When managing finances whether for a business or personal use two terms come up frequently: Income Statement and Balance Sheet.

While they might seem similar at first glance, they serve different purposes and offer unique insights into the financial status of a business.

Understanding these differences is crucial for anyone who wants to keep their finances in check. Sit back as we’ll explore each concept in depth, then break down the differences between them.

Table of Contents

What is an Income Statement?

An Income Statement, also referred to as an Income Sheet, is a financial document summarizing a company’s revenues, expenses, and net profit or loss over a set time period. Think of it as a report card for the business.

It shows how well the company is performing financially during a given period, such as a month, quarter, or year.To make things easier, The primary goal of an income statement is to measure a company’s profitability. By comparing revenue to expenses, it answers the essential question: “Is the business generating a profit or incurring a loss?”

The income statement helps businesses determine whether their operations are sustainable in the long run. While we break down the components of the income statement, we dive into four major elements which includes Revenue, Cost of Goods Sold, Gross Profit, and Operating Expenses respectively.

What is a Balance Sheet?

The Balance Sheet presents an immediate view of the company’s financial standing. Unlike the Income Statement, which focuses on performance over a period, the Balance Sheet shows what the business owns and owes at a single moment.

It’s more of a static picture of the business’s financial health than a performance tracker. The Balance Sheet delivers the purpose to depict a company’s financial stability. It details a business’s valuable insights into how much the business is worth, its debt levels, and whether it has the resources to meet its obligations.

Investors, creditors, and business owners rely on the balance sheet to evaluate the long-term viability of a company. Liabilities, assets, and equity together form a balance sheet.

Grow Your Practice with Confidence

Income Statement vs Balance Sheet

Now, you might be wondering, can’t we just use one of these sheets? Why complicate things?”

Well, the Income Sheet and Balance Sheet actually complement each other. The Income Sheet tells you if the business is profitable, while the Balance Sheet gives insights into whether that profit is sustainable.

You might be making a lot of sales, but if your liabilities are piling up on the Balance Sheet, you’re headed for trouble. Likewise, a strong Balance Sheet with plenty of assets and minimal liabilities doesn’t mean much if the Income Sheet consistently shows losses.

