Bookkeeping vs Payroll: What’s the Difference?

May 10, 2025

Benefits of Outsourcing Bookkeeping

May 20, 2025Bookkeeping vs Auditing: How Are They Different?

Running a business means juggling countless tasks, and managing finances is one of the trickiest. If you’ve ever mixed up bookkeeping vs auditing, don’t worry; you’re not alone.

Think of bookkeeping as the daily grind of tracking every dollar spent or earned. Auditing? That’s like the yearly check-up to ensure everything adds up.

Whether you run a cozy cafe or a growing tech startup, knowing the difference can save you time, money, and stress.

Read our blog to understand how these two roles complement each other and which one your business needs most.

Table of Contents

What is Meant by Bookkeeping and Auditing?

Before looking at their differences, let’s first understand bookkeeping and auditing:

Bookkeeping tracks daily financial transactions, such as sales, purchases, payroll, and expenses. Bookkeepers ensure that financial records are precise and continuously updated. Their detailed work forms the base for all financial reports.

Accurate records help businesses understand cash flow and make wise decisions. For example, a bookkeeper might track monthly rent payments or record sales from an online store, ensuring nothing gets ignored.

On the other hand, auditing is a systematic review of financial statements and practices. Auditors evaluate the accuracy and reliability of financial records to identify any errors or discrepancies.

Auditing typically happens after the financial records are prepared, providing a final check to verify their accuracy and legitimacy. Auditors may also assess the effectiveness of internal controls and offer recommendations for improvement.

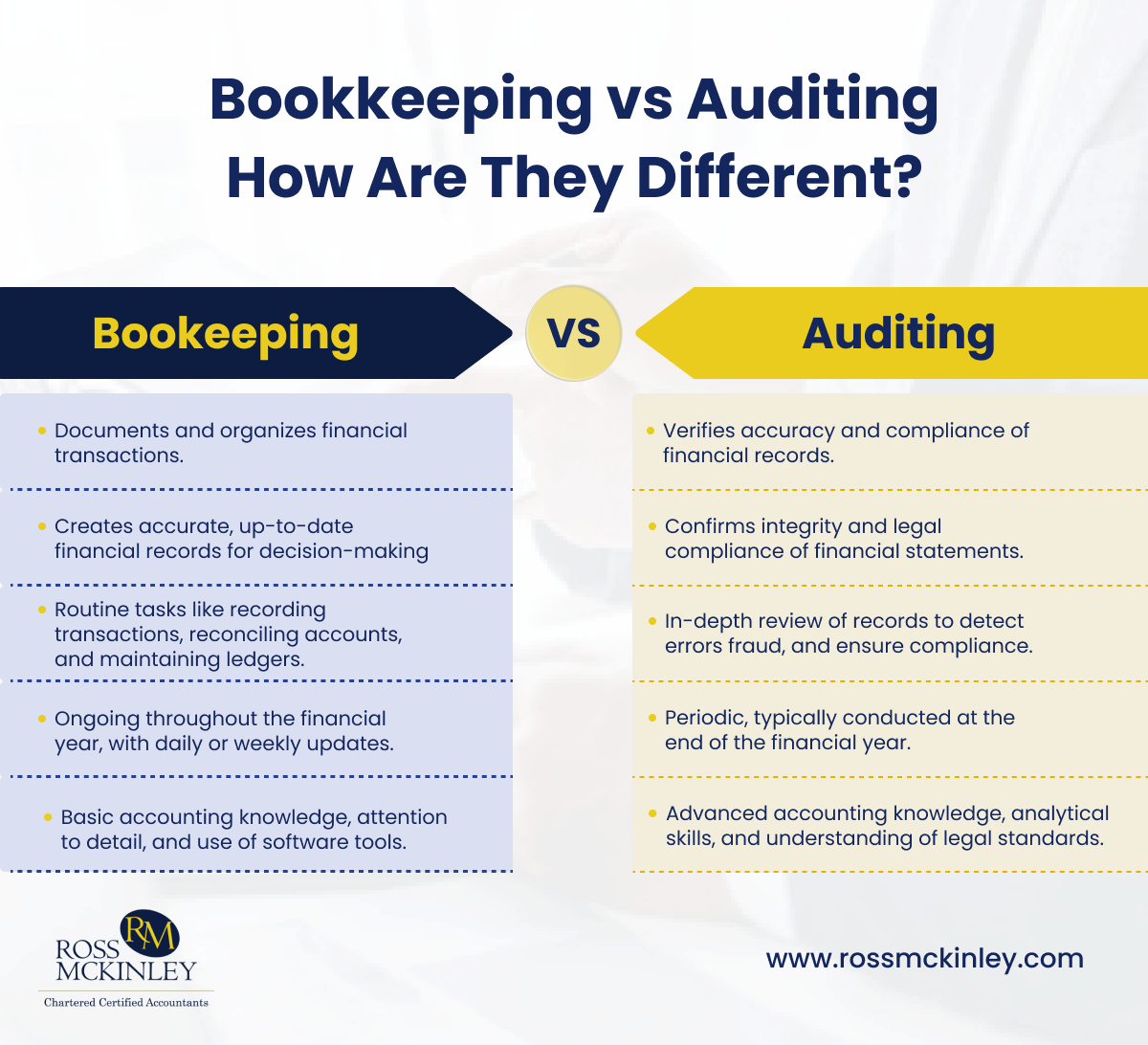

Differences Between Bookkeeping vs. Auditing

Understanding the differences between bookkeeping vs auditing can help you manage your finances effectively. Bookkeeping focuses on recording daily financial transactions, while auditing ensures those records are accurate and compliant.

