Let’s be real, bookkeeping might not be the most glamorous part of running a business, but it’s essential. You might think it’s just about tracking income and expenses, but there’s more magic behind the scenes. At the heart of bookkeeping lies the art of debits and credits, the two pillars that keep your financial records balanced and organized.

So, what exactly are these mysterious terms? How do they affect your business finances? And most importantly, how do you use them correctly without getting lost in numbers?

Don’t worry; we’ve got you covered. In this article, we’ll break down the rules of debits and credits in a way that makes sense, even if math isn’t your best friend.

Table of Contents

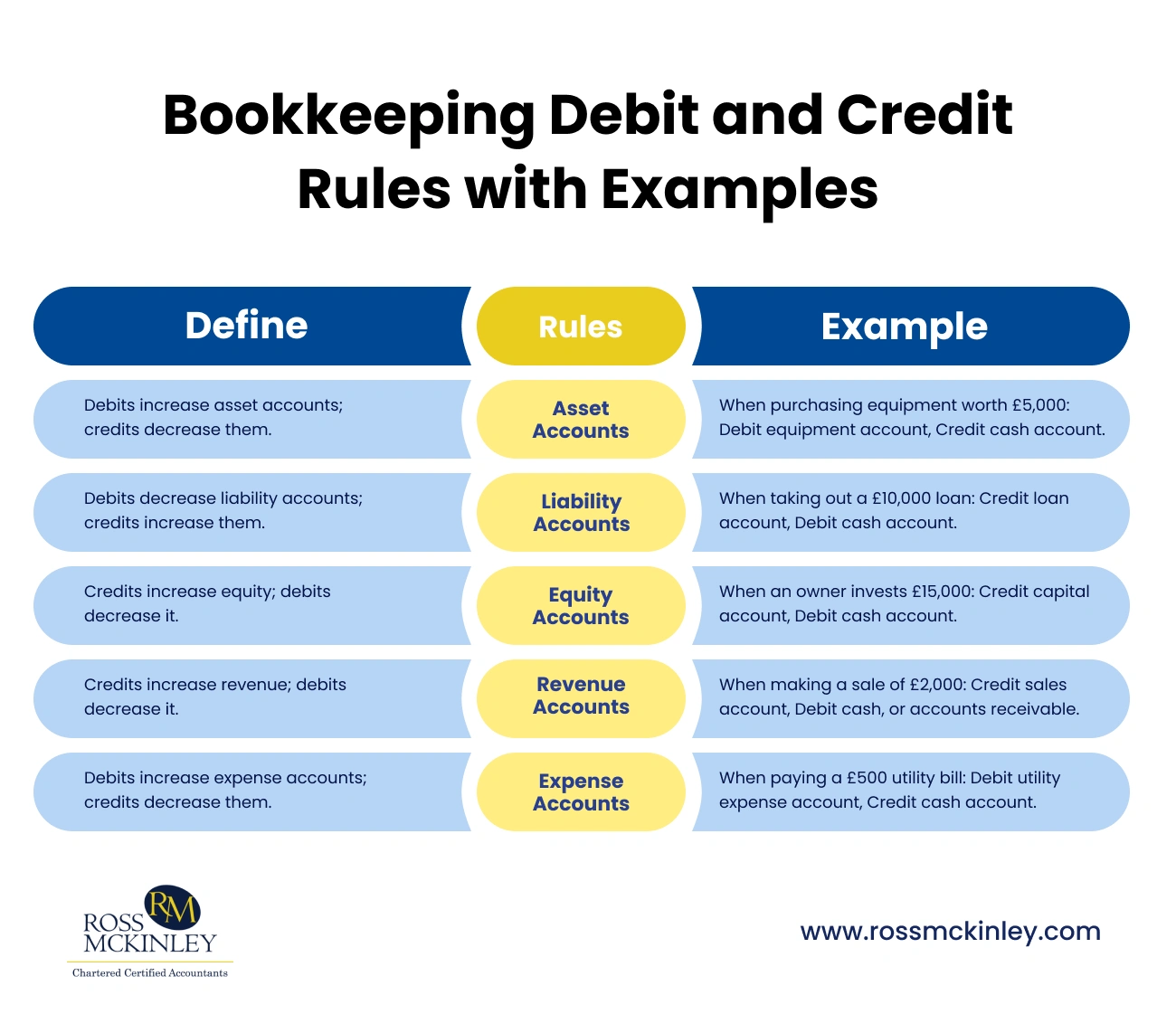

The Golden Rules of Debit and Credit

Think of your finances like a see-saw, for every move on one side, there must be an equal move on the other to stay balanced. These simple rules help you track money coming in and going out, keeping your books clear, accurate, and reliable.

