Value-added tax is a tax added to the price of goods and services. While primarily applied to sales of new goods and services, it can also impact the sale of second-hand vehicles, particularly when sold by businesses.

Let’s talk about the joy of buying a used car. The thrill of finding a pre-loved vehicle that fits your budget and style is unmatched. But wait, there’s a catch – VAT. Yes, that pesky tax can even rear its ugly head when you’re buying a second-hand car.

The general rule is to pay 20% VAT when buying something that is included in the price, but is there VAT on a used car, or second-hand car? In this article, we will discuss whether there is a VAT on used cars, how to calculate VAT on a used car, and the difference between VAT on a dealer and VAT on a private seller when buying a used car.

Table of Contents

What is VAT on Second-Hand Vehicles?

VAT on second-hand vehicles refers to the Value Added Tax applied when buying or selling pre-owned cars, motorcycles, or other vehicles. In many countries, VAT isn’t directly applied to private sales between individuals, as these are typically exempt. However, when buying from a registered dealer, VAT may be included in the sale price.

Dealers often use the “margin scheme” to calculate VAT, which applies only to the profit margin (the difference between the purchase and sale price) rather than the total sale price. This ensures buyers aren’t double-taxed on the vehicle’s original value.

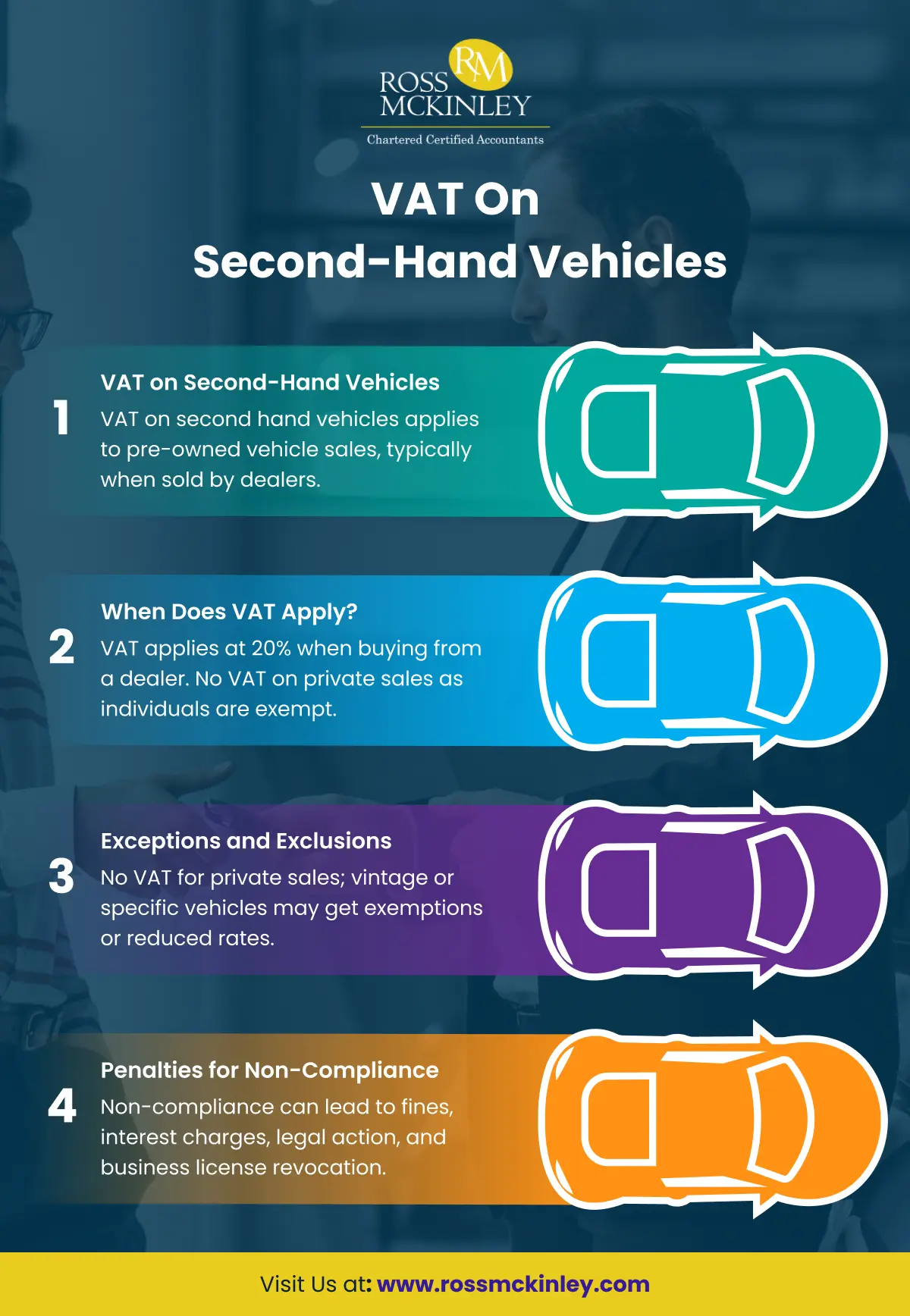

| VAT on Second-Hand Vehicles | VAT on second hand vehicles applies to pre-owned vehicle sales, typically when sold by dealers. |

| When Does VAT Apply? | VAT applies at 20% when buying from a dealer. No VAT on private sales as individuals are exempt. |

| Exceptions and Exclusions | No VAT for individual sellers, Vintage cars may be VAT-exempt, Some countries offer reduced VAT rates for specific vehicles. |

| Penalties for Non-Compliance | Non-compliance can lead to fines, interest charges, legal action, and business license revocation. |

When Does VAT Apply to Used Cars?

The quick explanation is that used autos typically have VAT. However, the precise conditions of the sale may affect the amount of VAT that is applicable.

Generally speaking, you will be required to pay VAT at the regular rate of 20% when purchasing a used car from a dealer. This is because the dealer is required to charge VAT on their sales as they are regarded as a business.

VAT will still be applied on cars that are pre-registered, meaning they have never been owned and registered to a specific person. This is because, despite the fact that it might not be a conventional dealership and that it still has a comparatively low delivery mileage, the automobile has officially been sold by a business.

