Income Statement vs Balance Sheet

December 10, 2024

Specialised Bookkeeping Tips for Restaurants and Hospitals

January 22, 2025VAT on New Build

Excited for a renovation, thinking you won’t have to pay the dreaded VAT. Well, you are in for a surprise! Whether you plan to build a new property or renovate the existing one, you’ll have to pay the VAT.

In some cases, the VAT is zero-rated on labor and material costs associated with construction, while in others, it may be the standard rate or reduced rate. Either way, you’ll have to have complete knowledge of the standards set by the government to understand the VAT you are entitled to pay.

The read-ahead will give you a brief idea of the different types of taxes on New builds. Also, what counts as “NEW” according to UK laws, and what is the VAT rate on various property structures?

Table of Contents

VAT on Construction

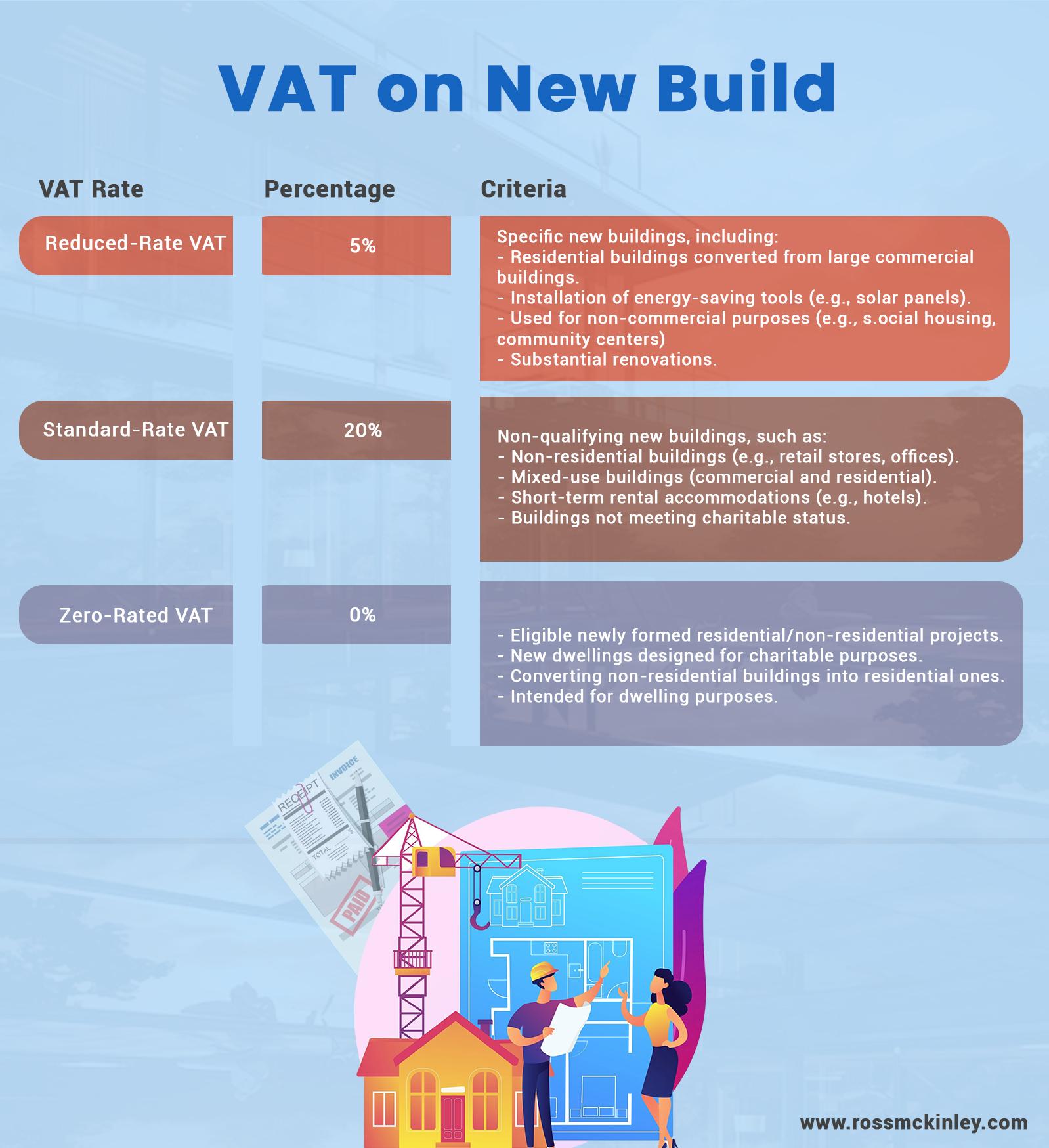

VAT on construction refers to VAT imposed on the construction, sale, or rentals of newly formed or renovated properties. VAT applicable to various forms of property comes in three types mentioned below:

1. Zero-Rating

A zero rating implies that zero VAT is charged on eligible newly formed residential/ non-residential projects. To qualify, the project must:

·Be a new dwelling design specially used for charitable purposes.

·Converting a non-residential building into a residential one.

·Intended to be used for dwelling purposes

2. Reduced-Rate: 5% VAT

The reduced rate implies that 5% VAT is charged on specific new buildings. To qualify, the project must:

· Be a new residential building converted from a large commercial building

· Installation of energy-saving tools such as solar panels.

· Be used for non-commercial purposes, for example, social housing, community centers, etc.

· Building used in case of substantial renovations.

3. Standard- Rate: 20% VAT

With the standard rate, 20% VAT is charged on non-qualifying new buildings. To qualify, the project must:

·Non-residential buildings eg for example, retail stores, offices, etc.

· Mixed-use buildings that have both commercial and residential usage.

· Short-term rental accommodation properties such as hotels.

·Buildings that don’t suffice for a charitable status.

VAT on Building New Homes

If you are building a new property or an apartment, the VAT rate will be zero. You don’t have to pay additional VAT charges for labor, building materials, or machinery. However, certain conditions must be met for the building to be considered a new building. Here’s a list of the criteria:

- The building should be independent, meaning there should be no doors or connections with other houses or properties.

- The building must be capable of being used independently without dependence on other buildings.

