Outsourced accounting has revolutionized financial management for businesses by offering an effective way to handle complex accounting tasks without the burden of maintaining an in-house team.

In today’s fast-paced market, businesses of all sizes, from startups to established corporations, are turning to outsourced accounting services to save costs, access expertise, and improve efficiency.

This article explores not just the core benefits but also the lesser-known advantages, from time-saving tools to compliance assurance, helping businesses gain a competitive edge.

Table of Contents

What is Outsourced Accounting?

Outsourced accounting is the strategic practice of delegating financial tasks to external professionals, allowing businesses to focus on growth without the burden of managing an in-house team.

By tapping into the expertise of specialized firms equipped with cutting-edge technology, companies can ensure accuracy, compliance, and efficiency in financial operations. This modern approach not only saves costs but also provides scalable solutions tailored to meet evolving business needs.

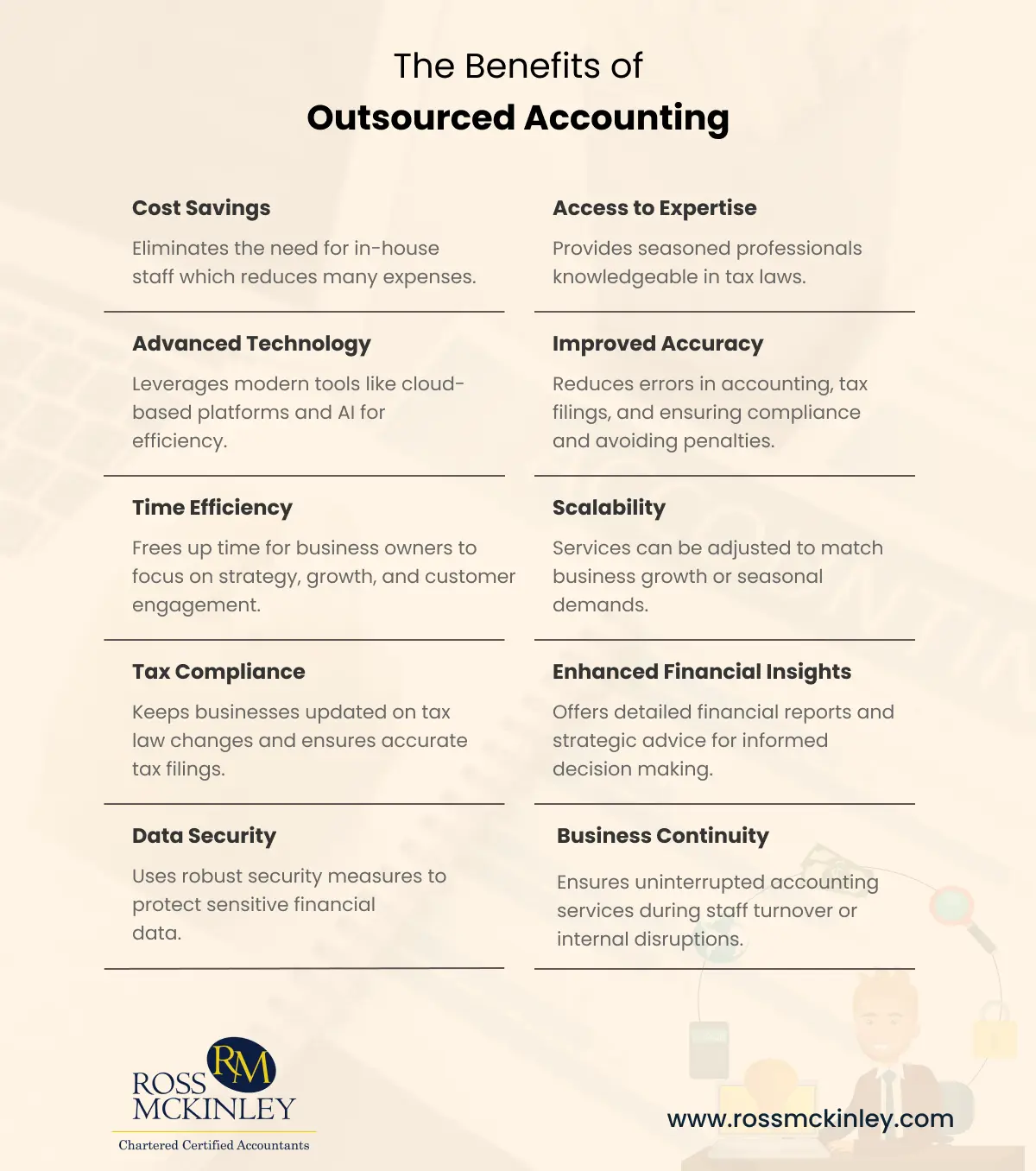

| Benefits | Details |

| Cost Savings | Eliminates the need for in-house staff which reduces many expenses. |

| Access to Expertise | Provides seasoned professionals knowledgeable in tax laws. |

| Advanced Technology | Leverages modern tools like cloud-based platforms and AI for efficiency. |

| Improved Accuracy | Reduces errors in accounting, tax filings, and reporting, ensuring compliance and avoiding penalties. |

| Time Efficiency | Frees up time for business owners to focus on strategy, growth, and customer engagement. |

| Scalability | Services can be adjusted to match business growth or seasonal demands. |

| Tax Compliance | Keeps businesses updated on tax law changes and ensures accurate tax filings. |

| Enhanced Financial Insights | Offers detailed financial reports and strategic advice for informed decision-making. |

| Data Security | Uses robust security measures to protect sensitive financial data. |

| Business Continuity | Ensures uninterrupted accounting services during staff turnover or internal disruptions. |

