Deciding how to get paid as a contractor? Choosing between agency PAYE and umbrella company employment can feel confusing, especially if you’re new to contracting. Each payroll method impacts your take-home pay, benefits, and employment structure in different ways.

With agency PAYE, you’re directly employed by the recruitment agency, which handles your taxes and other deductions. Umbrella companies, on the other hand, act as your employer for various contracts, offering more continuous employment and added perks.

Let’s take a close look at the differences in PAYE vs Umbrella, covering their features, costs, and benefits for both contractors and employers. This guide will help you decide which option is the best fit for your needs.

Table of Contents

What Is Agency PAYE?

Agency PAYE (Pay As You Earn) is a payroll system used by recruitment agencies to manage taxes and other deductions for contractors.

When you work through the agency PAYE, the recruitment agency becomes your employer for the duration of each contract.

They are responsible for handling all payroll-related tasks, including income tax and National Insurance (NI) deductions. One of the main advantages of agency PAYE is simplicity.

Contractors receive their pay minus tax and NI contributions, similar to standard employment. This setup also means contractors don’t need to set up a limited company or worry about managing taxes themselves.

However, agency PAYE employment ends with each contract. It could make it harder to show a continuous employment record if you’re applying for financial products like a mortgage.

In short, agency PAYE is best for those who prefer simple payroll management without the need for ongoing employment status.

Grow Your Practice with Confidence

What Is an Umbrella Company?

An umbrella company is a third-party employer that serves as an intermediary between contractors and their clients or recruitment agencies. Contractors sign up with the umbrella company, which manages administrative tasks such as invoicing, tax deductions, and payroll.

With an umbrella setup, the contractor becomes an employee of the umbrella company for the duration of their contract. One of the biggest benefits of working through an umbrella company is continuity of employment.

Contractors are technically employed by the umbrella company between contracts, making it easier to prove steady employment when applying for loans or mortgages.

Umbrella employees also gain access to statutory benefits like sick pay, maternity leave, and pensions.

However, umbrella companies usually charge a fee for their services, which is deducted from the contractor’s pay. This fee can vary between providers, so it’s essential to choose an umbrella company with transparent rates and reputable services.

