Navigating a business’s financial landscape can be like steering a ship through turbulent waters. Bookkeepers and Certified Public Accountants (CPAs) are among the crew who ensure a smooth voyage.

While both play pivotal roles in maintaining financial health, their responsibilities, expertise, and contributions differ significantly. Understanding these distinctions is crucial for UK businesses aiming to optimize their financial management strategies.

What is Bookkeeping and Certified Public Accountant (CPA)?

So, First things first. What is Bookkeeping? Bookkeeping is the systematic recording and organization of financial transactions within a business. Bookkeepers are responsible for maintaining accurate records of daily transactions, including sales, purchases, receipts, and payments.

A Certified Public Accountant (CPA) is a highly qualified financial professional who has passed rigorous examinations and met specific licensing requirements, demonstrating expertise in accounting, auditing, tax, and financial management.

Bookkeepers are responsible for various financial tasks, including recording transactions, reconciling bank statements, managing accounts payable and receivable, handling payroll, and preparing preliminary financial statements.

On the other hand, CPAs are trusted advisors who assist individuals and businesses with complex financial planning, compliance, and decision-making.

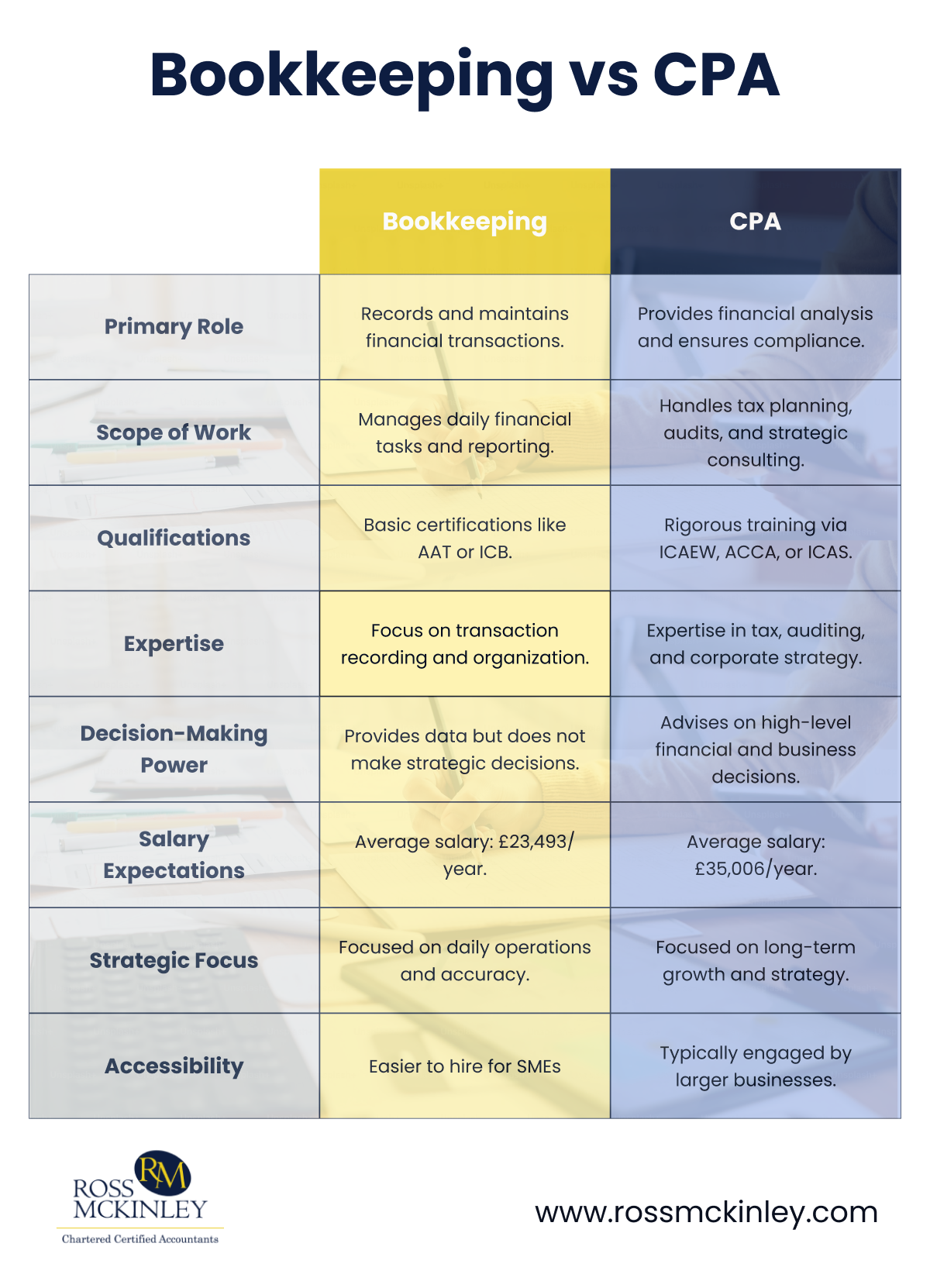

| Bookkeeping | CPA | |

| Primary Role | Records and maintains financial transactions. | Provides financial analysis and ensures compliance. |

| Scope of Work | Manages daily financial tasks and reporting. | Handles tax planning, audits, and strategic consulting. |

| Qualifications | Basic certifications like AAT or ICB. | Rigorous training via ICAEW, ACCA, or ICAS. |

| Expertise | Focus on transaction recording and organization. | Expertise in tax, auditing, and corporate strategy. |

| Decision-Making Power | Provides data but does not make strategic decisions. | Advises on high-level financial and business decisions. |

| Salary Expectations | Average salary: £23,493/year. | Average salary: £35,006/year. |

| Strategic Focus | Focused on daily operations and accuracy. | Focused on long-term growth and strategy. |

| Accessibility | Easier to hire for SMEs. | Typically engaged by larger businesses. |

