As we approach the tax season, many business owners find themselves scrambling to gather their financial documents and organize their accounts. It’s no surprise that taxes can be a headache for many — after all, the complexity of tax laws, deductions, and deadlines can be overwhelming.

But there’s a solution that can make this process much smoother: a professional bookkeeper. You might be thinking, “Isn’t bookkeeping just about keeping records and numbers in order?” While that’s true, the role of a bookkeeper goes far beyond simple record-keeping. In fact, bookkeepers are key players in the tax preparation process, and they can save you time, money, and stress by ensuring your financial records are in tip-top shape. Let’s dive into the vital role bookkeepers play in tax preparation, and highlight why hiring a professional bookkeeper is one of the smartest decisions you can make for your business.

Table of Contents

Role of Bookkeepers In Tax Preparation

At its core, bookkeeping involves the systematic recording, organizing, and managing of financial transactions. Bookkeepers handle daily tasks such as entering sales, tracking expenses, reconciling bank statements, and preparing financial statements.

But a good bookkeeper doesn’t just record transactions and call it a day. They go above and beyond by ensuring that everything is good to go. Now that we have a clear understanding of what bookkeepers do, let’s focus on their role in tax preparation.

You might not realize it, but your bookkeeper is often the first line of defense when it comes to managing taxes effectively. Here how.

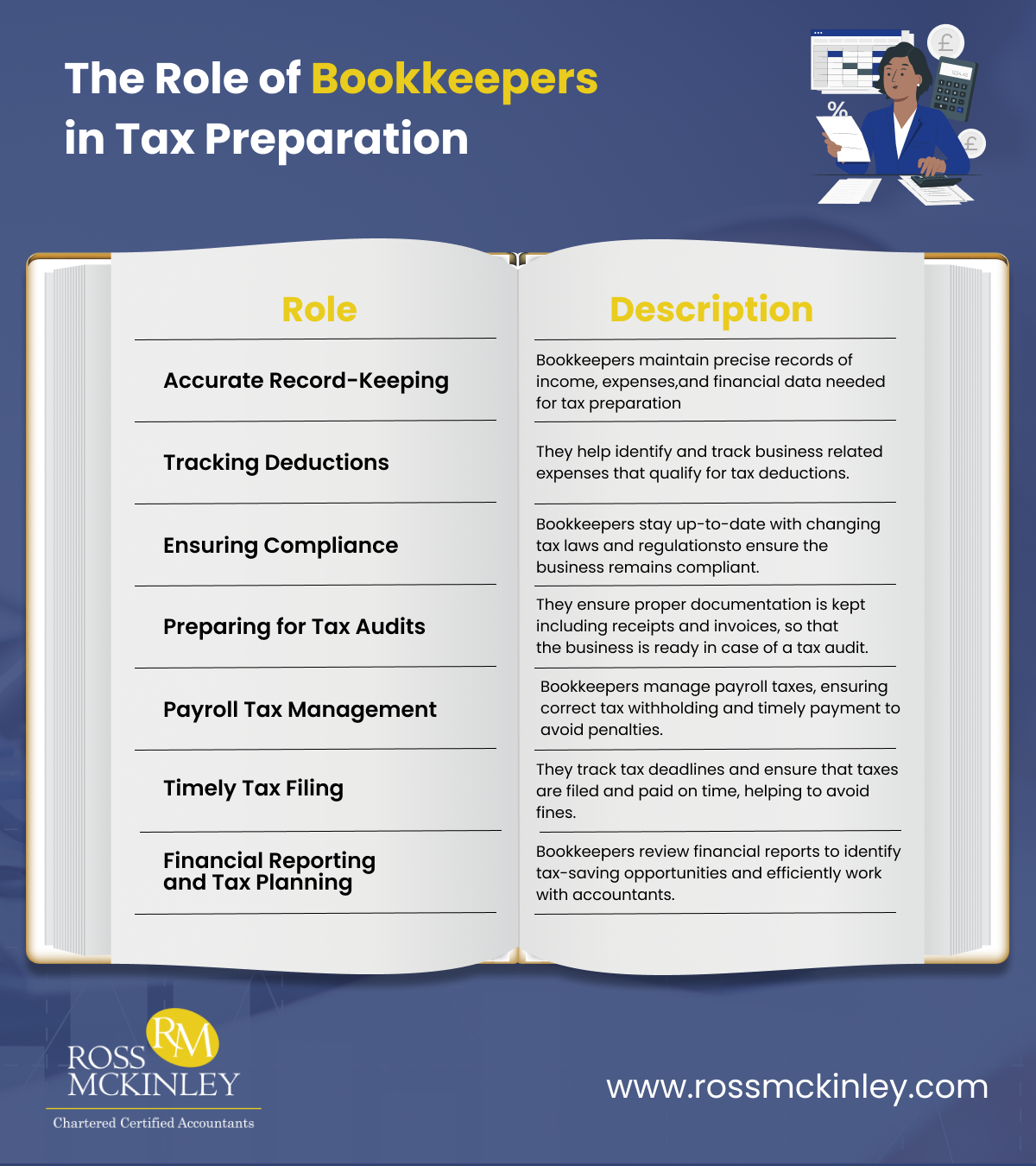

| Role | Description |

| Accurate Record-Keeping | Bookkeepers maintain precise records of income, expenses, and financial data needed for tax preparation |

