Have you ever looked at your financial reports and felt lost? You’re not the only one. Many business owners find the Balance Sheet and P&L hard to understand. These reports are essential for making good decisions but can be confusing.

Without knowing what they mean, it’s hard to see how your business is doing or what needs to be fixed. But it becomes easier to understand when you learn the differences between the Balance Sheet vs P&L.

Both statements tell you important things differently. In this guide, we’ll explain them in simple terms so you can understand your company’s finances and make better decisions.

Table of Contents

What Is a Balance Sheet?

A Balance Sheet is a financial document that reveals what a company possesses and what it owes, including assets, liabilities, and equity. Assets are everything the company owns, such as cash, inventory, or real estate.

Liabilities represent what the company is responsible for, like loans and outstanding bills. Equity is the owner’s share after paying off debts. The Balance Sheet helps people see how strong a company is financially.

A company with greater assets than liabilities indicates strong financial health. Investors and business owners look at the balance sheet to determine if the company can meet its obligations and remain stable.

Grow Your Practice with Confidence

What Is a P&L Statement?

A P&L statement, also called a Profit and Loss Statement or income statement, shows how much money a company made and spent over a certain time period, like a month or year. It lists revenue (money earned) and expenses (money spent).

The difference between them shows whether the company made a profit or lost money. The P&L helps business owners and investors see whether the company is making money or losing money.

It breaks down sales, product costs, and operating expenses. This helps them check whether the business is growing or shrinking and find ways to reduce costs or earn more.