Bookkeeping vs. Certified Public Accountant

While bookkeepers and Certified Public Accountants(CPAs) are integral to the financial ecosystem of businesses in the UK, understanding their specific roles and contributions is essential for effective financial management. Here’s a comprehensive look at how both of them differ:

Grow Your Practice with Confidence

Expertise

The primary objective of bookkeeping is to ensure that financial information is up-to-date and comprehensive, providing a solid foundation for further financial analysis

Their role and expertise of CPA goes beyond basic bookkeeping; they offer strategic insights, ensure adherence to financial regulations, and provide services such as tax preparation, auditing, and business consulting. In the UK, the equivalent of a CPA is often a Chartered Certified Accountant, reflecting a similarly esteemed qualification in the field.

Scope of Work

The bookkeeper’s role is foundational, ensuring that daily financial transactions such as sales, purchases, payments, and receipts are accurately recorded. They reconcile bank statements, manage ledgers, and prepare trial balances. Bookkeepers also handle payroll processing and basic tax reporting, making their work essential for maintaining organized and error-free financial data.

Whereas CPAs build on the work of bookkeepers by interpreting and analyzing recorded data. They prepare comprehensive financial statements, identify trends, and provide actionable insights for business strategy. Chartered Certified Accountants are involved in budgeting, forecasting, and making high-level decisions about investments, risk management, and overall financial health.

Expertise and Qualifications

Bookkeepers often begin their careers with basic qualifications or on-the-job training. Certifications from bodies like the Association of Accounting Technicians (AAT) or the Institute of Certified Bookkeepers (ICB) validate their expertise in handling transactional data. However, their role does not typically require deep knowledge of tax laws, auditing, or corporate finance.

The expertise of Certified Public Accountants is underpinned by years of rigorous training and examinations from recognized UK institutions such as ICAEW, ACCA, or ICAS. This equips them with a broad skill set encompassing tax law, corporate governance, auditing, and strategic planning.

Salary Expectations

According to Indeed data, the national average salary of a bookkeeper in the UK is £23,493 per year, while accountants earn an average of £35,006 per year.

Grow Your Practice with Confidence

Decision-Making Power

While Bookkeepers ensure accurate records and provide the data needed for analysis, they rarely participate in strategic decisions. Their work is more task-oriented and focuses on the “what” rather than the “why” behind financial trends.

However, CPAs play a pivotal role in decision-making by interpreting financial data and advising business leaders on strategic matters. Whether optimizing tax strategies, planning for expansions, or mitigating financial risks, CAs contribute significantly to long-term business growth.

Regulatory Compliance and Risk Management

Bookkeepers play a vital role in helping businesses meet basic compliance requirements, such as submitting VAT returns. They ensure records are audit-ready but lack the expertise to manage complex compliance issues.

In comparison, Accountants with their deep understanding of tax laws and regulations, CPAs are invaluable in navigating complex compliance landscapes. They manage statutory audits, prepare detailed tax filings, and ensure businesses stay within legal frameworks.

They also help identify and mitigate risks that could lead to financial penalties or reputational damage.

Cost and Accessibility

Hiring a bookkeeper is generally more cost-effective, making them an ideal choice for small businesses with straightforward financial needs. They provide the essential groundwork for accurate financial management without a significant financial outlay.

Accountants’ services are more expensive due to their advanced qualifications and specialized knowledge. However, for businesses with complex financial requirements, including large corporations or those planning significant growth, the cost is justified by the value they bring.

Strategic Focus

Bookkeepers operate operationally, focusing on the business’s day-to-day financial health. They ensure everything is ready for accountants or auditors to take over when needed.

On the other hand, Chartered Certified Accountants’ focus is strategic and long-term. They identify growth opportunities, optimize tax efficiency, and advise on mergers, acquisitions, or divestitures. Their ability to see the bigger picture makes them indispensable to businesses aiming for expansion or diversification.

Why Choose One Over the Other?

The choice between hiring a bookkeeper and a Certified Public Accountant often depends on a business’s size, complexity, and financial goals.

- A small business with straightforward financial needs may find a bookkeeper sufficient to manage daily transactions and prepare initial accounts.

- A larger business or one facing complex challenges such as tax optimization or regulatory compliance.

Understanding bookkeepers’ and CPA roles can help businesses make informed decisions about which professionals to engage. This will ensure optimal financial management at every growth stage.

Conclusion

In the UK, bookkeepers and Certified Public Accountants (CPAs) are essential to businesses’ financial well-being. Bookkeepers meticulously record financial transactions, while CPAs build upon this foundation to provide strategic insights and ensure compliance with complex financial regulations.

Understanding the distinct roles and qualifications of each can help businesses effectively allocate resources and seek the appropriate expertise to navigate the financial complexities of today’s business environment.

The easy way out is to outsource your financials to our credible accounting firm Ross Mckinley to help manage your finances and offer the right expertise as needed. So, ditch the hassle and enjoy peace of mind as we handle and streamline your finances.