Capital Gains Tax (CGT) can take a big bite out of your profits when you sell assets like property, shares, or cryptocurrency. But here’s the good news, there are smart, totally legal ways to slash your CGT bill or even avoid it altogether.

Why let the taxman claim more than he should when you could keep more of your hard-earned gains in your pocket? In this article, we’ll explore practical strategies, exemptions, and reliefs designed to help you navigate CGT like a pro.

Whether you’re selling a rental property, cashing in on stocks, or trading crypto, these tips can make a real difference. So grab a coffee (or your favorite snack), and let’s dive into the world of tax-savvy moves!

Table of Contents

What is Capital Gains Tax?

Capital Gains Tax (CGT) is applied to the profit you make when selling or disposing of an asset that has been appreciated. This tax covers various assets, including property, shares, and investments outside ISAs or pensions, cryptocurrencies, and personal items.

As changes to Capital Gains Tax (CGT) exemptions tighten, optimizing your investments for tax efficiency has become more critical than ever. With the CGT allowance reduced to £3,000 for the 2024/25 tax year, gains exceeding this limit may attract a CGT charge.

Higher and additional-rate taxpayers face a 24% CGT rate on taxable gains, while basic-rate taxpayers pay 18% if their total gains and taxable income remain within the basic-rate band. For amounts exceeding this threshold, the rate also rises to 24%. Below are some practical methods to reduce your CGT liability effectively.

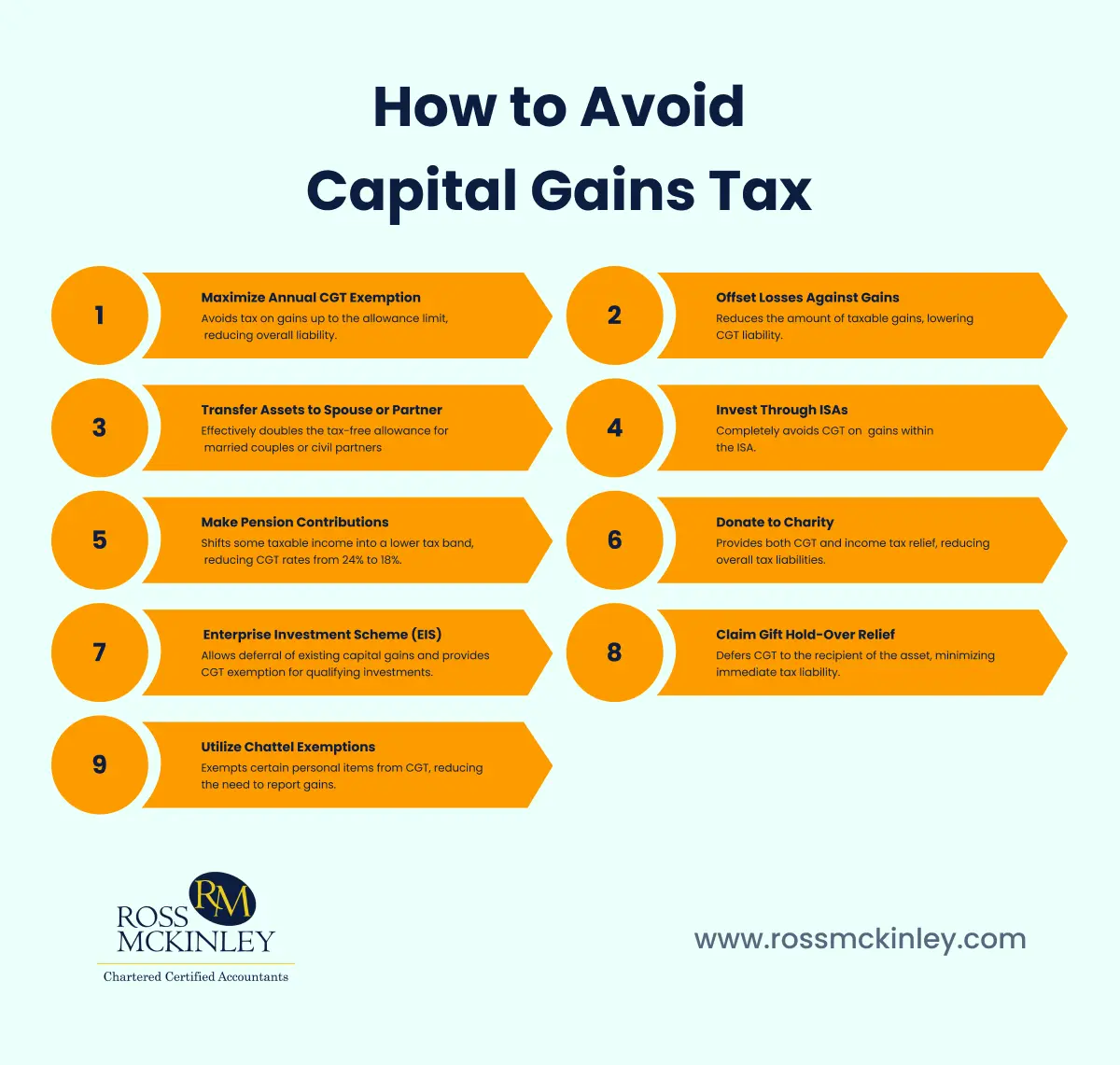

| Topic | Benefits |

| Maximize Annual CGT Exemption | Avoids tax on gains up to the allowance limit, reducing overall liability. |

