What Is a Memorandum of Sale for Smooth Property Transactions?

December 1, 2024

VAT on Mileage Claims

December 3, 2024VAT on Commercial Property

VAT (Value-Added Tax) on commercial property welcomes a feeling of having gotten lost inside of a tax related maze. As soon as you think you have grasped the rules some new regulation pops up, the risks can be quite high, and the complexity is through the roof.

But don’t worry! We will try to simplify the most important things so that it is useful and more entertaining. Thus, let’s explore the realm of VAT on commercial property and try to put an end to the confusion once and for all

Table of Contents

What is VAT on Commercial Property?

First things first: VAT is an abbreviation for Value Added Tax that is generally levied during production and sales with the final price being paid by the buyer. However, VAT on commercial properties and possessions is a different beast and it has quite a set of governing rules that are different sets of rules.

VAT on commercial property is a tax applied to certain transactions involving non-residential real estate. It typically applies to the sale of new commercial properties, certain commercial leases. When the landlord opts to tax, and specific property development and renovation services.

In some cases, VAT may also apply to land sales intended for commercial development. VAT rules and rates vary by region, so consulting local guidelines is essential for understanding specific obligations. Till then, here’s a brief overview of the various types of VAT on commercial property.

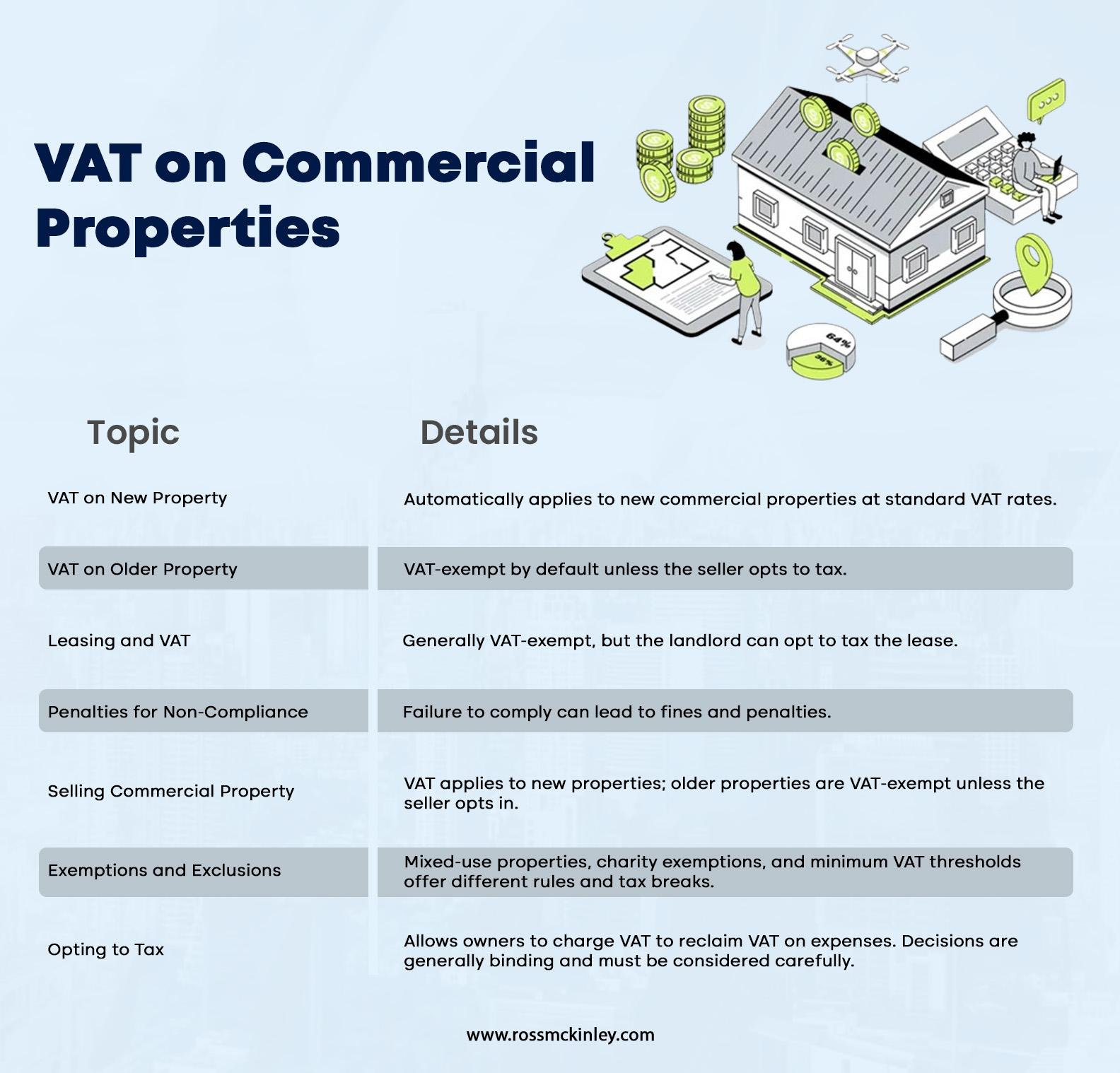

| Topic | Details |

| VAT on New Property | Automatically applies to new commercial properties at standard VAT rates. |

