Are you finding it hard to understand the VAT on Margin Scheme? You’re not the only one because understanding VAT and its nuances can be a real challenge, especially when it involves second-hand goods, art, or antiques.

However the VAT margin scheme isn’t just about tax savings; it’s about making your business more competitive, maximizing cash flow, and simplifying tax compliance.

When you get a grip on how this scheme works, you can take better control of your finances and make smarter, cost-saving decisions for your business.

In this blog, we’ll break down the VAT margin scheme in simple terms so you can see how it helps businesses stay competitive.

Table of Contents

What Is a VAT on Margin Scheme?

A VAT margin scheme is a unique tax approach aimed at easing the VAT burden on second-hand goods, art, antiques, and collectibles. Instead of taxing the full resale price, VAT is only charged on the difference (or “margin”) between what you paid for the item and what you sell it for.

To understand an example of a VAT on-margin scheme, let’s imagine you run an antique shop.

You purchase a clock for £300 and sell it for £500. Here, your VAT margin is £200 (the difference between £500 and £300). Under the VAT Margin Scheme, you only pay VAT on this £200, rather than the full £500.

This way, the VAT charged (at 16.67% of the margin) results in a much lower tax amount of £33.34, rather than the usual 20% of the total price.

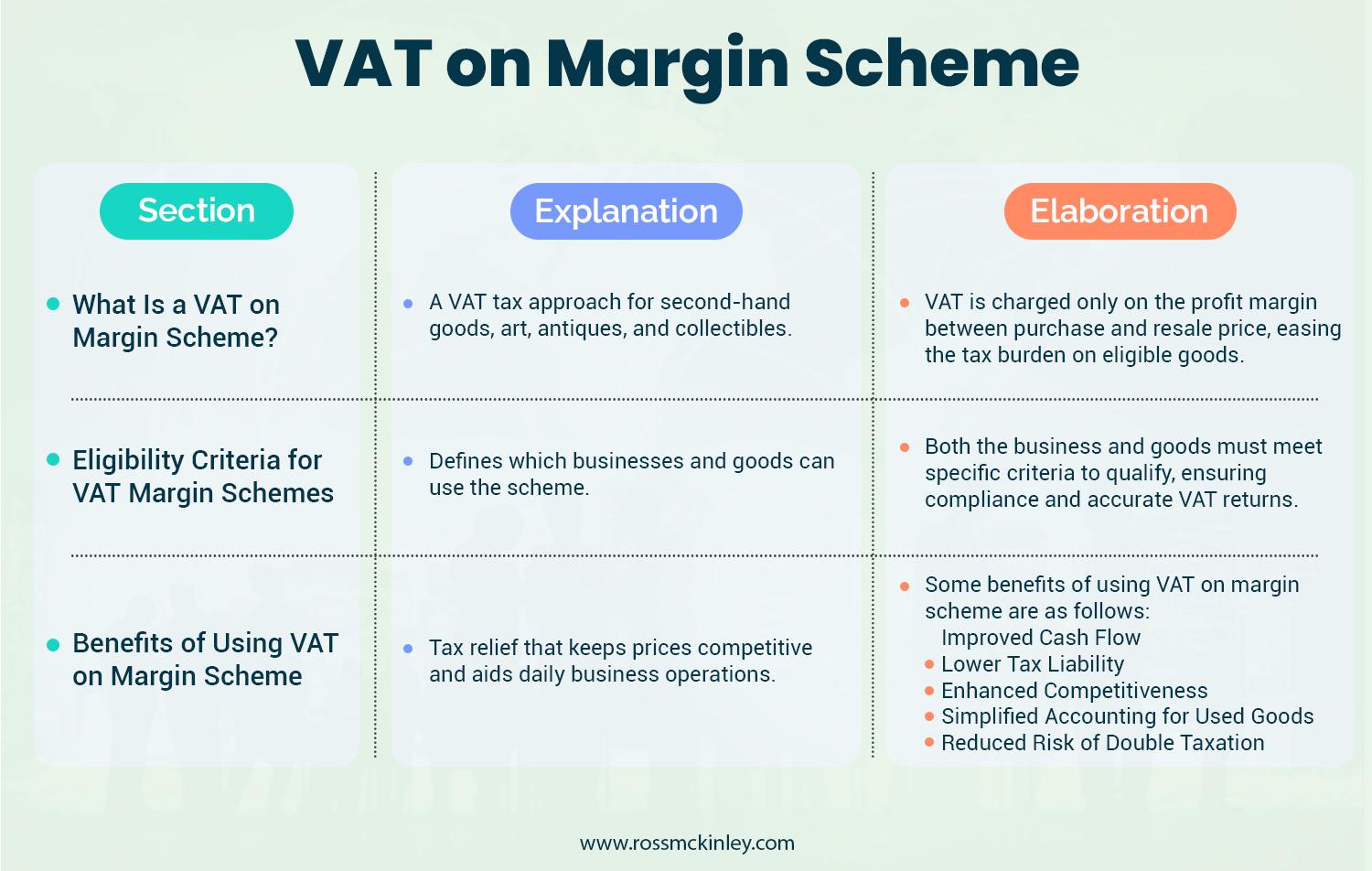

| Section | Explanation | Elaboration |

| What Is a VAT on Margin Scheme? | A VAT tax approach for second-hand goods, art, antiques, and collectibles. | VAT is charged only on the profit margin between purchase and resale price, easing the tax burden on eligible goods. |