1. Cost Savings with Flexible Solutions

Outsourcing eliminates the need for hiring, training, and maintaining an in-house team, significantly reducing overhead expenses such as salaries, benefits, office space, and software licenses.

Businesses only pay for the services they require, creating a tailored solution to meet their budget. This flexibility benefits small businesses, which may not need full-time staff, and larger organizations looking to cut back on operational costs.

Grow Your Practice with Confidence

2. Access to Industry Expertise and Advanced Technology

Outsourced accounting firms employ seasoned professionals with a deep understanding of tax laws, regulatory updates, and best practices. This expertise ensures precise and compliant financial management.

Moreover, outsourcing firms invest in cutting-edge accounting software and technologies, such as cloud-based platforms and AI-driven tools, which enhance efficiency, streamline processes, and provide real-time financial insights.

3. Improved Accuracy and Reduced Risk of Errors

Accurate financial records are crucial for maintaining compliance and making sound business decisions. By outsourcing accounting tasks to skilled professionals, businesses minimize the risk of errors in bookkeeping, tax filings, and financial reporting.

Errors in financial data can lead to penalties, audits, or even legal complications, making this one of the most valuable advantages of outsourcing.

4. Time Efficiency and Enhanced Focus

Accounting is time-consuming, especially for small business owners juggling multiple responsibilities. Outsourcing allows businesses to focus on growth-oriented tasks, such as strategy development, customer engagement, and product innovation, without being bogged down by routine financial work.

This increased focus can lead to higher productivity and a stronger competitive position.

5. Scalability and Customization

Outsourced accounting services are scalable, meaning businesses can adjust the level of service as they grow or face seasonal demands.

For instance, a business experiencing rapid growth can quickly scale up its financial operations without the hassle of hiring new staff. Similarly, businesses with fluctuating demands can downsize services during slower periods to control costs.

6. Tax Compliance and Risk Management

Navigating tax laws and regulations can be daunting, especially for businesses operating across multiple regions or industries. Outsourced accounting professionals stay updated on the latest legal changes, ensuring compliance and avoiding costly penalties.

Their expertise in risk management further helps businesses identify and address potential financial vulnerabilities.

7. Enhanced Financial Insights and Strategic Planning

Outsourced accountants offer detailed reports, forecasts, and analyses, empowering businesses with actionable insights.

These insights can be used to track performance, plan budgets, and make informed decisions. Businesses can rely on professional guidance to identify growth opportunities, manage cash flow effectively, and avoid financial pitfalls.

Grow Your Practice with Confidence

8. Secure and Confidential Data Handling

Security is a top priority for reputable outsourced accounting providers. They implement stringent data protection measures, including encryption, secure servers, and limited access protocols, to safeguard sensitive financial information.

This ensures businesses can trust their financial data is secure and in compliance with data protection regulations.

9. Access to a Comprehensive Suite of Services

Outsourced firms offer a wide range of services, from basic bookkeeping and payroll to advanced tax planning and financial auditing.

This all-in-one approach provides businesses with consistency and efficiency in financial management, eliminating the need to coordinate with multiple service providers.

10. Reliable Business Continuity

Outsourcing ensures uninterrupted accounting services, even during times of internal disruption, such as employee turnover or unexpected leave.

This reliability allows businesses to maintain smooth operations without worrying about gaps in financial management.

Challenges of In-House Accounting

While outsourced accounting offers numerous benefits, it’s not without its challenges. From potential communication barriers to concerns over data security, businesses must navigate these hurdles to fully capitalize on the advantages of external financial expertise.

- Higher Costs

Hiring and maintaining a full-time accounting team involves significant expenses.

- Limited Expertise

In-house accountants may lack specialized knowledge or access to advanced tools.

- Increased Risks

Errors in financial reporting or compliance issues can result in penalties or audits.

Outsourcing alleviates these challenges by providing cost-effective, expert-driven solutions tailored to the needs of the business.

Conclusion

Outsourced accounting combines expertise, technology, and cost-efficiency to deliver unparalleled value for businesses. By delegating financial tasks to external professionals, companies can focus on their core objectives, streamline their operations, and make informed strategic decisions.

Whether you’re a small business seeking to reduce overheads or a growing enterprise looking for scalable solutions, outsourcing accounting is a smart choice for achieving sustainable growth.

For expert accounting services tailored to your business needs, visit Ross Mckinley and discover how our professional team can support your financial management, streamline your operations, and ensure compliance with the latest regulations.

Let us handle your accounting, so you can focus on what matters most—growing your business.