Managing money in the real estate world can feel like trying to juggle too many balls at once. From tracking rental income to figuring out where all those expenses went, things can quickly get messy. And let’s face it, financial chaos isn’t just frustrating, it can cost you big time. But here’s the good news: it doesn’t have to be that way.

This guide is here to help you untangle the confusion, focus on what truly matters, and keep your bookkeeping in check. Whether you’re a seasoned pro or just getting started, you’ll learn exactly what to track and how to stay on top of your finances without breaking a sweat.

Table of Contents

Why is Bookkeeping Crucial in Real Estate?

Without tracking your revenues and expenses in real estate, you’re pretty much flying blind. Solid bookkeeping gives you a clear view of your cash flow, so you can make smarter decisions. Plus, it takes the stress out of tax season. But it’s not just about avoiding headaches—solid bookkeeping helps you stay compliant with laws and regulations, avoiding costly legal issues down the road.

However, in the long run, accurate records provide the foundation for growth, whether you’re looking to scale your investments, secure loans, or just understand where your money is really going. Proper financial management is what separates successful real estate pros from those struggling to keep up.

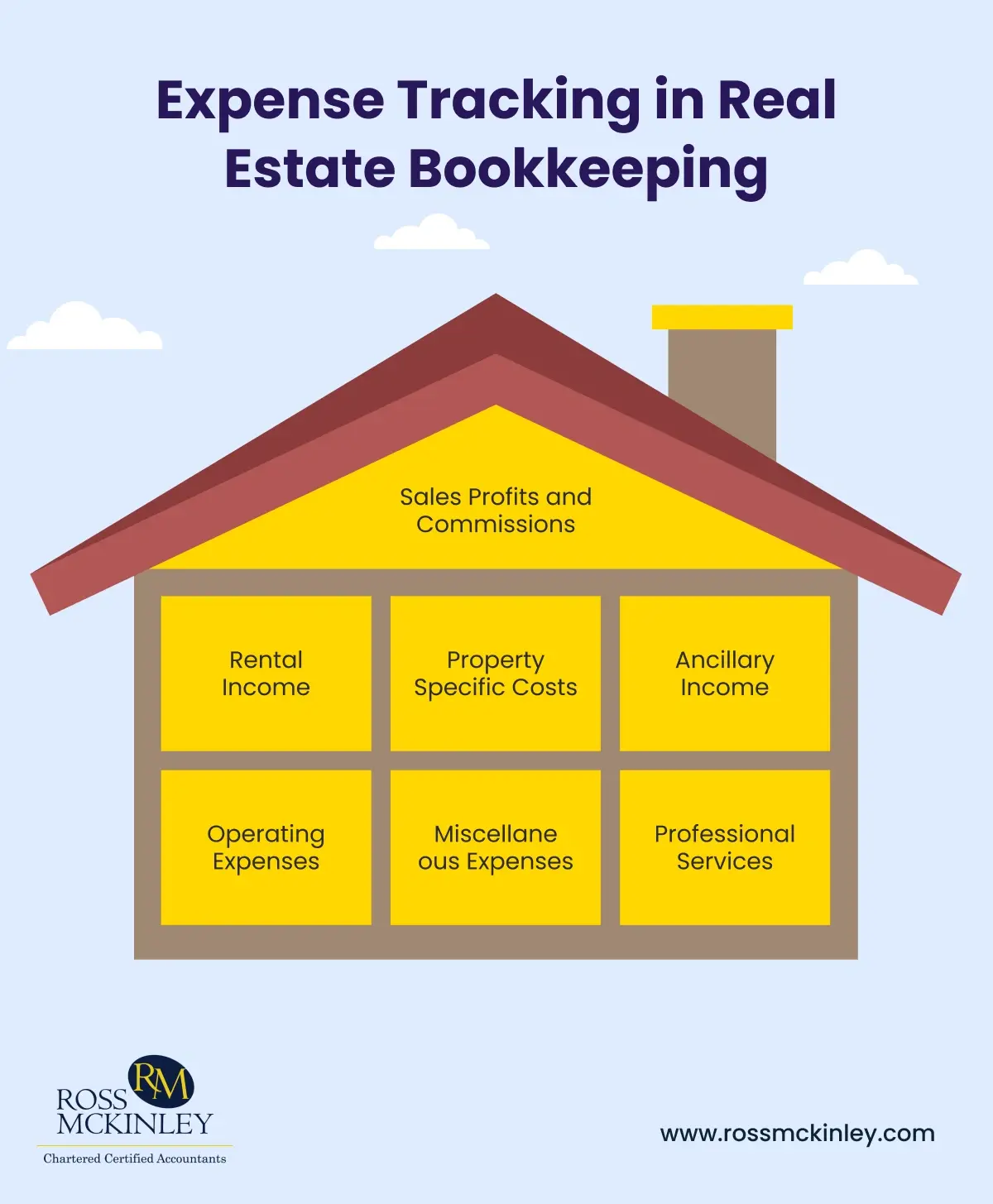

| Rental Income | Sales Profits and Commissions | Ancillary Income | Operating Expenses | Property Specific Costs | Professional Services | Miscellaneous Expenses |

