Bookkeeping Debit and Credit Rules

May 14, 2025

Step-by-Step Guide to Setting Up a Bookkeeping System

May 16, 2025Bookkeeping Year-End Checklist

The end of the year can be a hectic period for bookkeepers Ah, the end of the year—a time for reflection, resolutions, and reconciling financial records.

While it might not be as festive as holiday parties, year-end bookkeeping is essential for wrapping up your business year precisely and confidently. Whether you’re a seasoned business owner or just starting, getting your financial house in order ensures a solid foundation for growth and tax compliance in the upcoming year.

With this comprehensive year-end checklist, you’ll streamline the process, avoid common pitfalls, and head into the new year stress-free. A well-structured process not only streamlines operations but also enhances accuracy and efficiency.

Table of Contents

What is a Bookkeeping Checklist?

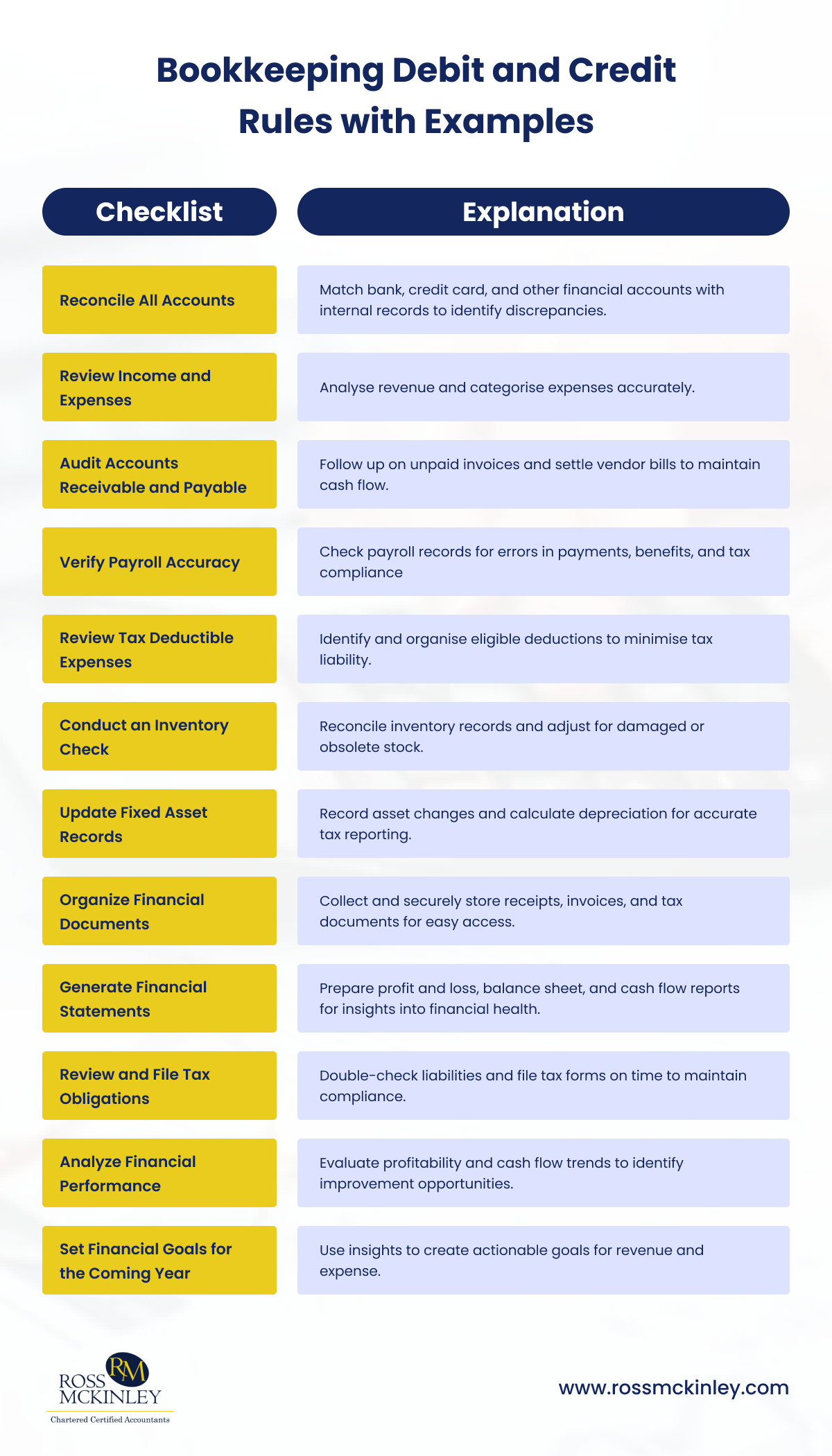

At its core, bookkeeping is the process of systematically recording, organising, and managing financial transactions. A good bookkeeping checklist covers essential tasks like reconciling accounts, reviewing income and expenses, entering sales, reconciling bank statements, verifying payroll accuracy, and preparing financial statements.

