Many business owners often need clarification when deciding whether they need a bookkeeper or an accountant. Both roles deal with financial tasks, but they serve different functions. The confusion arises because both are essential for managing finances, but the responsibilities of each are distinct.

This blog is designed to help you understand the differences between bookkeeping and accounting and make the right decision for your business. Ultimately, you’ll know exactly when to hire a bookkeeper and when to bring an accountant on board.

Table of Contents

What Is Bookkeeping?

Bookkeeping includes recording financial transactions daily. Every time a sale is made, a purchase occurs, or a payment is received, the bookkeeper records the details. Bookkeeping ensures that no financial transaction goes unnoticed and everything is accurately documented.

A bookkeeper maintains financial records by categorising transactions, such as sales, expenses, and receipts, ensuring each entry is clear and well-organized. Typically, bookkeepers use simple tools like ledgers, spreadsheets, or accounting software to stay on top of everything.

Grow Your Practice with Confidence

What Is Accounting?

As a bookkeeper, you track transactions daily but understand and analyse that data as an accountant. Accountants take the information recorded by bookkeepers and transform it into reports that provide insights into the business’s financial health. The reports accountants create include cash flow statements, balance sheets, and income statements.

An accountant uses complex tools, software, and frameworks to turn raw financial data into valuable insights. They prepare reports that help business owners make strategic decisions, like budgeting, forecasting, and tax planning. In short, accountants offer an overall financial picture that can guide business decisions for growth and stability.

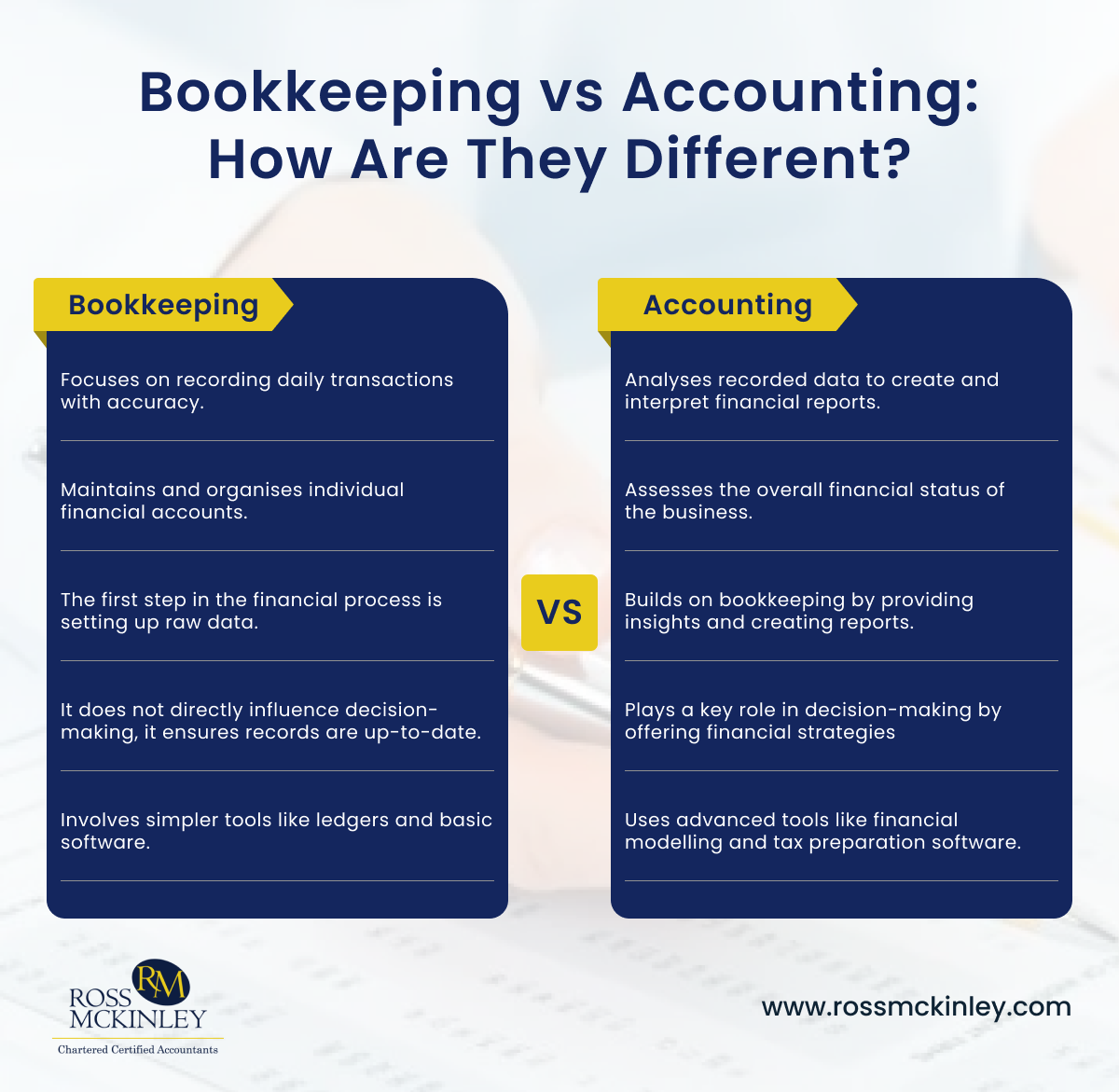

Differences Between Bookkeeping vs Accounting

Understanding the differences between bookkeeping and accounting can help you onboard the right person. While both belong to the same sector, they do different jobs.