Here’s a closer look at the differences between bookkeeping and auditing:

| Bookkeeping | Auditing |

| Documents and organizes financial transactions. | Verifies accuracy and compliance of financial records. |

| Creates accurate, up-to-date financial records for decision-making. | Confirms integrity and legal compliance of financial statements/ |

| Routine tasks like recording transactions, reconciling accounts, and maintaining ledgers. | In-depth review of records to detect errors fraud, and ensure compliance. |

| Ongoing throughout the financial year, with daily or weekly updates. | Periodic, typically conducted at the end of the financial year. |

| Basic accounting knowledge, attention to detail, and use of software tools. | Advanced accounting knowledge, analytical skills, and understanding of legal standards. |

Main Role

The central role of bookkeeping is to document and organise financial transactions. Bookkeepers handle tasks like recording sales, tracking expenses, and managing invoices. Their work ensures that financial data is ready for analysis.

For example, a bookkeeper might enter daily sales data into a financial software system. Their work ensures that financial data is ready for analysis and that all transactions are correctly recorded for future reference.

Auditing has a broader scope. Auditors review the financial records prepared by bookkeepers, checking whether they are accurate and follow accounting standards. They also ensure that the records align with laws and regulations.

For example, an auditor may examine a company’s tax filings to verify compliance with tax laws. Auditors may also find mistakes, errors, or fraudulent activity. They provide an independent review to ensure the financial data is reliable and trustworthy.

Difference in Objectives

Bookkeeping focuses on creating accurate, up-to-date financial records. For example, a bookkeeper might enter daily sales transactions into a ledger and track monthly expenses.

Business owners can use that data to make informed decisions, such as budgeting, forecasting, or planning for growth. Proper bookkeeping ensures that financial information is readily available for operational needs and helps the business stay organized.

On the other hand, auditing aims to verify the integrity of those records. Auditors check whether the financial statements are accurate and meet legal requirements, such as compliance with tax laws or accounting standards.

For example, an auditor may examine a company’s financial records to ensure that all income and expenses are reported correctly. Auditors also evaluate internal controls to ensure efficient, secure, and fraud-free financial processes.

Scope of Work

Bookkeeping involves routine tasks performed daily or weekly. These include recording transactions, reconciling accounts, and maintaining ledgers.

For example, a bookkeeper might update a company’s sales and expense records daily. Bookkeeping ensures a smooth flow of financial information.

Auditing, however, is a more in-depth process. It examines financial records to detect errors or irregularities. Auditors may also review policies, systems, and methods to ensure compliance.

For example, an auditor may check whether a company’s expenses are recorded correctly. This broader scope makes auditing a periodic activity, unlike bookkeeping, which is ongoing.

Timeline of Tasks

Bookkeeping is an ongoing activity throughout the financial year. Bookkeepers update daily, weekly, or monthly records to keep financial data current. For example, a bookkeeper might record daily sales and expenses.

Regular updates help businesses track performance and prepare for tax filings. Accurate bookkeeping also ensures that financial reports are up-to-date and ready when needed.

Auditing occurs periodically, often at the end of a financial year. Auditors conduct their reviews after the books are closed. They examine the complete set of financial records to ensure accuracy.

Auditors may also assess internal controls and processes. Their work provides an independent evaluation of financial accuracy and compliance. So, while bookkeeping is a continuous process, auditing happens in intervals.

Skills and Requirements

The skills required for bookkeeping or auditing differ based on their responsibilities. Bookkeepers must have a solid grasp of basic accounting principles and a keen eye for detail as they manage financial transactions daily.

Bookkeepers also use software tools to streamline their tasks. Their ability to stay organized helps ensure that records are accurate and up to date.

Auditors require advanced accounting knowledge and analytical skills. They must also understand legal standards and compliance regulations. Critical thinking and problem-solving abilities are necessary for finding errors or irregularities.

Auditors also need excellent communication skills to explain their findings clearly. In short, auditors require more expertise than bookkeepers.

Conclusion

Understanding the differences between bookkeeping vs auditing can help you make smarter business decisions.

Bookkeeping keeps your financial records well-organized and current, while auditing confirms their accuracy and ensures they meet legal requirements.

Are you struggling with messy financial records or worrying about compliance issues? Ross Mckinley can help. With our specialized bookkeeping and auditing services, we craft solutions that fit your business like a glove.

From accurate financial records to thorough audits, we ensure your finances are in perfect order. Get in touch today, and let’s make managing your finances stress-free.