Let’s be real—depreciation and amortization don’t exactly scream excitement. They’re like the broccoli of bookkeeping: not glamorous, but essential for keeping your financial records healthy. If you’ve ever wondered why your accountant keeps talking about the “useful life” of your office printer or the “intangible value” of your patents, you’re in the right place.

Depreciation and amortization may sound technical, but mastering them is key to understanding your business’s financial story. Whether you’re a small business owner scratching your head over tax deductions or an entrepreneur looking to streamline your financial processes, this guide is here to help.

Let’s break it down, step by step, and make sense of these accounting essentials. By the end, you’ll be understand depreciation and amortization like a pro!

Table of Contents

What is Depreciation and Amortization?

At their core, depreciation and amortization represent the gradual reduction in the value of your business assets over time. But, here’s how they differ.

Depreciation applies to tangible assets—those you can physically see and touch, like machinery, vehicles, or office furniture. Over time, these assets wear out, lose value, or become obsolete. Depreciation allows you to account for this decline systematically in your financial records.

Amortization, on the other hand, applies to intangible assets—things you can’t physically touch, like patents, copyrights, or trademarks. These assets also lose value over time, whether because of expiration or diminishing usefulness. Amortization spreads out their cost over their useful life.

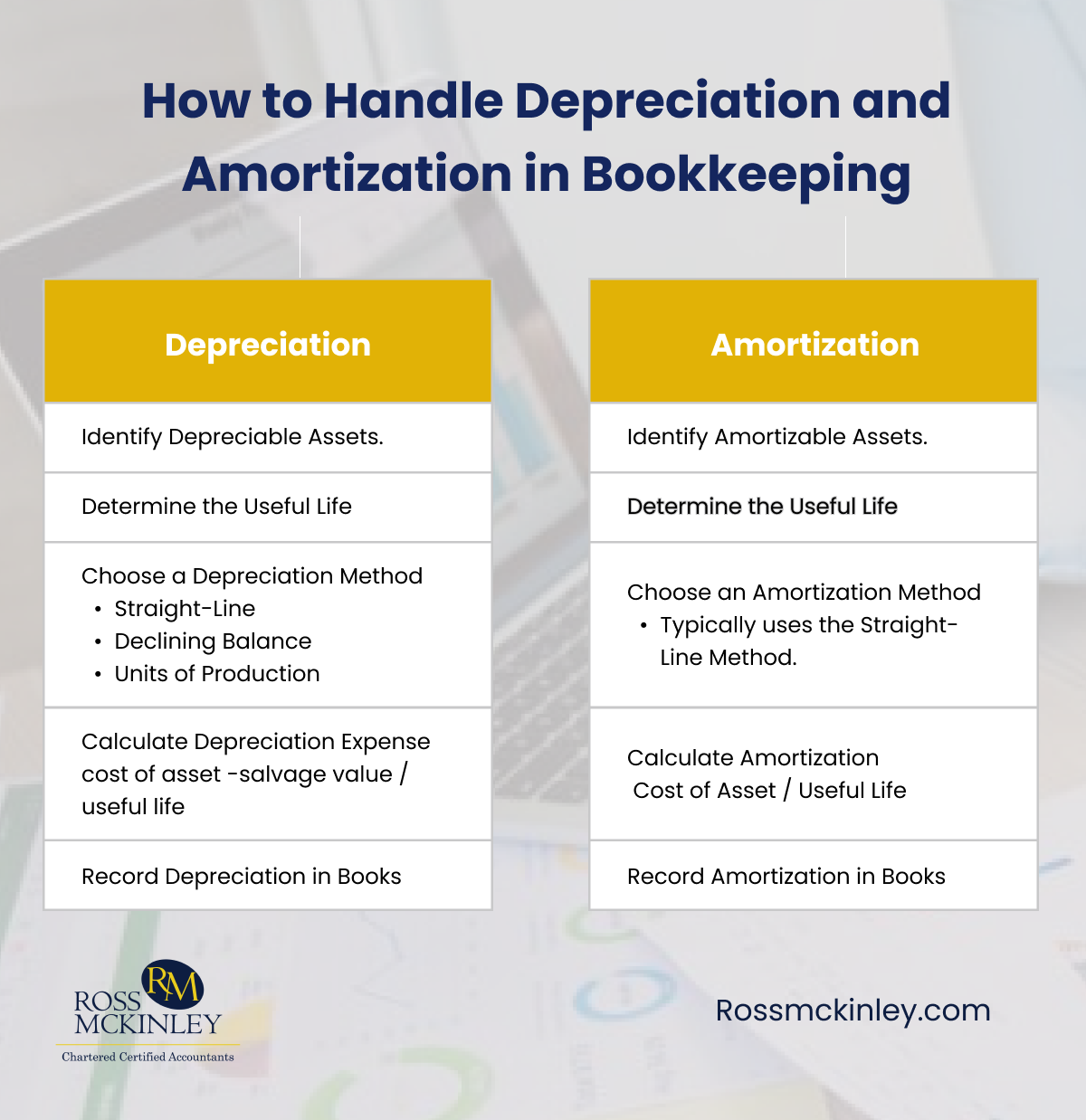

How to Handle Depreciation in Bookkeeping

Handling depreciation involves several steps to ensure your financial records remain accurate. From identifying depreciable assets to recording depreciation in your books, let’s handle them all.

Grow Your Practice with Confidence

1. Identify Depreciable Assets

Start by listing all the tangible assets your business owns. These assets should have a useful life of more than one year and not be intended for immediate resale. Common examples include machinery, vehicles, office equipment, and buildings.

2. Determine the Asset’s Useful Life

The useful life of an asset is the estimated period it will provide value to your business.

For example, a computer might have a useful life of 3–5 years, while a building might last 30 years.

3. Select a Depreciation Method

There are different methods for calculating depreciation. The method you choose will determine how the cost of the asset is allocated over time. Some of these methods are:

- Straight-Line Depreciation

This is the simplest and most commonly used method. It spreads the asset’s cost evenly over its useful life. For Instance, If you buy a £10,000 machine with a useful life of 5 years and a £2,000 salvage value, your annual depreciation would be

Depreciation Expense = (cost of asset- salvage value)useful life = (10,000- 2,000) 5= 1,600 per year

- Declining Balance Method

This method accelerates depreciation, with higher expenses recorded in the early years of an asset’s life. It’s useful for assets that lose value quickly, like electronics.

- Units of Production Method

This method bases depreciation on how much the asset is used rather than time. It’s suitable for machinery or vehicles where usage varies.

