

Disadvantages of Incorporated Business

Here are the disadvantages of incorporating a business:

Setup Is Expensive

Due to its complex structure, starting an incorporated business comes with high costs. Unlike sole proprietorships, corporations require significant legal, accounting, and state filing fees for investments.

Corporations must cover ongoing costs like compliance fees and professional services even after formation. These recurring expenses can affect finances, making it essential for businesses to plan before incorporating.

Additional Tax Burden

Corporations face more tax responsibilities than unincorporated businesses, increasing annual filing requirements. Companies must pay corporate taxes on profits, while owners must declare their earnings separately, which means you’ll pay double the tax.

Additionally, businesses providing perks like company cars or health benefits must file extra tax reports. Payroll taxes, employee deductions, and national insurance contributions also add to the financial burden.

Administrative Responsibilities

Running a corporation involves managing strict legal and regulatory obligations that increase administrative work. Business owners must maintain financial records, file tax returns, and submit annual reports to stay compliant.

Sole proprietors or partnerships transitioning to a corporation may struggle with these additional responsibilities. Hiring accountants or legal professionals can help, but it also adds to the company’s costs.

Public Disclosure Requirements

Corporations must follow public disclosure rules, making financial and operational details available. Annual reports, director information, and financial statements become accessible, increasing transparency and accountability.

Some companies prefer to keep internal matters confidential to maintain a competitive edge. However, incorporated businesses must follow these regulations, even if it means revealing sensitive business information.

Loss of Personal Control

Corporations shift decision-making power from individual owners to a board of directors. Shareholders elect board members, reducing a single owner’s direct control over the business.

This governance model may feel restrictive to entrepreneurs who prefer full autonomy. While it allows for business growth, it also means owners must collaborate with others when making major decisions.

What Must Be Your Decision?

Choosing an incorporated business brings benefits and challenges, but expert guidance makes a difference. Managing taxes is difficult, especially with corporation tax obligations and annual filings.

That’s why Ross Mckinley simplifies corporation tax, helping businesses like yours minimise liabilities while staying compliant. With our expert tax consultancy services, you can make informed financial decisions and optimise your tax structure.

Conclusion

Understanding Incorporated Business Advantages and Disadvantages helps you make the right choice for your company. While incorporation offers protection and credibility, it also brings costs and administrative responsibilities.

Before deciding, carefully assess your business goals, financial situation, and long-term plans. Consider expert guidance to handle taxes and legal obligations efficiently.

Staying informed about regulatory changes and tax-saving opportunities can improve your business’s financial health. With the right strategy, you can maximise benefits while minimising challenges.