VAT on New Build

December 14, 2024

Specialised Bookkeeping Tips for Restaurants and Hospitals

January 22, 2025C Corporation vs S Corporation: How Do They Differ?

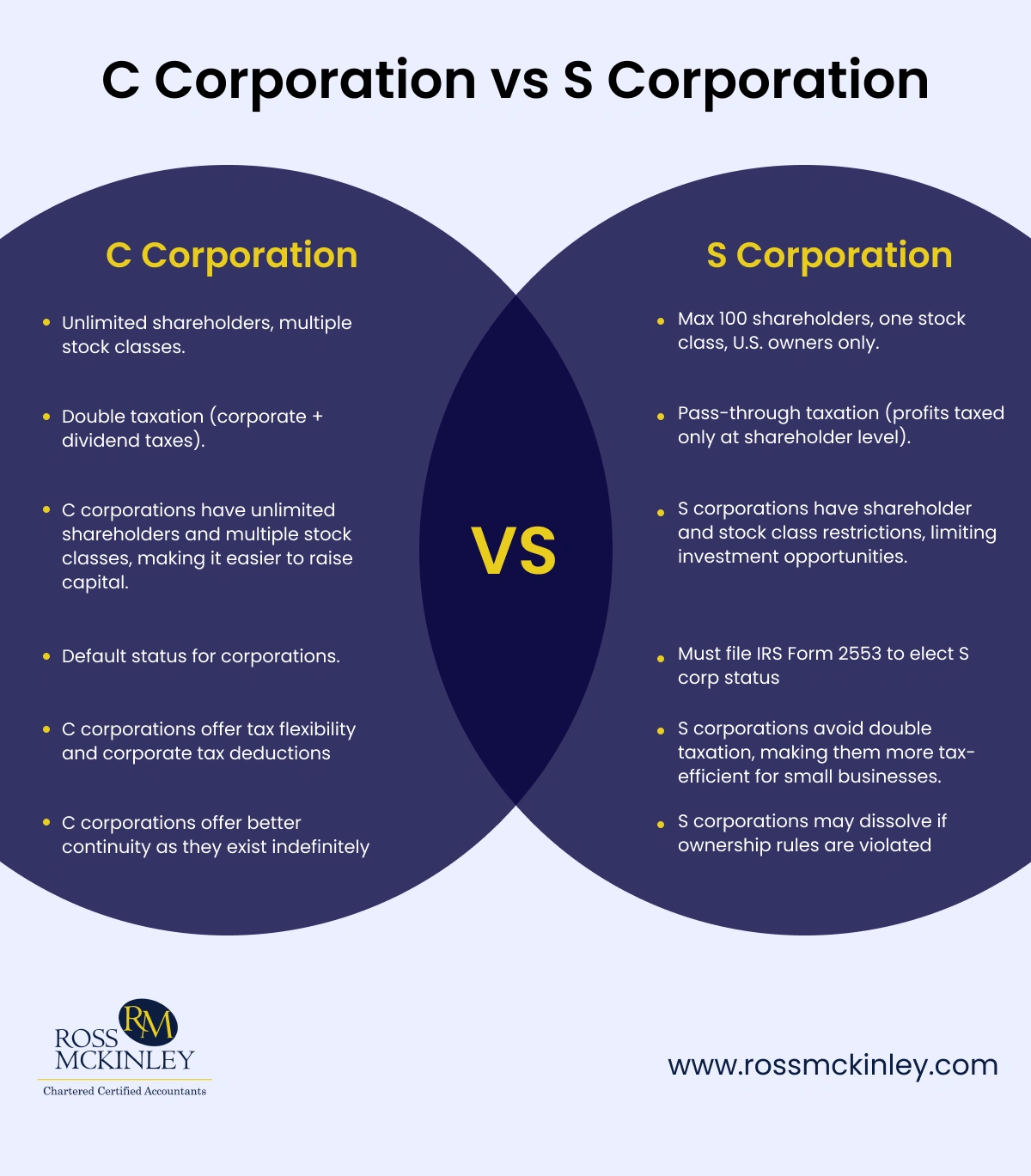

Do you find choosing between a C corporation and an S corporation for your business confusing? Selecting the right structure can shape your business’s future, as well as legal taxes. Making the wrong choice, however, can lead to unnecessary challenges and complications.

C corporation and S corporation are two kinds of corporations that are entirely different from each other. Thus, understanding the differences between these two structures is essential for your business’s success.

Our latest blog explores the major differences and benefits of a C corporation vs S corporation. Read it to the end to gain a clearer picture of which structure best aligns with your business goals.

Table of Contents

What Is a C Corporation vs S Corporation?

