For many in the UK, financial security during retirement often hinges on three important letters: DWP SP. If you’ve spotted this abbreviation on your bank statement or correspondence, you might be curious about what it stands for and what it means for you.

Well, sit tight, because we’re about to dive into the world of State Pensions and how the Department for Work and Pensions (DWP) helps retirees maintain financial stability through the SP system.

By the end of this article, you’ll know everything there is to know about DWP SP, from how it works to who qualifies for it.

Table of Contents

What Does DWP SP Mean?

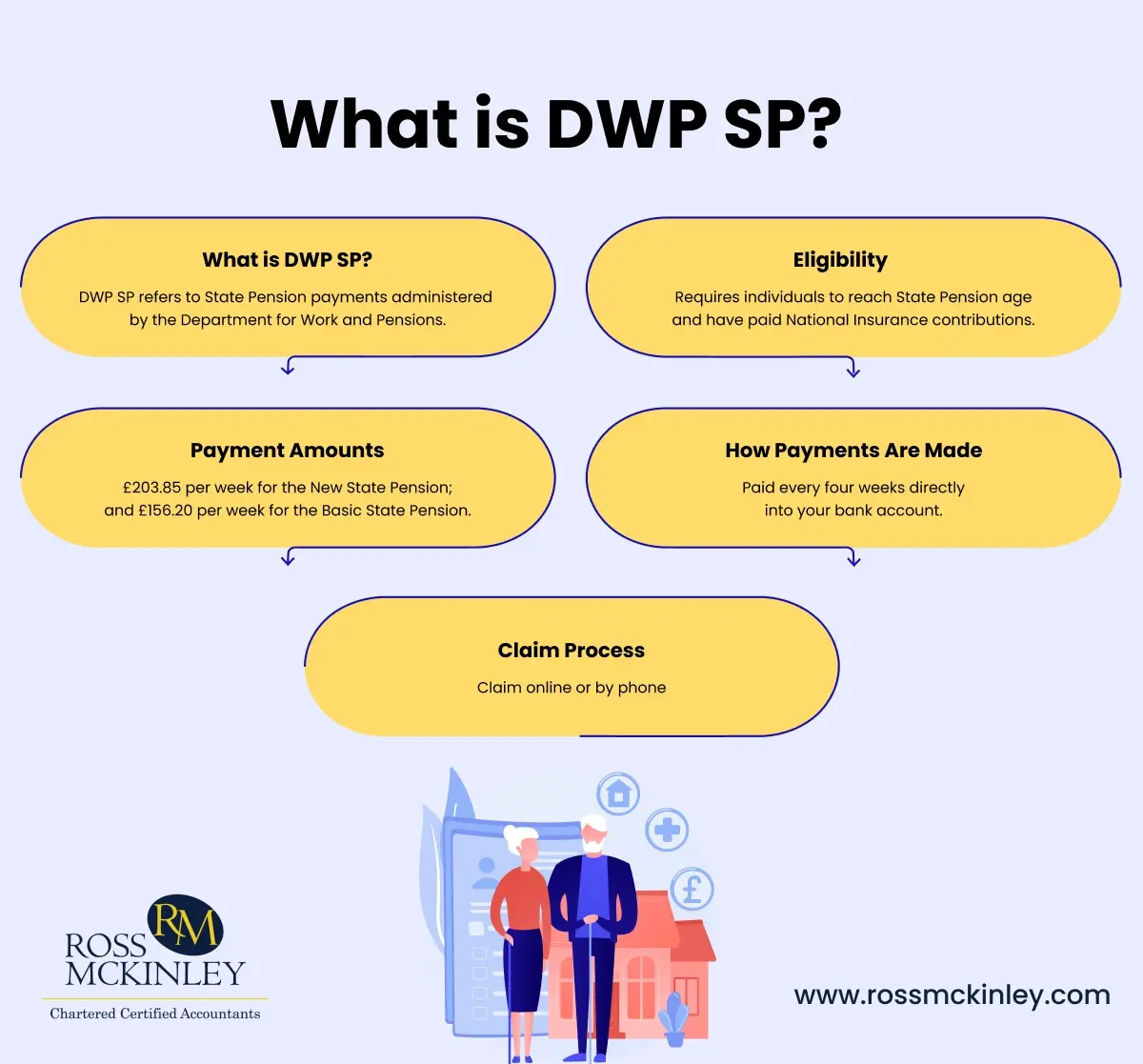

“DWP SP” refers to the State Pension payments administered by the Department for Work and Pensions (DWP) in the UK.

