So, you’ve profited from selling a property, whether a second home, a rental, or some land you’ve held onto for a while. That’s great news! But before you start celebrating, there’s something important you need to know.

That is Capital Gains Tax (CGT)! CGT could apply if you’re selling property for a profit in the UK. Don’t worry, though—this article is here to break it all down for you.

We’ll cover when you need to pay CGT, how much it would cost, and all the exemptions and reliefs that save you some cash.

What is Capital Gains Tax on Property?

Capital Gains Tax (CGT) on property applies when you sell a property that has increased in value since you bought it. If you profit from the sale, CGT is the tax the government wants a cut of.

This includes second homes, buy-to-let properties, and land but excludes your primary residence, which may qualify for relief (more on that later!). The amount of CGT you owe depends on how much profit you made, your income level, and any exemptions or reliefs you can apply.

Knowing the rules is important so you’re not hit with a surprise tax bill after selling a property.

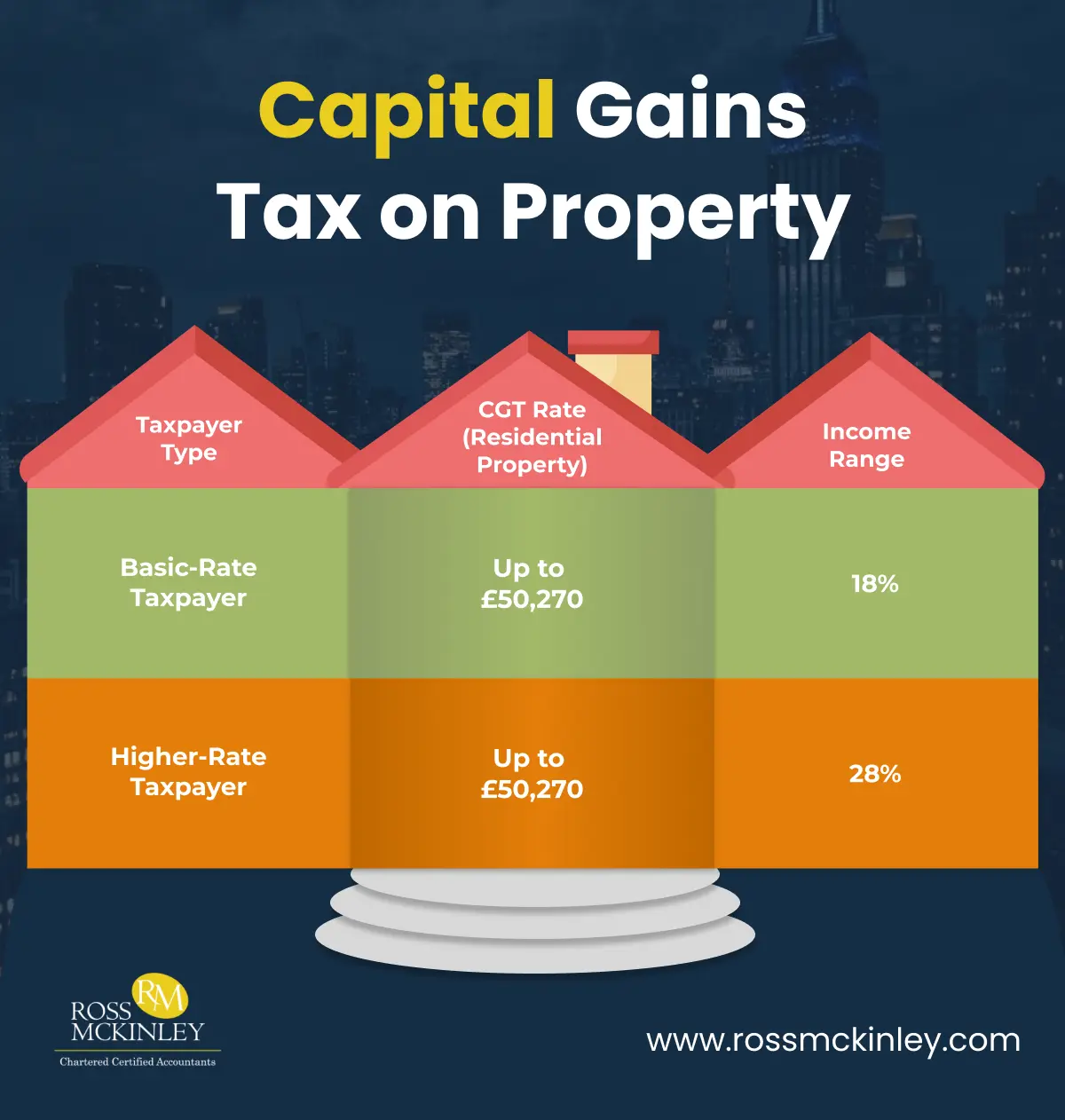

| Taxpayer Type | Income Range | CGT Rate (Residential Property) |

| Basic-Rate Taxpayer | Up to £50,270 | 18% |

| Higher-Rate Taxpayer | Over £50,270 | 28% |

Capital Gains Tax Rates on Property (2024/2025)

The Capital Gains Tax (CGT) rate you pay on property depends on your income tax bracket. If you’re a Basic Rate taxpayer, you’ll pay 18% on any gains from selling property. However, if you’re in the Higher Rate or Additional Rate tax brackets, the CGT rate increases to 28%. Your earnings are directly proportional to your tax rate on property profits.

Grow Your Practice with Confidence

How Capital Gains Tax on Property Works

When you sell a property that has increased in value, you are liable to pay Capital Gains Tax on the profit. It is the difference between the sale price and the amount you originally paid for the property, minus any allowable costs (e.g., improvements or selling costs).

It’s important to note that CGT applies to properties that are not your main residence. For example, if you sell a second home or a rental property for a profit, you may owe CGT on that gain.

However, if you sell your primary residence, you may be eligible for exemptions, which we’ll cover below in the article.

Tax-Free Allowances

For the 2024/2025 tax year, individuals have an annual CGT allowance of £6,000. Any gains above this allowance are subject to CGT. For trusts, the annual allowance is £3,000 or 50% of the individual allowance.

When Do You Pay Capital Gains Tax on Property?

You need to pay CGT on the sale of property when the sale results in a profit and the property is not your primary residence. If the property is your main home, you may not have to pay CGT due to a specific exemption known as Private Residence Relief.