A C corporation is a corporate structure business often chosen for tax, legal, or regulatory advantages. It offers several tax benefits and has a clear leadership setup, where shareholders elect a board of directors to manage operations.

On the other hand, an S corporation is a special type of corporation under the IRS code’s subchapter S. Unlike a C corporation, it allows income, losses, deductions, and credits to pass through to shareholders, avoiding double taxation.

Differences Between C Corporation and S Corporation

Do you want to know the difference between C corporation and S corporation difference? Here are the major differences between these two corporations:

| Differences | C Corporation | S Corporation |

| Ownership | Unlimited shareholders & multiple stock classes.Easier to attract investors & raise capital. | Limited to 100 shareholders & one stock class.Only U.S. citizens and certain entities can own shares. |

| Taxation | Subject to double taxation (corporate and dividend taxes).Files taxes using Form 1120 with corporate deductions. | Profits pass through to shareholders, avoiding double taxation.Shareholders report income on personal tax returns via Form 1120-S. |

| Formation | All corporations start as C corporations by default.No additional IRS filing is required. | Must file IRS Form 2553 for S corp status.Filing deadlines depend on fiscal year timing. |

Ownership

When comparing C Corporation vs S Corporation, ownership rules differ significantly. A C corporation offers more flexibility, allowing unlimited shareholders and multiple classes of stock. This makes it easier to attract investors and raise capital without giving up voting rights.

However, an S corporation has strict limits, such as a maximum of 100 shareholders and only one class of stock. Additionally, S corps cannot have shareholders who are non-U.S. citizens or entities like LLCs, partnerships, or other corporations. These restrictions can make it harder for S corps to grow or attract diverse investors.

Taxation

Taxation is a major factor when choosing between a C corporation and S corporation. C corps face double taxation, where the corporation pays taxes on profits, and shareholders pay taxes again on dividends. This can reduce overall earnings for both the business and its owners. However, C corps file taxes using Form 1120 and may benefit from certain corporate tax deductions.

S corps, on the other hand, avoids double taxation by passing profits directly to shareholders, who report them on their personal tax returns using Form 1120-S. This pass-through taxation can save money for small businesses. However, some states still tax S corps at both levels, so it’s essential to consider location when making your decision.

Formation

According to IRS rules, all corporations start as C corporations when formed. To become an S corporation, a business must file IRS Form 2553, Election by a Small Business Corporation. This change allows the company to enjoy the tax benefits of an S corporation while maintaining limited liability protection.

Timing is important for this conversion since Form 2553 must be filed by March 15 of the desired tax year for calendar-year corporations. Fiscal-year corporations have until the 15th day of the third month of their fiscal year. This flexibility allows businesses to choose the best structure based on their growth stage and tax goals.

Benefits of C Corporation vs S Corporation

So now you’ve understood the differences between both, but still understanding their benefits can help you make the right decision. Here are the benefits of C corporation vs S corporation:

Unlimited Growth Potential and Investment Opportunities

A C corporation offers unlimited growth potential, as it can have unlimited shareholders and issue multiple stock classes. Thus, attracting investors and raising capital for expansion becomes easier.

On the other hand, an S corporation has strict shareholder limits and only one stock class, which can restrict growth. For businesses aiming to scale or go public, a C corporation is often the better choice.

Tax Flexibility and Business Expense Deductions

C corporations provide tax flexibility, allowing businesses to reinvest profits and take advantage of corporate tax deductions. However, they face double taxation on profits and dividends.

S corporations avoid double taxation by passing income directly to shareholders, who report it on personal tax returns. This makes S corporations more tax-efficient for small businesses, but C corporations may benefit from lower corporate tax rates in some cases.

Stronger Liability Protection and Business Continuity

Both C corporations and S corporations offer strong liability protection, protecting owners from personal responsibility for business debts. However, C corporations often provide better business continuity, as they can exist indefinitely, regardless of ownership changes.

While S corporations also offer protection, they may be dissolved if ownership rules are violated. For long-term stability, a C corporation is often the more reliable option.

How Does Ross Mckinley Help You Choose and Manage Your C or S Corporation?

At Ross McKinley, our Corporation Tax Advisory service is your go-to solution for choosing and managing a C or S corporation.

Our experts guide you through the tax benefits and implications of each structure, helping you make the best decision for your business. We’ll support you so you can optimise taxes, ensure compliance, and fulfil your business goals.

Conclusion

Choosing between a C corporation vs S corporation depends on your business goals, growth plans, and tax preferences. C corporations offer flexibility and growth potential but face double taxation, while S corporations provide tax savings but come with ownership restrictions.

When deciding, consider factors like shareholder limits, tax implications, and long-term goals. To deal with these complexities, consult a tax advisor or legal expert. Remember, the right structure can help you save money, protect your assets, and support your business’s growth.