Here are some of the significant differences between bookkeeping vs accounting:

| Bookkeeping | Accounting |

| Focuses on recording daily transactions with accuracy. | Analyses recorded data to create and interpret financial reports. |

| Maintains and organises individual financial accounts. | Assesses the overall financial status of the business. |

| The first step in the financial process is setting up raw data. | Builds on bookkeeping by providing insights and creating reports. |

| It does not directly influence decision-making; it ensures records are up-to-date. | Plays a key role in decision-making by offering financial strategies. |

| Involves simpler tools like ledgers and basic software. | Uses advanced tools like financial modelling and tax preparation software. |

Scope of Work

A bookkeeper’s job focuses mainly on recording transactions, ensuring accuracy in every detail. They handle day-to-day tasks such as processing receipts, tracking expenses, and managing accounts receivable and payable.

In contrast, an accountant’s scope of work is broader. Accountants take the organised data from the bookkeeper and analyse it. They create and interpret financial statements to evaluate the business’s financial health. Accountants also provide strategic financial advice, helping you understand how to use your resources best and grow your business.

Relation to Financial Accounts

Bookkeepers are responsible for maintaining and organising financial accounts. They ensure that every account, such as cash, accounts receivable, and expenses, is appropriately tracked. Bookkeepers record individual transactions and ensure that everything adds up correctly.

Accountants, however, look at these financial accounts as a whole. They analyse the information from all accounts to assess the company’s overall financial status. For example, an accountant might analyse cash flow, determine the business’s profit margin, or generate tax filings. They work with a combination of financial data to provide insight into the broader picture of the company’s health.

Grow Your Practice with Confidence

Part of the Process

Bookkeeping is the first step in the financial process, setting up the raw data that accountants will later use. Without bookkeeping, accountants cannot perform their job effectively.

Think of it like making a cake. The bookkeeper is responsible for gathering the ingredients (transactions), and the accountant is the baker who turns those ingredients into a finished product (financial reports).

Accounting builds on the foundation laid by bookkeeping. It takes organised data and interprets it to create reports that reveal the company’s financial position. Without both roles, a business’s finances would be disorganised and unreliable.

Decision-Making Role

A bookkeeper does not directly influence the business’s decision-making. Instead, they ensure that records are accurate and up-to-date. They keep things running smoothly daily, ensuring that financial data is properly documented. However, while they may provide the data, they don’t typically offer insights on using it.

On the other hand, an accountant plays a key role in business decisions. Accountants create financial forecasts, budgets, and reports that can help business owners make informed choices. They assess the financial data, identify patterns, and offer strategic advice.

For example, an accountant might advise on cost-cutting measures, tax planning, or future investments. The accountant’s insights guide the overall direction of the business.

Tools and Complexity

Bookkeeping typically involves simpler tools and methods, such as ledgers, spreadsheets, and accounting software. These tools help bookkeepers organise financial data and record every transaction correctly. The job requires attention to detail and consistency, but the tools are straightforward.

In contrast, accountants use advanced software and tools to analyse financial data. They rely on complex accounting systems, such as tax preparation software and financial modelling tools.

Accountants also need to stay current with financial regulations and compliance standards, which adds an extra layer of complexity to their work. Their role requires a higher level of expertise and knowledge than bookkeeping.

How Can Ross McKinley Help You With Bookkeeping and Accounting?

At Ross Mckinley, we understand how confusing it can be to decide whether you need a bookkeeper or an accountant. That’s why we offer comprehensive services that cover both areas. Our experienced bookkeepers record your financial transactions accurately, creating a solid foundation for your financial operations.

Once your financial data is organized, our skilled accountants take over to provide you with insightful reports and strategic advice. We help you understand your finances and provide recommendations for growth. Whether you need help with daily bookkeeping or complex financial analysis, Ross Mckinley is here to help your business succeed.

Conclusion

Bookkeeping vs. accounting has one key difference: bookkeeping is about recording financial transactions, while accounting interprets data to provide strategic insights. Bookkeepers ensure everything is accurate and organized, while accountants take that organized data and help guide your business forward.

If you need a bookkeeper or an accountant, an accountancy firm can help you. They ensure that your financial records are accurate and provide valuable insights for long-term growth. Pick an accountancy firm according to your business size and requirements and witness the change.