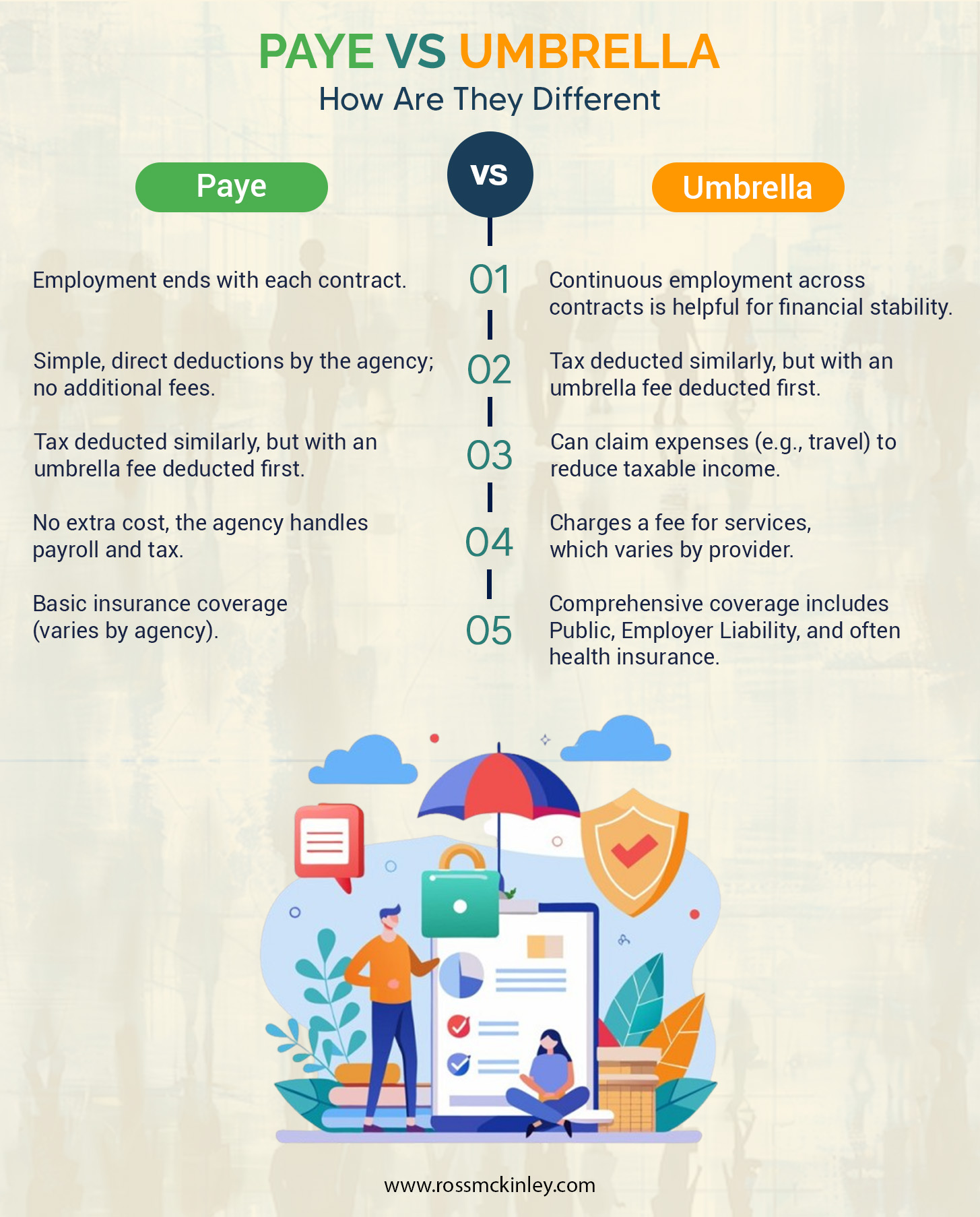

Differences Between Paye vs Umbrella

Before choosing to get paid via agency PAYE or umbrella company, you must understand the basic differences between them. Things such as cost, employment benefits, insurance, taxation, and financial control differ.

You don’t need to worry about that because we’re here to clear up the confusion. So let’s take a look at the differences between PAYE vs umbrella to make the right decision.

We will explain them in detail later on for now here are some basic differences between PAYE vs Umbrella:

| PAYE | Umbrella |

| No extra cost, the agency handles payroll and tax. | Charges a fee for services, which varies by provider. |

| Employment ends with each contract. | Continuous employment across contracts, helpful for financial stability. |

| Basic insurance coverage (varies by agency). | Comprehensive coverage including Public, Employer Liability, and often health insurance. |

| Simple, direct deductions by the agency; no additional fees. | Tax deducted similarly, but with an umbrella fee deducted first. |

| Limited control, no expenses claimed. | Can claim expenses (e.g., travel) to reduce taxable income. |

Differences in Cost

One major advantage of agency PAYE is that there’s typically no added cost. The agency handles payroll and tax deductions as part of their service to contractors, with no additional fees taken from your pay.

On the other hand, umbrella companies charge a fee for their services. This fee can vary, so it’s important to compare providers. Some umbrella companies also market higher “take-home pay” figures, which may involve questionable tax practices.

Remember, if an umbrella company’s promise sounds too good to be true, it probably may not be and could lead to tax complications.

Grow Your Practice with Confidence

Employment Benefits for Both

With agency PAYE, employment ends with each contract, which can impact your employment history. Although you’re treated as an employee for the duration of each contract, there’s no continuity of employment once the contract finishes.

Umbrella companies provide continuous employment across multiple contracts. This continuity can be valuable when applying for financial products, as it establishes a steady employment record.

Additionally, some umbrella companies offer extra benefits, such as pension plans and health insurance, which could make it a more attractive option for long-term contractors.

Provision of Insurance Difference

Some PAYE agencies include basic insurance coverage like Public Liability and Professional Indemnity, but the scope of coverage varies widely. Most umbrella companies provide comprehensive insurance packages, covering Public and Employer Liability as well as Professional Indemnity.

In many cases, additional coverage, such as health and life insurance, is also included at no extra cost. It offers peace of mind because you know that you’re protected in case of claims or accidents.

Taxation Difference

Under agency PAYE, taxes and NI contributions are directly deducted by the agency, so you receive net pay without any extra fees. However, the system is simple, as your income tax and NI are calculated based on standard rates and directly deducted from your paycheck.

With an umbrella company, the tax deduction process is similar, but the umbrella company deducts your fee before transferring your final salary. This fee reduces your take-home pay, so it’s important to understand the charges and ensure they’re reasonable.

Financial Control in PAYE vs Umbrella

One advantage of an umbrella company is the ability to claim specific expenses, such as travel or equipment, which can reduce your taxable income. These deductions could increase your take-home pay slightly if managed carefully.

However, since tax regulations change frequently, it’s essential to check current rules to ensure compliance.

Under agency PAYE, there’s less flexibility to claim expenses, and your income is processed easily. The simplicity can be an advantage, especially for those who prefer a no-fuss approach without additional paperwork or expense claims.

Conclusion

Before choosing between agency PAYE vs umbrella payroll, consider your contracting needs and lifestyle. While agency PAYE offers a simpler, fee-free structure, umbrella companies provide more flexibility, benefits, and continuous employment.

If you’re looking for straightforward payroll with no extra fees, agency PAYE is a solid choice. However, an umbrella company may be a better fit for contractors who want added benefits, expense claims, and an established employment record.

Evaluate each option’s costs, benefits, and flexibility to choose what aligns best with your professional and financial goals.