How Do I Cancel Marriage Allowance?

November 28, 2024

VAT on Margin Scheme

November 30, 2024What Is Goodwill in Accounts?

Ever heard about goodwill in accounts and felt a bit confused? It’s normal because goodwill is one of those accounting terms that can be tricky at first. Goodwill isn’t just a word on a balance sheet; it plays a major role in business acquisitions and financial statements.

Understanding goodwill in accounting can give you a clearer view of a company’s true worth and the hidden value it carries. Moreover, you’ll also feel confident about what goodwill is, why it matters, and how it impacts a business’s overall value.

To help you out in this blog, we’ll break down everything you need to know about goodwill, from its definition and types to its calculation and treatment.

Table of Contents

What Is Goodwill in Accounts?

When a business is acquired, the buyer often pays more than the market value of its identifiable assets and liabilities. This extra payment is known as goodwill. Goodwill is an intangible asset, and it isn’t a physical item like equipment or buildings. The acquirer records it as a long-term asset on their balance sheet, reflecting its premium value paid.

Examples of assets classified as goodwill include business reputation, brand name, licenses and permits, domain names, trade secrets, copyrights, patents, and executive talent.

What Is Goodwill in Accounts and How It’s Valued and Treated?

Do you find it difficult to comprehend the concept of goodwill in accounts? You don’t need to worry anymore because we will elaborate on it later on but for now let’s take a look at the brief sections on what goodwill is in accounts, its types, calculation, valuation, and treatment.

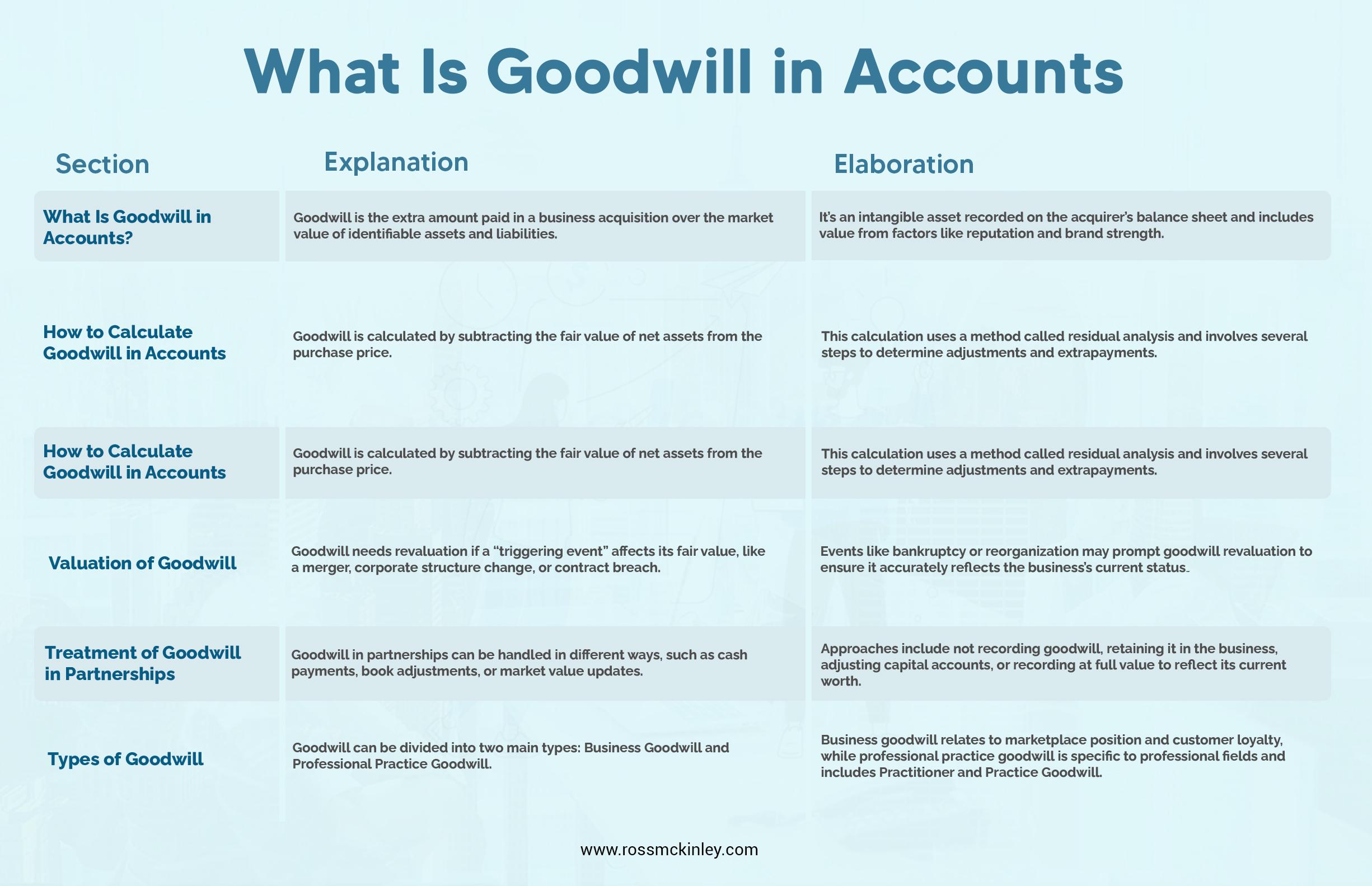

| Section | Explanation | Elaboration |

| What Is Goodwill in Accounts? | Goodwill is the extra amount paid in a business acquisition over the market value of identifiable assets and liabilities. | It’s an intangible asset recorded on the acquirer’s balance sheet and includes value from factors like reputation and brand strength. |

