Wondering what you’re really getting when you acquire a business? It’s not just desks and contracts; you also get those hard-to-define assets like brand reputation, customer loyalty, and location appeal. These assets fall under goodwill, which is an important aspect that can’t be physically touched but adds immense value to a business.

Understanding how to calculate goodwill is essential for business owners who want a clear view of their investment’s true worth, especially in a competitive market.

To help you understand goodwill easily, we will elaborate on goodwill, including everything from its calculation to why it matters in business valuation and the challenges to watch out for.

Table of Contents

What Is Goodwill?

Goodwill is the extra value that comes up when one company buys another. It’s the amount paid over the fair value of the company’s known assets and debts. Think of it as the “extra” you pay for qualities that make a business unique, like its customer relationships, brand name, or favorable location.

In technical terms, goodwill is the difference between the purchase cost and the net fair value of assets and liabilities acquired. Examples of goodwill include strong employee relations, proprietary technology, and a strategic location with an established client base.

In the case of large companies like Coca-Cola or Apple, goodwill often accounts for a large portion of their acquisition price due to brand value, loyal customers, and growth potential.

Without recognizing goodwill, a company’s true worth might be underestimated, as these intangibles often represent long-term profitability and market position.

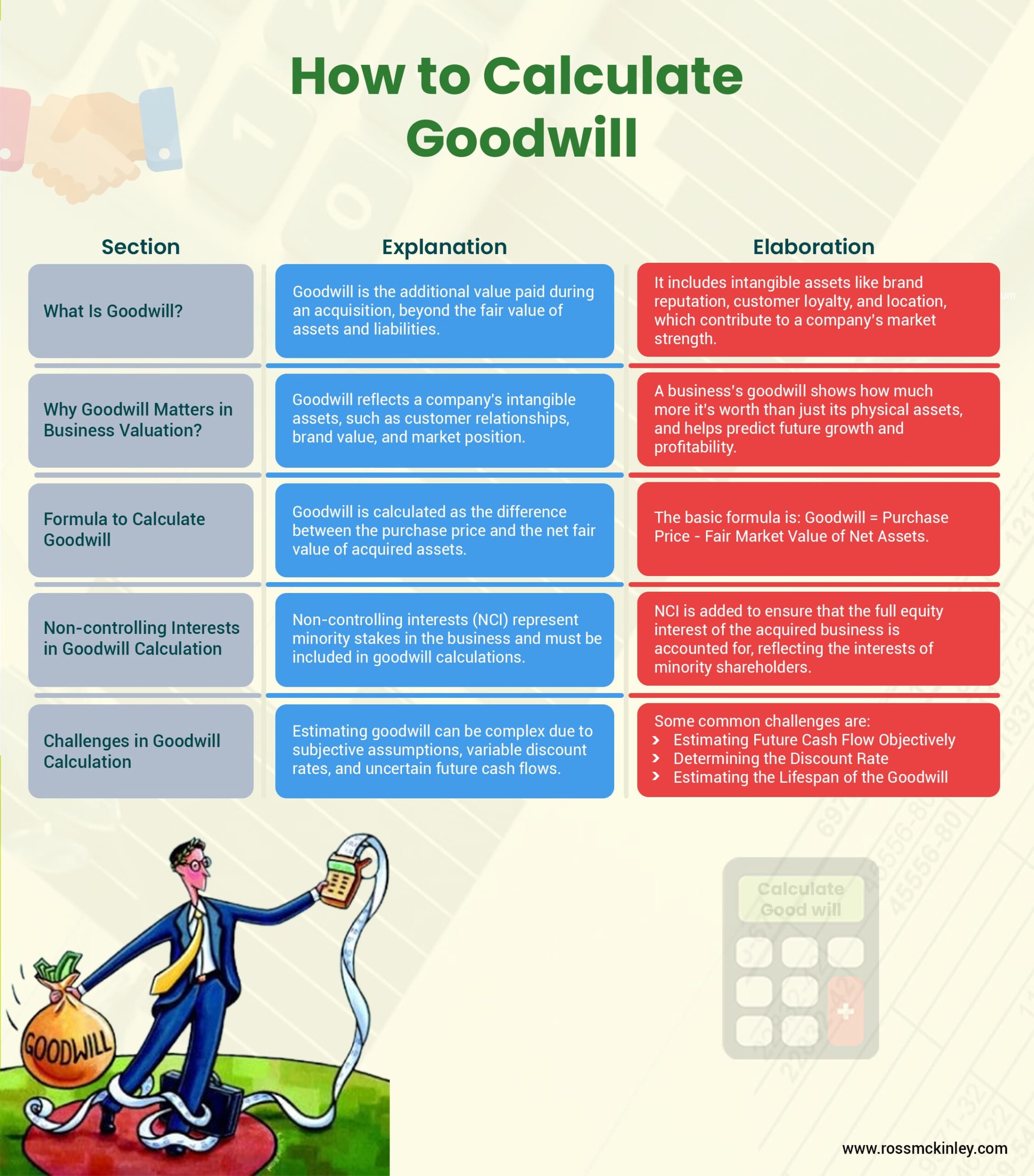

| Section | Explanation | Elaboration |

| What Is Goodwill? | Goodwill is the additional value paid during an acquisition, beyond the fair value of assets and liabilities. | It includes intangible assets like brand reputation, customer loyalty, and location, which contribute to a company’s market strength. |