Grow Your Practice with Confidence

Exceptions and Exclusions

While Value-Added Tax (VAT) is generally levied on the sale of goods and services, its application to second-hand vehicles can be more complex.

Let’s dive into the nuances of VAT on second-hand vehicles, exploring the exceptions and exclusions that may apply. Not all second-hand vehicle sales are subject to VAT. Some common exceptions and exclusions include:

- Private Sales

When individuals sell their personal vehicles, VAT is generally not applicable. This is due to the fact that individual sellers are exempt from VAT as they are not regarded as enterprises. In this instance, you won’t pay any extra taxes. Just the car’s MSRP.

- Exempt Goods

Certain types of vehicles, such as vintage or classic cars, may be exempt from VAT.

- Reduced Rates

Some countries may offer reduced VAT rates for specific types of used vehicles.

Penalties for Non-Compliance

Non-compliance with VAT regulations for second-hand vehicle sales can lead to severe consequences. Penalties can vary depending on the jurisdiction and the severity of the violation.

These penalties may include hefty fines, interest charges on unpaid VAT, legal action, and even the revocation of business licenses. To mitigate these risks, it’s imperative to understand and adhere to specific VAT regulations in your region.

Consulting with a tax professional can provide valuable guidance to ensure compliance and minimize the potential for penalties. Failure to comply with VAT regulations on second-hand vehicle sales can result in severe penalties.

Grow Your Practice with Confidence

Tips for Buyers and Sellers

To minimize VAT implications and ensure compliance, buyers should consult a tax professional or refer to the relevant tax authority for accurate and up-to-date information on VAT rules in your specific country.

Consult with a tax advisor to understand your VAT obligations, Keep detailed records of vehicle purchases and sales factor in VAT when pricing vehicles to avoid unexpected costs.

Ensure that the vehicle’s history is clear and that all relevant taxes have been paid.

Conclusion

While VAT on second-hand vehicles can be frustrating, it’s important to understand the rules and regulations to make informed decisions. By staying informed and seeking advice from experts, you can minimize the impact of VAT on your next car purchase.

So, the next time you’re browsing through used car listings, remember to factor in VAT. And if you’re feeling overwhelmed, just take a deep breath and laugh it off. After all, what’s a little extra tax compared to the joy of driving your dream car?