But an effective bookkeeping checklist goes beyond just recording numbers; it’s about ensuring everything is accurate, organised, and ready for future use. Now that we’ve got a clear understanding of what a bookkeeping checklist involves, here’s a checklist with 12 critical steps for effective year-end bookkeeping.

Annual Bookkeeping Checklist

Closing out your books for the year doesn’t have to feel like a dreaded chore. With a proper checklist in hand, you can transform this task into an opportunity to ensure your financial records are spotless and your business is ready for a fresh start.

1. Reconcile All Accounts

Match your bank accounts, credit card statements, and other financial accounts against your internal records. Identify discrepancies, such as missed transactions or recording errors, and resolve them promptly.

Now you might be wondering, why does it matter? Accurate reconciliation ensures your financial data aligns perfectly, which is critical for tax preparation and audit readiness.

2. Review Income and Expenses

Analyse your revenue streams and categorise expenses accurately. Ensure that all sources of income and every dollar spent are accounted for, using proper bookkeeping software or manual records.

Doing this makes sure that you get a detailed review that highlights trends in profitability and ensures that deductions are maximized while keeping your records audit-proof.

3. Audit Accounts Receivable and Payable

First, Follow up on outstanding invoices to ensure payment. Write off uncollectible debts if necessary. Secondly, Confirm that all vendor payments are recorded and settle any pending bills to start the new year debt-free.

It’s necessary because efficient management of receivables improves cash flow, while prompt payables strengthen vendor relationships and avoid unnecessary late fees.

4. Verify Payroll Accuracy

Review payroll records for any discrepancies in employee payments, benefits, and tax withholdings. Correct errors and ensure compliance with year-end reporting requirements.

Payroll errors can lead to penalties and employee dissatisfaction, so double-checking your records is non-negotiable.

5. Review Tax Deductible Expenses

Scan through your records for deductible business expenses, such as rent, travel, utilities, and professional services. Ensure receipts and supporting documents are organized. Claiming all eligible deductions, reduces your tax liability, saving your business significant money.

6. Conduct an Inventory Check

Give your business the time it needs. Physically count inventory and reconcile it with your records. Account for damaged, expired, or obsolete items and adjust your books accordingly. Inventory accuracy ensures correct financial reporting and helps avoid unnecessary tax implications or overstock issues.

7. Update Fixed Asset Records

Review your list of fixed assets, noting any additions, disposals, or depreciation. Ensure depreciation is calculated and recorded accurately for tax purposes. Keeping your fixed asset records current ensures proper tax reporting and reflects the true value of your business.

8. Organize Financial Documents

Compile all receipts, invoices, bank statements, and tax-related documents. Consider using digital tools or cloud storage for secure, Well, easy-to-access records.

9. Generate Financial Statements

Create key financial reports including a profit and Loss Statement to review income and expenses, a balance Sheet to check assets and liabilities, and a Cash Flow Statement to evaluate liquidity. These reports provide critical insights into your business’s financial health, aiding in strategic planning.

10. Review and File Tax Obligations

Double-check your tax liabilities, including VAT, payroll taxes, or sales taxes. Prepare and file any outstanding forms before deadlines. Make sure to avoid penalties and ensure compliance by staying proactive about tax filing and payments.

11. Analyze Financial Performance

Examine your business’s profitability, cash flow, and expense patterns over the year. And yes, most importantly, Identify areas for cost-saving and investment opportunities.

12. Set Financial Goals for the Coming Year

Use the insights gained from your year-end review to set realistic financial goals. Focus on revenue growth, expense control, and operational efficiency.

Get this done because clear and actionable goals help your business stay on track and measure success throughout the year.

Why Choose Us?

At Ross McKinley, we take the stress out of year-end bookkeeping. Our team of seasoned professionals specialises in reconciling accounts, organising financial records, and preparing tax-ready documentation.

With us by your side, you can focus on running your business while we handle the complexities of year-end financial management.

Conclusion

Year-end bookkeeping is more than a task—it’s an opportunity to assess your business’s financial health and set the stage for a successful new year. By following this detailed checklist and partnering with trusted bookkeeping professionals, you can confidently close the books on this year and welcome the next with clarity and focus.

Get started today with Ross McKinley and make this year-end your most organised yet!