Let’s get one thing straight: bookkeeping and data entry are different. But hey, if you’ve ever mixed them up, don’t feel bad, you’re not alone. On the surface, they both involve dealing with financial information, so the confusion makes sense.

However, the roles are distinct. Think of data entry as the foundation of your financial house and bookkeeping as the builder who turns that foundation into something functional. Do you want to understand these two roles better and determine which one your business needs? Let’s break it down step by step!

Table of Contents

What Is Bookkeeping and Data Entry?

So, First things first. What is Bookkeeping? Bookkeeping is the systematic recording and organization of financial transactions within a business. Bookkeepers are responsible for maintaining accurate records of daily transactions, including sales, purchases, receipts, and payments.

Data entry involves taking raw information including invoices, receipts, or sales figures, and entering it into a database or software system.

Bookkeepers are responsible for various financial tasks, including recording transactions, reconciling bank statements, managing accounts payable and receivable, handling payroll, and preparing preliminary financial statements.

On the other hand, Data entry clerks focus on accuracy, speed, and organization. Their role is about handling what the numbers are and ensuring they’re captured correctly.

Grow Your Practice with Confidence

Bookkeeping vs. Data Entry

While bookkeeping and data entry might seem similar at first glance, they serve very different purposes in the financial management process. Both are essential, but their scope, responsibilities, and impact on a business’s financial health vary significantly. Understanding these differences is key to knowing which role your business needs to thrive.