| Offset Losses Against Gains | Reduces the amount of taxable gains, lowering CGT liability. |

| Transfer Assets to Spouse or Partner | Effectively doubles the tax-free allowance for married couples or civil partners. |

| Invest Through ISAs | Completely avoids CGT on gains within the ISA. |

| Make Pension Contributions | Shifts some taxable income into a lower tax band, reducing CGT rates from 24% to 18%. |

| Donate to Charity | Provides both CGT and income tax relief, reducing overall tax liabilities. |

| Enterprise Investment Scheme (EIS) | Allows deferral of existing capital gains and provides CGT exemption for qualifying investments. |

| Claim Gift Hold-Over Relief | Defers CGT to the recipient of the asset, minimizing immediate tax liability. |

| Utilize Chattel Exemptions | Exempts certain personal items from CGT, reducing the need to report gains. |

1. Maximize Your Annual CGT Exemption

The annual CGT exemption allows you to make tax-free gains of up to £3,000 in the 2024/25 tax year. This allowance cannot be carried forward, so utilizing it each year is crucial to avoid accumulating a significant tax liability over time.

Grow Your Practice with Confidence

2. Offset Losses Against Gains

You can reduce your CGT liability by using losses to offset taxable gains. Losses and gains realized within the same tax year must first be offset against one another. Any unused losses can be carried forward to future years, provided they are reported to HMRC within four years of the end of the tax year in which the asset was disposed of.

3. Transfer Assets to Your Spouse or Civil Partner

Transfers of assets between spouses or civil partners are exempt from CGT, enabling couples to use each person’s annual CGT allowance. This strategy effectively doubles the allowance for married couples or civil partners, minimizing tax exposure. However, the transfer must be a genuine, outright gift to qualify.

4. Invest Through ISAs

Investments held within an Individual Savings Account (ISA) are exempt from CGT. Each individual can invest up to £20,000 per tax year in an ISA, and for couples, this allowance doubles to £40,000.

A popular approach is the “bed and ISA” strategy, where investments are sold to realize a capital gain and then immediately repurchased within an ISA. This ensures all future gains on the investment remain CGT-free. However, be aware of potential costs like stamp duty or market timing risks when repurchasing investments.

5. Make Pension Contributions

Pension contributions can help lower your CGT liability by increasing your income tax band limit. For instance, a £10,000 pension contribution raises the higher-rate threshold from £50,270 to £60,270 in the 2024/25 tax year.

If your taxable gain and other income fall within this extended basic-rate band, CGT is payable at 18% instead of 24%, provided the gain is not from residential property.

6. Donate to Charity

Giving land, property, or qualifying shares to a charity offers dual benefits: income tax relief and CGT relief. This not only supports a worthy cause but also reduces your overall tax liability.

7. Utilize the Enterprise Investment Scheme (EIS)

Investing in an Enterprise Investment Scheme (EIS) can provide CGT relief. Gains made on EIS investments are exempt from CGT if held for at least three years.

Additionally, you can defer a capital gain by reinvesting it into an EIS-qualifying company, provided the investment is made one year before or up to three years after the gain arises. However, EIS investments carry higher risk and may be less liquid than traditional investments.

Grow Your Practice with Confidence

8. Claim Gift Hold-Over Relief

If you gift business assets or sell them at a discounted price, you may qualify for gift hold-over relief. This defers the CGT liability to the recipient of the asset, rather than you paying it at the time of transfer. Several eligibility conditions apply, so seeking professional advice is recommended.

9. Take Advantage of Chattel Exemptions

Certain personal possessions, referred to as “chattels,” may be exempt from CGT. Wasting assets—items with a predictable life of 50 years or less, such as antique clocks or vintage cars—are typically CGT-free unless they qualify for business capital allowances.

For non-wasting chattels like jewelry or paintings, CGT depends on the sale proceeds, with gains on items sold for £6,000 or less generally being exempt.

10. Seek Professional Advice

Navigating CGT can be complex. Engaging a tax adviser or financial professional ensures you take full advantage of available reliefs, allowances, and exemptions while remaining compliant with the law. Personalized advice tailored to your specific circumstances can help secure your financial future and reduce unnecessary tax exposure.

Reporting and Avoiding Penalties

Reporting your gains accurately is crucial, even if you’re employing strategies to reduce or avoid Capital Gains Tax (CGT). Eligible gains must be declared to HMRC through a Self-Assessment Tax Return, detailing all profits and losses.

For property sales, reports must be submitted within 60 days, while gains from other assets should be filed by 31 January following the tax year’s end.

Missing these deadlines or inaccuracies can lead to penalties and interest charges. To stay compliant and avoid complications, consult a tax professional if you’re uncertain about the process.

Conclusion

While Capital Gains Tax can seem daunting, understanding the rules and utilizing exemptions and reliefs can significantly reduce or even eliminate your tax liability. Whether you’re selling property, shares, or cryptocurrency, planning and smart strategies are key.

If you’re unsure about any aspect of CGT, seek advice from a tax professional or use HMRC’s online resources. By staying informed and proactive, you can protect your gains and make the most of your investments!