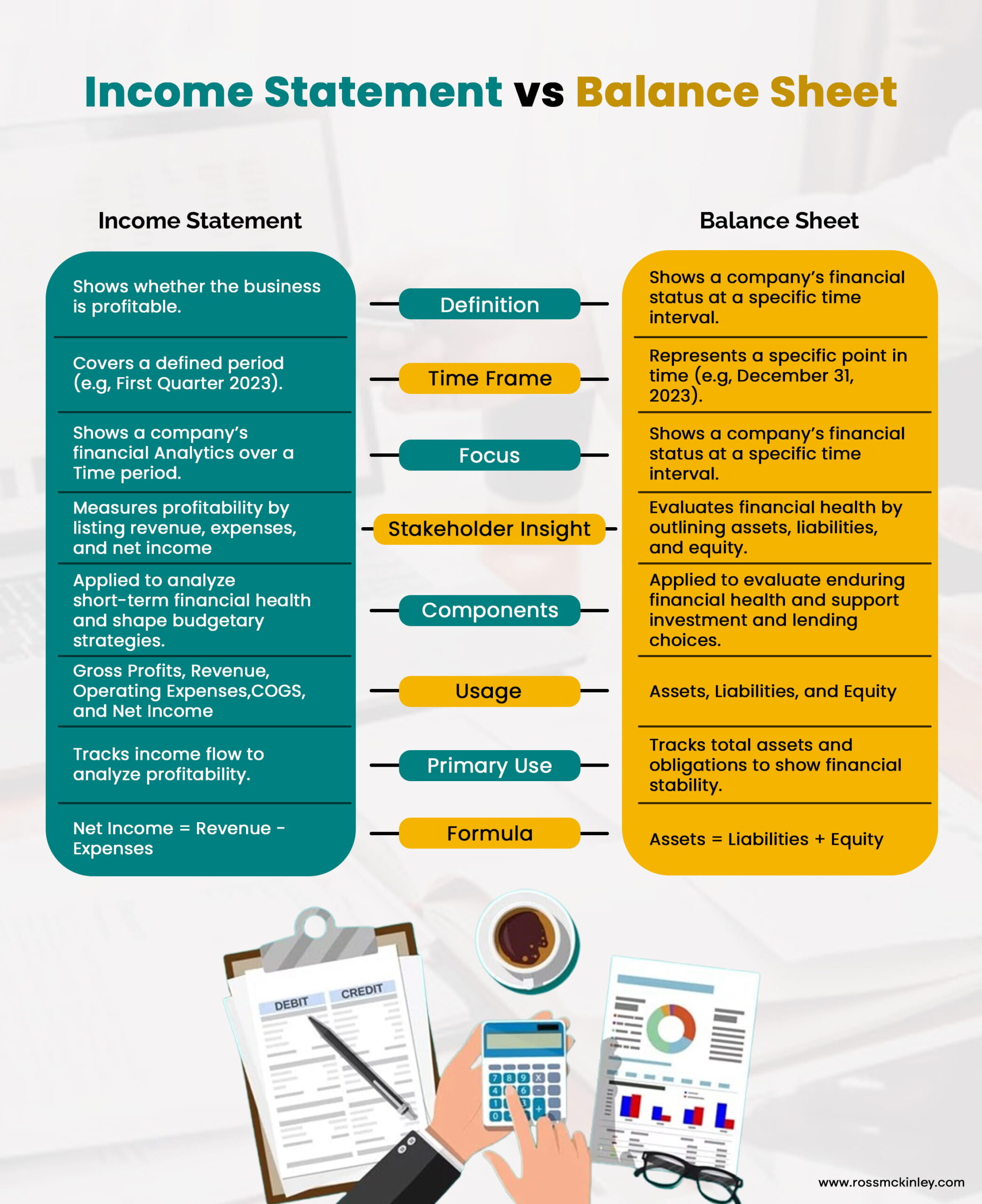

While the two compliment each other they differ in several ways highlighted in the table below. We have also explained these points to help you clearly identify their differences.

| Aspect | Income Sheet | Balance Sheet |

| Definition | Shows a company’s financial Analytics over a Time period. | Shows a company’s financial status at a specific time interval. |

| Usage | Measures profitability by listing revenue, expenses, and net income | Evaluates financial health by outlining assets, liabilities, and equity. |

| Time Frame | Covers a defined period (e.g, First Quarter 2023) | Represents a specific point in time (e.g, December 31, 2023) |

| Components | Gross Profits, Revenue, Operating Expenses,COGS, and Net Income | Assets, Liabilities, and Equity |

| Focus | Tracks income flow to analyze profitability. | Tracks total assets and obligations to show financial stability. |

| Primary Use | Applied to analyze short-term financial health and shape budgetary strategies. | Applied to evaluate enduring financial health and support investment and lending choices. |

| Formula | Net Income = Revenue – Expenses | Assets = Liabilities + Equity |

| Stakeholder Insight | Shows whether the business is profitable | Shows the business’s worth and financial structure |

1. Usage

Income Statement is used to track a business financial performance. It tracks the flow of income and expenses over time, showing whether the company is successfully generating revenue or experiencing losses. It’s particularly useful for budgeting and short-term financial planning.

The Balance Sheet, on the other hand, is used to assess the financial health and solvency of a business. It gives stakeholders a view of the company’s resources (assets) and obligations (liabilities) and the owner’s equity at a particular moment.

It’s most useful for assessing the long-term sustainability of the business and for making investment or lending decisions.

Grow Your Practice with Confidence

2. Focus

The Income Statement focuses primarily on the income flow of the business. It outlines how much revenue the business is generating and how much is being spent on various costs and expenses. It tracks the performance of the company over time, helping you understand if the business is profitable or running into trouble.

The Balance Sheet, in contrast, focuses on the company’s financial position at a given point in time. It details the business’s assets, which represent everything it owns, and liabilities, which represent what the company owes.

3. Timeframe

Income Statement spans over a specific timestamp. This can be a month, quarter, or year—any set duration that allows you to track the company’s income and expenses over that span. It’s a dynamic document that changes depending on the timeframe it covers.

The Balance Sheet, however, represents the financial status at a single point in time. Think of it as a picture of the company’s assets, liabilities, and equity on a particular date—such as December 31, 2024. It doesn’t change unless new transactions occur, as it is a static representation of the company’s overall financial position.

Conclusion

So, there you have it. The Income Sheet is the exciting one—like checking how much money you made at your business. The Balance Sheet is the one that’s quietly making sure your debts aren’t getting out of control.

Whether you’re running a business or just managing personal finances, these two statements together can help you make informed decisions. Thus, you can avoid financial trouble, and maybe even plan that vacation you always dreamt of.

And remember, whether you’re aiming for millionaire status or just trying to get through the month, these financial documents are your friends.