Accounting is essential for businesses today, making it one of the most in-demand fields. Several companies rely on accurate financial reporting and compliance. Thus, a career in accounting offers job stability and opportunities for growth. You can become an accountant if you’re looking for a field that combines analytical skills with a rewarding future.

There are various types of accountants, each specializing in different areas. For example, public accountants manage tax filings.

Understanding these specializations can help you choose the accounting path that best fits your interests and skills. We’ve outlined five types of accountants to help you choose the right accounting field. Look at them and pick the one you find suitable for yourself.

Table of Contents

Which Skills Are Essential for Accountants?

Earning a bachelor’s degree in accounting is the first step, while many consider getting a master’s degree to stand out. Earning a CPA and getting certified adds credibility and opens more career opportunities.

Choosing your accounting niche is equally important, allowing you to specialize in auditing, tax, or financial analysis. Here are the essential technical and soft skills accountants need:

- Financial Reporting:

It involves having the know-how to prepare accurate financial statements that meet all regulations.

Grow Your Practice with Confidence

- Tax Knowledge:

Having an understanding of tax laws is essential to ensure proper filing and compliance.

- Accounting Software:

Being an expert in using tools like QuickBooks or SAP helps an accountant manage finances efficiently.

- Auditing:

Evaluating financial records to detect errors and ensure everything’s in order.

- Data Analysis:

Interpreting numbers to offer business insights and support decision-making.

- Attention to Detail:

Accountants must be precise when handling financial data to avoid costly mistakes and to provide accurate reports.

- Analytical Thinking:

Strong analytical skills help accountants interpret financial data and provide valuable knowledge, which is useful when making business decisions.

- Time Management:

Managing multiple tasks and meeting deadlines is essential for efficiently handling reports, audits, and tax filings.

- Communication Skills:

Accountants need to explain complex financial information clearly to clients or management.