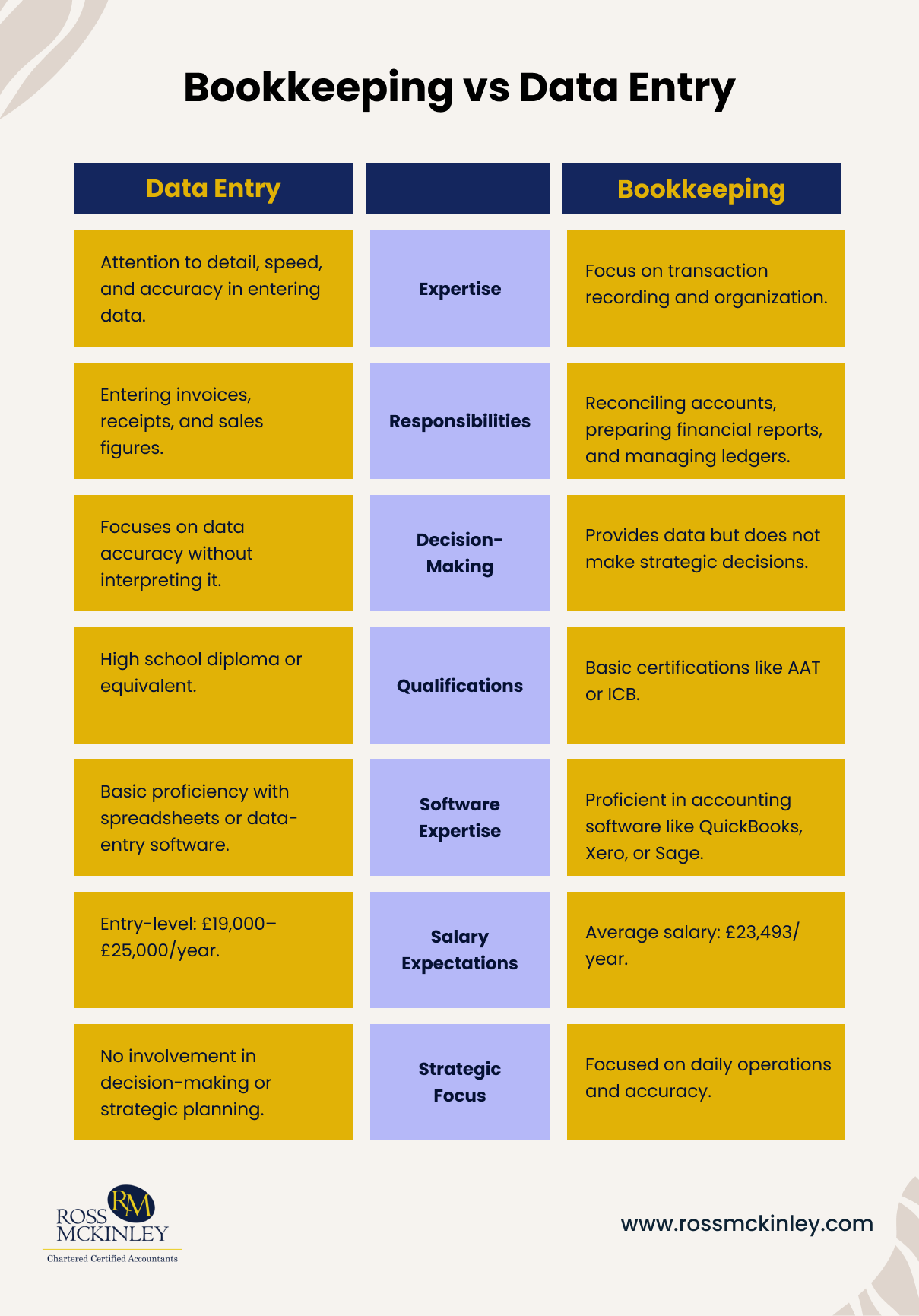

Expertise

A data entry clerk needs strong attention to detail, quick typing skills, and proficiency with data entry software or spreadsheets. Their job requires speed and precision but doesn’t demand expertise in financial principles.

Conversely, bookkeepers need a much broader skill set. In addition to accuracy, they require knowledge of accounting principles, problem-solving abilities, and analytical thinking to organize and interpret data effectively.

Responsibilities

The responsibilities of data entry clerks revolve around inputting information and ensuring invoices, receipts, and transactions are accurately entered into systems. They don’t interpret or analyze the data but focus purely on recording it efficiently.

Bookkeepers, in contrast, take on more complex tasks such as reconciling bank accounts, managing ledgers, and preparing financial reports like profit and loss statements. They also categorize transactions and ensure records comply with regulations.

Decision Making

Data entry clerks focus on ensuring data is recorded correctly without making judgment calls. Their role doesn’t involve interpreting the data or influencing business decisions.

Bookkeepers, however, are required to make informed decisions daily. They determine how transactions are categorized, whether accounts balance correctly, and how to prepare reports. Their judgment impacts how a company views its financial health and compliance.

Qualifications

Data entry clerks generally don’t require formal qualifications beyond a high school diploma or equivalent. Employers may prioritize experience with data-entry software or spreadsheets over certifications.

Bookkeepers on the other hand often begin their careers with basic qualifications or on-the-job training. Certifications from bodies like the Association of Accounting Technicians (AAT) or the Institute of Certified Bookkeepers (ICB) validate their expertise in handling transactional data. However, their role does not typically require deep knowledge of tax laws, auditing, or corporate finance.

Software Expertise

For data entry clerks, proficiency in basic software like Microsoft Excel or data-entry platforms is sufficient. Their job involves logging numbers and ensuring accuracy within straightforward systems.

Bookkeepers, however, rely heavily on advanced accounting software such as QuickBooks, Sage, or Xero. They use these tools for categorizing transactions, reconciling accounts, and generating detailed financial reports.

Grow Your Practice with Confidence

Salary Expectations

Data entry clerks typically earn an entry-level salary, averaging between £19,000 and £25,000 annually in the UK. Their work is foundational but doesn’t require extensive training or financial expertise, which is reflected in their earnings.

Bookkeepers, with their broader skill set and specialized knowledge, earn higher salaries, averaging around £23,493 annually. This pay reflects their ability to handle more complex financial tasks like account reconciliation and financial reporting.

Strategic Focus

Data entry focuses on completing operational tasks and inputting numbers accurately into systems to maintain up-to-date records. It’s about completing the groundwork for financial tracking.

Bookkeeping, however, is more strategic. Bookkeepers analyze data, create meaningful reports, and provide insights that influence financial decision-making. While data entry is limited to capturing what happens daily, bookkeeping ensures this information is organized for tax filings, compliance, and long-term business planning.

Why Choose One Over the Other?

The choice between hiring a bookkeeper and a data entry clerk often depends on a business’s size, complexity, and financial goals.

For Small Businesses, If you just need someone to handle routine data input, a data entry clerk might be enough.

But, For Growing Businesses: If you need financial reports, account reconciliation, or help preparing for taxes, a bookkeeper is a must. Hiring the right person ensures your financial processes run smoothly and avoids costly mistakes.

Conclusion

Data entry and bookkeeping are essential roles, but they serve different purposes. Data entry clerks handle the “what” of financial data and ensure everything gets entered accurately. Bookkeepers take this data and add structure and meaning to it, helping businesses understand their financial story.

So, who do you need? It depends on your business’s size, complexity, and financial goals. Need someone to handle both? That’s where outsourcing to experts comes to the rescue! At Ross McKinley, we’re here to handle the nitty-gritty of your finances, from data entry to full-scale bookkeeping. Let us simplify your financial processes so you can focus on what matters, growing your business!