VAT Deregistration: When and How to Cancel Your VAT Registration

December 6, 2024

How to Calculate Goodwill?

December 8, 2024Gross Pay vs Net Pay: What’s the Difference?

Have you ever looked at your payslip and wondered why the amount deposited in your account is smaller than the figure at the top? One of them is gross pay, and the other one is net pay!

That’s why understanding the differences between gross pay vs net pay isn’t just for accountants. It’s significant for both employees and employers. Knowing these terms inside out will help you while negotiating a salary, creating a budget, or managing payroll.

In this blog, we’ll break down gross pay vs net pay, their components, and how to calculate them. Let’s explore what makes these figures tick and how understanding them can impact your finances.

Table of Contents

What Is Gross Pay?

Gross pay represents the total amount you earn before any deductions occur. It includes basic salary, overtime, bonuses, and allowances like housing or travel. When negotiating wages, discussions revolve around gross pay since it reflects your overall earning potential.

For example, if your monthly basic salary is £2,500 and you receive a £500 bonus, your gross pay is £3,000. Keep in mind that gross pay doesn’t account for deductions like taxes, pensions, or insurance contributions.

Deductions include federal, state, or local income taxes and national insurance contributions, which are a required percentage of earnings. They also include pension contributions and wage garnishments, which are court-ordered deductions like loan repayments.

While gross pay sounds impressive, it’s not the amount you’ll have to spend.

What Is Net Pay?

Net pay is what remains of your earnings after all deductions. Think of it as your “take-home pay.” It’s the amount that hits your bank account and is available for spending, saving, or investing.

For instance, if your gross pay is £3,000 and you have £500 in deductions for taxes, pension, and insurance, your net pay is £2,500. This figure provides a clearer picture of your financial health, showing what you can use.

Deductions influencing net pay include income tax, national insurance contributions, health or life insurance premiums, and retirement savings contributions.

When planning your monthly budget, focus on your net pay, not your gross pay, to get a realistic view of your financial standing.

Differences Between Gross Pay vs Net Pay

The fundamental difference between gross pay and net pay lies in deductions. Gross pay is your total earnings, while net pay is what’s left after taxes, insurance, and other deductions.

Employers use gross pay to calculate tax obligations and benefits, while employees rely on net pay to budget their expenses. Understanding these differences ensures clearer communication about salary expectations and better financial planning.