| VAT on Older Property | VAT-exempt by default unless the seller opts to tax. |

| Leasing and VAT | Generally VAT-exempt, but the landlord can opt to tax the lease. |

| Selling Commercial Property | VAT applies to new properties; older properties are VAT-exempt unless the seller opts in. |

| Opting to Tax | Allows owners to charge VAT to reclaim VAT on expenses. Decisions are generally binding and must be considered carefully. |

| Exemptions and Exclusions | Mixed-use properties, charity exemptions, and minimum VAT thresholds offer different rules and tax breaks. |

| Penalties for Non-Compliance | failure to comply can lead to fines and penalties. |

Types of Commercial Property Transactions and VAT

When we talk about commercial property, we’re generally looking at three main types of transactions: purchases, leases, and sales. Proper Knowledge of listed components is crucial to get into business. Let’s break it down.

1. Purchasing Commercial Property

If you’re buying commercial property, VAT doesn’t automatically apply—unless it’s a “new” property (typically less than three years old). New commercial properties usually come with VAT included at a standard rate, which varies by country (often around 20%). For older properties, VAT is only applied if the seller has opted to “charge VAT.” Why would they do that? To recover VAT they’ve previously paid on refurbishments and other expenses.

2. Leasing Commercial Property

Generally, leasing commercial property is VAT-exempt. But (there’s always a “but” with VAT), the landlord may opt to “tax” the lease if they want to reclaim VAT on their expenses. If the landlord decides to opt-in, this VAT applies to rent payments. However, it’s essential for tenants to know upfront if they’ll be shouldering this extra 20%.

3. Selling Commercial Property

Selling commercial property is similar to purchasing—new commercial buildings are subject to VAT. For older properties, the seller decides if VAT will be charged.

Each of these transactions has different implications, so it’s crucial to know the rules before signing on the dotted line.

Opting to Tax: The Magic of VAT Options

If you’re a property owner, “opting to tax” might sound like something you’d rather avoid. However, there are good reasons to consider it.

By “opting to tax,” you are making the decision to charge VAT on properties that would otherwise be exempt from VAT. This move can be strategic, allowing you to reclaim VAT on your costs associated with the property (renovations, maintenance, etc.). However, once you’ve opted in, you’re usually in for the long haul; changing your mind later isn’t simple.

Pros of Opting to Tax:

– Ability to reclaim VAT on related expenses (like upgrades or repairs).

– Flexibility if you expect your tenant or buyer to have a taxable business.

Cons of Opting to Tax:

– Can scare off potential tenants or buyers who’d rather not pay VAT.

– Adds administrative complexity—your accounting team will thank you.

Opting to tax can work wonders for cash flow, but it’s not a decision to make lightly. Consult your accountant or tax adviser to understand the implications for your situation.

Exemptions and Exclusions

There’s an entire universe of exemptions, exclusions, and special rules when it comes to VAT on commercial property. But here’s a cheat sheet of some common scenarios:

Mixed-Use Properties:

If your property has both residential and commercial areas, VAT rules differ. Generally, VAT only applies to the commercial part.

VAT Thresholds:

Some countries have minimum VAT thresholds and here’s the good part, below this amount, you’re VAT-free!

Exemptions for Charities:

Some charitable organizations may be VAT-exempt when renting or buying commercial property.

Penalties:

Remember how we said VAT can be a maze? Here’s where it gets really tricky. VAT compliance requires impeccable records, and non-compliance can result in hefty fines and even criminal charges in extreme cases. It’s not the part you want to ignore.

File Your Returns:

VAT-registered businesses must file VAT returns.

Track Your Transactions:

Every VAT-charged transaction needs documentation. That means invoices, receipts, and meticulous records.

Consult the Experts:

If you’re feeling lost, seek guidance. VAT law is dense, and professional advice can prevent costly mistakes.

Conclusion

Without a doubt, negotiating VAT on staging a commercial property can be a tall order, however, it has its own finesse. Whether you’re buying, leasing, or selling property knowing the basics helps you make informed choices.

Also, knowing about VAT on commercial property will save you from penalties which may be costly for a company’s reputation and budget. So, when you are looking to file your returns make sure to look into the exemptions and penalties for a smooth filing process.