| Benefits of Using VAT on Margin Scheme | Tax relief that keeps prices competitive and aids daily business operations. | Some benefits of using VAT on margin scheme are as follows:Improved Cash FlowLower Tax LiabilitySimplified Accounting for Used GoodsReduced Risk of Double TaxationEnhanced Competitiveness |

| Eligibility Criteria for VAT Margin Schemes | Defines which businesses and goods can use the scheme. | Both the business and goods must meet specific criteria to qualify, ensuring compliance and accurate VAT returns. |

Benefits of Using VAT on Margin Scheme

The VAT margin scheme is a win-win for businesses selling eligible goods as they gain tax relief while keeping their prices competitive. But how does VAT help businesses day-to-day?

Here are some of the benefits of using VAT on margin scheme:

Grow Your Practice with Confidence

Improved Cash Flow

The VAT Margin Scheme helps maintain a business’s cash flow by lowering the VAT liability on sales. Because VAT is only calculated on the margin, businesses pay less VAT overall. As a result, you’ll have more cash on hand for other needs, like inventory or operational expenses.

For many businesses, better cash flow translates into easier day-to-day management and a stronger financial position. With more funds available for reinvestment, businesses using this scheme can pursue growth opportunities without the financial strain of high VAT costs.

Lower Tax Liability

One of the important benefits of using VAT on margin scheme is the reduced tax burden. Taxing only the margin allows businesses to keep more funds that would otherwise be spent on VAT for the full selling price. This reduction is especially valuable for businesses dealing in low-margin, high-turnover items.

Lower tax costs also mean greater profits and a better competitive edge. Businesses that maximize these savings can offer customers more competitive prices, making their products more attractive in the market.

Simplified Accounting for Used Goods

Managing VAT can be complex, especially with second-hand goods. The VAT margin scheme simplifies things by allowing VAT to be calculated only on the profit margin. You get rid of the hassle of calculating VAT for the entire sale value, making accounting and compliance easier for small businesses.

Simplified accounting also translates into less administrative work and fewer resources spent on tax management. Businesses can focus on core operations without getting bogged down by complicated VAT calculations.

Reduced Risk of Double Taxation

The VAT on margin scheme is structured to avoid double taxation on used goods, which are often taxed when first sold. By taxing only the margin, businesses don’t end up paying VAT twice for the same goods.

For businesses, this means they’re not penalized for reselling items. The reduced tax impact makes it easier for them to build inventory from second-hand sources, knowing they won’t face excessive tax costs in the resale process.

Grow Your Practice with Confidence

Enhanced Competitiveness

VAT margin scheme lowers your tax expenses, enabling your businesses to price your products more competitively. The savings allow you to offer better prices than businesses not using the scheme, attracting more buyers.

Competitive pricing is mandatory in industries where customers shop for deals. The VAT margin scheme allows sellers to provide these deals without compromising their profit margins. It’s a tax-efficient way to improve their market position and increase sales.

Eligibility Criteria for VAT Margin Schemes

VAT on margin schemes is not beneficial for all businesses. If you want to participate, both your business and the goods you sell must fulfill that specific eligibility criteria.

Let’s take a closer look at the businesses and goods that are eligible for VAT margin schemes:

Businesses Eligible for VAT on Margin Schemes

You can benefit from the VAT on Margin Scheme, but your business must be VAT-registered. While there’s no need for a special scheme registration, businesses must keep thorough records, such as a stock book and accurate invoices for both purchases and sales.

Detailed record-keeping is essential, as businesses need to report their VAT margin calculations in their VAT return accurately. Businesses that meet these criteria can enjoy tax benefits without extra administrative barriers.

Goods Eligible for VAT on Margin Schemes

Not all items qualify for the VAT Margin Scheme. Eligible goods include second-hand items, works of art, antiques, and collectibles. These items must also be acquired under specific conditions, such as from a private seller or through a VAT margin scheme dealer.

Certain products, like alcohol and livestock, are excluded from the scheme. Staying informed on these criteria helps businesses avoid compliance issues and focus on eligible inventory.

Conclusion

The VAT on Margin Scheme provides a tax-efficient way for businesses to handle second-hand goods, art, and more. Taxing only the margin allows businesses to enhance cash flow and strengthen their competitive edge.

To get the most out of the VAT margin scheme, keep accurate records and understand eligibility rules. Not only will this streamline your tax processes, but it’ll also help you avoid any potential issues with tax authorities.

Considering implementing the VAT Margin Scheme in your business? Take the first step today to enjoy better cash flow and smarter tax savings!