| Why Goodwill Matters in Business Valuation? | Goodwill reflects a company’s intangible assets, such as customer relationships, brand value, and market position. | A business’s goodwill shows how much more it’s worth than just its physical assets, and helps predict future growth and profitability. |

| How to Calculate Goodwill | Goodwill is calculated as the difference between the purchase price and the net fair value of acquired assets. | The basic formula is: Goodwill = Purchase Price – Fair Market Value of Net Assets. |

| Non-controlling Interests in Goodwill Calculation | Non-controlling interests (NCI) represent minority stakes in the business and must be included in goodwill calculations. | NCI is added to ensure that the full equity interest of the acquired business is accounted for, reflecting the interests of minority shareholders. |

| Challenges in Goodwill Calculation | Estimating goodwill can be complex due to subjective assumptions, variable discount rates, and uncertain future cash flows. | Some common challenges are:Estimating Future Cash Flow Objectively Determining the Discount Rate Estimating the Lifespan of the Goodwill |

How to Calculate Goodwill?

When it comes to calculating goodwill, you can use a basic formula. IFRS 3, “Business Combinations,” quotes that calculating goodwill involves finding the difference between the total payment made by the buyer and the fair value of the acquired company’s identifiable assets and liabilities.

In simpler terms, goodwill represents the extra amount a buyer pays beyond the net worth of the tangible and identifiable intangible assets of the business being acquired.

The formula to calculate Goodwill is:

Grow Your Practice with Confidence

Goodwill = Purchase Price – Fair Market Value of Net Assets

Breaking this down:

- Purchase Price: The amount paid to acquire the business.

- Fair Market Value of Net Assets: The value of all identifiable assets minus liabilities.

In cases where there’s a non-controlling interest (NCI), minority ownership is without control, which influences the calculation. The expanded goodwill formula under IFRS 3 includes NCI and other equity interests:

Goodwill = (Consideration Transferred + Non-Controlling Interest + Fair Value of Previous Equity Interests) – Net Assets

Adding NCI and fair value of previous equity interests can help account for the full scope of intangible benefits gained in the acquisition.

Non-controlling Interests in the Goodwill Calculation

Non-controlling interest (NCI) represents a minority ownership stake in a business where the position isn’t large enough to exert control. In goodwill calculations, this value must be included to reflect the total equity interest of the acquisition accurately.

Since NCI represents a portion of the business not completely owned by the acquirer, it is added to the calculation. It ensures that all equity interests are reflected in the formula to calculate goodwill. Accurate calculation of NCI can be challenging, as it requires assessing both tangible and intangible assets associated with minority shareholders.

Challenges in Goodwill Calculation

The challenges you face while calculating goodwill highlight why businesses often seek professional appraisals when determining goodwill.

Here are the challenges in goodwill calculation:

Estimating Future Cash Flow Objectively

Estimating future cash flows can be challenging, and assumptions don’t always match reality. Since goodwill values rely on these forecasts, mistakes in estimating can lead to inaccurate valuations. It’s important to base these projections on solid assumptions and real market data.

Grow Your Practice with Confidence

Determining the Discount Rate

The discount rate influences the current value of future cash flows, which affects the final goodwill amount. Picking this rate means looking at the company’s risk level, industry risks, and market conditions. These are the factors that can change over time and differ across industries.

Choosing the right discount rate can be tricky, making it a big challenge in calculating goodwill.

Estimating the Lifespan of the Goodwill

Goodwill doesn’t have a fixed lifespan, which makes it difficult to determine how long it will last. Factors like a company’s position in the market, industry trends, and possible changes in regulations can affect how long goodwill stays valuable.

Estimating this lifespan is important for accurate valuation, as assumptions about how long it lasts impact goodwill depreciation.

Why Goodwill Matters in Business Valuation?

The reason behind the importance of goodwill in business valuation is its intangible value going beyond a company’s physical assets and financial statements. When a company has strong brand recognition, a loyal customer base, or exclusive intellectual property, it gains a competitive edge.

Goodwill also represents a company’s market position, reflecting the trust it has built with customers, investors, and stakeholders over time. Tangible assets alone aren’t enough to position a business as an industry leader, especially in today’s digital-first world, where reputation and customer engagement are everything.

Ultimately, understanding the importance of goodwill helps buyers, investors, and business owners make informed decisions. A company with high goodwill can enjoy increased market confidence, attracting both customers and investors.

Goodwill doesn’t just show past success; it’s also a powerful predictor of future growth, making it a major factor in acquisitions and strategic growth.

Conclusion

Goodwill is that extra intangible value that makes a business unique and appealing. It’s mandatory to understand how to calculate goodwill and recognize its significance in business valuation, as it affects everything from acquisition price to financial health.

For best results, rely on accurate data and, if needed, seek expert guidance in calculating goodwill. It’s also important to stay updated on market trends and industry conditions, as these factors can significantly influence goodwill.

Being careful during this process helps you make informed decisions and avoid potential financial mistakes during acquisitions. Always approach goodwill valuation with careful consideration and precision.