Freelancing and running your own solo business is the dream, isn’t it? You get to be your boss, work on projects you’re passionate about, and set your schedule. But let’s face it: being your boss also means taking on responsibilities you might not have signed up for-like bookkeeping.

This article will explore practical and straightforward bookkeeping tips that will save you time, keep you compliant, and help you make smarter financial decisions. Whether you’re new to freelancing or an experienced solopreneur, these tips will give you the tools to stay on top of your finances like a pro.

Table of Contents

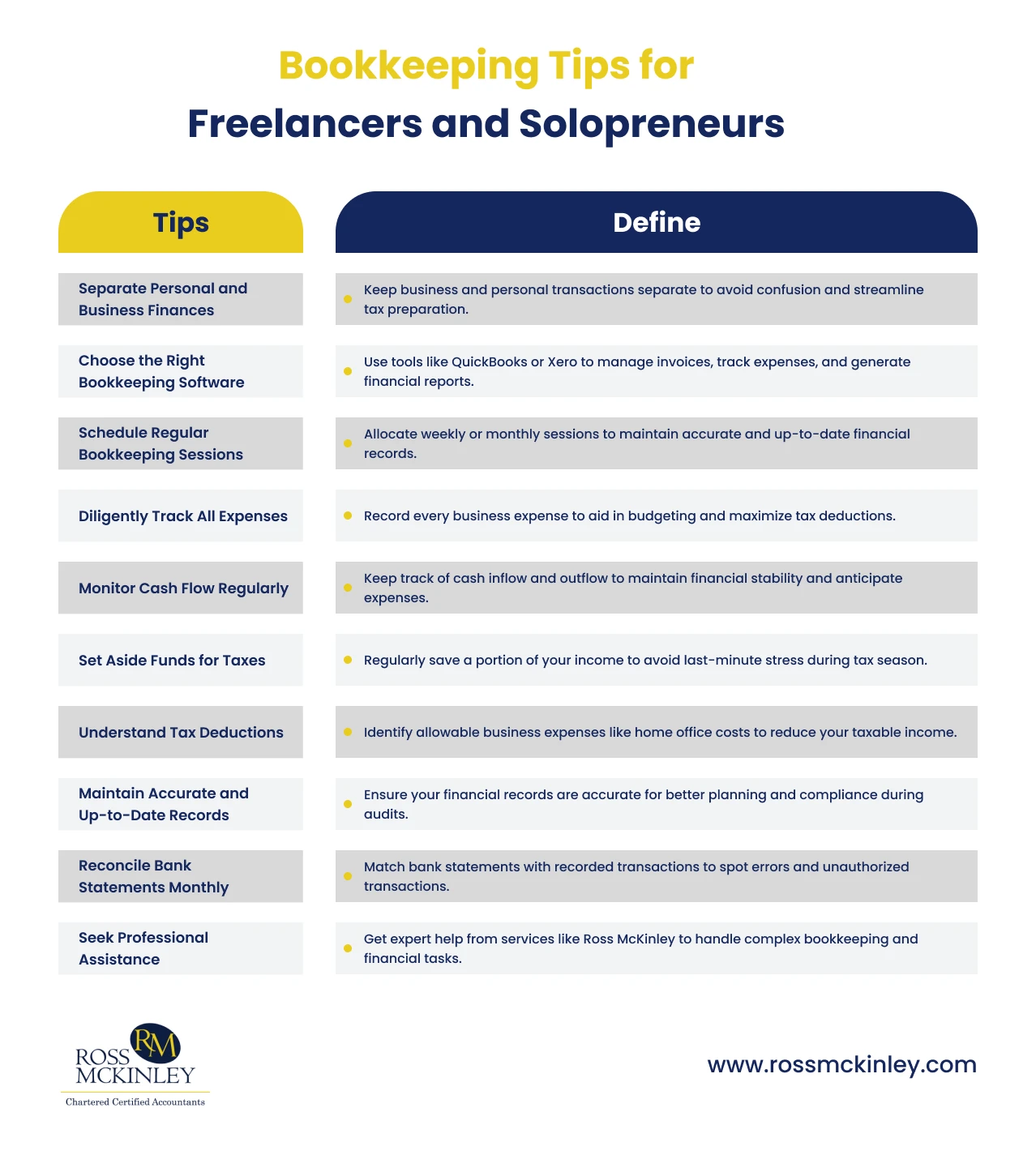

Bookkeeping Tips for Freelancers and Solopreneurs

So, First things first. What is Bookkeeping? Bookkeeping is the systematic recording and organisation of financial transactions within a business.