Asset Accounts

Debits represent increases in asset accounts, while credits indicate decreases. For instance, when your business purchases a new asset, you must record this acquisition by increasing the relevant asset account using a debit.

Conversely, when assets are sold or disposed of, you record a credit to show a reduction in assets. Suppose you purchase a new piece of equipment worth £5,000; in this case, the cash account (an asset) is credited for £5,000 to reflect the outflow of funds, while the equipment account (another asset) is debited by £5,000 to record the increase in your assets.

Liability Accounts

For liabilities, debits decrease balances, and credits increase them. This may sound counterintuitive at first, but it makes sense when you think about how liabilities work. Taking out a loan means your liabilities increase. Thus, you credit the loan account.

On the other hand, when you pay off part of the loan, your liability decreases, so you debit the loan account. For example, if your business takes out a £10,000 loan, you would credit the loan account and debit your cash account.

Equity Accounts

Equity accounts follow a similar pattern to liabilities, credits increase the balance while debits decrease it. When an owner injects capital into the business, the equity account must reflect this increase with a credit entry.

Conversely, debts to equity may occur when profits are withdrawn or losses are incurred. For instance, an owner’s investment of £15,000 in the business would be recorded by crediting the capital account and debiting the cash account.

Revenue Accounts

Credits increase revenue accounts, while debits decrease them. This is because revenue generation directly contributes to increasing the company’s financial position.

When a sale is made, the sales revenue account is credited, and an asset account such as cash or accounts receivable is debited. For example, if you sell goods worth £2,000, you would credit the sales account and debit the cash account.

Expense Accounts

Expenses work differently from assets and revenues debits increase the balance of expense accounts, while credits reduce them. This makes sense because expenses reduce the company’s net income.

Paying for office rent, utilities, or supplies all involves debiting expense accounts. For instance, when paying a £500 utility bill, you debit the utility expense account and credit the cash account to show the outflow of funds.

Why Debit and Credit Rules Matter

Ever wondered what keeps your business finances from turning into chaos? Debit and credit rules are the backbone of every accurate financial record. They ensure your books stay balanced, helping you spot opportunities, avoid costly mistakes, and stay on the right side of tax laws.

Ensuring Financial Accuracy

The proper use of debit and credit rules ensures your financial statements are accurate and complete. Every transaction must have a corresponding debit and credit entry to maintain the integrity of your financial records.

This double-entry system helps detect errors, making it easier to reconcile discrepancies and maintain accurate ledgers.

Regulatory Compliance

Many regulatory authorities require businesses to maintain accurate financial records. By following debit and credit rules, companies can meet tax reporting obligations and comply with industry regulations. This helps avoid penalties, audits, or legal consequences.

Improving Decision-Making

Accurate financial statements enable business owners and managers to make informed decisions. Understanding whether your company is operating at a profit, and identifying areas where costs can be reduced, all depend on well-maintained financial records.

Building Stakeholder Confidence

Investors, lenders, and other stakeholders rely on financial statements to assess a company’s financial health. Accurate bookkeeping fosters transparency and builds trust, making it easier to attract investment and secure loans.

Common Challenges in Applying Debit and Credit Rules

In bookkeeping, applying debit and credit rules may seem straightforward, but various challenges can arise, leading to discrepancies in financial records. From misidentifying account types to dealing with complex transactions, even small errors can have a significant impact on the accuracy of your financial statements.

Misidentifying Accounts

One of the most common errors is mistaking one account type for another. For example, treating an asset purchase as an expense can result in incorrect records and impact financial statements.

Skipping the Double-Entry Requirement

Failure to record both the debit and credit sides of a transaction disrupts the balance of your books. This omission can cause significant issues during financial reconciliations and audits.

Handling Complex Transactions

Transactions involving multiple steps, foreign currencies, or intercompany dealings can be challenging to record accurately. These complexities often require additional expertise or specialized software.

Balancing Errors

Even small data entry mistakes can throw off the entire balance of your books. These errors may be difficult to track down without thorough reviews and reconciliations.

Why Choose Ross McKinley Bookkeeping Services?

When it comes to accurate, reliable, and efficient bookkeeping, Ross McKinley is your trusted partner. Our expert team ensures your financial records are in top shape, helping you avoid errors and stay compliant.

Let us handle the numbers, so you can focus on what matters most, growing your business!

Conclusion

While the world of debits and credits may initially seem daunting, it’s the foundation of sound financial management. By understanding the rules and applying them correctly, you can ensure your books stay balanced, your financial reports stay accurate, and your business stays on the path to success.

So, next time you’re balancing your books, remember debits and credits are more than just numbers; they’re the secret to keeping your business financially healthy and thriving.