What to Track In the Must-Know Revenues and Expenses in Real Estate

When you’re handling your real estate finances, knowing what to track is half the battle. The key is identifying the revenue streams and expenses that actually make a difference to your bottom line. Here’s how to break it down for both: Revenues and Expenses.

1. Rental Income:

If you’re renting out properties, this is the big one. Every month, track your lease payments, yes, even those late fees that can add up. Also, be sure to note any deposits, as they might impact cash flow.

Grow Your Practice with Confidence

2. Sales Profits and Commissions:

If you’re flipping properties or selling on behalf of clients, your sales income is vital. Track the profits from each sale, along with any commissions you earn. This isn’t just about what you make, it’s about knowing what’s working and what’s not.

3. Ancillary Income

Real estate offers all kinds of side income opportunities. This might be from property management fees or offering consulting services. Whatever it is, don’t forget to record those extra earnings as well.

4. Operating Expenses:

Operating expenses are essential, too. They are the ongoing costs of keeping your business running. You’ve got things like marketing expenses (ads, flyers, etc.), utilities, office supplies, and software subscriptions. They can quickly add up, so make sure you’re keeping track of every penny.

5. Property-Specific Costs:

From routine maintenance to property taxes and insurance, these are the costs tied directly to each property. If you own multiple places, keeping them separate is key. Some properties will be more expensive to maintain than others, and knowing that gives you better control over your budget.

6. Professional Services:

Real estate isn’t a one-person show. Lawyers, accountants, and consultants all play a role in keeping your business running smoothly. Track their fees, and keep those costs in check.

7. Miscellaneous Expenses:

Travel costs for property visits, educational courses to sharpen your skills, and even client dinners or meetings, these little expenses often get overlooked, but they can add up. Keep them recorded too, so you’re not left wondering where your money went.

Grow Your Practice with Confidence

How to Track Expenses and Revenues Efficiently

Okay, so you know what you need to keep an eye on, but now it’s time to make sure you’re tracking it right. Everything needs to be organized. Here are some practical ways to do it efficiently:

1. Use of Software:

Tools like QuickBooks, Buildium, and Stessa are designed specifically for real estate professionals and can help you stay on top of your finances with ease. These programs automatically categorize your transactions and generate reports, so you don’t have to do everything manually.

QuickBooks is great for handling both personal and business finances, Buildium is perfect if you’re managing rental properties, and Stessa is free and ideal for tracking rental income and expenses. You can choose the one that fits your needs and stick with it.

2. Create a Chart of Accounts:

One of the best ways to stay organized is by setting up a Chart of Accounts. This is a simple list of categories for your income and expenses, which helps you easily classify and track each transaction.

For example, under revenues, you can have categories like rental income, sales commissions, and ancillary income (like property management fees).

For expenses, categories can include operating costs (marketing, utilities), property maintenance, and professional fees. This way, everything has a place, and you can quickly find what you’re looking for.

3. Digital Record Keeping:

There are days when you keep shoe boxes full of receipts. With cloud-based storage, you can scan and store all your receipts and invoices digitally. You can use apps like Expensify or just take photos with your phone.

This helps you stay organized and keeps your records accessible if you ever need them for tax season or audits. Plus, it’s way more eco-friendly!

4. Regular Updates:

One of the best ways to keep your finances in check is to update your records regularly. Don’t wait until the end of the month or year to enter everything at once.

Set a timer for 10 minutes a day or a half-hour once a week to go through your transactions. It might feel like a small thing, but doing it consistently will save you time and headaches in the long run.

Conclusion

At the end of the day, bookkeeping isn’t just a chore, it’s the backbone of every business. Now that you know the key steps to track your real estate revenues and expenses, it’s time to get started.

Proper bookkeeping can make all the difference in boosting your profits and avoiding headaches down the line. However, if you’re looking for professional help with your real estate finances, we’re here for you at Ross Mckinely.