5 Types of Accountants and What They Do

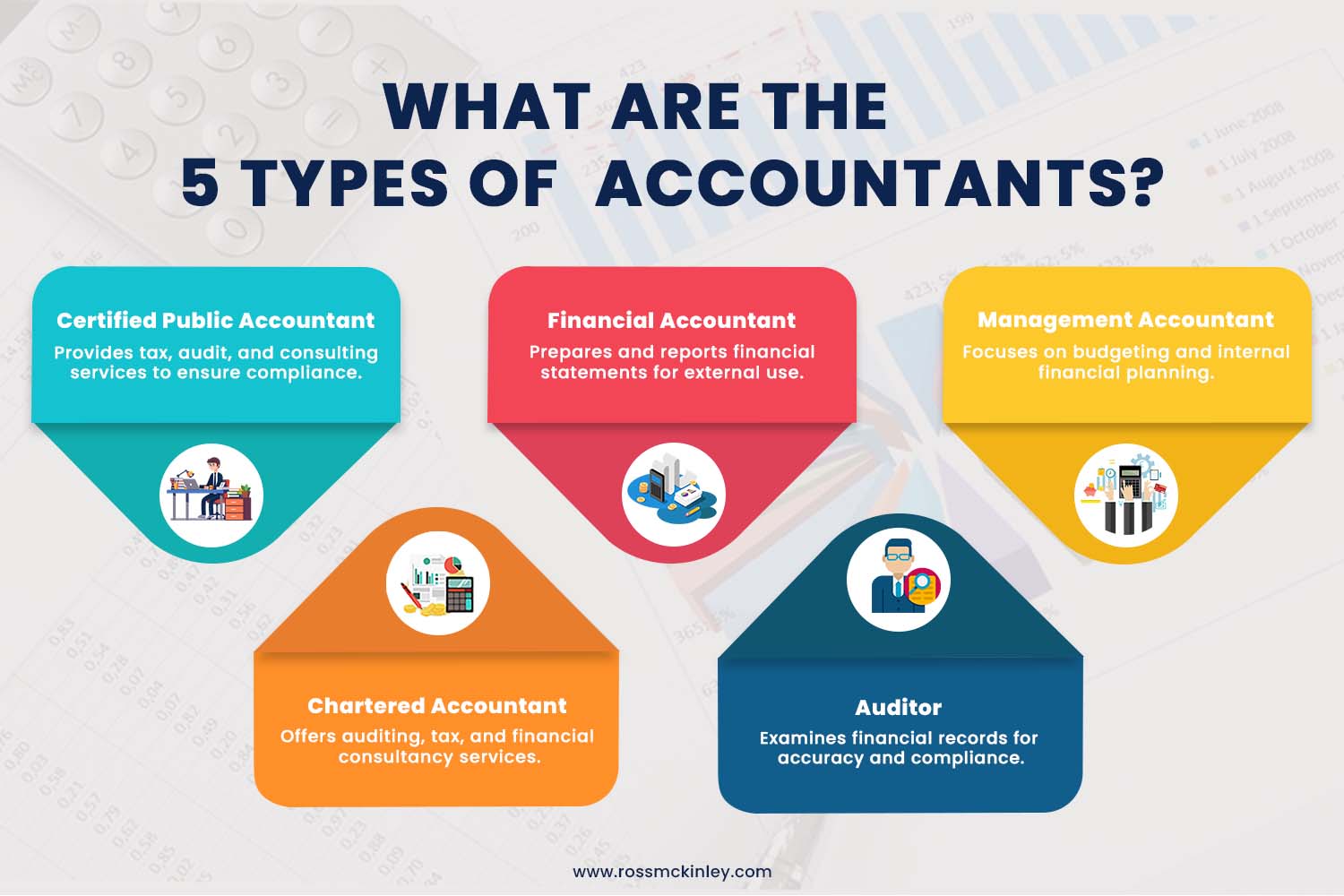

There are several types of accountants, each with specialized roles that cater to different financial needs. From handling taxes to managing audits, these accounting careers serve a unique purpose in business and personal finance. Let’s examine the five types of accountants and what they do.

Grow Your Practice with Confidence

Certified Public Accountant (CPA)

A Certified Public Accountant (CPA) has passed the Uniform CPA Examination covering essential accounting topics. To become a CPA, individuals get a bachelor’s degree in accounting and gain one to three years of professional experience.

CPAs ensure compliance with generally accepted accounting principles (GAAP) and are qualified to perform various tasks, including tax preparation, financial planning, and audits.

CPAs work in various sectors, such as public accounting, corporate accounting, government, and nonprofits. Their expertise allows them to be promoted to senior roles, such as Chief Financial Officer (CFO).

Financial Accountant

Financial accountants play an important role in analyzing a company’s financial transactions. They create detailed reports that reflect the company’s financial health, which stakeholders rely on for making informed investment decisions. Do you enjoy working with numbers and can simplify complex financial data? A career as a financial accountant is perfect for you.

A financial accountant tracks and records financial data, ensuring accuracy and compliance with regulations. They also prepare statements like balance sheets and income statements.

Accounting jobs like these include presenting clear financial reports. Financial accountants help stakeholders understand the company’s performance and make strategic decisions.

Management Accountant

Management accountants, or cost accountants, focus on budgeting and performance evaluation. They help companies assess financial data to improve decision-making and enhance operational efficiency.

These accountants prepare forecasts and budgets, providing insights that guide management in financial planning.

In addition to analyzing costs, a management accountant guides entry-level accountants and maintains the company’s financial systems.

Their role involves interpreting data to support strategic decisions. Management accountants enable businesses to allocate resources wisely, invest in growth, and generate profits.

Chartered Certified Accountant

Chartered Certified Accountants (CAs) hold global accounting qualifications similar to CPAs but are more common outside the U.S. They specialize in areas like tax, financial reporting, and auditing. CAs handle a variety of accountant responsibilities, ensuring accurate financial reporting and compliance with regulations. International businesses highly regard the expertise of Chartered Certified accountants.

CAs work in many industries and perform diverse tasks, including preparing financial statements and conducting audits. Their ability to understand different regulatory systems makes them flexible professionals.

This adaptability allows a Chartered Certified accountant to effectively support businesses in maintaining financial health and meeting compliance requirements across various jurisdictions.

Auditor

Auditors examine financial records to verify accuracy and compliance with applicable laws. They play a critical role in identifying discrepancies and recommending corrections.

There are two types of auditors: internal and external. Internal auditors work within companies to assess risks and improve financial practices, while external auditors operate independently to evaluate financial statements.

An auditor often collaborates with various teams to ensure financial practices align with regulations. They also help businesses improve their operational efficiency and prevent fraud.

Their work fosters transparency and accountability, essential for maintaining stakeholder trust. As a result, auditors can contribute to the overall stability of businesses and the economy.

Conclusion

Understanding the types of accountants is essential for anyone considering a career in this field. Each accountant type has its own importance and helps businesses operate efficiently according to financial regulations.

Do you want to secure an excellent job as an accountant and get promoted? Then, you must focus on gaining relevant qualifications and certifications. First, get started by securing an internship to gain practical experience and enhance your resume. Additionally, stay updated with the changes in the accounting world.

Networking with professionals can open doors and provide knowledge about skills required for various roles of accountants. Learn every day to adapt according to evolving accounting practices and technologies. You can find a rewarding path in the accounting profession with dedication and the right skills.