Differences Between Balance Sheet and P&L

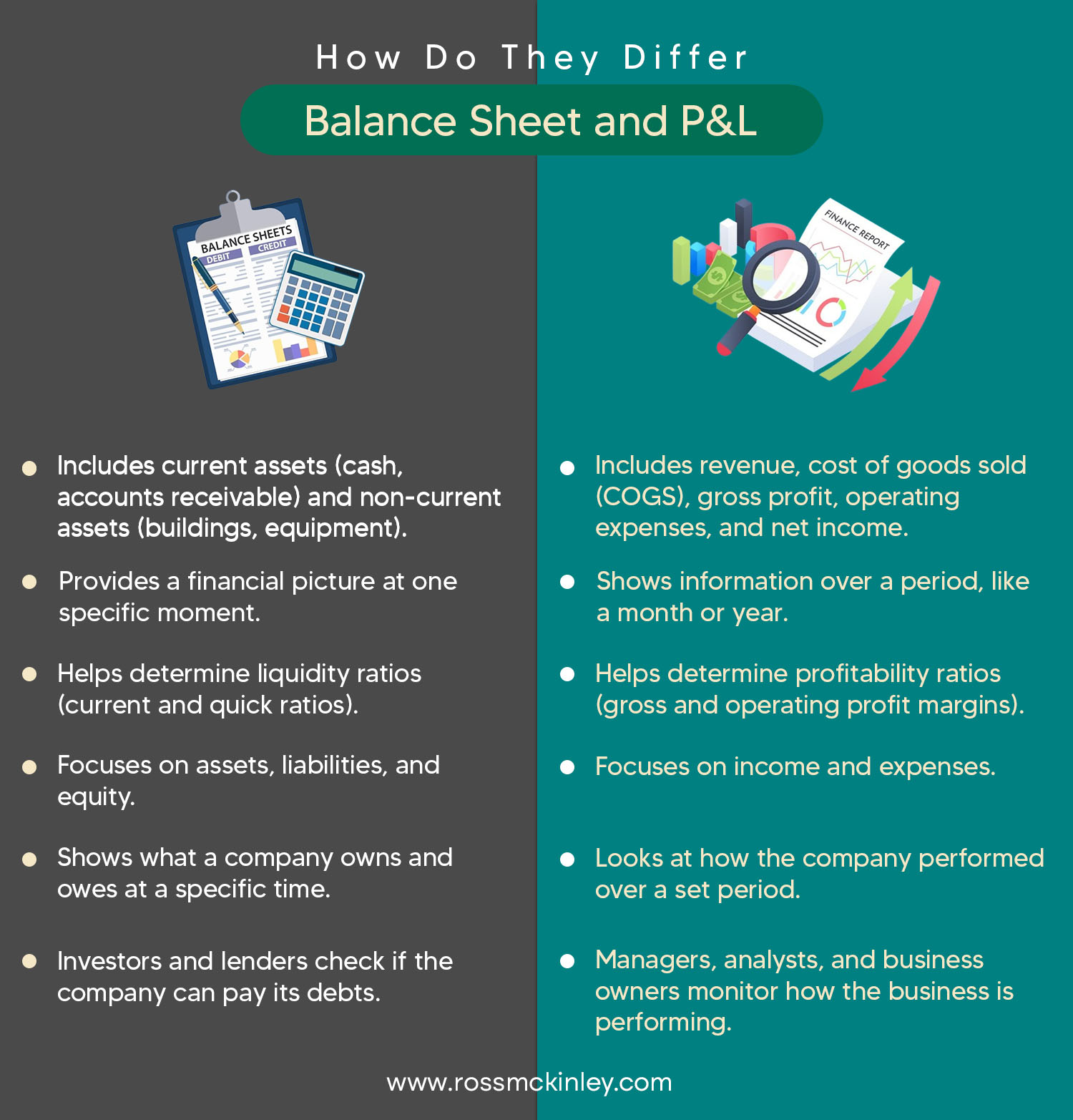

At first glance balance sheet and P&L statement might seem similar as both come in handy when understanding a company’s financial standing. However, there are some notable differences that set them apart as discussed below and outlined in the table:

| Balance Sheet | P&L |

| Shows what a company owns and owes at a specific time. | Looks at how the company performed over a set period. |

| Focuses on assets, liabilities, and equity. | Focuses on income and expenses. |

| Provides a financial picture at one specific moment. | Shows information over a period, like a month or year. |

| Includes current assets (cash, accounts receivable) and non-current assets (buildings, equipment). | Includes revenue, cost of goods sold (COGS), gross profit, operating expenses, and net income. |

| Helps determine liquidity ratios (current and quick ratios). | Helps determine profitability ratios (gross and operating profit margins). |

| Investors and lenders check if the company can pay its debts. | Managers, analysts, and business owners monitor how the business is performing. |

Purpose Of Balance Sheet and P&L

The balance sheet shows what a company owns and owes at a particular moment. It tells you, “What does the company have, and what does it need to pay right now?”

In contrast, the P&L looks at how the company performed over a set period.It tells you, “How much money did the company make, and how much did it spend during that time?”

Grow Your Practice with Confidence

Difference in Focus of Balance Sheet and P&L

The balance sheet mainly looks at assets, liabilities, and equity to provide a clear picture of the company’s financial health.

It helps you understand how stable the company is, how easily it can pay its bills, and how it is funded. On the other hand, the P&L focuses on income and expenses.

It shows how much money the company earns, what it spends, and how profitable it is over time. This information helps you see how well the company runs.

Time Frame of Balance Sheet and P&L

One big difference between the Balance Sheet and P&L is how much time they cover and how they present financial information.

The Balance Sheet gives a financial picture at one specific moment, usually at the end of a reporting period, like a quarter or a year.

However, the P&L shows information over a period, such as a month, a quarter, or a year. It tells you how much money the company made and how much profit it earned during that time.

Balance Sheet and P&L Components Difference

The balance sheet includes everything the company owns, such as current assets like cash and money owed to it (accounts receivable) and non-current assets like buildings and equipment.

Liabilities are what the company needs to pay back, divided into short-term debts and equity, which shows how much of the company belongs to the owners after all debts are paid.

The P&L, or Profit and Loss statement, includes revenue, cost of goods sold (COGS), gross profit, operating expenses, and net income. It tells you how much money the company made, what it spent, and how much profit it earned over a specific time period.

Financial Ratios of Both Balance Sheet and P&L

The balance sheet helps you determine liquidity ratios, such as current and quick ratios. These ratios help determine whether a company can pay its short-term and long-term debts.

On the other hand, the P&L enables you to determine profitability ratios, such as gross and operating profit margins. These ratios show how well the company makes money compared to its sales.

Users of Balance Sheet vs P&L

Investors and lenders look at the balance sheet to check if a company can pay its short-term and long-term debts. They want to see if the company has enough assets to cover what it owes and how much ownership the shareholders have.

On the other hand, managers, analysts, and business owners focus more on the P&L to see how the business is performing. They monitor how much money the company makes, how well it controls costs, and whether it is making a profit over time.

What Comes First, P&L or Balance Sheet?

The P&L usually gets prepared before the balance sheet because it shows whether the company made a profit or a loss. The profit or loss from the P&L is then added to the equity section of the balance sheet.

This step is important because it shows how the company’s earnings affect its financial health. So, while both reports are important, the P&L must be done first to help create the balance sheet.

Conclusion

Both the Balance Sheet and the P&L are important for understanding a business’s financial situation. The balance sheet gives a picture of the company’s financial situation at a specific time.

In contrast, the P&L explains how the company performed over time, showing its earnings and expenses. These two reports provide a full view of the business’s finances.

To manage money better, it’s important to often check the balance sheet and P&L. Also, look at key financial ratios in these reports. They can help you make smart choices to improve your business’s financial health.