Managing a hospital or operating a restaurant both provide difficulties, particularly with regard to bookkeeping. It can be challenging for restaurants to remain profitable due to daily cash flow issues and shifting food costs. On the other hand, medical bills, insurance claims, and departmental spending are complicated issues that hospitals deal with, and they can easily become too much to handle.

For these industries, standard bookkeeping techniques are insufficient. The secret to streamlining these procedures and guaranteeing precise financial management is specialized bookkeeping. Therefore, we’ll look at useful, sector-specific advice in this blog to help you manage your money and stay clear of typical errors.

Table of Contents

Why Specialized Bookkeeping Matters for Restaurants

Running a restaurant involves managing a lot of moving parts, and it’s all about keeping track of inventory, labour costs, and cash flow. With food prices constantly changing, a restaurant can’t afford to let money slip through the cracks due to overordering or wasted stock. Also, staff wages, tips, and overtime make calculating payroll more complicated.

For restaurants, staying on top of daily cash flow and inventory turnover is essential. For example, tracking food costs efficiently means knowing exactly what ingredients are being used up and when to reorder.

Payroll management is also crucial, as tip-based pay requires special attention for tax reporting. And then there’s managing day-to-day transactions—having a real-time view of cash flow helps you avoid financial surprises.

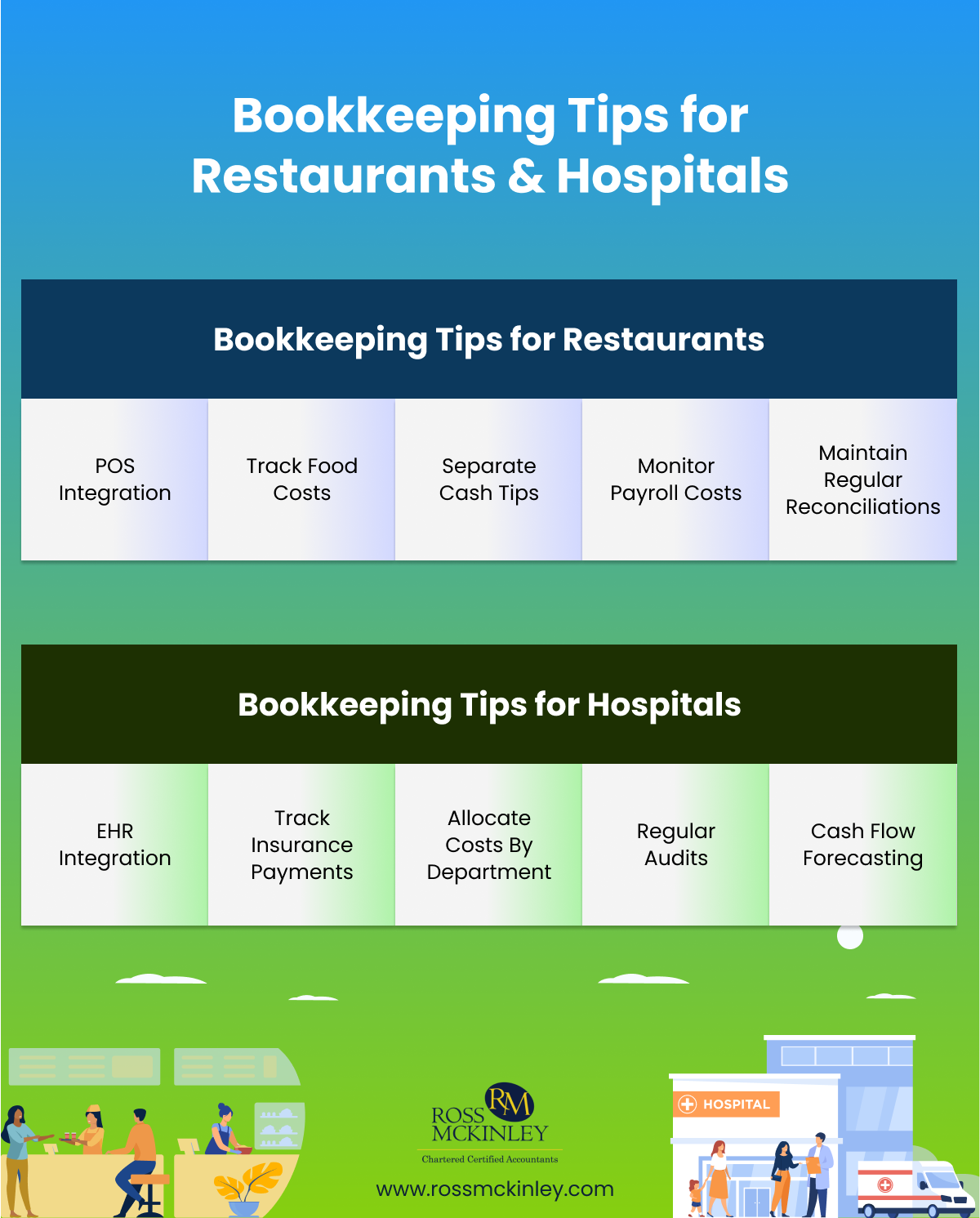

| Specialized Bookkeeping Tips for Restaurants | ||||

| POS Integration | Track Food Costs | Separate Cash Tips | Monitor Payroll Costs | Maintain Regular Reconciliations |

| Specialized Bookkeeping Tips for Hospitals | ||||

| EHR Integration | Track Insurance Payments | Allocate Costs By Department | Regular Audits | Cash Flow Forecasting |