Bookkeepers are responsible for various financial tasks, including recording transactions, reconciling bank statements, managing accounts payable and receivable, handling payroll, and preparing preliminary financial statements.

Bookkeeping for freelancers and solopreneurs isn’t just about balancing the books or checking off a tax-season to-do list. It’s about understanding your business’s financial health, planning for the future, and avoiding the dreaded “Uh-oh, where did all my money go?” moment.

So grab a coffee, and let’s dive into the art of keeping your business books in tip-top shape!

Grow Your Practice with Confidence

1. Separate Personal and Business Finances

One of the cardinal rules for any freelancer or solopreneur is to keep personal and business finances distinct. Merging these accounts can lead to confusion, inaccurate financial records, and complications during tax season.

By maintaining separate bank accounts and credit cards for business transactions, you streamline expense tracking and simplify tax preparation.

2. Choose the Right Bookkeeping Software

Thanks to our 21st-century technology advancements, leveraging technology can significantly enhance your bookkeeping efficiency. Platforms like QuickBooks, Xero, and FreshBooks are designed to cater to the unique needs of freelancers and small business owners.

These tools assist in managing invoices, tracking expenses, and generating financial reports, allowing you to focus more on your core business activities.

3. Schedule Regular Bookkeeping Sessions

Consistency is key in bookkeeping. Allocating specific times weekly or monthly to update your financial records ensures accuracy and it significantly prevents the backlog of unrecorded transactions.

Regular Bookkeeping sessions help in identifying discrepancies and making informed financial decisions.

4. Diligently Track All Expenses

Well, Every expense, no matter how minor, should be recorded. Detailed expense tracking not only aids in budgeting but also maximizes potential tax deductions.

Utilizing mobile apps to scan and store receipts digitally can simplify this process, ensuring you have a comprehensive record come tax time.

5. Monitor Cash Flow Regularly

Understanding the inflow and outflow of cash is vital for financial stability. Regularly monitoring your cash flow helps in anticipating shortfalls, planning for upcoming expenses, and making strategic decisions about investments or scaling your business.

Monitoring cash flow not only ensures financial stability but also helps you in making informed financial decisions, so you might consider monitoring your cash flow a win-win situation.

6. Set Aside Funds for Taxes

We all know tax obligations can be daunting, especially without an employer handling withholdings. It’s prudent to set aside a portion of your income regularly to meet tax liabilities. This mindful approach prevents the stress of scrambling for funds during tax season and ensures compliance with tax regulations.

7. Understand Tax Deductions Applicable to You

Being informed about allowable tax deductions can significantly reduce your taxable income. Expenses related to your business operations, such as home office costs, travel, and professional services, may be deductible.

Keeping meticulous records of these expenses is essential for substantiating claims during tax filings.

8. Maintain Accurate and Up-to-Date Records

Accuracy in bookkeeping cannot be overstated. Maintaining up-to-date records of all financial transactions ensures that your financial statements reflect the true state of your business.

This practice not only aids in strategic planning but also positions you favorably during audits or when seeking financing.

9. Reconcile Bank Statements Monthly

Another pro tip for freelancers and solopreneurs is Monthly reconciliation. Regular reconciliation of your bank statements with your recorded transactions helps in identifying errors, unauthorized transactions, or omissions. This practice ensures the integrity of your financial data and fosters trust in your financial reporting.

Grow Your Practice with Confidence

10. Seek Professional Assistance When Necessary

While managing your books on your own can be cost-effective, there are times when professional expertise becomes invaluable.

That’s where Ross McKinley comes in. With a team of experienced professionals dedicated to your financial success, Ross McKinley can handle the intricacies of bookkeeping, taxes, and financial planning, leaving you with more time to do what you do best—run your business.

Conclusion

Effective bookkeeping is the cornerstone of a successful freelance or solopreneur venture. By implementing these tips, you not only ensure compliance and accuracy but also empower yourself to make strategic decisions that drive growth.

Remember, the time invested in meticulous bookkeeping today paves the way for a prosperous and sustainable business tomorrow.