The State Pension is a regular payment provided to individuals who have fulfilled two requirements. The requirements include that the individual has reached State Pension age and has contributed to the system through National Insurance (NI) contributions over their working life. It’s a cornerstone of financial planning for retirement and a key part of the UK’s welfare system.

| Topic | Details |

| What is DWP SP? | DWP SP refers to State Pension payments administered by the Department for Work and Pensions. |

| Eligibility | Requires individuals to reach State Pension age and have paid National Insurance contributions. |

| Payment Amounts | £203.85 per week for the New State Pension; and £156.20 per week for the Basic State Pension. |

| How Payments Are Made | Paid every four weeks directly into your bank account. |

| Claim Process | Claim online or by phone |

The Basics of the State Pension

The State Pension isn’t a one-size-fits-all benefit. The amount you receive is determined by your National Insurance record as well as whether you are enrolled in the new or basic State Pension system. This applies to anybody who achieved pension age before April 6, 2016.

1. The New State Pension (Post-April 2016)

The new State Pension, introduced post-April 2016, is available to men born on or after April 6, 1951, and women born on or after April 6, 1953.

For the 2024/2025 tax year, the maximum weekly payment is £203.85. To qualify, you need a minimum of 10 years of National Insurance contributions, with 35 qualifying years required to receive the full amount.

Grow Your Practice with Confidence

2. The Basic State Pension (Pre-April 2016)

The basic State Pension, applicable to individuals who reached the State Pension age before April 6, 2016, offers a maximum weekly payment of £156.20 for the 2024/2025 tax year.

To receive the full amount, you need at least 30 qualifying years of National Insurance contributions.

How Does DWP SP Work?

The State Pension is designed to provide retirees with a reliable source of income after they stop working. Which not only provides the old citizens a happy retirement but also benefits them in many perspectives. Here’s how it all comes together:

- Building Up Contributions

Throughout your working life, you make National Insurance contributions (NICs). These contributions build up your entitlement to the State Pension. Even if you’re unemployed or earning below a certain threshold, you might still qualify through National Insurance credits, which are granted in specific situations like caring for a child or receiving certain benefits.

- Reaching Pension Age

Once you reach the State Pension age, you can claim your State Pension. Additionally, The current State Pension age is set to 66, but it ought to rise to 67 between 2026 and 2028.

- Receiving Payments

The State Pension is paid every four weeks directly into your bank account. If you see “DWP SP” on your statement, voila! it’s your State Pension payment.

How to Claim the State Pension

Unlike some benefits, the State Pension isn’t paid automatically. Navigating the process can feel overwhelming if you’re unsure where to begin. Whether you’re approaching the State Pension age or helping a loved one with their application, understanding the steps can help you alot. Here’s what you need to do:

- Receive a Letter from DWP

About four months before you reach State Pension age, the DWP will send you a letter explaining how to claim.

- Claim Online or By Phone

You can claim your State Pension online through the official UK government website or by calling the DWP’s pension service.

- Choose to Defer

If you’re not ready to claim your pension right away, you can choose to defer it. This will increase the amount you receive when you eventually claim.

Grow Your Practice with Confidence

What is the purpose of DWP SP?

The State Pension is more than just a financial benefit—it’s a recognition of your contributions to society throughout your working life. It offers retirees a sense of security, knowing they’ll have a regular income, even if it’s modest.

For some, the State Pension is a lifeline, helping them cover essential expenses like housing, food, and utilities.

However, it’s important to view the State Pension as just one part of your retirement planning. By supplementing it with personal savings, workplace pensions, or other investments, you can ensure a more comfortable and secure retirement.

The Role of DWP SP in Financial Planning

For many people, their retirement income is based on the State Pension. Even though it’s an asset, you should be aware that it probably won’t be enough to meet all of your retirement expenses.

That’s why most financial advisors recommend supplementing it with workplace pensions, private pensions, or other investments.

For example, if you receive the full new State Pension of £203.85 per week, that amounts to around £10,600 per year. While helpful, this amount may not be sufficient for a comfortable lifestyle without additional income sources.

Conclusion

DWP SP may appear as a simple code on your bank statement, but behind those letters lies a crucial system designed to support retirees across the UK. Whether you’re nearing retirement age or still in the workforce, understanding how the State Pension works is essential for planning your financial future.

So, the next time you see “DWP SP” on your statement, you’ll know it’s not just a payment. It’s the government’s acknowledgment of a lifetime of hard work and contributions. And while it might not cover everything, it’s a strong foundation to build upon as you enjoy your golden years.