Are you confused about which business structure to choose? Many business owners struggle when choosing the best legal setup. The terms “incorporated” and “corporated” might sound similar but have different meanings.

Due to the confusion, you’ll end up delaying decisions and making costly mistakes. Understanding the difference between the two helps you make smarter decisions about your business related to taxes, liability, and management.

Knowing these differences ensures you pick the proper structure and ensure smoother operations for long-term success. To help you, we’ve highlighted the differences between incorporated vs corporated, along with their meanings and examples. Give it a read!

Table of Contents

What Is Meant by Incorporated and Corporated?

An incorporated business is a legal entity that operates separately from its owners. It can own assets, enter into contracts, and take on debts without making the owners personally liable.

Incorporation provides limited liability, which protects owners from being responsible for the company’s financial obligations.

For example, Apple Inc. is an incorporated company, and its shareholders never pay if the company suffers losses or goes into debt. Another example of an incorporated business is Microsoft Corp., which also benefits from limited liability protection.

On the other hand, corporated refers to a business that is part of a group of corporations or has undergone the process of forming a corporation. Though the term “corporated” is less commonly used, it still refers to businesses that have structured themselves as corporations.

A company like Walmart is an example of a large corporation since it manages various branches and operates under a single legal entity. Another example is Procter & Gamble, which consists of multiple brands and operates as a corporate entity.

Incorporated vs Corporated – Differences

Do you find difficulty in understanding the difference between incorporated and corporated? But you don’t need to worry anymore because we have described them in detail below and have also added brief points in the table.

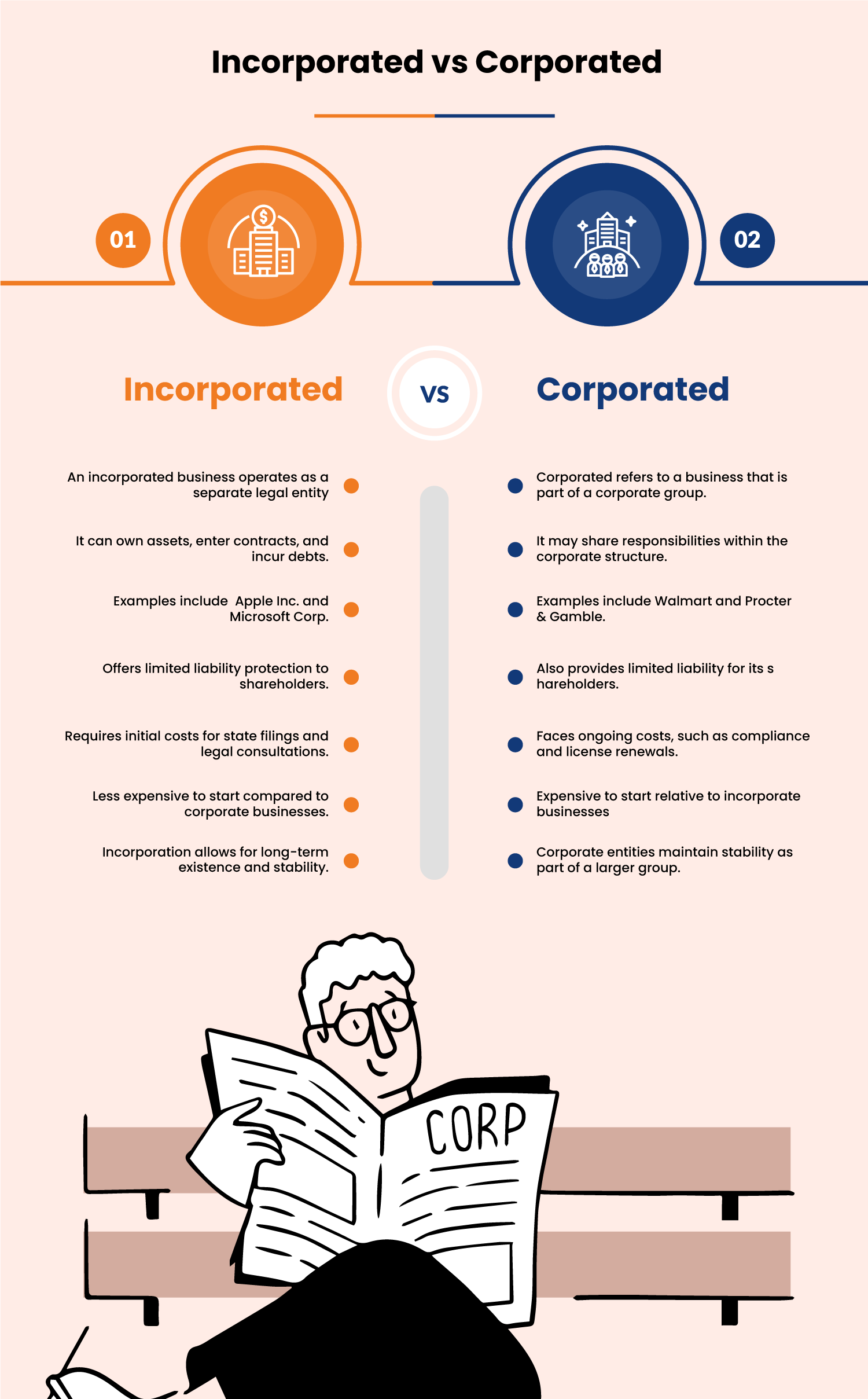

| Incorporated | Corporated |

| An incorporated business operates as a separate legal entity | Corporated refers to a business that is part of a corporate group. |

