Let’s be honest, bookkeeping isn’t exactly the rock star of the business world. It’s not flashy like marketing campaigns or thrilling like closing big sales deals. But if your finances are the heartbeat of your business, then bookkeeping is the steady rhythm keeping everything in sync.

Without it, you’d probably be buried under a pile of receipts, invoices, and missing financial information.

Have you ever wondered why your accountant breathes easier when they see clean, well-organized books? That’s because a good bookkeeper is the unsung hero ensuring your financial records are accurate, up-to-date, and ready for action.

So, let’s dive into what bookkeeping is all about and break down the duties and responsibilities of a bookkeeper in a way that makes sense-even if you’re not a numbers person.

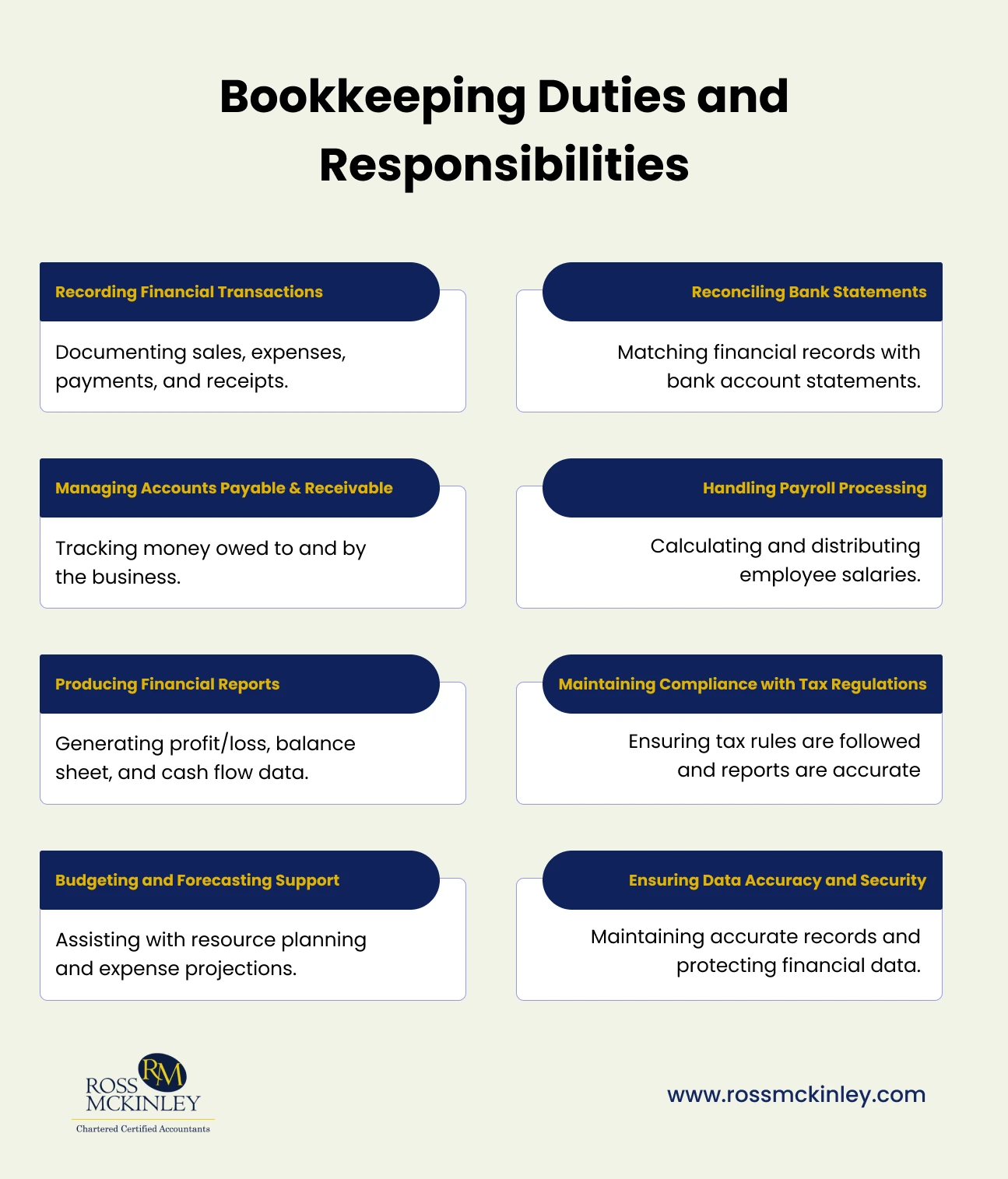

| Duties and Responsibilities | Define |

| Recording Financial Transactions | Documenting sales, expenses, payments, and receipts. |

| Reconciling Bank Statements | Matching financial records with bank account statements. |

| Managing Accounts Payable & Receivable | Tracking money owed to and by the business. |

| Handling Payroll Processing | Calculating and distributing employee salaries. |

| Producing Financial Reports | Generating profit/loss, balance sheet, and cash flow data. |

| Maintaining Compliance with Tax Regulations | Ensuring tax rules are followed and reports are accurate. |

| Budgeting and Forecasting Support | Assisting with resource planning and expense projections. |

| Ensuring Data Accuracy and Security | Maintaining accurate records and protecting financial data. |

Bookkeeping Duties and Responsibilities

Bookkeeping is the process of recording, organizing, and maintaining a business’s financial transactions. Think of it as the foundation for all financial reporting. Bookkeepers are responsible for tracking every penny that flows in and out of a company.