| Types of Goodwill | Goodwill can be divided into two main types: Business Goodwill and Professional Practice Goodwill. | Business goodwill relates to marketplace position and customer loyalty, while professional practice goodwill is specific to professional fields and includes Practitioner and Practice Goodwill. |

| How to Calculate Goodwill in Accounts | Goodwill is calculated by subtracting the fair value of net assets from the purchase price. | This calculation uses a method called residual analysis and involves several steps to determine adjustments and extra payments. |

| Valuation of Goodwill | Goodwill needs revaluation if a “triggering event” affects its fair value, like a merger, corporate structure change, or contract breach. | Events like bankruptcy or reorganization may prompt goodwill revaluation to ensure it accurately reflects the business’s current status. |

| Treatment of Goodwill in Partnerships | Goodwill in partnerships can be handled in different ways, such as cash payments, book adjustments, or market value updates. | Approaches include not recording goodwill, retaining it in the business, adjusting capital accounts, or recording it at full value to reflect its current worth. |

Types of Goodwill

The types of goodwill refer to different forms of intangible value a business may have. However they differ according to the kind of business and customers.

Here are the two major types of goodwill you must keep in mind while understanding its significance in accounts:

Business Goodwill

Business goodwill is tied to the business itself, including factors like its position in the marketplace and customer loyalty. For example, a business with a strong brand and loyal customer base would have a higher business goodwill value.

Professional Practice Goodwill

Professional practice goodwill applies to fields like medicine, law, and accounting and has two further subtypes:

- Practitioner Goodwill: This is related to the individual reputation and skill of the professional, such as a doctor or lawyer known for expertise.

- Practice Goodwill: This refers to the practice’s institutional reputation, location, and established operating procedures. For example, a well-established medical clinic with a strong reputation would have high practice goodwill.

How to Calculate Goodwill in Accounts?

Calculating goodwill in accounts involves a specific process, often using a method called residual analysis. Here’s a simplified step-by-step guide:

- Begin with checking the balance sheet and finding the book value of all the listed assets.

- Determine the fair value of these assets.

- Find the fair value adjustment, which is the difference between the fair value and the book value of the assets.

- Calculate the extra purchase price by subtracting the net book value of the assets from the acquisition price.

- Finally, goodwill is calculated by taking the extra amount paid for the business and subtracting any adjustments to its fair value.

Example: Suppose you purchase a business for £3 million. This business has £2 million in assets and £600,000 in liabilities, leaving £1.4 million in net assets (£2 million minus £600,000). The goodwill in accounting is calculated by subtracting the net assets from the purchase price, which in this case is £1.6 million (£3 million minus £1.4 million). The £1.6 million is recorded as goodwill in the noncurrent assets section of the balance sheet.

The Valuation of Goodwill

You must re-evaluate goodwill when a “triggering event” occurs and leads to its fair value falling below its current book value. Certain events can lead to the need for valuation of goodwill, including:

- Damages caused by breaches of contract, copyright infringement, or interference with business operations.

- Mergers, acquisitions, or separations within the business.

- Bankruptcy or business reorganization.

- Changes in corporate structure, like conversion from a C corporation to an S corporation.

Although businesses can create internal goodwill by building strong client relationships and training employees, only acquired goodwill is recorded as an asset. So organically built goodwill isn’t recorded on the balance sheet.

How Is Goodwill in Accounts Treated?

When a new partner joins a business, there are a few ways goodwill in accounts can be handled, depending on the partnership agreement. Here are five common methods for accounting for goodwill when a new partner is admitted:

- Goodwill in Cash but Not Recorded: If the new partner pays cash for their share of goodwill, it won’t appear in the balance sheet. Instead, it’s treated as a separate cash contribution.

- Goodwill in Cash and Kept in the Business: Here, the new partner brings cash for goodwill, which is added to the business funds and recorded as an increase in the business’s capital.

- No Cash Contribution for Goodwill: If the new partner doesn’t bring cash for goodwill, the existing partners might adjust their capital accounts to balance the new partner’s share.

- Goodwill Already on the Books: If goodwill is already recorded, the current value may be adjusted to reflect the new partner’s entry, affecting each partner’s share of total goodwill.

- Goodwill Recorded at Full Value: Sometimes, goodwill is updated to its full market value, and each partner’s capital account is adjusted to reflect this. As a result, you can see the current goodwill value of your business.

Conclusion

In accounting, goodwill is the extra value of a business beyond what its physical assets are worth. During acquisitions, it plays a significant role on the balance sheet and reflects factors like brand value, customer loyalty, and reputation.

To handle goodwill in accounts successfully, remember how it’s calculated, valuation of goodwill, and the ways it’s treated in accounting. Developing an understanding of these points will help you gain valuable insights into how goodwill affects a company’s long-term value.

So, whether you’re assessing a potential acquisition or simply expanding your financial knowledge, a firm grasp of goodwill in accounting will serve you well. Goodwill may be intangible, but its impact on business valuation is very real.