Accounting can feel like a maze of numbers, technical jargon, and brain-melting spreadsheets. But what if I told you there’s a part of accounting that feels more like solving a mystery?

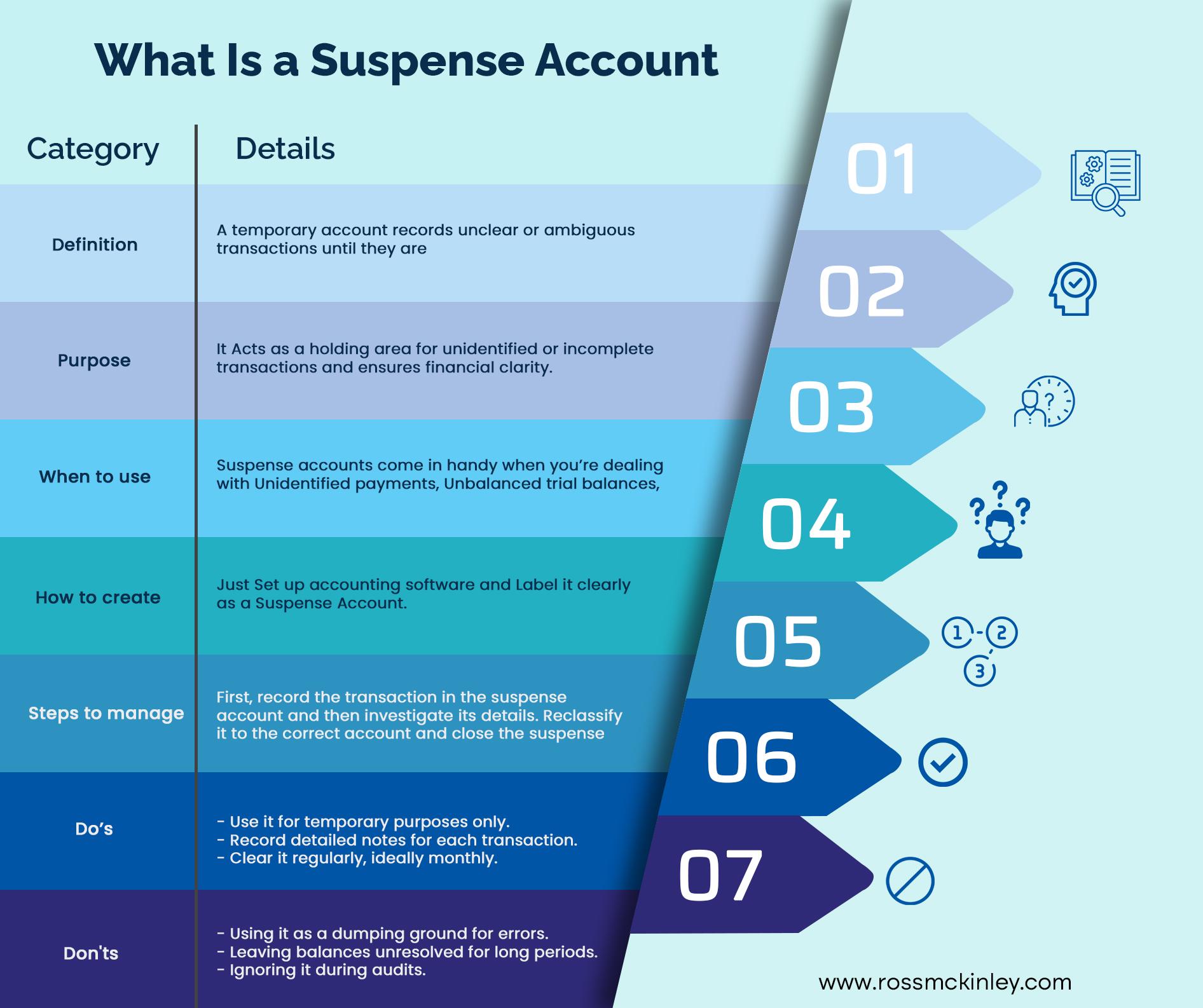

A suspense account is a temporary holding account for all those “what on earth are these?” These are your transactions! It’s where unclassified entries, discrepancies, or incomplete information find a temporary home until their true identity is revealed.

Whether it’s a mysterious payment, a misclassified entry, or a number that doesn’t add up, the suspense account keeps your books balanced and your stress levels in check. So, buckle up as we uncover the secrets of this fascinating account that’s equally practical and intriguing!

Table of Contents

What Is A Suspense Account?

In technical terms, a suspense account is a temporary account used in accounting to record uncertain or ambiguous transactions until they can be classified appropriately or categorized. Consider it a holding area for the “I’ll figure this out later” items.