| It can own assets, enter contracts, and incur debts. | It may share responsibilities within the corporate structure. |

| Examples include Apple Inc. and Microsoft Corp. | Examples include Walmart and Procter & Gamble. |

| Offers limited liability protection to shareholders. | Also provides limited liability for its shareholders. |

| Requires initial costs for state filings and legal consultations. | Faces ongoing costs, such as compliance and license renewals. |

| Less expensive to start compared to corporate businesses. | Expensive to start relative to incorporate businesses |

| Incorporation allows for long-term existence and stability. | Corporated entities maintain stability as part of a larger group. |

Differences in Incorporated vs Corporated

If you’re in different business circles, you’d hear people mention the terms “incorporated” and “corporated .”You might think that these are similar, but that’s not the case. While both relate to business structures, understanding their differences is essential for entrepreneurs.

We’ve already covered their meaning and examples above, so here are the significant differences between incorporated vs corporated.

Grow Your Practice with Confidence

Difference in Legal Entity Status

Incorporated businesses enjoy specific rights, similar to citizens in a nation. Once a company incorporates, it can enter contracts, own assets, and raise capital. Incorporated businesses can benefit from growing and contributing to the economy.

In contrast, corporated entities operate as part of a larger corporate group. They have their responsibilities, but these are tied to the corporate structure they belong to. Incorporation transforms a business into an active entity but the change comes with both rights and duties.

Corporations must comply with regulations, pay taxes, and fulfill stakeholder commitments. Incorporation establishes a clear framework for these responsibilities, ensuring businesses act responsibly while enjoying their corporate rights.

Costs and Time Commitment

Starting an incorporated business involves costs and time. Entrepreneurs face fees for state filings and legal consultations. The incorporation process requires attention to detail, which can be time-consuming.

However, a corporate business may deal with ongoing costs, such as license renewals and compliance expenses. While these costs can add up, they often lead to operational efficiencies and potential financial benefits.

Incorporation requires significant initial investments in both money and time. Entrepreneurs must complete paperwork and wait for approvals. However, once incorporated, businesses can streamline operations.

Corporated entities also have expenses, but their established framework may allow smoother operations.

Protection From Personal Liability

Incorporation protects shareholders’ personal assets from the company’s financial issues. If an incorporated business faces debts or legal troubles, the shareholders are only liable for their investment. Hence the owners get the reassurance that their personal finances are protected.

Conversely, corporated businesses also benefit from this principle of limited liability. Shareholders in corporate entities enjoy the same protection regarding their personal assets. Incorporation acts as a barrier, separating personal finances from business liabilities. This separation offers peace of mind to business owners.

Tax Implications for Incorporated vs Corporated

The tax landscape for incorporated businesses can be complex but advantageous. C corporations, for example, face double taxation. They pay taxes on profits, and shareholders pay taxes again on dividends. However, an S corporation allows profits to pass through to shareholders’ personal tax returns, simplifying tax obligations for incorporated businesses.

The tax implications for corporate entities depend on their structure as well. Corporate businesses may also choose between C and S corporation statuses. The choice also affects how they handle taxes and could lead to savings.

Entrepreneurs should make informed decisions about their corporate structure to optimize tax outcomes.

Grow Your Practice with Confidence

Longevity and Permanence in Incorporated vs Corporated

Incorporated businesses are built to last. Unlike many other business types, they can exist independently of their owners. This design allows corporations to continue operating even when owners or managers change. For example, if a founder steps down or passes away, the company remains unharmed. Incorporation gives businesses a long-lasting identity.

On the other hand, corporate businesses also benefit from this permanence. They are part of a larger group of corporations, which enhances their stability. Corporate entities can endure shifts in ownership and management just like incorporated ones. They can use the structure to maintain their vision and goals over time.

In both cases, the ability to last beyond individual owners is a significant advantage.

Conclusion

Thus, it is important for entrepreneurs to understand the differences between incorporated vs corporate businesses. An incorporated business is a separate legal entity that provides liability protection and specific rights.

As a result, incorporated business owners can protect their personal assets while enjoying the benefits of corporate status.

Corporate entities operate as part of a larger corporate group. They also gain limited liability but have unique responsibilities tied to their structure. Both types of businesses have significant tax implications and costs associated with their operations.

Choosing the proper structure impacts your business’s success and financial health. Consider your needs and goals when deciding between incorporated and corporate options. Remember that this decision will make or break your business’s future and growth potential.

So take time, consult experts, and then take the right step!