Bookkeepers juggle several tasks, ranging from daily transaction recording to preparing financial reports. Now that you’ve got a snapshot of what bookkeeping is, let’s break down their duties and responsibilities in detail. Shall we?

1. Recording Financial Transactions

One of the most fundamental duties of a bookkeeper is recording financial transactions. This involves meticulously documenting every sale, purchase, payment, and receipt that takes place in a business. Bookkeepers not only enter sales revenue and expenses into accounting software but also categorize these transactions appropriately.

For example, distinguishing between office supplies and marketing expenses ensures better reporting and analysis. They also ensure that every financial entry matches supporting documents like invoices, purchase orders, and receipts to maintain transparency and accountability.

Grow Your Practice with Confidence

2. Reconciling Bank Statements

Reconciling bank statements involves comparing the business’s financial records with bank account statements to ensure accuracy and consistency. This duty is essential for catching errors such as duplicate payments, missed entries, or unauthorized transactions that can distort financial reporting.

Furthermore, Bookkeepers carefully review bank transactions alongside internal records to identify discrepancies and resolve them promptly. By aligning balances between bank accounts and books, they help maintain a clean and accurate financial record, giving business owners a clearer picture of their cash position.

3. Managing Accounts Payable and Accounts Receivable

Handling accounts payable and receivable is a crucial aspect of maintaining healthy cash flow. Accounts payable refers to money a business owes its suppliers, while accounts receivable covers money owed by customers.

Bookkeepers are responsible for tracking incoming payments, issuing and managing invoices, and ensuring timely payments to suppliers. They also follow up on overdue payments, helping businesses avoid cash flow bottlenecks that can hinder operations.

4. Handling Payroll Processing

Processing payroll is one of the most sensitive and detail-oriented responsibilities of a bookkeeper. This task involves calculating employee salaries, deductions, and benefits accurately while ensuring compliance with tax regulations.

Additionally, they record payroll expenses meticulously to maintain accurate books. Errors in payroll processing can damage employee trust and lead to legal complications. So bookkeepers must stay vigilant and up-to-date on tax laws and employment regulations to avoid mistakes and ensure smooth payroll operations.

5. Producing Financial Reports

Bookkeepers play a significant role in generating financial reports that provide insights into a business’s financial health. These reports help business owners and managers make informed decisions about budgeting, investments, and growth strategies.

Bookkeepers prepare profit and loss statements, balance sheets, and cash flow reports that highlight the business’s financial performance over specific periods.

6. Maintaining Compliance with Tax Regulations

Tax compliance is a critical area where bookkeepers help businesses avoid penalties and maintain their reputations. Bookkeepers track VAT or other sales tax obligations and ensure that accurate tax records are maintained.

They assist with tax filing preparations by providing the necessary financial documentation and organizing tax-related information. Their understanding of tax requirements ensures that the business stays within legal frameworks and meets all reporting deadlines.

Grow Your Practice with Confidence

7. Budgeting and Forecasting Support

Though not every bookkeeper handles budgeting, those with advanced responsibilities assist in creating financial forecasts and budgets. By analyzing historical financial data, bookkeepers help businesses project future expenses, revenues, and cash flows.

This information is essential for resource allocation, cost control, and long-term financial planning. Their support in this area helps businesses plan proactively rather than reactively.

8. Ensuring Data Accuracy and Security

Data accuracy and security are critical responsibilities for bookkeepers. They implement rigorous data entry checks to prevent costly errors and inconsistencies. Regular backups of financial records are maintained to safeguard against data loss, whether from technical failures or cyber threats.

By using secure accounting software, bookkeepers ensure that sensitive financial information remains protected from unauthorized access.

Ross McKinley is there for you

At Ross McKinley, we take the stress out of your financial bookkeeping. Our team of seasoned professionals specializes in reconciling accounts, organizing financial records, and preparing tax-ready documentation.

With us by your side, you can focus on running your business while we handle the complexities of your financial management.

Conclusion

Bookkeepers wear many hats, balancing daily transactional tasks with responsibilities that contribute to the long-term stability of a business. Their expertise keeps financial records accurate, compliant, and accessible, making them invaluable to any organization.

Bookkeeping may not be the most glamorous part of running a business, but it’s undoubtedly one of the most crucial. Bookkeepers handle everything from recording transactions to ensuring tax compliance, all while keeping your finances organized and accessible.

So next time you look at those clean, detailed financial statements, you’ll know who to thank.