Thinking about a career in accounting but unsure of the difference between a CPA and an accountant? We get it that confusion can occur between these two roles, so you’re not alone.

While the terms “accountant” and “CPA” (certified public accountant) are often used interchangeably, they each have distinct roles. Moreover, the qualifications and career paths also differ, so understanding these differences is essential for anyone considering this field.

In this guide, we will elaborate on the significant differences between CPA vs accountant, such as their responsibilities and career opportunities. Let’s get started and discover how each role plays a unique role in the world of finance!

Table of Contents

What Is a CPA?

A CPA, or certified public accountant, is an accountant who has met strict standards in education, experience, and ethics. Unlike general accountants, CPAs have to complete a specific exam and obtain state licensing, qualifying them to handle advanced financial responsibilities, represent clients before the IRS, and offer specialized consulting.

CPAs bring expertise in areas such as conducting audits to ensure financial accuracy and oversee complex financial analyses for businesses. Moreover, they prepare tax strategies and manage compliance with larger clients.

A CPA also provides in-depth consulting in areas like financial forensics and internal controls. As licensed professionals, CPAs must complete continuing education and adhere to ethical guidelines, which are set by the American Institute of Certified Public Accountants (AICPA).

What Is an Accountant?

An accountant handles financial records, tracks transactions, and ensures the accuracy of financial reports. They work to keep cash flow stable and may assist with basic tax preparation.

Grow Your Practice with Confidence

Accountants are often involved in the financial planning process and may take on roles in auditing or cost analysis, depending on the company. Their responsibilities include verifying that financial documents comply with regulations, recording transactions, and preparing financial statements.

They may also recommend internal controls to improve financial practices and provide business owners with guidance on overcoming financial obstacles.

Accountants can work across industries, with responsibilities that vary depending on the company size and sector. While their roles are broad, accountants generally offer essential services to keep financial operations smooth and compliant.