| Tracking Deductions | They help identify and track business-related expenses that qualify for tax deductions. |

| Ensuring Compliance | Bookkeepers stay up-to-date with changing tax laws and regulations to ensure the business remains compliant. |

| Preparing for Tax Audits | They ensure proper documentation is kept, including receipts and invoices, so that the business is ready in case of a tax audit. |

| Payroll Tax Management | Bookkeepers manage payroll taxes, ensuring correct tax withholding and timely payment to avoid penalties. |

| Timely Tax Filing | They track tax deadlines and ensure that taxes are filed and paid on time, helping to avoid fines. |

| Financial Reporting and Tax Planning | Bookkeepers review financial reports to identify tax-saving opportunities and efficiently work with accountants. |

1. Accurate Record-Keeping

One of the main responsibilities of a bookkeeper is maintaining accurate and organized financial records. This is crucial when it comes to tax time because the HMRC requires precise records to ensure taxes are filed correctly.

Bookkeepers track income, expenses, assets, liabilities, and other financial data. They categorize transactions and keep everything organized, making it easier for accountants to prepare tax returns.

2. Tracking Deductions

One of the most important roles a bookkeeper plays in tax preparation is helping business owners track and maximize deductions. Deductions can significantly reduce taxable income, which means lower tax liabilities.

Bookkeepers know exactly what expenses qualify for deductions such as business-related travel, office supplies, and utilities. They will ensure that expenses are accurately recorded and categorized.

3. Ensuring Compliance

Tax laws are constantly changing, and staying compliant with those laws is vital for avoiding penalties. Bookkeepers help businesses stay up-to-date with these changes and ensure that they are following the correct tax regulations.

For instance, a bookkeeper may be responsible for keeping track of VAT (Value Added Tax) payments, sales tax, and payroll taxes.

By regularly reviewing financial records and comparing them to current tax regulations, a bookkeeper can prevent errors and ensure that your business remains in good standing with tax authorities.

4. Preparing for Tax Audits

Another crucial aspect of tax preparation is being audit-ready. Tax audits can happen for various reasons, and while they’re not something anyone looks forward to, proper documentation can make the process much smoother.

Bookkeepers ensure that all financial records are thoroughly documented and that receipts, invoices, and other supporting documents are kept organized and easily accessible

5. Payroll Tax Management

Payroll taxes are an essential component of tax preparation, especially for businesses that have employees. A bookkeeper plays a key role in managing payroll, ensuring that the correct amount of taxes is withheld from employee paychecks and that all payroll taxes are paid on time.

Failure to manage payroll taxes properly can result in penalties or hefty fines.

6. Timely Tax Filing

Missed deadlines can lead to hefty fines and penalties, which can be especially harmful for small businesses. Bookkeepers ensure that important tax deadlines are met, such as quarterly estimated tax payments, payroll tax deadlines, and the annual filing of income tax returns.

They help by keeping track of these deadlines and alerting the business owner or accountant when a payment or filing is due.

7. Financial Reporting and Tax Planning

In addition to preparing for taxes, bookkeepers play an important role in financial reporting and tax planning. Financial reports such as the balance sheet, income statement, and cash flow statement provide insights into a business’s overall financial health.

By reviewing these reports, a bookkeeper can help identify potential tax-saving opportunities or areas where a business might be overpaying. By working closely with accountants and tax preparers, bookkeepers ensure that financial records are ready for tax filing and that all tax-related matters are handled efficiently.

The Benefits of Hiring a Bookkeeper for Tax Preparation

So, We saw the roles bookkeepers play to get our financial records tip-top. Let’s look at some of the benefits of hiring a professional bookkeeper for your tax needs:

1. Saves Time

Filing taxes can be a time-consuming process, especially for business owners who are juggling many responsibilities. By hiring a bookkeeper, you can save valuable time and focus on growing your business.

2. Reduces Stress

Tax preparation can be stressful, but having a bookkeeper by your side can reduce that stress. With a bookkeeper handling your records and tax-related tasks, you can rest easy knowing that everything is being managed professionally and accurately.

3. Maximises Deductions

A bookkeeper’s knowledge of tax laws and available deductions can help maximise your savings. By properly categorising and tracking expenses, they can ensure that you take advantage of all available deductions, which can significantly reduce your tax liability.

Conclusion

The role of bookkeepers in tax preparation cannot be overstated. From ensuring accurate record-keeping to maximizing deductions, bookkeepers provide invaluable support during tax Preparation. They help businesses stay compliant with tax laws, avoid penalties, and file their taxes on time. With their expertise, you can rest assured that your finances are in good hands.

So, if you’re not already working with a bookkeeper, Feel free to contact Ross McKinley. With a team of experienced professionals dedicated to your financial success, Ross McKinley can handle the intricacies of bookkeeping, leaving you with more time to do what you do best—run your business.