However, if the property is a second home, a buy-to-let property, or a commercial property, CGT will likely apply.

How to Calculate Capital Gains Tax on Property

Knowing how to work out your CGT liability is key to avoiding any nasty surprises when it’s time to file your taxes. Let’s break down the steps involved in calculating CGT on a property, including how to figure out your profit, what expenses you can deduct, and the allowances that may reduce your tax bill.

Let’s get started and make this process as straightforward as possible!

Grow Your Practice with Confidence

- Determine the Gain

Subtract the acquisition cost (including associated expenses) from the disposal value.

Formula: Gain = Sale Price – (Purchase Price + Associated Costs)

Associated costs may include legal fees, stamp duty, and improvement costs.

- Apply Tax-Free Allowance

Deduct the annual CGT allowance (£6,000 for individuals in 2024/2025).

For instance, If your gain is £10,000, the taxable amount is: £10,000 – £6,000 = £4,000.

- Identify Your Tax Bracket

Add the taxable gain to your total taxable income.

- If the total is below £50,270, CGT is charged at the introductory rate.

- For amounts above £50,270, higher rates apply.

4. Calculate the Tax

Once the taxable gain is determined, apply the appropriate tax rate based on your income tax bracket (18% for basic-rate taxpayers or 28% for higher-rate taxpayers).

Reporting Capital Gains Tax on Property

If you sell a property and make a profit, you must report the gain to HMRC and pay any CGT owed. You do this by completing a Self-Assessment Tax Return, where you’ll declare the sale of the property, the gain made, and any reliefs you’re claiming.

Firstly, You must report the sale of the property within 60 days of the sale if CGT is due (for most properties sold after 27 October 2021).

Secondly, Suppose you’re required to file a Self-Assessment tax return. In that case, you will report the sale in the appropriate return section and pay any CGT by the deadline (usually 31 January after the tax year ends).

Conclusion

Capital Gains Tax on property can be a complex subject. With the proper knowledge and understanding of the rules, you can effectively navigate the process and potentially reduce your tax liability.

The key is knowing when CGT applies, understanding the available reliefs, and accurately calculating your gain. If you’re unsure about your specific situation or how to report a property sale, consult with a tax professional to ensure compliance with UK tax law.

Whether selling a second home or a rental property, staying informed about Capital Gains Tax will help you make smarter financial decisions and avoid unexpected tax bills.