CPA vs Accountant: Differences

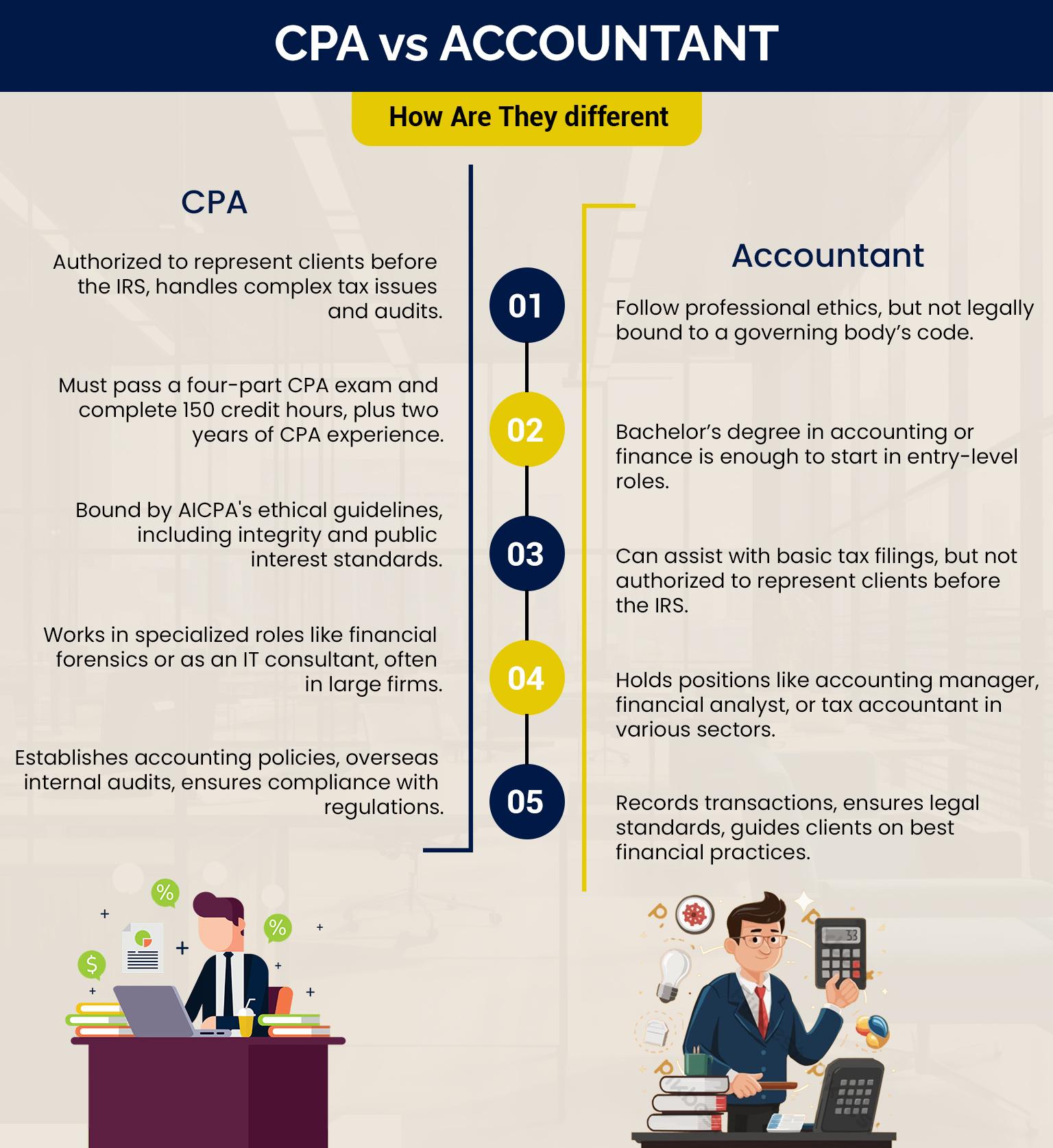

Are you struggling to understand the differences between a CPA and an accountant? Get rid of all the worries because we’re here to clear up the confusion. Although we’ll elaborate on them later, for now, look at some of the basic differences between a CPA vs accountant:

| CPA | Accountant |

| Establishes accounting policies, oversees internal audits, and ensures compliance with regulations. | Records transactions, ensures legal standards, and guides clients on best financial practices. |

| Must pass a four-part CPA exam and complete 150 credit hours, plus two years of CPA experience. | A bachelor’s degree in accounting or finance is enough to start in entry-level roles. |

| Authorized to represent clients before the IRS, handles complex tax issues and audits. | Can assist with basic tax filings, but not authorized to represent clients before the IRS. |

| Bound by AICPA’s ethical guidelines, including integrity and public interest standards. | Follow professional ethics, but not legally bound to a governing body’s code. |

| Works in specialized roles like financial forensics or as an IT consultant, often in large firms. | Holds positions like accounting manager, financial analyst, or tax accountant in various sectors. |

Difference Between CPA vs Accountant

While both CPAs and accountants focus on financial management, their responsibilities and job roles are completely different. Here are some of the major differences between a CPA vs Accountant below:

Clear Difference in Responsibilities

There are some major differences between the responsibilities of a CPA and an accountant. For example, the responsibilities of a CPA include establishing and updating accounting policies, overseeing internal audits and reporting accuracy.

As a CPA you also work on financial statements, send them to executives, and file SEC reports for public transparency. Moreover you can also provide consultation on compensation, spending, and budgeting and ensure compliance with industry regulations.

An accountant’s responsibilities include checking that financial documents meet legal requirements and recording and classifying transactions. You can also guide clients on best financial practices, assist them with tax preparation and audits and improve their internal accounting systems.

The role of a CPA includes more advanced and specialized tasks, providing deeper insights for clients and organizations.

Training and Licensing

You can become an accountant by getting a bachelor’s degree in accounting or finance. This foundational education is enough to start in entry-level roles where you can gain practical experience and grow under senior guidance.

However, if you want to become a CPA, you must meet additional requirements. You must pass the four-part CPA exam and complete 150 credit hours of college coursework, which is beyond a standard bachelor’s degree.

The CPA exam includes auditing & attestation, financial accounting & reporting, regulation, and business environment & concepts. An additional ethics component is also required in most states.

In addition to the exam, candidates must have two years of experience working under a licensed CPA. To maintain certification, CPAs must complete annual continuing education credits to stay updated on industry changes and ethics standards.

Grow Your Practice with Confidence

Tax Preparation and Audits

Both accountants and CPAs can prepare tax returns for individuals and businesses. However, CPAs are uniquely qualified to represent clients before the IRS, which is especially beneficial in cases involving complex tax issues or audits. They can legally represent clients in front of tax authorities and handle complicated tax matters with confidence.

General accountants, while knowledgeable about tax law, do not have this authority. They may assist with basic tax filing and compliance, but in complex situations, a CPA is often the better choice to ensure complete compliance and representation.

Difference in the Code of Ethics

The role of an accountant generally demands that they follow a code of ethics based on professional standards, though they are not legally bound to any one governing body.

In contrast, the role of a CPA is to adhere to strict ethical principles set by the AICPA, covering integrity, public interest, objectivity, and due care. These guidelines ensure that CPAs deliver unbiased, high-quality services and keep up with ongoing education requirements.

Job Opportunities for CPAs and Accountants

The career paths for CPAs and general accountants also vary. Job opportunities for accountants include working as an accounting manager, financial analyst, tax accountant, and management accountant.

However, job opportunities for CPAs with their specialized skills may pursue roles that include financial forensics specialist, IT consultant, and personal financial advisor.

CPAs often work in larger firms, public corporations, government agencies, or multinational companies, where their expertise in compliance and reporting is highly valued.

Conclusion

While both accountants and CPAs manage financial tasks, a CPA vs Accountant brings unique strengths to their roles. CPAs undergo extensive training and must meet strict standards, giving them an edge in complex financial and compliance matters.

If you’re considering a career in accounting, it’s essential to understand the job opportunities available for both CPA and accountants. Both roles offer rewarding paths, so consider which aligns best with your goals. You can also consult accounting professionals or seek educational resources to understand specific requirements and make your journey easier.