For example, if a payment is received without proper details, like the sender’s name or the invoice it relates to. It can temporarily sit in the suspense account while you investigate.

Similarly, during trial balances, any discrepancies or errors can be placed here until they’re resolved. This practice keeps your books organized and makes audits and reconciliations much smoother, acting as a safety net for your accounting system.

When Do You Use a Suspense Account?

Now, you might be wondering when is the right time to use these suspense accounts and get the utmost benefits from them. Well, there are some scenarios where you must have one.

For instance, a small business once discovered a whopping $1,000,000 in its suspense account. It turned out that the CEO had accidentally miscategorized an investment. It was resolved quickly, but not before the CEO joked about using it for a company yacht. Without proper usage knowledge, you might be in such a situation.

Here’s when Suspense accounts come in handy:

Grow Your Practice with Confidence

1. Unidentified Payments:

Sometimes, money lands in your bank account, and you have no clue who sent it or why. A suspense account is the perfect place to park that payment while you investigate.

2. Unbalanced Trial Balances:

If your trial balance isn’t adding up—one side is heavier than the other—you can temporarily dump the difference into a suspense account while you figure out what went wrong. It’s like calling a timeout in the middle of a chaotic game.

3. Incomplete Documentation:

Ever had a vendor send a senseless invoice? Instead of putting it in the wrong category, you park it in the suspense account until the paperwork catches up. Thus, The suspense account is your go-to solution for suspicious transactions.

How to Create and Manage a Suspense Account

To create and manage a suspense account, set it up in your accounting system and record unclear transactions with detailed notes. Investigate the transactions, reclassify them to the correct accounts once resolved, and clear the suspense account regularly to maintain clean and accurate records.

Let’s further break down these concepts briefly to grasp the concept.

1. Open the Account:

Most accounting software (hello, QuickBooks, and Tally users) lets you create a suspense account with a few clicks. Name it something obvious like “Suspense Account” so you don’t lose track of it.

2. Record the Transaction:

As soon as you encounter an unknown or unbalanced item, dump it into the suspense account. Make sure to record as much information as possible—date, amount, and any reference numbers.

3. Investigate:

This is where your inner Sherlock comes into play. Review bank statements, emails, invoices, or even call clients to get to the bottom of things.

4. Reclassify:

Once you’ve identified the transaction’s proper home, move it out of the suspense account and into the correct ledger.

Grow Your Practice with Confidence

5. Close the Account:

Suspense accounts aren’t meant to hang around forever. Ideally, you clear them out before your reporting period ends. Leaving transactions in suspense can raise eyebrows during audits (and no one wants an auditor with raised eyebrows).

The Dos and Don’ts of Using a Suspense Account

Using a suspense account effectively requires a mix of good practices and caution. To keep your books clean and organized, it’s important to know what to do—and what to avoid. From proper record-keeping to timely resolution of entries, here’s a quick guide to the dos and don’ts of managing suspense accounts like a pro.

DO:

– Use it for temporary purposes only.

– Keep detailed notes about every transaction in the account.

– Clear the account regularly—monthly is ideal.

DON’T:

– Treat it as a dumping ground for your lazy accounting habits.

– Leave large balances unresolved for extended periods.

– Forget about it during financial reporting or audits.

Why Suspense Accounts Matter for Your Business

Suspense accounts might seem trivial, but they’re a lifesaver for businesses. These are considered a critical tool for maintaining accurate and organized financial records in your business.

They help manage unclear transactions, ensure precise reporting, and keep your books audit-ready. Using suspense accounts effectively saves time, reduces stress, and avoids costly errors, making them an essential part of any efficient accounting process. Here’s why:

1. Accurate Financial Reporting

Using suspense accounts ensures that your financial statements reflect reality, even if some transactions are temporarily in limbo.

2. Audit Preparedness

Auditors love clean books. A suspense account shows you’re responsible enough to separate unknown transactions instead of shoving them into random accounts.

3. Time Efficiency

Imagine pausing everything every time an unclear transaction pops up. A suspense account lets you keep working while you figure out the details.

4. Stress Reduction

There’s comfort in knowing that you have a system for handling the unexpected. And let’s be honest—anything that reduces accounting stress is a win.

Conclusion

A suspense account is like a good friend who holds your wallet when you don’t have pockets—it’s practical, reliable, and there when you need it. But just like that friend, you don’t want to rely on it forever. Use it wisely, clear it quickly, and your books will thank you.

So the next time you see yourself scratching your head over a mysterious transaction, remember that suspense accounts are here to save the day. And who knows? Maybe solving accounting mysteries will even become your new favorite thing. Or not.

Let’s just agree that suspense accounts are extraordinary. Period.