Specialized Bookkeeping Tips for Restaurants

When it comes to your finances, however, small changes can lead to big improvements. Here are some tips that will help you stay on top of your restaurant’s financials:

1. Use Point-of-Sale (POS) Integration:

A POS system that integrates with your accounting software can transform your business. It lets you track sales, inventory, and even customer preferences in real-time. This means you don’t have to manually input data, reducing the chance of errors and saving you tons of time. It keeps everything in sync, so you can focus on running your business.

Grow Your Practice with Confidence

2. Track Food Costs & Waste:

Knowing exactly how much you’re spending on food and ingredients is another important thing to consider. Calculate your food costs regularly and keep an eye on waste. Reducing waste and controlling food costs will help improve your profit margins and prevent unnecessary spending.

3. Separate Cash Tips:

Cash tips can get tricky, especially when it comes to taxes. It’s crucial to separate them and track them separately. Make sure your staff reports their tips accurately and that you keep a record for tax purposes. This way, you’ll stay compliant and avoid any unexpected tax headaches.

4. Monitor Payroll Costs:

Labour costs are one of your biggest expenses, so tracking them closely is key. Using payroll software to monitor hours worked, overtime, and any tip-related adjustments can prevent overpaying or running into budget issues. You can even automate some of these calculations to save time and avoid mistakes.

5. Maintain Regular Reconciliations:

Keep everything on track by balancing your revenues and costs regularly, whether daily or weekly. This guarantees that your cash flow remains healthy and that any inconsistencies are identified early. It’s a simple habit that will prevent bigger problems down the line.

Why Specialized Bookkeeping Matters for Hospitals

Hospitals deal with a whole different set of financial challenges. Medical billing is complicated, insurance claims are often delayed, and costs for equipment, staff, and treatment fluctuate.

With specialized bookkeeping, hospitals can streamline billing processes, track reimbursements, and avoid costly errors. It also helps with managing patient payments and insurance claims, ensuring everything is recorded correctly. Specialized systems also track operational costs like medical supplies and equipment, so you never overspend in these areas.

Grow Your Practice with Confidence

Specialized Bookkeeping Tips for Hospitals

Managing your hospital’s finances is crucial for smooth operations, and a few adjustments can make a world of difference. Here are some practical tips to help you streamline your hospital’s bookkeeping:

1. EHR Integration:

Simplifying patient billing and claims can be achieved by integrating your accounting software with your Electronic Health Records (EHR) system. You may decrease errors, expedite the billing process, and more effectively monitor unpaid invoices by directly connecting medical information with financial data. This integration makes it easier to stay on top of patient payments and charges at all times.

2. Track Insurance Payments:

In the healthcare industry, denials or delayed payments are frequent, and insurance claims can be complex. Make sure every claim is handled accurately and keep a careful check on insurance payouts. To prevent payment delays, follow up right away if a claim is rejected. Cash flow can be greatly enhanced by being proactive with insurance billing.

3. Allocate Costs by Department:

As we know, hospitals have numerous departments; it’s critical to appropriately assign costs to each one. You may find opportunities for cost reduction and have a better understanding of where your money is going by segmenting your finances by department, such as emergency care, surgery, and outpatient services. This level of detail allows you to make smarter, more informed financial decisions.

4. Regular Audits:

Regular internal audits are necessary to preserve openness and guarantee regulatory compliance. Hospitals are subject to several restrictions, so keeping an eye on your finances will help you stay out of trouble and remain out of trouble with the law. You may rest easy knowing that your records are in order when you have regular audits.

5. Cash Flow Forecasting:

Cash flow management can be challenging, particularly when insurance payments are delayed. By anticipating cash flow and making plans for any delays, you can make sure your hospital operates without any financial disruptions.

Conclusion

Running a busy hospital or restaurant can both benefit greatly from the correct bookkeeping strategy. You can use these suggestions as a guide to manage your money better, feel less stressed, and perform at your peak.

With a little perseverance and focus, you’ll quickly realize how crucial good bookkeeping is to the long-term viability of your company. However, for expert bookkeeping services in London, you can feel free to reach out to us at Ross Mckinely.