- Can be sold independently

- Must have proper planning permission

- The existing building should be demolished to create a new property using new foundations.

Paying VAT on new Build Used For Residential Purposes

There is generally zero VAT on a newly built house; however, renovations to convert an existing residential property into another, such as converting a house into flats, may involve a reduced VAT rate.

If a residential property that has not been used for 2 years or more is being renovated, a standard VAT rate would apply. This rate applies to all renovation works, including repairs, maintenance, energy efficiency upgrades, etc.

VAT on Commercial Property Construction

Generally, any renovation, sale, or lease of commercial property construction is charged at the standard VAT rate. However, there is an exception to this rule if the property is being used for charitable purposes, such as an orphanage.

Moreover, if your company is VAT registered, you can claim back the VAT once the work is done. This means that by claiming your VAT, you can recover most of your outlay. In addition, the sale of a property older than three years can enjoy VAT exemption.

Likewise, most commercial leases are VAT exempted by default. However, landlords still have the option to charge VAT on rent, especially if they wish to reclaim VAT.

VAT on Listed Buildings

People in the construction works believe that listed buildings enjoy zero VAT. Well, it’s just about time to debunk this myth! This was the case previously, but the rule was altered in 2012. Since then, they have implied a standard rate.

If a listed commercial building is converted into a commercial property, the labor cost and other conversion costs may have a reduced VAT rate of 5% or zero. In the end, the VAT rate will ultimately be decided by the property’s prior and future use.

General repairs and maintenance costs on listed buildings imply a standard 20% VAT rate. On the contrary, VAT reliefs may apply if a listed building is used for charitable purposes.

Also, if some energy-saving installations are made in listed buildings, they may qualify for a reduced VAT rate of 5%. However, the VAT rate depends on the building’s function and usage.

Conclusion

VAT on new-build property is a complex and crucial issue for developers, builders, property owners, and residents. To understand its implications, a proper understanding of the VAT laws is needed.

The points mentioned above will help you understand the VAT implications of different new builds, whether commercial or residential.

VAT is a significant addition to your construction cost; hence, it’s best to know what to expect before starting the project. This way, you’ll have clarity and allocate your budget accordingly.