4. Calculate the Depreciation Expense

Use the chosen method to calculate the depreciation expense for each accounting period. This calculation allocates the asset’s cost over its useful life.

5. Record Depreciation in Your Books

In your accounting records, you’ll debit the depreciation expense account and credit the accumulated depreciation account. This entry reduces the asset’s book value and shows the total depreciation taken to date.

How to Handle Amortization in Bookkeeping

Managing amortization involves similar principles, but it applies to intangible assets. The process ranges from identifying amortizable assets to recording amortization in your books.

1. Identify Amortizable Assets

List all intangible assets your business owns that have a finite useful life. Examples include patents, copyrights, trademarks, and software licenses. Note that some intangible assets, like goodwill, are not amortized if they have an indefinite life.

2. Determine the Useful Life

The useful life of an intangible asset is the period it will provide economic benefits to your business.

For example, a patent might have a useful life of 20 years if it’s protected for that period.

3. Choose an Amortization Method

Amortization typically uses the straight-line method, spreading the asset’s cost evenly over its useful life.

4. Calculate the Amortization Expense

For Instance, If you buy a £10,000 machine with a useful life of 5 years. Use the following formula to calculate the annual amortization expense

Amortization Expense =cost of assetuseful life = (10,000- 2,000) 5= 1,600 per year

Unlike depreciation, amortization generally doesn’t account for a salvage value.

5. Record Amortization in Your Books

Record the amortization expense by debiting the amortization expense account and crediting the accumulated amortization account. This reflects the reduction in the asset’s book value over time.

Why Are Depreciation and Amortization Important?

Recording depreciation and amortization isn’t just about following accounting rules—it serves multiple vital purposes such as

- Accurate Financial Reporting

By spreading out the cost of assets over their useful lives, your financial statements provide a more accurate picture of your business’s profitability and expenses during each accounting period.

- Tax Deductions

Both depreciation and amortization can lower your taxable income, saving you money on taxes. Most tax laws allow businesses to deduct these costs, making them powerful tools for tax planning.

- Informed Decision Making

Tracking the declining value of assets helps you plan for future investments.

For example, if a piece of machinery is nearing the end of its useful life, you can budget for its replacement.

Conclusion

Understanding and managing depreciation and amortization is essential for accurate bookkeeping. These processes not only ensure compliance with accounting standards but also provide valuable insights into the true cost of doing business.

At Ross McKinley, we understand the complexities of managing depreciation and amortization. Our team of experts is dedicated to helping you navigate these accounting essentials with ease. From ensuring accurate calculations to optimizing tax benefits, we take the stress out of bookkeeping, because your success is our priority.