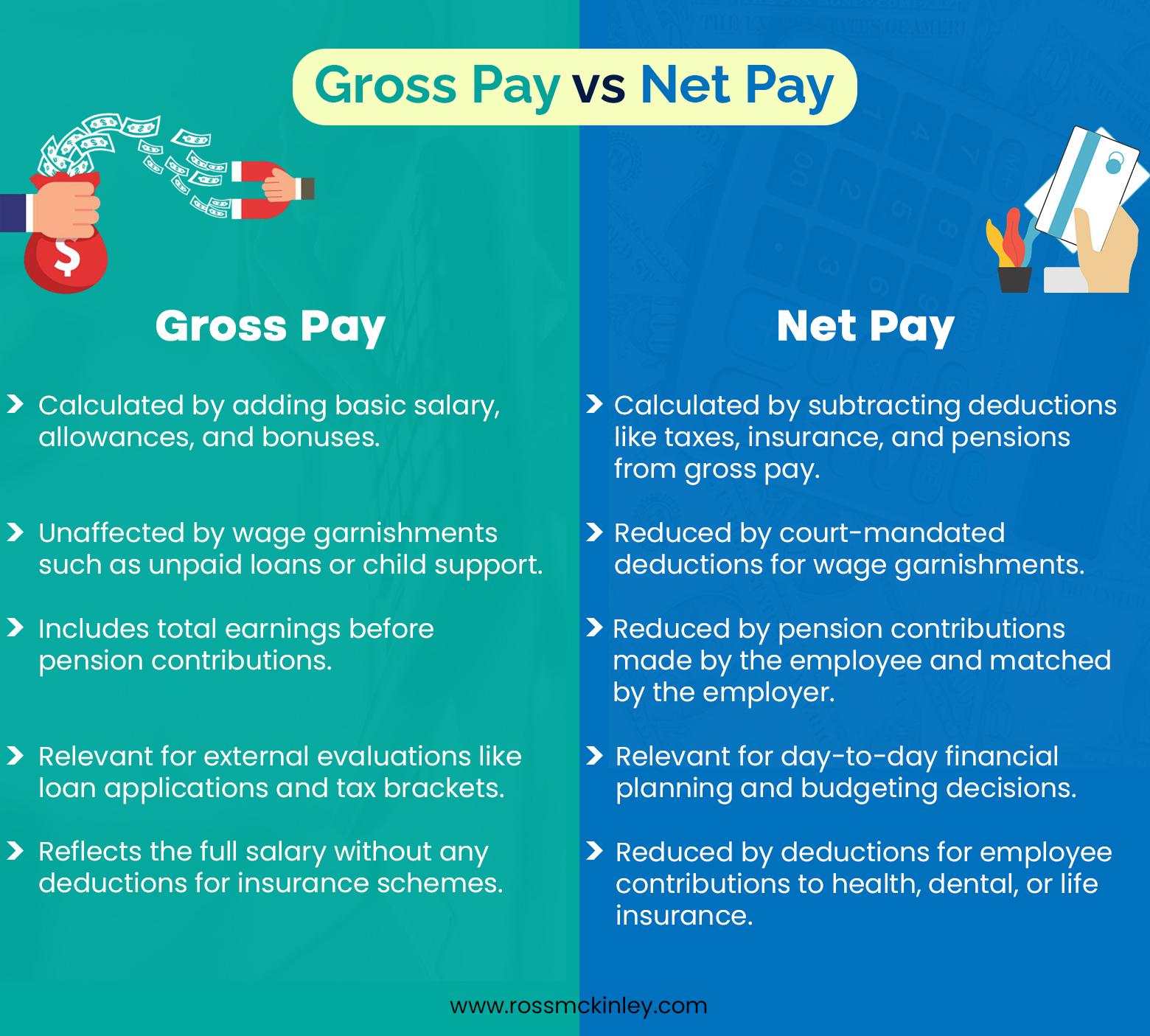

Here are the common differences between gross pay vs net pay:

| Gross Pay | Net Pay |

| Calculated by adding basic salary, allowances, and bonuses. | Calculated by subtracting deductions like taxes, insurance, and pensions from gross pay. |

| Includes total earnings before pension contributions. | Reduced by pension contributions made by the employee and matched by the employer. |

| Reflects the full salary without any deductions for insurance schemes. | Reduced by deductions for employee contributions to health, dental, or life insurance. |

| Unaffected by wage garnishments such as unpaid loans or child support. | Reduced by court-mandated deductions for wage garnishments. |

| Relevant for external evaluations like loan applications and tax brackets. | Relevant for day-to-day financial planning and budgeting decisions. |

Calculation Differences

Calculating gross pay and net pay involves understanding each of the components. The calculations highlight the importance of knowing both figures to understand your earning power.

Gross Pay Calculation

Imagine an employee earns a basic salary of £30,000 annually, with an additional £5,000 in allowances and £2,000 as a bonus. The Gross Pay would be:

£30,000 (Basic Salary) + £5,000 (Allowances) + £2,000 (Bonus) = £37,000 Gross Pay

Net Pay Calculation

Now let’s subtract deductions from the £37,000 gross pay. Suppose the deductions are:

- Income Tax: £5,000.

- National Insurance: £2,000.

- Pension Contributions: £1,000.

The net pay would be:

£37,000 – (£5,000 + £2,000 + £1,000) = £29,000 Net Pay

Retirement Deduction in Gross Pay vs Net Pay

Pensions and retirement contributions significantly impact both gross pay and net pay.

A percentage of your gross pay is often allocated to workplace pension schemes or private retirement plans. For example, if you contribute 5% of your salary and your employer matches this, a £2,000 monthly gross pay results in £100 deducted for pensions.

This deduction directly reduces your net pay. While it might seem like less money in your pocket now, it helps secure financial stability during retirement. Balancing your pension contributions with immediate financial needs is vital for long-term planning.

Differences in Insurance Schemes

Insurance schemes further distinguish gross pay vs net pay. Employers may fund health, dental, or life insurance partially or fully through deductions from gross pay.

For example, if your employer covers 70% of your health insurance premium, and your share is £200 per month, this amount reduces your net pay. While these deductions impact your take-home amount, they provide valuable benefits that can offset healthcare costs.

Understanding how insurance contributions affect net pay helps you evaluate the true value of your compensation package.

Wage Garnishments Differences

Wage garnishments are court-mandated deductions from your earnings to settle debts such as unpaid loans, child support, or tax arrears.

For example, if you owe £1,000 and the court orders a £100 deduction monthly, this amount will come directly from your net pay. These garnishments don’t affect your gross pay calculation but can significantly reduce the money you receive.

Being aware of wage garnishments and their impact on net pay can help you plan your finances effectively, especially if you have ongoing obligations.

Relevance Difference in Gross Pay vs Net Pay

Gross pay is relevant for external assessments like applying for loans or calculating tax brackets. It reflects your earning capacity and often serves as a benchmark for financial evaluations.

However, net pay is more relevant to your day-to-day life. It dictates how much money you have for essentials like rent, groceries, and leisure. Whether you’re saving for a big purchase or managing monthly expenses, net pay offers a clearer view of your disposable income.

Knowing the relevance of gross pay and net pay ensures smarter financial planning, whether you’re an employee or an employer.

Conclusion

Gross pay vs net pay may seem straightforward, but understanding their differences is necessary for effective financial planning. Gross pay reflects your earning potential, while net pay shows your disposable income.

To make the most of your earnings, review your deductions, adjust voluntary contributions, and monitor wage garnishments. This ensures you’re meeting financial obligations and saving for the future.

Remember, the more precise your understanding of your pay structure, the easier it becomes to budget wisely, negotiate better salaries, and achieve your financial goals. Keep these insights handy and take charge of your finances today!